PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851301

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851301

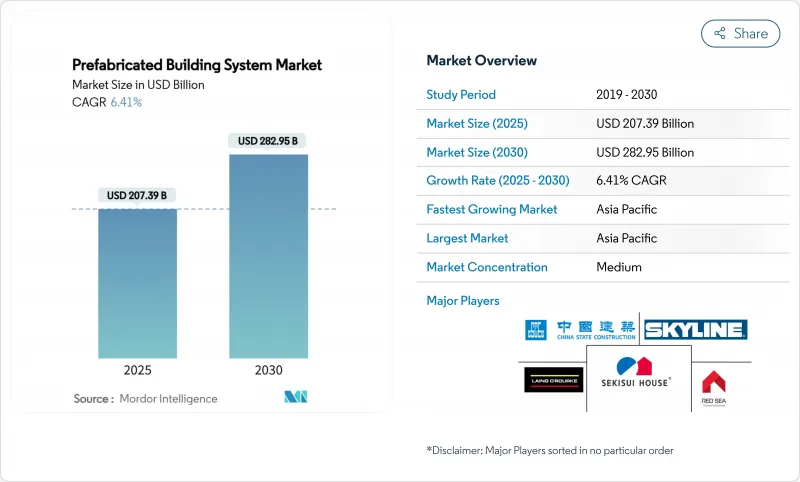

Prefabricated Building System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Prefabricated Building System Market size is estimated at USD 207.39 billion in 2025, and is expected to reach USD 282.95 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Current expansion is underpinned by labor shortages, policy incentives, and technology that delivers factory-level precision at construction-site scale. Rising urban household formation, worsening housing affordability, and mandatory green-building codes are pushing public agencies and private developers toward off-site manufacturing solutions that cut on-site work by more than 50%. Consolidation is intensifying as leading suppliers integrate design, production, and assembly to capture margin across the value chain. Logistics optimization, fire-safety code harmonization, and continued material innovation remain decisive levers for sustaining growth momentum within the prefabricated building systems market.

Global Prefabricated Building System Market Trends and Insights

Accelerating Urbanization and Housing Shortages

Urban centers are swelling, with ASEAN cities expected to absorb 90 million additional residents by 2030, outpacing traditional construction capacity. National programs such as Australia's pledge to deliver 1.2 million new homes by 2029 rely heavily on imported modular components that speed project cycles by up to 40%. Large-scale migration is forcing developers to embrace standardized floor plates and repeatable modules that reduce permitting complexity and enable parallel manufacturing. Modular factories can operate around the clock, bringing predictable output that aligns with monthly housing delivery schedules. Consequently, the prefabricated building systems market is evolving from a niche alternative into a primary housing supply channel for high-growth urban corridors.

Government Incentives and Green-Building Mandates

Canada's federal Build Canada Homes plan reserves more than USD 25 billion for builders deploying prefabricated techniques, creating a clear procurement preference for off-site manufacturing. In the United States, the Section 45L tax credit provides up to USD 5,000 per dwelling for energy-efficient homes, a threshold easily met by factory-produced envelopes with verified airtightness. The U.S. Department of Energy's Zero Energy Ready Home guidelines further reinforce performance benchmarks that favor modular assemblies with integrated HVAC, insulation, and rooftop solar. Across the EU, 2025 revisions to Energy Performance of Buildings regulations require life-cycle carbon accounting, positioning factory-controlled production as the lowest-waste delivery model. These converging policies guarantee multi-year demand visibility for the prefabricated building systems market.

High Logistics Costs and Size Constraints

Moving volumetric units requires wide-load permits, escort vehicles, and carefully sequenced delivery windows that can push transport charges to USD 25,000 per single-family module. Cost-to-weight ratios remain unfavorable because finished modules contain large volumes of air yet occupy entire truck-beds. Bridge clearances, turning radii, and axle-weight limits often dictate smaller module footprints, leading to additional onsite stitching that erodes factory efficiency. Investing in regionally distributed micro-factories can mitigate distance penalties but raises capital intensity. Overcoming these constraints will determine how broadly the prefabricated building systems market can penetrate low-density or infrastructure-constrained territories.

Other drivers and restraints analyzed in the detailed report include:

- Labor Shortage and Rising Wages in Construction

- Carbon-Credit Monetization for Timber Modules

- Fragmented High-Rise Fire Codes for Modular Buildings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Combined systems accounted for a 35.04% share of the prefabricated building systems market in 2024 while registering the leading 7.56% CAGR. Developers favor integrated skeleton-plus-panel platforms that deliver structural integrity alongside rapid enclosure, reducing trade handovers and compressing critical path schedules. These hybrid assemblies simplify cross-border sourcing because steel or concrete frames can be fabricated locally while facade and interior panels ship globally.

Demand is especially strong in mixed-use towers where open spans at podium levels transition into repetitive residential modules above. As Building Information Modeling gains traction, designers specify optimal mixes of volumetric cores, paneled facades, and steel megaframes to balance speed, cost, and architectural expression. The prefabricated building systems market benefits as bundled offerings provide one-stop procurement, mitigating interface risk that typically burdens conventional subcontracting.

Concrete held 49.56% of the prefabricated building systems market share during 2024, drawing strength from mature supplier networks and proven durability under diverse loading conditions. Automation of reinforcement placement, 3-D-printed formwork, and ultra-high-performance mixes are lowering unit costs and enabling thinner panels, expanding concrete's design latitude. Yet the segment faces mounting embodied-carbon scrutiny, pressing producers to adopt low-clinker cement and recycled aggregates to protect market position.

Timber posted the fastest 7.34% CAGR and is commanding premium valuations in jurisdictions offering carbon credits or expedited permitting for biogenic materials. Engineered wood panels, dowel-laminated slabs, and hybrid timber-steel connectors now achieve 18-story height approvals, erasing historic limitations.

The Prefabricated Building Systems Report is Segmented by Dimension (Skeleton System, Panel System, and More), Material (Concrete, Steel, Timber, and Others), Construction Method (2-D Panelised, 3-D Volumetric, and Hybrid), Application (Residential and Non-Residential), and Geography (North America, South America, Europe, Asia Pacific, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific controlled 48.91% of 2024 turnover, buoyed by China's USD 1 trillion Special Economic Zone investments that finance extensive modular factory rollouts and by Singapore's 90% adoption rate for high-rise prefabrication. Regional governments couple industrial policy with urban housing targets, ensuring continuous project pipelines that lock in long-term plant capacity. The prefabricated building systems market size in Asia Pacific is on track for a 7.25% CAGR, reflecting both intra-regional trade and rising domestic content requirements that foster indigenous technology maturation.

North America is propelled by the USD 50 million Regional Homebuilding Innovation Initiative in Canada and supportive zoning reforms in the United States that classify modular units as permanent real property. Momentum is further sustained by stringent building-energy standards that favor tightly sealed factory-produced envelopes. The regional share is expected to edge higher as inland logistics corridors improve, reducing cost penalties for cross-border volumetric shipments.

Europe continues its steady advance on the back of labor shortages, aging housing stock, and Green Deal directives mandating whole-life carbon disclosure. Progressive municipalities, notably in the Nordics and the Netherlands, now include off-site construction criteria in public tenders. Mid-sized producers cluster near high-speed rail corridors, enabling overnight delivery across multiple capital cities.

- Abtech Inc.

- Algeco Scotsman

- Astron Buildings

- Butler Manufacturing

- CSCEC Modular (China State Construction)

- Kirby Building Systems

- Laing O'Rourke

- Lindal Cedar Homes

- MMY Global Ltd.

- Modular Engineering

- Niko Prefab Building Systems

- Par-Kut International

- Red-Sea International

- Schulte Building Systems

- Sekisui House

- Skyline Homes

- United Partition Systems,Inc

- Vardhman Pre-Engineered Building Systems

- Vederra Modular

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Urbanization and Housing Shortages

- 4.2.2 Government Incentives and Green Building Mandates

- 4.2.3 Labor Shortage and Rising Wages in Construction

- 4.2.4 Carbon-Credit Monetization for Timber Modules

- 4.2.5 Climate-Resilient Rapid-Deployment Housing Demand

- 4.3 Market Restraints

- 4.3.1 High Logistics Costs/Size Constraints

- 4.3.2 Fragmented High-Rise Fire Codes for Modular Buildings

- 4.3.3 Integration with Traditional Construction

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Dimension

- 5.1.1 Skeleton System

- 5.1.2 Panel System

- 5.1.3 Cellular/Volumetric System

- 5.1.4 Combined/Hybrid System

- 5.2 By Material

- 5.2.1 Concrete

- 5.2.2 Steel

- 5.2.3 Timber

- 5.2.4 Others (Aluminium, Composites)

- 5.3 By Construction Method

- 5.3.1 2-D Panelised

- 5.3.2 3-D Volumetric

- 5.3.3 Hybrid (2-D + 3-D)

- 5.4 By Application

- 5.4.1 Residential

- 5.4.2 Non- Residential

- 5.4.2.1 Infrastructure

- 5.4.2.2 Commercial

- 5.4.2.3 Industrial/Institutional

- 5.5 By Geography

- 5.5.1 Asia Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIAC

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Egypyt

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Rest of Middle-East and Africa

- 5.5.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Abtech Inc.

- 6.4.2 Algeco Scotsman

- 6.4.3 Astron Buildings

- 6.4.4 Butler Manufacturing

- 6.4.5 CSCEC Modular (China State Construction)

- 6.4.6 Kirby Building Systems

- 6.4.7 Laing O'Rourke

- 6.4.8 Lindal Cedar Homes

- 6.4.9 MMY Global Ltd.

- 6.4.10 Modular Engineering

- 6.4.11 Niko Prefab Building Systems

- 6.4.12 Par-Kut International

- 6.4.13 Red-Sea International

- 6.4.14 Schulte Building Systems

- 6.4.15 Sekisui House

- 6.4.16 Skyline Homes

- 6.4.17 United Partition Systems,Inc

- 6.4.18 Vardhman Pre-Engineered Building Systems

- 6.4.19 Vederra Modular

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Circular-Economy Re-use of Modules

- 7.3 Net-Zero-Carbon Modular Campuses