PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851962

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851962

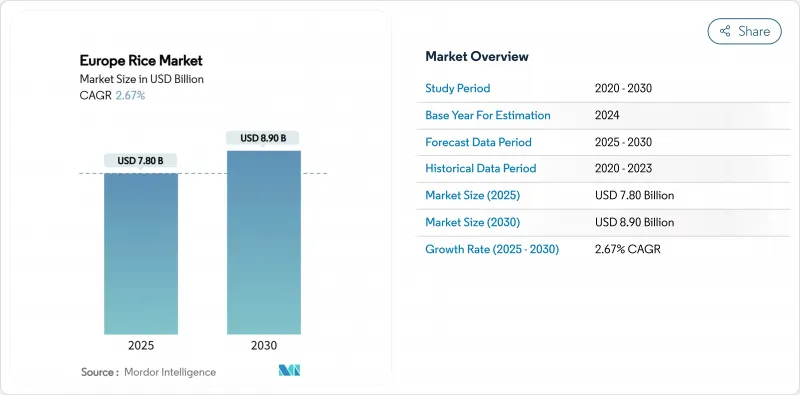

Europe Rice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe rice market size reached USD 7.8 billion in 2025 and is projected to grow to USD 8.9 billion by 2030, at a CAGR of 2.67% during the forecast period.

Consumer preferences for gluten-free and premium grains maintain stable demand across retail and food-service segments. The import volumes of aromatic varieties like Basmati and Jasmine rice exceed traditional long-grain rice, driven by increasing multicultural food preferences, particularly in Western Europe. Production decreases in Italy and Spain due to climate factors have constrained regional supply and increased costs, leading processors to establish extended agreements with Asian suppliers. The industry has implemented precision irrigation systems and digital traceability to reduce water consumption and enhance product authenticity. Consumer interest in sustainability and ethical sourcing has led companies to implement transparent supply chain practices. The growing adoption of plant-based diets has strengthened rice's position as an essential food ingredient in European cuisine.

Europe Rice Market Trends and Insights

Boom in Specialty and Ethnic Cuisine Demand

European consumers show a growing preference for aromatic and specialty rice varieties, driven by diverse culinary preferences and health awareness. UK supermarkets have created dedicated sections for Basmati, Jasmine, and colored rice varieties, improving product visibility. Basmati rice sells at prices two to three times higher than conventional long-grain rice, generating higher retail margins. To ensure authenticity and prevent adulteration, suppliers use elemental fingerprinting tests. The shift from ethnic stores to mainstream retail channels has increased consumer access and established premium pricing.

Europe's Farm-to-Fork Subsidies for Sustainable Rice

The European Union's agricultural policy provides payments to farmers who implement alternate wetting and drying techniques, which reduce methane emissions by up to 50% while maintaining crop yields. The Netherlands alone sets aside EUR 964 million (USD 1,060 million) each year to incentivize soil health and pesticide reduction measures. The EU's Farm to Fork Strategy aims to decrease chemical pesticide usage and increase organic farming across member states. The policy includes multi-year funding guarantees that enable Italian and Spanish agricultural cooperatives to invest in energy-efficient pumps and laser land leveling equipment, supporting their long-term sustainability initiatives. The strategy provides financial support and technical guidance to help farmers implement precision agriculture and conservation practices that balance environmental protection with economic sustainability.

Volatile Fertilizer and Energy Prices

Natural gas supply disruptions led to temporary closures of nitrogen production facilities across Europe, causing urea prices to increase and reducing farmer profit margins despite stable rough-rice prices. According to Rabobank, persistent high input costs may force milling operations to move outside Europe to reduce expenses. Increased energy costs have affected fertilizer supply chains, creating additional challenges for producers. The ongoing volatility in input prices has prompted downstream processors to review their procurement strategies to protect profits and maintain a reliable supply.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Precision Irrigation and Water-saving Technologies

- Adoption of Climate-Resilient Rice Cultivars

- Stricter European Pesticide-Residue Limits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Europe Rice Market Report is Segmented by Geography (Belgium, United Kingdom, France, Italy, Germany, Netherlands, and Spain). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Boom in Specialty and Ethnic Cuisine Demand

- 4.2.2 Europe's Farm-to-Fork Subsidies for Sustainable Rice

- 4.2.3 Adoption of Precision Irrigation and Water-saving Technologies

- 4.2.4 Adoption of Climate-Resilient Rice Cultivars

- 4.2.5 Consumer Shift from Glutenous Cereals to Rice

- 4.2.6 Investments in Organic and Bio-fortified Rice

- 4.3 Market Restraints

- 4.3.1 Volatile Fertilizer and Energy Prices

- 4.3.2 Low-cost Asian Import Pressure under GSP Quotas

- 4.3.3 Environmental Yield Uncertainty

- 4.3.4 Stricter European Pesticide-Residue Limits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 Belgium

- 5.1.2 United Kingdom

- 5.1.3 France

- 5.1.4 Italy

- 5.1.5 Germany

- 5.1.6 Netherlands

- 5.1.7 Spain

6 Competitive Landscape

- 6.1 List of Stakeholders

7 Market Opportunities and Future Outlook