PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851374

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851374

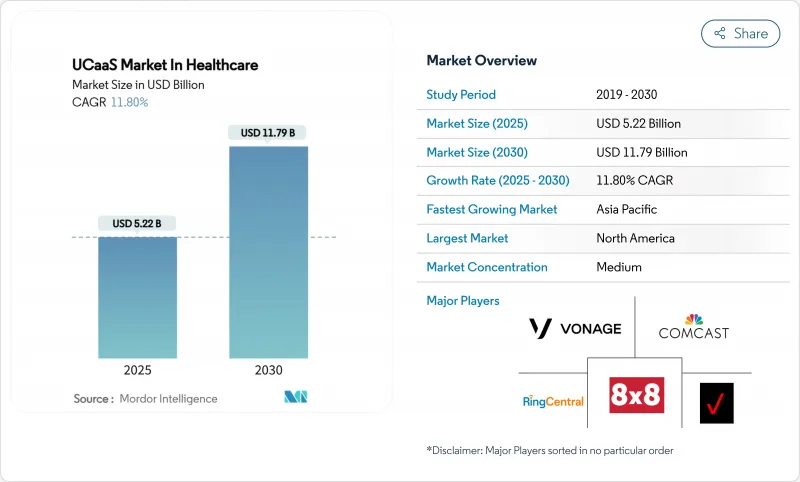

UCaaS In Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UCaaS in Healthcare market size stands at USD 5.22 billion in 2025 and is projected to reach USD 11.79 billion by 2030, registering an 11.8% CAGR over the forecast period.

The expansion reflects hospitals, clinics, and home-care agencies replacing on-premises PBX equipment with cloud platforms that unify voice, video, messaging, and collaboration in HIPAA-compliant environments. Measurable benefits such as a 211% three-year ROI and a 45% fall in average call-handling time have validated the business case, encouraging rapid budget reallocations toward cloud communications . Momentum is further reinforced by 5G-enabled edge use cases, AI-assisted clinical documentation, and a steady rise in hybrid care models that rely on always-on connectivity. North America leads adoption through mature EHR integration, whereas Asia-Pacific records the fastest growth as public-sector digitization initiatives subsidize telehealth infrastructure. Cyber-security, compliance complexity, and legacy PBX inertia remain headwinds, yet the overall trajectory continues upward as platforms demonstrate clear productivity gains and patient-safety improvements.

Global UCaaS Market Trends and Insights

Tele-health Expansion Post-COVID-19

Elevated telehealth volumes have stabilized, pushing providers to consolidate voice, video, and remote-monitoring traffic onto single platforms. Average cost per encounter in virtual care is falling by up to 17%, and caregivers report higher job satisfaction when workflows remain inside one secure environment. Providers now contract "virtualist" physicians who practice exclusively online, requiring continuous, HIPAA-grade connectivity for hand-offs and escalations. Integration of predictive analytics and AI-driven triage elevates tele-consultations from episodic events to longitudinal care pathways. Demand for contextual messaging within electronic health records (EHRs) grows in parallel, underpinning fresh opportunities for UCaaS vendors that can certify interoperability.

Cost-Saving OPEX Model of UCaaS

Switching from capital-intensive PBX hardware to subscription-based UCaaS frees cash for patient-centric investments. A 40-site community health network saved USD 350,000 annually after migrating 2,000 employees to RingCentral, an outcome echoed across multi-facility systems looking to trim support overhead. The operating-expense structure removes large refresh cycles, aligning expenses with fluctuating patient volumes. CFOs under pressure from value-based reimbursement find predictable monthly fees preferable to lumpy capital outlays. Smaller practices benefit most because cloud providers assume maintenance, security patching, and disaster recovery, lowering the personnel barrier to enterprise-class communications.

Data Security and HIPAA Concerns Create Adoption Barriers

Encrypting data at rest and in transit, enforcing granular access controls, and signing business-associate agreements add cost and delay. Smaller clinics report six-to-twelve-month project slippage while security teams validate cloud architectures and map data flows. Breach penalties can exceed USD 1.5 million per incident, elevating risk perception and driving preference for incumbents with long compliance track records. Multi-tenant clouds intensify worries about co-mingling patient records, spurring interest in hybrid and dedicated instances despite higher price points.

Other drivers and restraints analyzed in the detailed report include:

- Integration with EHR & Clinical Workflows

- 5G Edge-Enabled AR Surgical Collaboration

- Legacy PBX and Low Digital Readiness Constrain Migration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public Cloud dominated 2024 with 45.6% share of the UCaaS in Healthcare market, reflecting preference for on-demand scalability and automatic software updates. Large integrated-delivery networks tap global data centers to support geographically dispersed care teams, while start-ups exploit pay-as-you-go pricing to sidestep capital outlays. Hybrid Cloud trajectories are set to compound at 17.2% CAGR, the fastest within the deployment category, as privacy policies and data-sovereignty laws force providers to retain clinical databases in local vaults. The UCaaS in Healthcare market size for Hybrid Cloud is projected to reach USD 6.3 billion by 2030. Providers typically host call-detail records and recordings on-premises while offloading real-time workloads to the cloud. The arrangement mitigates latency for on-site emergency codes and integrates with elevators, alarms, and medical-device gateways that remain behind hospital firewalls.

Demand for Private Cloud remains niche, concentrated in academic medical centers conducting high-risk clinical trials or operating under national defense constraints. These deployments attract higher total cost due to dedicated hardware and carrier circuits. Nonetheless, managed-service options that bundle security appliances and 24X7 monitoring are lowering entry barriers. Some providers adopt a phased approach: migrate non-clinical departments such as HR and billing to Public Cloud first, then shift patient-facing workloads once governance models mature.

Telephony/Voice retained 27.1% share in 2024, underlining voice's enduring role for code calls, consults, and switchboard operations. However, Collaboration Tools hold the growth spotlight with an 18.5% CAGR. Across multidisciplinary team huddles, clinicians now prefer persistent chat rooms, file-share spaces, and video huddle portals embedded inside their EHR cockpit. The UCaaS in Healthcare market share for Collaboration Tools is forecast to exceed 32% by 2030. Vendors differentiate by embedding note-taking AI, automatic language translation, and virtual whiteboards that map directly to patient records.

Unified Messaging converges voicemail, email, and SMS into one queue, easing information scatter. Conferencing solutions integrate high-definition camera carts and stethoscope peripherals for virtual rounding. Contact-Center Integration remains pivotal to omni-channel patient engagement, routing lab results, appointment reminders, and pharmacy queries through a unified queue. Momentum here climbs as providers emphasize consumer-grade experience to retain patients under value-based reimbursement.

The Unified Communications-As-A-Service in Healthcare Market is Segmented by Deployment Model (Public Cloud, Private, Cloud, and Hybrid Cloud), Component (Telephony / Voice, Unified Messaging, and More), Application (Clinical Communications and Collaboration, Tele-Health and Virtual Care, and More), Organization Size (Large Enterprises, and Small and Medium Enterprises ), End-User (Hospitals, and More), and Geography.

Geography Analysis

North America contributed 36.3% of 2024 revenue, driven by entrenched HIPAA mandates, EHR ubiquity, and aggressive AI pilots. Microsoft's DAX Copilot is live in 400+ provider networks, generating 9.5 million encounter notes and validating clinical-grade speech recognition at scale. Providers leverage mature broadband and 5G coverage for in-unit teleconsults and cross-facility resource pooling. Federal flexibilities for telehealth reimbursement, extended through 2026, further entrench cloud reliance.

Asia-Pacific leads in growth momentum at 13.8% CAGR. Public-sector smart-hospital pilots in Thailand, South Korea, and China exemplify 5G-enabled ambulance telemetry and AI-based triage that slash imaging turnaround from 15 minutes to 25 seconds. Regionally diverse privacy laws cultivate demand for configurable data-residency settings and bring-your-own-carrier options inside UCaaS stacks. Local system integrators bundle compliance consultancy, making adoption less daunting for mid-tier clinics.

Europe holds steady mid-single-digit growth underpinned by eHealth initiatives and cross-border data-sharing goals in the European Health Data Space. France's tele-consult legislation expanded remote-work eligibility for clinicians, fueling demand for secure video channels. GDPR obligations push interest in hybrid deployments, where communication payloads remain inside regional data centers. Vendor roadmaps increasingly reference "Schrems-II ready" architectures to court public hospitals.

- RingCentral, Inc.

- 8x8, Inc.

- Verizon Communications Inc.

- Comcast Corporation

- Vonage Holdings Corp. (Telefonaktiebolaget LM Ericsson)

- Intrado Corporation

- Star2Star Communications, LLC

- International Business Machines Corporation

- ALE International SAS (Alcatel-Lucent Enterprise)

- Cisco Systems, Inc.

- Microsoft Corporation

- Google LLC (Google Cloud)

- Zoom Video Communications, Inc.

- Avaya LLC

- Mitel Networks Corporation

- Fuze, Inc.

- Dialpad, Inc.

- NEC Corporation

- Twilio Inc.

- Genesys Telecommunications Laboratories, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tele-health expansion post-COVID-19

- 4.2.2 Cost-saving OPEX model of UCaaS

- 4.2.3 Integration with EHR and clinical workflows

- 4.2.4 5G edge-enabled AR surgical collaboration

- 4.2.5 Compliance-as-a-Service bundles for HIPAA

- 4.2.6 AI-driven clinical documentation and workflow automation

- 4.3 Market Restraints

- 4.3.1 Data security and HIPAA concerns

- 4.3.2 Legacy PBX and low digital readiness

- 4.3.3 Budget squeeze from value-based care

- 4.3.4 Vendor lock-in with vertical UC stacks

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Deployment Model

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Component

- 5.2.1 Telephony / Voice

- 5.2.2 Unified Messaging

- 5.2.3 Conferencing

- 5.2.4 Collaboration Tools

- 5.2.5 Contact-Center Integration

- 5.3 By Application

- 5.3.1 Clinical Communications and Collaboration

- 5.3.2 Tele-health and Virtual Care

- 5.3.3 Administrative and Billing

- 5.3.4 Emergency Response Coordination

- 5.3.5 Patient Outreach and Engagement

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Clinics and Physician Offices

- 5.5.3 Ambulatory Surgical Centers

- 5.5.4 Long-Term Care Facilities

- 5.5.5 Diagnostic and Imaging Centers

- 5.5.6 Home Healthcare Agencies

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 RingCentral, Inc.

- 6.4.2 8x8, Inc.

- 6.4.3 Verizon Communications Inc.

- 6.4.4 Comcast Corporation

- 6.4.5 Vonage Holdings Corp. (Telefonaktiebolaget LM Ericsson)

- 6.4.6 Intrado Corporation

- 6.4.7 Star2Star Communications, LLC

- 6.4.8 International Business Machines Corporation

- 6.4.9 ALE International SAS (Alcatel-Lucent Enterprise)

- 6.4.10 Cisco Systems, Inc.

- 6.4.11 Microsoft Corporation

- 6.4.12 Google LLC (Google Cloud)

- 6.4.13 Zoom Video Communications, Inc.

- 6.4.14 Avaya LLC

- 6.4.15 Mitel Networks Corporation

- 6.4.16 Fuze, Inc.

- 6.4.17 Dialpad, Inc.

- 6.4.18 NEC Corporation

- 6.4.19 Twilio Inc.

- 6.4.20 Genesys Telecommunications Laboratories, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment