PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851726

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851726

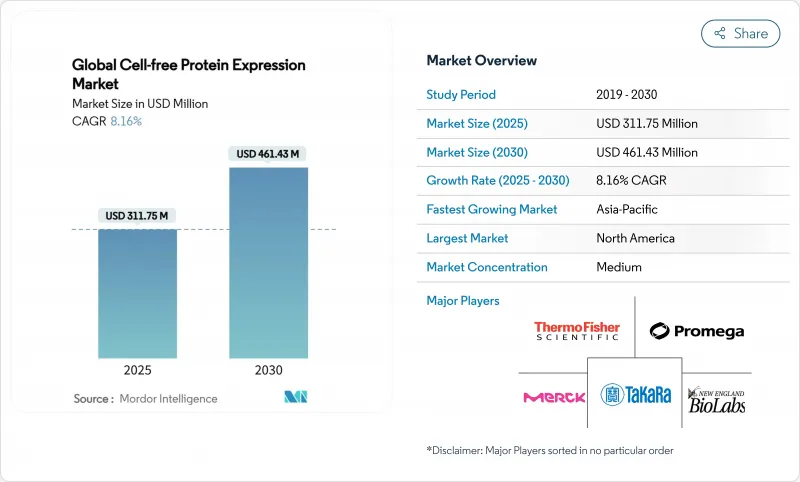

Cell-free Protein Expression - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cell-free protein expression market size stands at USD 311.75 million in 2025 and is forecast to reach USD 461.43 million by 2030, reflecting an 8.16% CAGR.

The technology's move from academic benches to cGMP suites is reshaping biomanufacturing workflows, particularly where rapid design-build-test timelines and toxic protein profiles challenge cell-based systems. Regulatory support is widening, as the US FDA's advanced-manufacturing guidance outlines clear validation paths for commercial-scale cell-free facilities. Strategic capital flows into synthetic biology, improved lysate yields, and greater reagent standardization are expanding the addressable market well beyond discovery research. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing geography on the back of vaccine-oriented national programs, while North America retains the largest revenue base due to entrenched pharmaceutical demand. Competitive intensity remains moderate, with integrated platform providers differentiating on lysate quality, automation, and end-to-end workflow support.

Global Cell-free Protein Expression Market Trends and Insights

Growth of Personalized & Rapid Vaccine Prototyping

Decentralized vaccine strategies now emphasize on-site production of patient-specific conjugates, and cell-free systems are delivering dose costs as low as USD 0.50 while eliminating cold-chain dependencies. Northwestern University's iVAX platform increased yields by 91% through vesicle enrichment, pushing per-dose costs near USD 1. These economics, coupled with freeze-dried lysate stability, strengthen pandemic-readiness measures in ways unattainable by large stainless-steel fermenters. Global regulators are responding; the FDA's advanced-manufacturing framework explicitly cites cell-free systems as an eligible pathway for rapid-response vaccines, accelerating their clinical translation.

Rise in Cell-free Platforms for On-demand Biologics Manufacturing

Contract manufacturers are scaling flexible facilities as the therapeutic pipeline shifts toward low-volume, high-mix biologics. Samsung Biologics committed USD 6 billion and Fujifilm Diosynth USD 3.2 billion to multiproduct plants favoring agile technologies. Cell-free workflows align with this strategy by decoupling protein synthesis from cell growth, permitting near-instant campaign changeovers. The commercial milestone arrived in 2025 when Boehringer Ingelheim ran Sutro Biopharma's cell-free process at full GMP scale to produce luveltamab tazevibulin . The success validated consistent yields, confirming that cell-free lines can meet stringent quality specifications required for antibody-drug conjugates.

Persistent Gap in Large-volume Lysate Supply

As demand migrates from 50 mL bench reactions to 1,000 L cGMP reactors, batch-to-batch variability in lysate activity remains the Achilles heel. NIZO's alliance with Enzymit focuses on continuous-fermentation harvests to stabilize enzymatic composition, yet supply lags still ripple through Asia-Pacific contract campaigns. Niche systems such as wheat germ or human cell extract face steeper shortages due to more complex upstream workflows, limiting their availability for production runs. Advances in bioreactor scale-down models and standardized freeze-dry protocols are mitigating variability, but industrial consistency is not yet fully realized.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Research and Development in Proteomics and Genomics

- Surging Investments in Synthetic Biology Start-ups

- High Upfront Capital for Cell-free Automation Workstations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lysate systems held 67.12% of 2024 revenue, anchoring the cell-free protein expression market size at the process core. Escherichia coli lysates dominate because they leverage mature fermentation know-how and linear scalability, while wheat germ extracts deliver superior folding for eukaryotic proteins, an essential parameter for structural studies. Rabbit reticulocyte and insect cell lysates occupy specialty niches where mammalian or baculoviral translation machinery offers added authenticity. Human cell lysate remains capacity-constrained but commands premium pricing for post-translational modifications that mirror native biology.

Standardization around pre-blended energy mixes and enhanced chaperone cocktails is shifting value capture toward accessories and consumables, the fastest-growing sub-segment at 8.56% CAGR. Reagents now account for nearly 40% of lifetime operating costs, creating annuitized revenue streams for suppliers. Single-use reaction cartridges and lyophilized enhancer pellets simplify workflow reproducibility, an attractive feature for high-throughput automation lines and distributed manufacturing sites that underpin the cell-free protein expression market.

Translation-only kits represented 56.65% of 2024 sales, favored for their simplicity and alignment with mRNA template libraries. They enable precise control over codon optimization, initiation factors and ribosomal pausing, which is valuable for studying protein variants at analytical scale. However, coupled transcription-translation systems are expanding at a 9.71% CAGR, driven by cost advantages from DNA-direct inputs and shrinking workflow steps. Linear-DNA protocols that skip plasmid cloning further reduce turnaround times, while AI-guided parameter sweeps optimize magnesium, NTP and amino-acid concentrations concurrently.

This convergence is boosting yields closer to cellular titers without the metabolic burden or time penalties of cell standards. As high-throughput facilities chase cost per microgram and speed metrics, coupled systems are poised to absorb volume share, intensifying product-level competition within the broader cell-free protein expression market .

The Cell-Free Protein Expression Market Report is Segmented by Products (Accessories & Consumables, Lysate Systems), Expression Method (Coupled Transcription and Translation, Translation), Application (Enzyme Engineering, and More), End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 41.44% of 2024 revenue for the cell-free protein expression market, underpinned by federal funding mechanisms, deep synthetic-biology venture pools and a regulatory climate endorsing novel manufacturing technologies. The FDA's clarity on advanced-manufacturing routes mechanized industry confidence and triggered scale-up partnerships such as Boehringer Ingelheim and Sutro Biopharma's commercial ADC run.

Asia-Pacific is the fastest-expanding geography at 9.21% CAGR to 2030. Singapore's investment in mRNA cancer vaccine pilot plants and South Korea's explicit policy goal of a global vaccine hub drive localized demand for rapid, modular production. Emerging Chinese frameworks for cell and gene therapy, coupled with Japan's emphasis on GMP transparency, further stimulate adoption. The genetic heterogeneity within Asian populations also encourages personalized vaccine campaigns that lean heavily on cell-free agility.

Europe advances steadily underpinned by MHRA modular-manufacturing regulations that encourage point-of-care ATMP production, a natural fit for decentralized cell-free units. Sustainability imperatives and the preference for animal-component-free inputs resonate with the platform's reagent profile, enhancing its regional reception. Cross-border collaborations, such as RNA-based therapy tech-transfer programs, are proliferating and bolstering the region's role in the cell-free protein expression market.

- Thermo Fisher Scientific

- Promega

- Merck

- Takara Bio

- New England Biolabs

- Biotechrabbit

- CellFree Sciences Co., Ltd.

- Cube Biotech

- GeneCopoeia

- Jena Bioscience

- Creative Biolabs

- Bioneer

- LenioBio

- Sutro Biopharma Inc.

- Addgene

- TAIYO NIPPON SANSO Corporation

- QIAGEN

- Synthelis biotech

- Arbor Biosciences

- Cayman Chemical

- Nuclera

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Personalized & Rapid Vaccine Prototyping

- 4.2.2 Rise in Cell-free Platforms for On-demand Biologics Manufacturing

- 4.2.3 Increasing Research and Development in the field of Proteomics and Genomics

- 4.2.4 Surging Investments in Synthetic Biology Start-ups

- 4.2.5 Growing burden Cancer and other infectious diseases creating a need for cell-free protein expression

- 4.2.6 Increasing advantages of cell-free protein expression systems

- 4.3 Market Restraints

- 4.3.1 Persistent Gap in Large-volume lysate supply

- 4.3.2 Low Awareness Among CROs in Emerging Markets

- 4.3.3 High Upfront Capital for Cell-free Automation Workstations

- 4.3.4 Stringent development workflow

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Products

- 5.1.1 Accessories & Consumables

- 5.1.2 Lysate Systems

- 5.1.2.1 E. coli Lysate

- 5.1.2.2 Wheat Germ Extract Lysate

- 5.1.2.3 Rabbit Reticulocyte Lysate

- 5.1.2.4 Insect Cell Lysate

- 5.1.2.5 Human Cell Lysate

- 5.1.2.6 Other Lysate Systems

- 5.2 By Expression Method

- 5.2.1 Coupled Transcription and Translation

- 5.2.2 Translation

- 5.3 By Application

- 5.3.1 Enzyme Engineering

- 5.3.2 High Throughput Production

- 5.3.3 Protein Labeling

- 5.3.4 Protein-Protein Interaction Studies

- 5.3.5 Vaccine & Therapeutic Development

- 5.3.6 Other Applications

- 5.4 By End-User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Academic & Research Institutes

- 5.4.3 CROs & CDMOs

- 5.4.4 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Promega Corporation

- 6.3.3 Merck KGaA (Sigma-Aldrich)

- 6.3.4 Takara Bio Inc.

- 6.3.5 New England Biolabs

- 6.3.6 Biotechrabbit GmbH

- 6.3.7 CellFree Sciences Co., Ltd.

- 6.3.8 Cube Biotech GmbH

- 6.3.9 GeneCopoeia, Inc.

- 6.3.10 Jena Bioscience GmbH

- 6.3.11 Creative Biolabs

- 6.3.12 Bioneer Corporation

- 6.3.13 LenioBio GmbH

- 6.3.14 Sutro Biopharma Inc.

- 6.3.15 Addgene Inc.

- 6.3.16 TAIYO NIPPON SANSO Corporation

- 6.3.17 QIAGEN N.V.

- 6.3.18 Synthelis biotech

- 6.3.19 Arbor Biosciences

- 6.3.20 Cayman Chemical

- 6.3.21 Nuclera

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment