PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907236

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907236

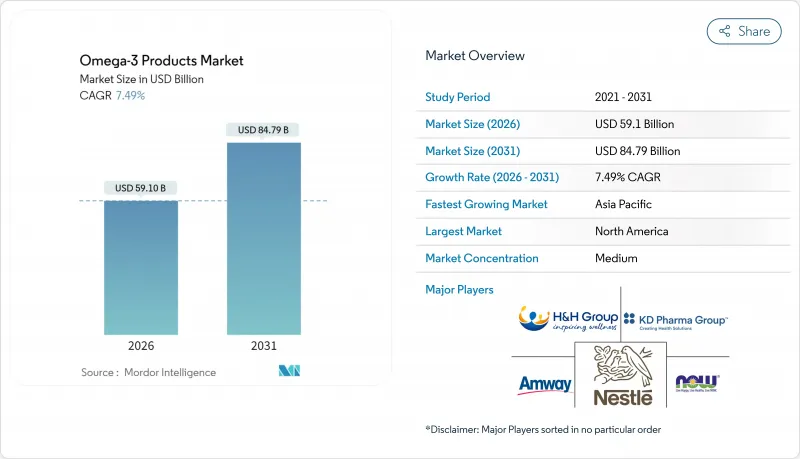

Omega-3 Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Omega-3 products market size in 2026 is estimated at USD 59.1 billion, growing from 2025 value of USD 54.98 billion with 2031 projections showing USD 84.79 billion, growing at 7.49% CAGR over 2026-2031.

The market expansion is driven by increasing consumer awareness about healthy and natural products, particularly in developed regions where nutritional supplements are gaining popularity. The growing demand for plant-based products, supported by rising health consciousness, further contributes to market growth. Consumers are increasingly seeking omega-3 supplements derived from sources like algae and flaxseed, reflecting a broader shift toward sustainable and plant-based alternatives. The market also benefits from the growing incorporation of omega-3 ingredients in functional foods, beverages, and dietary supplements, catering to diverse consumer preferences and nutritional needs.

Global Omega-3 Products Market Trends and Insights

Growing demand for brain development and joint health supplements

Various research studies demonstrate omega-3s' expanding effectiveness in cognitive health applications beyond traditional cardiovascular benefits. Clinical studies show that high-dose EPA formulations deliver superior efficacy in migraine prevention compared to conventional medications, with patients reporting significant reductions in frequency and intensity of episodes. The U.S. Department of Defense's comprehensive investigation of omega-3 supplements for mild traumatic brain injury treatment in March 2025 validates these neurological benefits through extensive clinical trials and documentation . Moreover, clinical evidence and institutional adoption drive the development of cognitive health formulations at premium prices, especially for therapeutic uses. Studies show that postmenopausal women absorb EPA and DHA at higher rates compared to men, revealing metabolic differences that inform product development. These gender-based variations in bioavailability and efficacy create opportunities for personalized omega-3 products.

Increasing demand for DHA and EPA in prenatal and infant nutrition

The European Food Safety Authority's approval of Schizochytrium limacinum oil for infant and follow-on formula applications has strengthened regulations supporting DHA inclusion in infant formulas. This approval expands the available sources of DHA beyond traditional fish oil derivatives. The EFSA safety assessment confirmed that the oil, containing 40-43% DHA of total fatty acids, meets EU regulations for mandatory DHA content in infant formulae. This assessment aligns with European Food Safety Authority data from 2025 . Various clinical studies demonstrate that DHA and arachidonic acid supplementation in infant formulas leads to positive developmental outcomes, including improved cognition and visual acuity, with optimal ratios mimicking breast milk composition. The convergence of regulatory approval and clinical evidence creates sustained demand despite declining birth rates in developed markets. Low- and middle-income countries present growth opportunities as accessibility to animal-source foods increases and awareness of early childhood nutrition benefits expands

High production cost

Small and medium-sized brands experience significant pricing pressures due to their limited negotiating power for alternative sourcing arrangements and reduced ability to absorb margin reductions. These companies often struggle to maintain profitability when raw material costs increase, as they lack the economies of scale that larger competitors possess. Companies are exploring ingredient reformulation and alternative sourcing strategies to manage costs, including the use of algal omega-3 sources, despite their higher production expenses. The shift toward algal sources represents a growing trend in the industry, though the technology and production infrastructure remain costly. Environmental factors and increased aquaculture demand create fish oil supply constraints, as limited marine resources cannot meet the growing global demand. The strain on wild fish stocks, coupled with climate change impacts and fishing quotas, further complicates the supply situation. Companies that maintain vertically integrated supply chains or long-term sourcing contracts hold competitive advantages during periods of cost inflation, as they can better control their supply chain and maintain more stable pricing structures.

Other drivers and restraints analyzed in the detailed report include:

- Surging demand for omega-3 enriched pet nutrition products supporting coat health

- Augmented demand for omeaga-3 in functional food

- Limited consumer awareness regarding omega-3 products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Infant nutrition holds the largest market share at 42.63% in 2025, driven by regulatory requirements and clinical studies showing benefits for cognitive development. This dominance is further strengthened by increasing parental awareness of early childhood nutrition and growing disposable income in developing regions. The functional food segment is projected to grow at 8.62% CAGR (2026-2031), supported by advances in fortification technology and increasing consumer demand for convenient nutrition options. This growth is particularly evident in ready-to-drink beverages, fortified cereals, and dairy products enriched with omega-3 fatty acids.

The dietary supplements segment maintains strong market presence, driven by consumers seeking targeted nutritional benefits, particularly among aging populations and fitness enthusiasts. The animal feed segment demonstrates steady growth as aquaculture and pet food manufacturers integrate omega-3 enrichment to address demand for premium pet nutrition and sustainable fish farming. The market continues to expand in infant formula applications, as evidenced by Bobbie's April 2025 launch of the first USDA organic infant formula with soy-based milk and increased DHA levels.

The Omega-3 Products Market is Segmented by Product Type (Functional Food, Dietary Supplements, Infant Nutrition, Animal Feed, and Others), Source (Animal-Based and Plant-Based), Sales Channel (Supermarkets/Hypermarkets, Health and Specialty Stores, Online Stores, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a 29.85% market share in 2025, driven by established supplement consumption patterns, clear regulatory frameworks for health claims, and widespread consumer understanding of omega-3 benefits. The region's robust distribution networks and healthcare provider endorsements contribute to market growth. According to the American Heart Association's 2024 data, the recommendation of two fatty fish servings weekly, along with supplement use for dietary gaps, supports market expansion . The regulatory environment allows companies to make qualified health claims for cardiovascular benefits, enhancing market development. The region's emphasis on personalized nutrition and premium products creates market opportunities for new formulations and delivery systems.

Asia-Pacific demonstrates the highest growth rate at 8.81% CAGR (2026-2031), supported by increasing disposable incomes, growing health awareness, and an expanding middle class seeking preventive health solutions. BASF's Chinese market expansion indicates the industry's recognition of regional opportunities, with Asia-Pacific designated as a primary market for nutrition and health products. The region's varying regulatory frameworks present market challenges and opportunities, as countries develop different approaches to functional foods and dietary supplements. The cultural familiarity with seafood consumption in Asian markets provides a foundation for omega-3 supplement adoption.

Europe maintains a strong market position through comprehensive regulatory frameworks and consumer acceptance of functional foods, supported by the European Union Health Claims Registry's clear marketing guidelines. The region's commitment to sustainability drives demand for algal and plant-based omega-3 sources, reflecting consumer preferences for ethical products. While regulatory requirements create market entry barriers, they ensure product quality and consumer safety, supporting premium pricing. Europe's aging population and focus on healthy aging maintain consistent demand for omega-3 products targeting cognitive and cardiovascular health.

- Soparfin SCA (Vetoquinol)

- Wiley Companies (AlaskOmega)

- Orkla Health AS (Moller's)

- KD Pharma Group

- Epax Norway (Pelagia)

- Aker BioMarine (Kori)

- UFAC UK Ltd

- Nordic Naturals

- Natures Crops International

- Now Health Group

- Herbalife Ltd.

- Reckitt (Mead Johnson)

- Nestle S.A.

- Body Cupid Pvt Ltd (Wow Life Science)

- Amway Corp.

- Kirin Holdings Company (Blackmores Ltd.)

- Healthwise Pharma

- H&H Group (Swisse)

- The Procter & Gamble Company (Seven Sea)

- VitaBright

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for brain development and joint health supplements

- 4.2.2 Increasing demand for DHA and EPA in prenatal and infant nutrition

- 4.2.3 Surging demand for omega-3 enriched pet nutrition products supporting coat health

- 4.2.4 Augmented demand for omeaga-3 in functional food

- 4.2.5 Expansion of personalized and gender-specific omega-3 products

- 4.2.6 Technological advancements in extraction, purification, and microencapsulation

- 4.3 Market Restraints

- 4.3.1 High production cost

- 4.3.2 Limited consumer awareness regarding omega-3 products

- 4.3.3 Sustainability concern over sourcing of omega-3 ingredients

- 4.3.4 Short shelf life and oxidation challenges constrain market growth

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Functional Food

- 5.1.2 Dietary Supplements

- 5.1.3 Infant Nutrition

- 5.1.4 Animal Feed

- 5.1.5 Others

- 5.2 By Source

- 5.2.1 Plant-Based

- 5.2.2 Animal-Based

- 5.3 By Sales Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Health and Spectality Store

- 5.3.3 Online Stores

- 5.3.4 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products, Recent Developments)

- 6.4.1 Soparfin SCA (Vetoquinol)

- 6.4.2 Wiley Companies (AlaskOmega)

- 6.4.3 Orkla Health AS (Moller's)

- 6.4.4 KD Pharma Group

- 6.4.5 Epax Norway (Pelagia)

- 6.4.6 Aker BioMarine (Kori)

- 6.4.7 UFAC UK Ltd

- 6.4.8 Nordic Naturals

- 6.4.9 Natures Crops International

- 6.4.10 Now Health Group

- 6.4.11 Herbalife Ltd.

- 6.4.12 Reckitt (Mead Johnson)

- 6.4.13 Nestle S.A.

- 6.4.14 Body Cupid Pvt Ltd (Wow Life Science)

- 6.4.15 Amway Corp.

- 6.4.16 Kirin Holdings Company (Blackmores Ltd.)

- 6.4.17 Healthwise Pharma

- 6.4.18 H&H Group (Swisse)

- 6.4.19 The Procter & Gamble Company (Seven Sea)

- 6.4.20 VitaBright

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK