PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851448

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851448

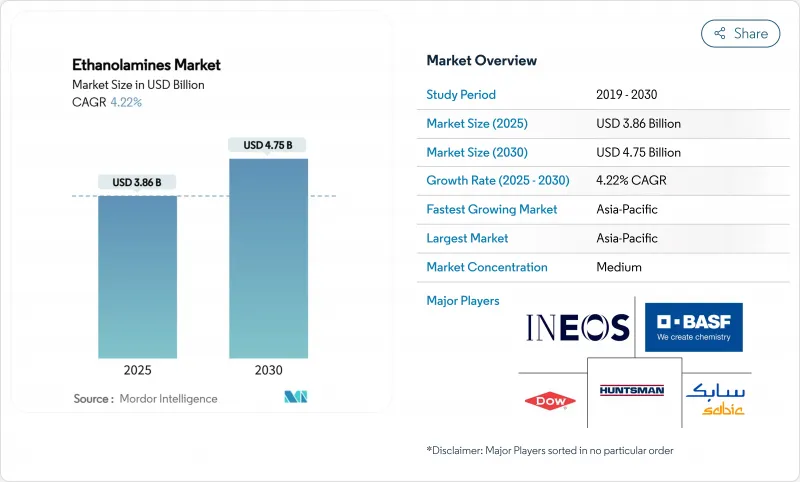

Ethanolamines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ethanolamines market size reached USD 3.86 billion in 2025 and is projected to touch USD 4.75 billion by 2030, advancing at a 4.22% CAGR.

Healthy demand from gas treatment, detergents, agrochemicals and advanced manufacturing keeps volumes stable even as producers confront stricter safety and environmental rules. Feedstock-backward integration deals, such as INEOS's purchase of LyondellBasell's ethylene oxide and derivatives assets, illustrate how leading suppliers secure cost advantages while locking in supply certainty. Regulatory shifts-most notably the United States Environmental Protection Agency's significant-new-use rules for ethanolamines entering force in August 2025-encourage investments in bio-based routes without eroding near-term consumption in conventional applications. Meanwhile, incremental capacity expansions by incumbents like BASF in Antwerp and Nouryon in Sweden position the ethanolamines market to meet rising sustainability requirements while preserving regional supply security.

Global Ethanolamines Market Trends and Insights

Rapid industrialisation in emerging economies

Surging fixed-asset investment across China, India, Indonesia and Vietnam stimulates fresh consumption of ethanolamines for gas sweetening, cement additives and process chemicals. Chinese policy packages that target advanced battery raw materials directly raise monoethanolamine offtake for electrolyte purification projects. India's widening bio-ethanol capacity reinforces future feedstock availability for renewable ethanolamines plants, lowering import dependence while supporting export-oriented specialty chemicals clusters. Expanding construction programs in Southeast Asia lift triethanolamine demand for cement grinding aids, while regional utilities deploy amine-based CO2 capture to decarbonize coal and gas-fired plants. Urbanisation unlocks higher per-capita purchases of detergents and personal-care items, embedding a structural pull for surfactant-grade ethanolamines. Collectively, these trends embed a broad-based, medium-term uplift in the ethanolamines market.

Surging glyphosate production for herbicide-tolerant crops

Even as weed-resistance debates intensify, acreage sown with herbicide-tolerant soybean and maize varieties keeps expanding in Brazil, Argentina and the United States, sustaining large synthesis volumes for glyphosate that rely on ethanolamines neutralisation steps. Multinational formulators are relocating production to cost-competitive Asian hubs, giving the ethanolamines market fresh demand corridors without altering global consumption totals. In developing economies, farm-mechanisation campaigns elevate glyphosate usage because labour-saving herbicides remain cheaper than manual weeding. New double-knock programs that mix glyphosate with complementary actives often boost total amine requirements per hectare. Although regulators in the European Union push for reduced synthetic loads, these restrictions typically shift manufacturing to friendlier jurisdictions rather than curbing absolute tonnage. Consequently, near-term momentum from glyphosate maintains a positive swing factor for ethanolamines market growth.

Volatile ethylene oxide feedstock prices

Spot ethylene-oxide quotes remain highly sensitive to naphtha and natural-gas swings, squeezing standalone ethanolamines producers during sudden upcycles. Several South Korean crackers idled in early 2025 because negative olefin margins rendered operations uneconomic, tightening ethylene-oxide supply in the wider Asia-Pacific basin. Integrated majors such as BASF and Dow weather volatility better by reallocating oxide streams to the highest-margin derivatives, underscoring structural advantages that reinforce market concentration. Freight disruptions through the Suez and Panama canals add further unpredictability to feedstock arbitrage flows. Smaller formulators respond by trimming run rates or passing through surcharges, yet prolonged price shocks risk demand destruction in price-sensitive applications like commodity detergents. Net impact is a near-term drag on the ethanolamines market until feedstock trends normalise.

Other drivers and restraints analyzed in the detailed report include:

- Rising demand for water-based metal-working fluids in EV manufacturing

- Increasing utilization in the agrochemical industry

- Increasing weed resistance to weaken glyphosate demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monoethanolamine held 45.18% of 2024 revenues, supported by steady gas-sweetening runs, burgeoning carbon-capture pilots and broad detergent usage. The segment is forecast to post a 6.80% CAGR to 2030, reinforcing its anchor role in the ethanolamines market. Monoethanolamine's high reactivity allows formulators to tailor a wide pH spectrum, sustaining cross-industry relevance. Meanwhile, diethanolamine retains a solid niche in metal-working fluids and herbicide neutralisation, with coproduct value uplift from improved corrosion-inhibition performance. Triethanolamine advances in cement grinding aids, delivering up to 5 MPa compressive-strength gains that shorten curing times on major infrastructure projects.

Diversification across three primary grades protects suppliers from demand swings in any one downstream sector. Carbon-capture retrofits in refineries and steel mills could sharply raise monoethanolamine call-offs, whereas personal-care premiumisation supports triethanolamine margin resilience. Together, these dynamics keep the ethanolamines market well balanced at the product level.

The legacy ethylene-oxide process represented 92.16% of global throughput in 2024, reflecting decades of optimisation and sunk-capital advantages. Even so, the bio-ethanol pathway is predicted to accelerate at a 7.24% CAGR, propelled by renewable-content mandates and corporate net-zero targets. Early commercial plants in Thailand and Brazil demonstrate that agricultural-residue-derived bio-ethylene can integrate seamlessly into existing amination trains, reducing downstream qualification hurdles. Carbon-border-adjustment schemes in Europe tighten the cost gap by pricing embedded emissions, tilting future expenditures toward low-carbon routes.

Process intensification efforts-continuous reaction systems, membrane-based separations and catalysed rearrangements-keep legacy technology competitive on cash cost. Still, brand owners willing to pay premiums for certified-low-carbon molecules grant bio-based suppliers an attractive foothold. The resulting dual-pathway framework ensures ample supply while catalysing technology upgrades across the wider ethanolamines market.

The Ethanolamines Market Report is Segmented by Product Type (Monoethanolamine, Diethanolamine, and More), Technology (Ethylene Oxide Route and Bio-Ethanol Route), Application (Gas Treatment, Herbicides, and More), End-User Industry (Oil and Gas, Agriculture, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with a 46.81% revenue share in 2024, buoyed by integrated petrochemical complexes, competitive labour and expanding downstream manufacturing hubs. Chinese refiners continually debottleneck mono-ethanolamine lines to serve domestic detergent and electronic-chemicals customers, while India's bio-ethanol surge positions the subcontinent as a future export base for renewable ethanolamines. Southeast Asia's agrochemical formulators, concentrated in Thailand and Vietnam, offer further pull as regional crop-protection spending climbs.

North America retains a robust production backbone anchored by Texas and Louisiana oxide-derivative clusters. INEOS's USD 700 million purchase of LyondellBasell's facility secures feedstock for long-term supply contracts with gas-sweetening licensors. Huntsman's E-GRADE expansion in The Woodlands targets semiconductor-purification niches, giving the region a value-added hedge against commodity margin cycles.

Europe's stringent carbon agenda steers investment toward low-emission units, exemplified by BASF's 140,000-ton upgrade in Antwerp. Nouryon's ISCC PLUS accreditation at Stenungsund spurs personal-care demand by enabling traceable renewable content. Carbon-border-adjustment pricing is expected to elevate import premiums on high-emission ethanolamines, indirectly favouring certified European output. Collectively, these regional dynamics sustain a balanced global network that underpins steady flows in the ethanolamines market.

- Amines & Plasticizers ltd.

- BASF

- Dow

- Huntsman Corporation

- INEOS

- NIPPON SHOKUBAI CO., LTD.

- Nouryon

- OUCC

- SABIC

- Sintez OKA Group

- Thai Ethanolamines Co.

- Tosoh Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid industrialisation in emerging economies

- 4.2.2 Surging glyphosate production for herbicide-tolerant crops

- 4.2.3 Rising demand for water-based metal-working fluids in EV manufacturing

- 4.2.4 Increasing utilization in the agrochemical industry

- 4.2.5 Growth in bio-based surfactant formulation in personal-care

- 4.3 Market Restraints

- 4.3.1 Volatile ethylene oxide feedstock prices

- 4.3.2 Increasing Weed Resistance to Weaken the Demand for Glyphosate

- 4.3.3 Emergence of greener bio-solvents challenging ethanolamines

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Monoethanolamine (MEA)

- 5.1.2 Diethanolamine (DEA)

- 5.1.3 Triethanolamine (TEA)

- 5.2 By Technology

- 5.2.1 Ethylene Oxide Route

- 5.2.2 Bio-ethanol Route

- 5.3 By Application

- 5.3.1 Gas Treatment

- 5.3.2 Herbicides (Glyphosate)

- 5.3.3 Surfactants & Detergents

- 5.3.4 Cement & Concrete Additives

- 5.3.5 Personal-care Formulations

- 5.3.6 Metal-working Fluids

- 5.3.7 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Oil and Gas

- 5.4.2 Agriculture

- 5.4.3 Construction

- 5.4.4 Personal Care

- 5.4.5 Textile

- 5.4.6 Metallurgy and Metalworking

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacifc

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacifc

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Amines & Plasticizers ltd.

- 6.4.2 BASF

- 6.4.3 Dow

- 6.4.4 Huntsman Corporation

- 6.4.5 INEOS

- 6.4.6 NIPPON SHOKUBAI CO., LTD.

- 6.4.7 Nouryon

- 6.4.8 OUCC

- 6.4.9 SABIC

- 6.4.10 Sintez OKA Group

- 6.4.11 Thai Ethanolamines Co.

- 6.4.12 Tosoh Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment