PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851539

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851539

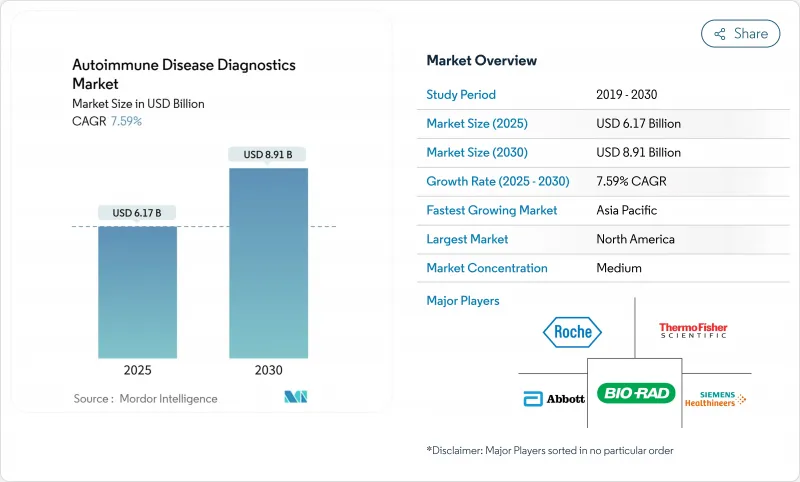

Autoimmune Disease Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Autoimmune Disease Diagnostics Market size is estimated at USD 6.17 billion in 2025, and is expected to reach USD 8.91 billion by 2030, at a CAGR of 7.59% during the forecast period (2025-2030).

Growth is fueled by rising incidence across more than 100 distinct conditions, rapid uptake of AI-enabled automation, and demand for multiplex immunoassays that shorten testing cycles while increasing analytical depth. The autoimmune disease diagnostics market is also benefiting from robust investments in informatics platforms that convert raw assay data into clinically actionable insights, easing the workload of overstretched laboratory staff. North America heads global revenue owing to early technology adoption and insurance coverage that supports comprehensive panels, whereas Asia-Pacific is setting the pace for growth as governments extend reimbursement to previously underserved populations. Systemic conditions drive the bulk of test demand because clinicians require multi-analyte profiles to distinguish overlapping symptoms and monitor organ-wide disease activity. Competitive intensity remains moderate; the leading vendors protect share by pairing assay chemistry with automation and decision-support software that elevates laboratory throughput and result consistency.

Global Autoimmune Disease Diagnostics Market Trends and Insights

Rising Prevalence of Autoimmune Disorders

Surging incidence now affects 3-5% of the global population, with pronounced growth among adolescents aged 15-39 years. Health-system analyses show sustained annual testing volume increases of 25-30%, compelling laboratories to replace manual workflows with automated benches that can process larger sample loads without compromising accuracy. Economic modeling demonstrates that early detection via comprehensive panels lowers lifetime treatment costs by preventing irreversible tissue damage. The autoimmune disease diagnostics market therefore experiences consistent baseline demand, insulating vendors against cyclical healthcare spending shifts. EHR-driven population screening protocols in major U.S. networks further normalize routine autoimmune testing as part of preventive care.

Shift Toward Multiplex & Point-of-Care Immunoassays Shortening Diagnostic Odyssey

Platforms capable of profiling 50 autoantibodies in a single run deliver up to 1,200 results per hour, replacing serial workflows that once extended over months. Photonic ring assays now complete 12-analyte panels on whole blood in 15 minutes with greater than 91% concordance to laboratory gold standards. Clinical studies report 19% higher systemic lupus erythematosus detection when multiplex methods are employed, particularly in serologically inactive patients. Although unit pricing remains higher than legacy ELISA formats, declining reagent costs and streamlined consumable footprints are narrowing the gap. Laboratories are adopting multiplex architecture to conserve patient samples, accelerate turnaround, and capture incremental revenue through extended menus.

Slow Turnaround Time of Results and Need for Multiple Diagnostic Tests

Conventional indirect immunofluorescence still demands 10-17 days to complete full panels, a delay compounded when sequential reflex testing is required. Laboratory staffing shortages intensify bottlenecks; vacancy rates for medical technologists continue trending upward and are projected to climb 13% by 2026. Rural patients often travel over 200 miles for specialist sampling, adding logistical delays that can postpone therapy initiation and enable disease progression. Automation mitigates the issue yet capital outlays deter mid-tier labs from immediate upgrades, keeping legacy workflows in service.

Other drivers and restraints analyzed in the detailed report include:

- Government-Led Autoimmune Screening Programs

- Integration of AI-Guided Pattern Recognition in IFA Slides Boosting Lab Throughput

- Limited Reimbursement Coverage for Multiplex Panels in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Systemic autoimmune diseases generated 62.92% revenue in 2024, reflecting the multi-organ nature of conditions such as rheumatoid arthritis, systemic lupus erythematosus, and multiple sclerosis that require broad antibody panels for differential diagnosis. This segment alone captured the largest slice of the autoimmune disease diagnostics market, as clinicians deploy multiparametric profiles to parse overlapping presentations across organ systems. Localized autoimmune diseases, though smaller in volume, are scaling at a 9.6% CAGR thanks to portable devices that bring thyroid, celiac, and type 1 diabetes testing closer to primary-care clinics. The autoimmune disease diagnostics market size tied to systemic evaluations is projected to climb steadily as treatment guidelines embed routine disease-activity monitoring to tailor biologic therapy. Simultaneously, fecal calprotectin assays refine inflammatory bowel disease work-ups, disentangling autoimmune etiology from functional disorders and widening adoption among gastroenterologist.

Second-generation T-cell assays enhance systemic lupus detection by identifying cellular immunity markers absent in classic serology, revealing previously overlooked sub-phenotypes. In multiple sclerosis, neurofilament light chain quantification integrates with autoantibody panels to improve prognostication, sharpening demand for multi-analyte workflows. Growth on the localized front is tied to at-home finger-stick kits that detect anti-tTG antibodies, empowering earlier celiac intervention and enlarging the consumer-initiated testing cohort. Overall, systemic testing retains scale advantages, but localized disease panels represent an agile growth niche for innovators targeting primary-care and retail health settings.

Reagents and assay kits supplied 53.13% of 2024 revenue, anchoring the consumable engine that drives repeat testing across all modalities. The autoimmune disease diagnostics market maintains a steady pull for validated chemistries because every new instrument launch creates fresh installed-base demand for compatible kits. Yet software and informatics are racing ahead at a 12.15% CAGR, reflecting laboratories' pivot toward digital workflows that integrate instrument control, result interpretation, and quality management. Such systems leverage AI to flag atypical patterns, auto-validate negatives, and push finalized reports to electronic health records, trimming bench-time and reimbursement cycle delays.

Instrumentation continues its incremental progression toward consolidated immunochemistry lines, evidenced by analyzers combining ELISA, CLIA, and multiplex cartridges within a single footprint. Service contracts expand as vendors provide remote calibration, proficiency testing, and compliance audits, catering to small labs that lack in-house expertise. The autoimmune disease diagnostics market size attributed to reagents remains resilient; however, software margins are higher and create recurring revenue streams that are less tied to raw test volumes. Vendors are, therefore, bundling cloud dashboards with kit purchases to cement long-term customer lock-in.

The Autoimmune Disease Diagnostics Market is Segmented by Disease Type (Systemic Autoimmune Disease, and More), Product and Service (Reagents & Assay Kits, and More), Test Type (Antinuclear Antibody Tests, and More), Technology (Enzyme-Linked Immunosorbent Assay, and More), End User (Hospital, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.45% of 2024 revenue, reflecting mature insurance frameworks and early adoption of AI-enabled interpretation platforms that streamline large-volume testing runs. The autoimmune disease diagnostics market size in the region will continue rising steadily as payer policies increasingly reimburse multiplex panels that demonstrate clear clinical utility. Furthermore, federal regulatory clarity around laboratory-developed tests is fostering capital investments in high-throughput analyzers, reducing previously perceived compliance risks.

Europe contributes a significant share with consistent, if moderate, annual growth. Stringent accreditation norms such as the European Autoimmunity Standardisation Initiative push laboratories toward harmonized protocols and foster cross-border proficiency testing that elevates result comparability. Aging demographics, combined with heightened autoimmune prevalence in northern latitudes, maintain consistent baseline demand. National health services continue integrating expanded diagnostic menus into reimbursement schedules, though budgetary scrutiny keeps pricing pressure on suppliers.

Asia-Pacific is advancing fastest at a 9.98% CAGR, propelled by aggressive healthcare infrastructure upgrades and government-funded screening programs that enlarge the patient funnel. China, Japan, and India spearhead regional volume, with private hospital chains racing to differentiate via on-site autoimmunity centers of excellence. The autoimmune disease diagnostics market is additionally buoyed by domestic manufacturing incentives that lower instrument costs and encourage local kit production. Meanwhile, Middle East & Africa and South America present emerging opportunities: urban tertiary hospitals adopt automation, whereas rural outreach relies on portable point-of-care kits paired with teleconsultation to bridge specialist gaps.

- Abbott Laboratories

- Thermo Fisher Scientific

- Roche

- Siemens Healthineers

- Bio-Rad Laboratories

- bioMerieux

- EUROIMMUN Medizinische Labordiagnostika AG

- Inova Diagnostics

- Grifols

- Trinity Biotech plc

- Beckton Dickinson

- Danaher

- Hologic

- Exagen

- DiaSorin

- Werfen (Instrumentation Laboratory)

- Mindray

- R-Biopharm

- ZEUS Scientific, Inc.

- Myriad Genetics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Autoimmune Disorders

- 4.2.2 Shift Toward Multiplex & Point-of-Care Immunoassays Shortening Diagnostic Odyssey

- 4.2.3 Government-Led Autoimmune Screening Programs

- 4.2.4 Integration of AI-Guided Pattern Recognition in IFA Slides Boosting Lab Throughput

- 4.2.5 Expansion of Direct-to-Consumer Genetic Testing Enabling Self-initiated Autoimmunity Work-ups

- 4.2.6 Surging Adoption of Autoantibody Panels in Oncology-Linked Paraneoplastic Syndromes

- 4.3 Market Restraints

- 4.3.1 Slow Turnaround Time of Results and Need for Multiple Diagnostic Tests

- 4.3.2 Limited Reimbursement Coverage for Multiplex Panels in Emerging Markets

- 4.3.3 Shortage of Skilled Immunopathologists in Rural Areas

- 4.3.4 High Capital Cost of Fully Automated CLIA Platforms for Mid-size Labs

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Disease Type

- 5.1.1 Systemic Autoimmune Diseases

- 5.1.1.1 Rheumatoid Arthritis

- 5.1.1.2 Psoriasis

- 5.1.1.3 Systemic Lupus Erythematosus (SLE)

- 5.1.1.4 Multiple Sclerosis

- 5.1.1.5 Other Systemic Autoimmune Diseases

- 5.1.2 Localized Autoimmune Diseases

- 5.1.2.1 Inflammatory Bowel Disease

- 5.1.2.2 Type 1 Diabetes

- 5.1.2.3 Autoimmune Thyroid Diseases

- 5.1.2.4 Other Localized Autoimmune Diseases

- 5.1.1 Systemic Autoimmune Diseases

- 5.2 By Product and Service

- 5.2.1 Reagents & Assay Kits

- 5.2.2 Instruments/Analyzers

- 5.2.3 Software & Informatics

- 5.2.4 Services

- 5.3 By Test Type

- 5.3.1 Antinuclear Antibody (ANA) Tests

- 5.3.2 Autoantibody Tests

- 5.3.3 Complete Blood Count (CBC)

- 5.3.4 C-reactive Protein (CRP)

- 5.3.5 Urinalysis

- 5.3.6 Other Tests

- 5.4 By Technology

- 5.4.1 Enzyme-linked Immunosorbent Assay (ELISA)

- 5.4.2 Chemiluminescence Immunoassay (CLIA)

- 5.4.3 Indirect Immunofluorescence (IFA)

- 5.4.4 Multiplex Assay Platforms

- 5.4.5 Flow Cytometry

- 5.4.6 Other Technologies

- 5.5 By End User

- 5.5.1 Hospital & Clinical Laboratories

- 5.5.2 Reference Laboratories

- 5.5.3 Academic & Research Institutes

- 5.5.4 Other End Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 F. Hoffmann-La Roche AG

- 6.3.4 Siemens Healthineers

- 6.3.5 Bio-Rad Laboratories Inc.

- 6.3.6 bioMerieux SA

- 6.3.7 EUROIMMUN Medizinische Labordiagnostika AG

- 6.3.8 Inova Diagnostics Inc.

- 6.3.9 Grifols S.A.

- 6.3.10 Trinity Biotech plc

- 6.3.11 Becton, Dickinson and Company

- 6.3.12 Danaher Corporation (Beckman Coulter)

- 6.3.13 Hologic Inc.

- 6.3.14 Exagen Inc.

- 6.3.15 DiaSorin S.p.A.

- 6.3.16 Werfen (Instrumentation Laboratory)

- 6.3.17 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.18 R-Biopharm AG

- 6.3.19 ZEUS Scientific, Inc.

- 6.3.20 Myriad Genetics Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment