PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852046

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852046

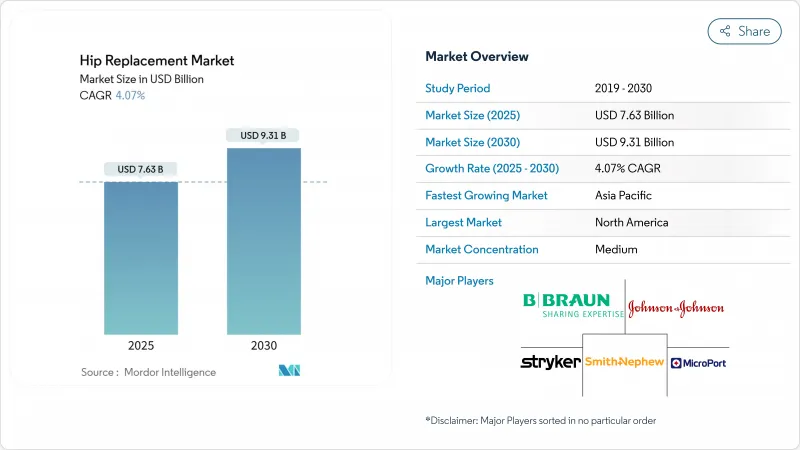

Hip Replacement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hip arthroplasty market size reached USD 7.63 billion in 2025 and is forecast to expand at a 4.07% CAGR, lifting value to USD 9.31 billion by 2030.

Demand scales with demographic aging, surging osteoarthritis prevalence, and widening acceptance of outpatient joint-replacement protocols that displace inpatient care. Procedure growth is reinforced by rapid adoption of robotic-assisted systems that give surgeons reproducible component alignment, while 3-D-printed porous implants extend device longevity by optimizing bone ingrowth. North America leads revenue, but Asia-Pacific posts the quickest pace because China and India deploy volume-based tenders that lower implant costs and expand patient access. Competitive positioning centers on differentiated technology; leading suppliers integrate robotics, AI planning, and surface-engineered implants to secure premium price realization even as reimbursement pressure intensifies.

Global Hip Replacement Market Trends and Insights

Growing Prevalence of Osteoarthritis

Osteoarthritis affects 606.5 million people worldwide, a figure that continues to climb as populations age and obesity rates rise. Hip disease progression is particularly aggressive, and traditional bearings show a 35% higher revision risk than advanced OXINIUM surfaces that deliver 94.1% twenty-year survivorship. Regional burden is heaviest in East and South Asia, yet modifiable risks such as body-mass-index contribute one-fifth of related disability. Genomic studies link more than 900 loci to disease, and 10% of implicated genes map to existing therapies, hinting at pharmacologic options that could postpone surgery. The convergence of aging and metabolic disorders thus keeps procedure demand ahead of surgical capacity.

Rising Geriatric & Obese Population

By 2030, surgeons in the United States alone anticipate 635,000 primary hip replacements-up 171% from today-while global volumes may top 1.23 million by 2060. Higher body-mass-index complicates manual component positioning; robotic systems correct these challenges and boost acetabular accuracy in patients with BMI > 24 kg/m2. High-income nations carry the steepest caseload growth, but emerging markets battle capacity gaps that restrict timely care, particularly for women who present with more complex hip anatomy requiring personalized implants.

High Implant & Procedure Cost Burden

Medicare reimbursement for total hip arthroplasty slid 44.04% between 2013 and 2021 even as volumes rose 44.17%, squeezing provider margins. The American Association of Hip and Knee Surgeons has petitioned Congress to counter another scheduled cut for 2025. Regional spreads are stark: the Northeast commands USD 1,731 average payment yet suffered the steepest percentage decline. Supply chain inputs such as titanium now represent up to 20% of orthopedic manufacturing cost bases, and geopolitical tension magnifies volatility. These factors risk curtailing uptake in cost-sensitive zones and widening inequity in care access.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Robotic-Assisted Hip Arthroplasty

- Shift Toward Outpatient & ASC-Based Procedures

- Device Recalls & Metal-On-Metal Litigation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Total hip replacement accounted for 63.21% of 2024 revenue, reaffirming its status as the clinical workhorse across age cohorts. The hip arthroplasty market size for this product reached USD 4.84 billion in 2025 and continues to grow in tandem with incremental design refinements, such as dual-mobility cups that mitigate dislocation risk. Hip resurfacing, although presently niche, is advancing at 6.84% CAGR as bone-preserving philosophy gains traction among active patients seeking long-term implant compatibility.

Momentum in robotic revision surgery underscores rising revision volumes: Stryker's Mako 4 introduces algorithmic guidance that simplifies acetabular explant and re-implant workflows. Adjacent innovations, like FDA-authorized reverse-hip constructs for severe deformity, illustrate the pipeline's tilt toward personalized solutions commanding premium reimbursement.

Cementless constructs captured 57.23% revenue in 2024, and associated hip arthroplasty market share is forecast to climb further as surgeons favor biologic fixation for younger, active cohorts. Highly porous titanium and tantalum buttress early bone infiltration, yielding 2% nonunion in femoral neck fractures compared to markedly higher rates with standard screws. Cemented stems remain indispensable for osteoporotic bone, and hybrid techniques blend both principles for complex anatomy.

Additive manufacturing accelerates cementless innovation: topology-optimized lattices reduce implant stiffness and distribute load uniformly, curbing stress shielding and extending functional lifespan. Smith+Nephew's CATALYSTEM stem, optimized for anterior approach surgery, typifies designs that shorten OR time-a critical metric in high-throughput ASC settings.

The Hip Replacement Market Report is Segmented by Product (Total Hip Replacement, Hip Resurfacing, Hip Revision, and More), Fixation Type (Cemented, and More), Material (Metal-On-Polyethylene, Ceramic-On-Polyethylene, and More), End User (Hospitals, Orthopedic Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 37.58% of 2024 revenue and retains technology leadership through early adoption of robotics, AI planning, and advanced bearing surfaces. The hip arthroplasty market size for the region is estimated at USD 2.87 billion in 2025, underpinned by favorable reimbursement for clinically evidenced upgrades. Europe's mature payer environment sustains steady growth, though cost-containment imperatives temper premium device penetration speed.

Asia-Pacific emerges as the expansion engine, registering 5.98% CAGR through 2030 as China and India execute procurement programs that halve implant prices and stimulate surgical uptake. China's case volume jumped from 168,040 in 2011 to 577,153 in 2019, while domestic implants captured nearly one-quarter of procedures. India, buoyed by medical-tourism inflows and hospital investment, anticipates double-digit annual growth in elective joint replacement.

South America and the Middle East & Africa present latent potential: Brazil projects 39,270 lower-limb arthroplasties by 2050, yet current penetration is 8.01 per 100,000-far below global averages. Capacity expansion hinges on training orthopedic surgeons and easing import tariffs that elevate device cost. Gulf Cooperation Council states, flush with hydrocarbon revenue, increasingly import U.S. and European systems while funding specialty joint institutes, setting the stage for localized manufacturing over the long term.

- Zimmer Biomet

- Stryker

- Johnson & Johnson

- Smiths Group

- B. Braun

- MicroPort

- Enovis

- Exactech

- Corin Group

- Wright Medical Group

- Integra LifeSciences

- Globus Medical

- Conformis

- Medacta Group

- LimaCorporate

- Bioimpianti

- Arthrex

- Mathys Ltd Bettlach

- United Orthopedic

- JRI Orthopaedics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Osteoarthritis

- 4.2.2 Rising Geriatric & Obese Population

- 4.2.3 Adoption of Robotic-Assisted Hip Arthroplasty

- 4.2.4 3-D Printed Porous Implants Enabling Bone In-Growth

- 4.2.5 Shift Toward Outpatient & ASC-Based Procedures

- 4.2.6 China-India Price-Volume Tenders Expanding Access

- 4.3 Market Restraints

- 4.3.1 High Implant & Procedure Cost Burden

- 4.3.2 Device Recalls & Metal-On-Metal Litigation

- 4.3.3 Reimbursement Compression in Mature Markets

- 4.3.4 Supply-Chain Tightness for Titanium & Cobalt

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Total Hip Replacement

- 5.1.2 Hip Resurfacing

- 5.1.3 Hip Revision

- 5.1.4 Other Products

- 5.2 By Fixation Type

- 5.2.1 Cemented

- 5.2.2 Cementless

- 5.2.3 Hybrid

- 5.3 By Material (Bearing Couple)

- 5.3.1 Metal-on-Polyethylene

- 5.3.2 Ceramic-on-Polyethylene

- 5.3.3 Ceramic-on-Ceramic

- 5.3.4 Metal-on-Metal

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Orthopedic Centers

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Zimmer Biomet

- 6.3.2 Stryker Corporation

- 6.3.3 Johnson & Johnson (DePuy Synthes)

- 6.3.4 Smith & Nephew plc

- 6.3.5 B. Braun SE

- 6.3.6 MicroPort Scientific Corporation

- 6.3.7 Enovis (DJO Global)

- 6.3.8 Exactech Inc.

- 6.3.9 Corin Group

- 6.3.10 Wright Medical Group N.V.

- 6.3.11 Integra LifeSciences

- 6.3.12 Globus Medical

- 6.3.13 Conformis

- 6.3.14 Medacta Group

- 6.3.15 LimaCorporate

- 6.3.16 Bioimpianti

- 6.3.17 Arthrex

- 6.3.18 Mathys Ltd Bettlach

- 6.3.19 United Orthopedic

- 6.3.20 JRI Orthopaedics

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment