PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851642

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851642

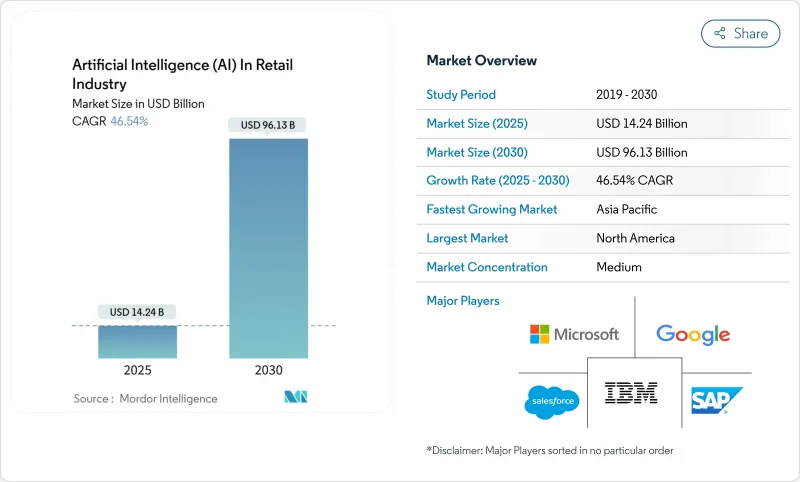

Artificial Intelligence (AI) In Retail Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Artificial Intelligence in Retail market is valued at USD 14.24 billion in 2025 and is forecast to reach USD 96.13 billion by 2030, registering a CAGR of 46.54%.

This steep trajectory is propelled by retailers that embed advanced analytics and generative models into pricing, merchandising, and customer-engagement workflows. Demand forecasting engines that lift accuracy by 15% and cut overstocks by 10% are delivering immediate working-capital improvements, while edge-based computer-vision systems accelerate autonomous checkout adoption and drive basket-value gains of up to 35%. Cloud cost curves continue to fall, expanding access to enterprise-grade AI stacks for mid-tier retailers. At the same time, regional regulation around data privacy and algorithmic fairness is prompting investment in local inference and privacy-preserving architectures. Competitive intensity is rising as hyperscalers package retail-specific AI toolkits and seal multi-year deals with global chains.

Global Artificial Intelligence (AI) In Retail Industry Market Trends and Insights

Rapid adoption of omnichannel AI for personalization

Omnichannel AI now maps full customer journeys and adjusts in real time across mobile, web, and store touchpoints. Target's Store Companion AI, rolled out to nearly 2,000 locations, illustrates how generative models can serve staff questions while tailoring offers to shoppers. FairPrice Group's Store of Tomorrow, built on Google Cloud, unifies cart data, in-store sensors, and e-commerce profiles to create a single view of each customer. Such deployments bind physical and digital channels, yet a perception gap persists: while 96% of retailers report project success, only 45% of consumers feel understood, revealing execution shortfalls.

Declining cost and accessibility of cloud-based AI stacks

Unit costs for inference are falling as chip efficiency rises and hyperscalers invest heavily. Amazon earmarked USD 100 billion in AI and AWS infrastructure to keep latency low and capacity high. Microsoft's Cloud for Retail bundles pre-configured AI modules, slashing deployment cycles for mid-market chains. Partnerships such as Currys with Accenture and Microsoft highlight how retailers bypass talent constraints by renting turnkey stacks. The access shift pressures incumbents who still operate legacy data centers.

Data-privacy regulations limiting data harvesting

The EU AI Act elevates retail algorithms to "high-risk," obliging mandatory transparency, human oversight, and impact assessment. Retailers must now run Data Protection Impact Assessments and embed privacy-by-design from code commit through model retraining. Localized LLMs that never leave company firewalls are emerging as a compliance hedge, yet smaller chains struggle with cost and governance overhead.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce expansion demands real-time analytics

- Generative-AI-powered vision checkout

- Shortage of retail-specific AI talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Omnichannel approaches held a dominant 45.7% Artificial Intelligence in Retail market share in 2024, emphasizing the strategic value of unified data flows across store, web, and mobile. Pure-play online models, though smaller, are scaling fastest at a 19.8% CAGR as cloud-native architectures let them launch AI pilots without ripping out legacy POS layers. Brick-and-mortar chains are leveraging in-store IoT sensors to feed behavioral data back into recommendation engines, improving cross-sell accuracy and raising conversion.

Investment momentum underscores the shift: leading UK apparel chain Matalan applied generative AI to product descriptions and quadrupled copy throughput, trimming content cost while preserving brand tone. Conversely, specialty chains that silo e-commerce from store teams report inconsistent recommendations and cart-abandon spikes. Looking ahead, mixed-reality fitting rooms and mobile checkout promise to blur any remaining distinction between channels.

Software platforms still contributed 61.3% of Artificial Intelligence in Retail market size during 2024, covering predictive-analytics engines, LLM-powered chatbots, and vision-recognition APIs. Yet managed services are rising at 21.3% CAGR as retailers outsource model tuning, MLOps, and compliance. For cash-constrained banners, opex-style AI is easier to defend than multimillion-dollar licenses.

Service specialists bundle domain know-how-shelf-allocation heuristics, markdown timing, labor scheduling-into pre-trained models. This shrink-wrapped expertise eases adoption for chains lacking data-science benches. Professional services growth is steadier, focused on advisory projects such as AI readiness audits and ethical-risk mapping.

The AI in Retail Industry Market Report Segments the Industry Into by Channel (Omnichannel, Brick-And-Mortar, and Pure-Play Online Retailers), Component (Software, and Services), Deployment (On-Premise, and Cloud), Application (Supply-Chain and Logistics, Product Optimization and Merchandising, and More), Technology (Machine Learning and Predictive Analytics, Natural Language Processing, and More), and Geography.

Geography Analysis

North America controlled 37.4% of Artificial Intelligence in Retail market size in 2024, buoyed by robust cloud infrastructure, venture capital, and retailers willing to pilot bleeding-edge models. Walmart's 4.8% revenue uplift from generative-AI-driven merchandising underscores tangible returns. Regulatory scrutiny around bias and pricing discrimination is intensifying, yet transparent model governance practices are helping majors keep deployment on track. Investments continue in proprietary stacks such as Walmart Element and Target Store Companion to maintain competitive moats.

Asia-Pacific is the growth engine, expanding at 18.9% CAGR through 2030. Mobile-first consumers, government funding, and aggressive digital-native entrants create fertile ground. In India, 80% of retailers intend to scale AI in 2025, with expectations that generative models will raise frontline productivity by as much as 37%. China's social-commerce titans combine live video, conversational AI, and integrated payments to optimize impulse purchasing. ASEAN markets leapfrog traditional POS with cloud-only solutions, though uneven broadband and skills gaps temper rollout speed in secondary cities.

Europe balances innovation and regulation. GDPR and the upcoming AI Act demand rigorous privacy-impact audits, pushing chains toward federated learning and edge encryption. Sainsbury's five-year pact with Microsoft exemplifies partnerships that blend compliance with state-of-the-art tools. Intermarche's smart-cart pilot and IKI Lithuania's age-estimation checkout illustrate practical, privacy-aligned use cases. The region's patient, ethics-first approach is generating templates for responsible AI that could export globally.

- Accenture plc

- Amazon Web Services, Inc.

- BloomReach, Inc.

- Cognizant Technology Solutions Corporation

- Conversica, Inc.

- Daisy Intelligence Corporation

- Google LLC

- IBM Corporation

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- SymphonyAI LLC

- Tencent Holdings Ltd.

- ViSenze Pte. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of omnichannel AI for personalization

- 4.2.2 Declining cost and accessibility of cloud-based AI stacks

- 4.2.3 E-commerce expansion demanding real-time analytics

- 4.2.4 Generative-AI-powered vision checkout

- 4.2.5 Retail media networks monetizing first-party data

- 4.2.6 ESG-driven AI inventory carbon optimization

- 4.3 Market Restraints

- 4.3.1 Data-privacy regulations limiting data harvesting

- 4.3.2 Shortage of retail-specific AI talent

- 4.3.3 Algorithmic bias risk in dynamic pricing

- 4.3.4 Edge-compute energy cost in micro-fulfillment

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Channel

- 5.1.1 Omnichannel

- 5.1.2 Brick-and-Mortar

- 5.1.3 Pure-play Online Retailers

- 5.2 By Component

- 5.2.1 Software

- 5.2.2 Services

- 5.3 By Deployment

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By Application

- 5.4.1 Supply-Chain and Logistics

- 5.4.2 Product Optimization and Merchandising

- 5.4.3 In-Store Navigation and Experience

- 5.4.4 Payment, Pricing and Checkout Analytics

- 5.4.5 Inventory and Demand Forecasting

- 5.4.6 Customer Relationship Management

- 5.4.7 Fraud and Loss Prevention

- 5.5 By Technology

- 5.5.1 Machine Learning and Predictive Analytics

- 5.5.2 Natural Language Processing

- 5.5.3 Generative AI and Large Language Models

- 5.5.4 Computer Vision (Image and Video)

- 5.5.5 Chatbots and Virtual Assistants

- 5.5.6 Swarm and Reinforcement Intelligence

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Egypt

- 5.6.4.2.3 Nigeria

- 5.6.4.2.4 Rest of Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 India

- 5.6.5.3 Japan

- 5.6.5.4 South Korea

- 5.6.5.5 ASEAN

- 5.6.5.6 Australia

- 5.6.5.7 New Zealand

- 5.6.5.8 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 Amazon Web Services, Inc.

- 6.4.3 BloomReach, Inc.

- 6.4.4 Cognizant Technology Solutions Corporation

- 6.4.5 Conversica, Inc.

- 6.4.6 Daisy Intelligence Corporation

- 6.4.7 Google LLC

- 6.4.8 IBM Corporation

- 6.4.9 Infosys Limited

- 6.4.10 Intel Corporation

- 6.4.11 International Business Machines Corporation

- 6.4.12 Microsoft Corporation

- 6.4.13 NVIDIA Corporation

- 6.4.14 Oracle Corporation

- 6.4.15 Salesforce, Inc.

- 6.4.16 SAP SE

- 6.4.17 SAS Institute Inc.

- 6.4.18 SymphonyAI LLC

- 6.4.19 Tencent Holdings Ltd.

- 6.4.20 ViSenze Pte. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment