PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910528

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910528

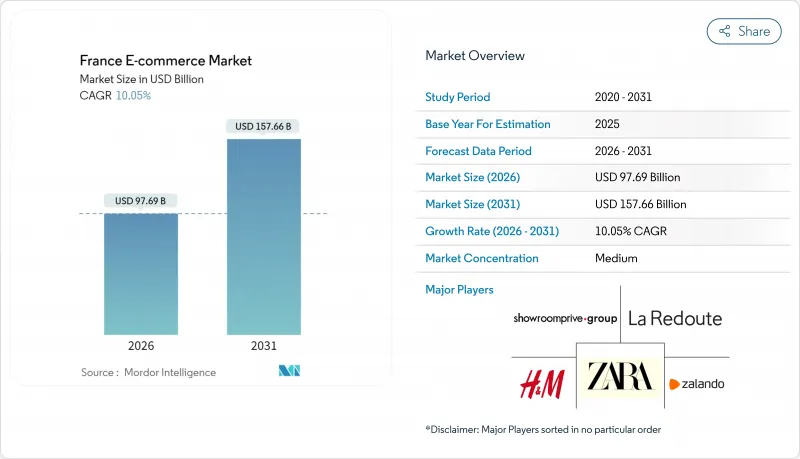

France E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The France ecommerce market is expected to grow from USD 88.77 billion in 2025 to USD 97.69 billion in 2026 and is forecast to reach USD 157.66 billion by 2031 at 10.05% CAGR over 2026-2031.

Rapid broadband deployment, a strong mobile shopping culture, and widespread payment innovation are underpinning this expansion. Volumes are being reshaped by higher rural connectivity, omnichannel fulfillment habits, and the swift uptake of Buy Now Pay Later (BNPL) among Gen Z and millennials. Competitive intensity is rising as Chinese cross-border platforms amplify price pressure, while domestic operators counter with "Made-in-France" positioning. The France ecommerce market continues to benefit from public-sector stimulus such as the 'France Num' program, even as stricter data-protection rules and congested urban last-mile networks temper margin gains.

France E-commerce Market Trends and Insights

Ubiquitous High-Speed Fiber & 5G Coverage Accelerating Online Shopping in Rural France

Nearly 93.2% of France's populated areas now fall under 5G coverage, while 41% of households enjoy >=100 Mbps broadband. These upgrades widen the France ecommerce market to regions once constrained by slow connections and add scalable demand for retailers specializing in grocery, home improvement, and leisure goods. Rural merchants gain fresh routes to market, and logistics providers record healthier route density that cuts per-parcel costs. Public-private fiber roll-outs financed under France 2030 keep pace, ensuring that latency-sensitive categories such as live-stream shopping and instant-delivery groceries can reach remote buyers. The resulting activity is projected to contribute EUR 190 billion (USD 209 billion) in 5G-related sales by 2030, solidifying broadband as a foundation for digital commerce.

Government's 'France Num' Initiative Driving SME E-commerce Adoption

France Num delivers digital audits, training, and low-interest loans that address SMEs' hardware, software, and skills gaps. Only 52% of SMEs showed basic digital readiness in 2024, yet the program's tools are already nudging adoption upwards, notably in manufacturing belts around Lyon and Lille. As SMEs integrate web-stores and e-procurement portals, the France ecommerce market gains fresh supplier diversity, particularly in niche B2B categories such as industrial equipment and professional services. Improved SME participation also de-risks supply chains for larger retailers that source locally, reinforcing resilience against global shocks.

Stringent GDPR/CNIL Compliance Increasing Operating Costs

The CNIL levied EUR 55 million (USD 59.4 million) in fines during 2024, a figure that signals elevated regulatory risk for digital merchants. Its 331 corrective measures tightened consent, cookie, and mobile-data rules, disproportionately affecting sellers with thin compliance budgets. New SREN provisions widen liability for illegal content, compelling site owners to invest in AI moderation and audit trails. These outlays can reach 20% of operating expenses for smaller actors, curbing marketing spend and delaying platform enhancements that fuel the France ecommerce market.

Other drivers and restraints analyzed in the detailed report include:

- Cultural Embrace of Click & Collect Enhancing Omnichannel Penetration

- Shift Toward Sustainable Consumption Boosting Second-Hand Marketplaces

- Intensifying Low-Cost Cross-Border Competition from Chinese Marketplaces

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The B2C segment commanded 81.35% of the France ecommerce market in 2025, underscoring entrenched consumer adoption. Yet B2B channels are forecast to advance at 8.9% CAGR, surpassing overall market growth. This pace highlights latent demand among suppliers integrating procurement portals and electronic catalogs. The France ecommerce market size for B2B benefits from state incentives, improved cyber-security tools, and cloud ERP penetration, which collectively reduce transaction friction.

France Ecommerce industry players targeting SMEs deploy marketplace-as-a-service offerings, helping smaller manufacturers reach new buyers without heavy IT investments. Sector-specific logistics, bulk-pricing algorithms, and dynamic credit scoring further bolster B2B adoption. As awareness of France Num spreads beyond early adopters, traditional wholesalers modernize, lifting average order values and broadening the product mix online.

Smartphones captured 62.10% of transactions in 2025, reflecting user preference for frictionless, app-based checkout flows. Enhanced 5G speeds and biometric authentication drive higher conversion, positioning mobile screens as the primary revenue engine of the France ecommerce market. Retailers investing in progressive web apps observe 15-20% stronger repeat-business metrics compared with desktop-only competitors.

Desktop remains relevant for complex B2B quotes and high-priced electronics, while emerging voice and smart-TV channels prepare to add incremental reach. The CNIL's 2024 mobile guidelines compel developers to tighten SDK governance and data minimization, adding compliance layers but ultimately boosting consumer trust. Over the forecast window, mobile-first innovation is set to compress acquisition costs and widen rural penetration, sustaining France ecommerce market growth.

The France E-Commerce Market Report is Segmented by Business Model (B2C, B2B), Device Type (Smartphone / Mobile, Desktop and Laptop, Other Device Types), Payment Method (Credit / Debit Cards, Digital Wallets, BNPL, Other Payment Method), B2C Product Category (Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverages, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amazon.com, Inc.

- Cdiscount SA

- FNAC Darty SA

- eBay Inc.

- Carrefour SA

- Veepee SA

- La Redoute SA

- ZARA France

- Alibaba Group Holding Ltd.

- LeBonCoin (Adevinta ASA)

- Showroomprive SA

- H & M Hennes & Mauritz GBC AB

- Zalando SE

- Groupe Adeo (Leroy Merlin SA)

- Vertbaudet SAS

- Rue du Commerce (Shopinvest Holding)

- ManoMano (Colibri SAS)

- Auchan Retail International SA

- Intermarche (Les Mousquetaires)

- Boulanger SA

- Rakuten France SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ubiquitous High-Speed Fiber and 5G Coverage Accelerating Online Shopping in Rural France

- 4.2.2 Government's 'France Num' Initiative Driving SME E-commerce Adoption

- 4.2.3 Shift Toward Sustainable Consumption Boosting Second-Hand Online Marketplaces

- 4.2.4 Cultural Embrace of 'Click and Collect' Enhancing Omnichannel Penetration

- 4.2.5 Growing Popularity of Buy-Now-Pay-Later Among Gen-Z and Millennials

- 4.2.6 Rise of the 'Made-in-France' Label Fueling Domestic Platforms' Traffic

- 4.3 Market Restraints

- 4.3.1 Stringent GDPR/CNIL Compliance Increasing Operating Costs

- 4.3.2 High Reverse-Logistics Costs Driven by Fashion Returns

- 4.3.3 Saturation of Urban Last-Mile Networks Causing Margin Pressure

- 4.3.4 Intensifying Low-Cost Cross-Border Competition from Chinese Marketplaces

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Demographic and Socio-Economic Analysis of French Online Shoppers

- 4.8 Payment Landscape and Transaction Modes

- 4.9 Cross-Border E-commerce Flow Analysis

- 4.10 France's Positioning within European E-commerce

- 4.11 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Business Model

- 5.1.1 B2C

- 5.1.2 B2B

- 5.2 By Device Type

- 5.2.1 Smartphone / Mobile

- 5.2.2 Desktop and Laptop

- 5.2.3 Other Device Types

- 5.3 By Payment Method

- 5.3.1 Credit / Debit Cards

- 5.3.2 Digital Wallets

- 5.3.3 BNPL

- 5.3.4 Other Payment Method

- 5.4 By B2C Product Category

- 5.4.1 Beauty and Personal Care

- 5.4.2 Consumer Electronics

- 5.4.3 Fashion and Apparel

- 5.4.4 Food and Beverages

- 5.4.5 Furniture and Home

- 5.4.6 Toys, DIY and Media

- 5.4.7 Other Product Categories

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon.com, Inc.

- 6.4.2 Cdiscount SA

- 6.4.3 FNAC Darty SA

- 6.4.4 eBay Inc.

- 6.4.5 Carrefour SA

- 6.4.6 Veepee SA

- 6.4.7 La Redoute SA

- 6.4.8 ZARA France

- 6.4.9 Alibaba Group Holding Ltd.

- 6.4.10 LeBonCoin (Adevinta ASA)

- 6.4.11 Showroomprive SA

- 6.4.12 H & M Hennes & Mauritz GBC AB

- 6.4.13 Zalando SE

- 6.4.14 Groupe Adeo (Leroy Merlin SA)

- 6.4.15 Vertbaudet SAS

- 6.4.16 Rue du Commerce (Shopinvest Holding)

- 6.4.17 ManoMano (Colibri SAS)

- 6.4.18 Auchan Retail International SA

- 6.4.19 Intermarche (Les Mousquetaires)

- 6.4.20 Boulanger SA

- 6.4.21 Rakuten France SAS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment