PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851288

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851288

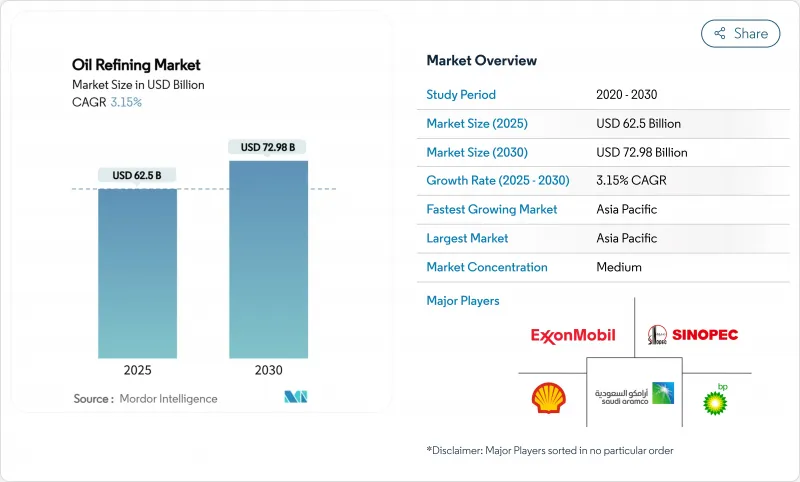

Oil Refining - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Oil Refining Market size is estimated at USD 62.5 billion in 2025, and is expected to reach USD 72.98 billion by 2030, at a CAGR of 3.15% during the forecast period (2025-2030).

This forward trajectory stems from refiners' accelerated push into petrochemical integration, large-scale desulfurization retrofits, and renewable diesel platforms that help shield margins from soft gasoline demand. Operators that combine conversion depth, digital optimization, and diversified fuel slates continue to outperform, while plants locked into single-fuel economics or lacking feedstock flexibility are closing or converting to specialty uses. Refinery throughput growth remains strongest in Asia-Pacific, the Middle East, and select African markets where governments back downstream self-sufficiency and export ambitions. Simultaneously, OECD rationalization and ESG-linked capital scarcity limit green-field build in developed regions, intensifying the global contest for high-quality barrels and resilient cracks.

Global Oil Refining Market Trends and Insights

Petro-chemical feed-stock push in Asia bolstering conversion upgrades

Asia's refiners integrate catalytic crackers and polypropylene lines to move up the value chain. CNOOC's Ningbo upgrade added 450,000 tpy polypropylene capacity and lifted crude runs by 50%, giving the complex access to robust domestic chemical demand . Similar investments in India target 35-40 million t of new capacity by 2030, with naphtha directed to aromatic and olefin chains. Integration protects margins from electric-vehicle-driven gasoline erosion while capturing higher petrochemical spreads that underpin long-run earnings resilience across the oil refining market.

Low-sulfur marine fuels post-IMO 2020 triggering desulfurization retrofits

The sulfur cap continues to reshape fuel quality expectations. ExxonMobil's Fawley investment adds a hydrotreater producing 570 million gallons of low-sulfur diesel annually. Inland refiners also retrofit desulfurizers to supply premium bunker fuel, expanding geographic supply and improving arbitrage options. Sustained capital inflows toward compliance upgrades reinforce demand for hydrogen and catalyst systems, sustaining throughput flexibility and supporting the oil refining market.

OECD refinery rationalisation under net-zero targets

Europe and North America close or repurpose older plants as firms align with climate policies. TotalEnergies is converting Grandpuits into a zero-crude platform producing sustainable aviation fuel and biopolymers. Shell will end crude runs at Wesseling by 2025, shifting to base oils . These actions tighten regional supply, elevate utilization at surviving sites, and reshape product import patterns, yet cap capacity growth within the oil refining market.

Other drivers and restraints analyzed in the detailed report include:

- Middle-East NOCs' forward integration capturing downstream margins

- U.S. light-tight oil boom driving condensate splitter investments

- Rising ESG-driven capital scarcity for green-field plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Middle distillates retained the 37.5% oil refining market share in 2024 as jet fuel and diesel recovered with global travel and emerging-market freight. Light distillates continue to benefit from rising vehicle ownership in developing economies yet face structural declines in mature regions. Heavy fuel oil struggles with stricter marine and power regulations, prompting coker and hydrocracker investments that upgrade residues. The petrochemical feedstock category grows fastest at a 3.9% CAGR as integrated operators channel naphtha and LPG into high-margin polymer chains. The chemicals pivot enhances margin stability and supports a broader revenue base within the oil refining market.

Greater integration increases unit complexity, improving crude flexibility and enabling diverse slate selection. CNOOC's polypropylene addition in Ningbo and Shell's Huizhou expansion, scheduled for 2028, highlight the trend toward chemicals-centric operations. Such projects expand the oil refining market size for high-conversion assets and shield earnings from gasoline displacement by electric vehicles.

The Refining Market Report is Segmented by Product Slate (Light Distillates, Middle Distillates, Fuel Oil and Residuals, and Petro-Chemical Feed-Stocks), Ownership (National Oil Companies, Integrated Oil Companies, and Independent/Merchant Refiners), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Size and Forecasts are Provided in Terms of Revenue (USD).

Geography Analysis

Asia-Pacific's refining complex expansion underpins its leadership. CNOOC's USD 2.74 billion Ningbo upgrade lifted crude runs to 240,000 bpd, adding polypropylene units to meet domestic plastics demand. India's planned capacity builds worth INR 1.9-2.2 lakh crore support sustained supply as consumption expands at 4% CAGR. Southeast Asia sees new projects in Vietnam and Indonesia to reduce product import dependence, while Japan and South Korea focus on high-efficiency operations and technology exports. The region's integrated models and government backing continue to enlarge the oil refining market.

North America remains a pivotal exporter. Shale-driven light crude availability reduces feedstock costs for Gulf Coast refineries. Phillips 66's Sweeny upgrades allow flexible runs that favor gasoline and chemical feedstock production. Valero channels USD 5.4 billion into low-carbon projects, including renewable diesel, to balance emissions objectives with margin capture. Canada and Mexico vie to modernize assets amid policy shifts, yet the U.S. maintains a structural advantage in the oil refining market through abundant feedstocks and deepwater logistic networks.

Europe experiences the fastest structural change. TotalEnergies converts Grandpuits to a renewable platform, while Shell repurposes Wesseling, removing conventional capacity yet adding sustainable aviation and base-oil output. Carbon pricing raises operating costs for heavy-fuel streams, incentivizing conversion units and hydrogen integration. Supply tightness from closures increases imports from the Middle East and the United States, elevating trans-Atlantic trade and reinforcing competitiveness gaps among surviving plants within the oil refining market.

- Exxon Mobil Corporation

- Sinopec Corp.

- Shell plc

- Saudi Aramco

- BP plc

- Chevron Corporation

- Valero Energy Corp.

- Marathon Petroleum Corp.

- Phillips 66

- Indian Oil Corporation Ltd.

- Rosneft PJSC

- CNPC

- TotalEnergies SE

- PKN Orlen SA

- Petrobras SA

- ENOC

- Reliance Industries Ltd.

- Petron Corp.

- PETRONAS

- Bharat Petroleum Corporation Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Petro-chemical feed-stock push in Asia bolstering conversion upgrades

- 4.2.2 Low-sulfur marine fuels post-IMO 2020 triggering desulfurization retrofit wave

- 4.2.3 Middle-East NOCs' forward integration capturing downstream margins

- 4.2.4 U.S. light-tight oil boom driving condensate-splitter investments

- 4.2.5 Discounted Russian Urals stimulating European complex refinery margins

- 4.2.6 Renewable diesel co-processing incentives in OECD raising hydro-treating spend

- 4.3 Market Restraints

- 4.3.1 OECD refinery rationalization under net-zero targets

- 4.3.2 Rising ESG-driven capital scarcity for green-field plants

- 4.3.3 Volatile crack?spreads eroding ROCE for merchant refiners

- 4.3.4 Carbon-pricing schemes compressing heavy-fuel margins

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Slate

- 5.1.1 Light Distillates (Gasoline, Naphtha)

- 5.1.2 Middle Distillates (Diesel/Gasoil, Jet/Kero)

- 5.1.3 Fuel Oil and Residuals

- 5.1.4 Petro-chemical Feed-stocks (Propylene, Aromatics)

- 5.2 By Ownership

- 5.2.1 National Oil Companies (NOCs)

- 5.2.2 Integrated Oil Companies (IOCs)

- 5.2.3 Independent/Merchant Refiners

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Nordic Countries

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Australia

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Exxon Mobil Corporation

- 6.4.2 Sinopec Corp.

- 6.4.3 Shell plc

- 6.4.4 Saudi Aramco

- 6.4.5 BP plc

- 6.4.6 Chevron Corporation

- 6.4.7 Valero Energy Corp.

- 6.4.8 Marathon Petroleum Corp.

- 6.4.9 Phillips 66

- 6.4.10 Indian Oil Corporation Ltd.

- 6.4.11 Rosneft PJSC

- 6.4.12 CNPC

- 6.4.13 TotalEnergies SE

- 6.4.14 PKN Orlen SA

- 6.4.15 Petrobras SA

- 6.4.16 ENOC

- 6.4.17 Reliance Industries Ltd.

- 6.4.18 Petron Corp.

- 6.4.19 PETRONAS

- 6.4.20 Bharat Petroleum Corporation Limited

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment