PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910504

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910504

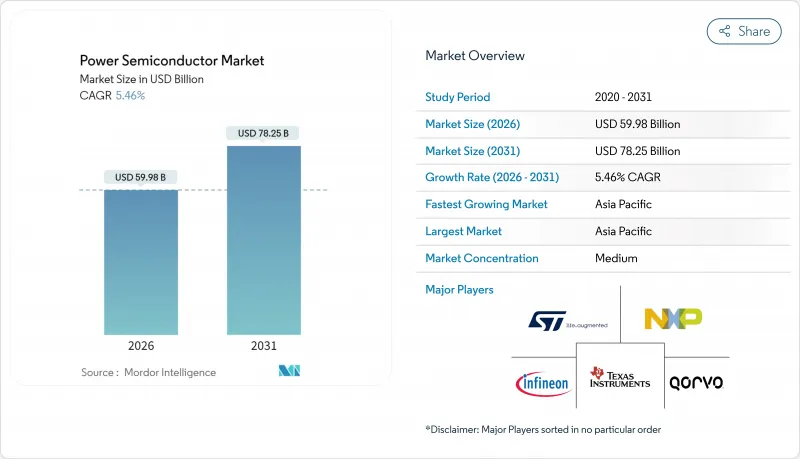

Power Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The power semiconductor market was valued at USD 56.87 billion in 2025 and estimated to grow from USD 59.98 billion in 2026 to reach USD 78.25 billion by 2031, at a CAGR of 5.46% during the forecast period (2026-2031).

Strong demand for efficient power conversion across electric vehicles, renewable energy systems, and data-intensive electronics keeps the power semiconductor market resilient even as cyclical slowdowns emerge elsewhere. Wide-bandgap (WBG) materials-chiefly silicon carbide (SiC) and gallium nitride (GaN)-command premium pricing because they outperform silicon in high-voltage and high-frequency conditions. Automotive electrification anchors volume, yet rapid growth stems from solar-plus-storage installations, 5G infrastructure rollouts, and factory automation upgrades. Regional supply-chain policies such as the U.S. CHIPS Act and the European Chips Act intensify domestic fabrication investments, while the Asia Pacific leverages its end-to-end manufacturing scale to maintain leadership.

Global Power Semiconductor Market Trends and Insights

Surging Demand for EVs and Charging Infrastructure

Electric vehicles increasingly rely on SiC MOSFETs that raise drivetrain efficiency and shorten charging times. Automakers shifting to 800 V systems specify SiC to trim inverter losses, evidenced by FORVIAs, such as onsemi's agreement with Volkswagen, secure vertically integrated chip-to-module deliveries, mitigating allocation risks. Parallel DC fast-charger roll-outs require 8 kW to 1 MW power blocks, effectively doubling SiC demand from vehicle content alone. Automotive-grade yields stay challenging, so IDMs add captive substrate capacity to stabilize cost curves and safeguard margins.

Proliferation of 5G Base-Stations

GaN high-electron-mobility transistors deliver higher gain and efficiency than LDMOS at sub-6 GHz and mmWave frequencies. Small-cell densification pushes GaN shipments to quadruple by decade-end as operators combat escalating energy bills. NXP couples Si LDMOS with GaN die in multichip massive-MIMO modules that integrate antenna arrays and simplify thermal design. Power semiconductor suppliers add sintered die-attach materials to cope with hot-spot temperatures above 225 °C. The telecom sector's focus on total-cost-of-ownership converts incremental efficiency gains into reduced opex, cementing GaN adoption in next-phase rollouts.

Silicon Wafer Supply Tightness Cycles

Total wafer demand now eclipses qualified capacity, and inventory drawdown at memory suppliers distorts short-term purchasing behavior . Geopolitical friction inflates fab-construction costs, while water-usage limits restrict greenfield sites in drought-prone zones. Chinese entrants pursue price competition that compresses margins across the chain. Although front-end equipment bookings hint at recovery, end-market weakness in PCs and smartphones tempers volume pick-up, exposing structural rather than cyclical imbalances.

Other drivers and restraints analyzed in the detailed report include:

- Renewables-Led Power Conversion Growth

- Industrial Automation and Motor-Drive Upgrades

- High Cost / Design Complexity of WBG Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Power integrated circuits contributed significantly to the power semiconductor market size in 2025 and will climb at a 6.02% CAGR through 2031. Automotive battery-management units require multi-rail regulators and functional-safety diagnostics delivered in a compact PMIC footprint. Infineon's ISO 26262-compliant OPTIREG TLF35585 underpins safety-related electronic control units, illustrating the trend toward single-chip power management . Discrete devices remain indispensable for high-current paths, preserving 44.60% revenue share; nevertheless, the discrete share edges lower as designers favor cost-optimized module or IC solutions in space-constrained subsystems.

Supplier roadmaps bundle GaN or SiC dies within intelligent power modules that integrate gate drive, sensing, and protection, shortening time-to-market for inverter and charger assemblies. Module consolidation benefits mid-volume industrial and residential energy customers who lack in-house packaging expertise. Conversely, consumer-electronics ODMs still procure discrete MOSFETs for adapter designs to exploit board-level flexibility and price advantages. The coexistence of discrete, module, and IC formats enriches the power semiconductor market, enabling tailored performance-cost trade-offs.

The Power Semiconductor Market Report is Segmented by Component (Discrete, Modules, Power IC), Material (Silicon, Silicon Carbide, Gallium Nitride, Others), End-User Industry (Automotive, Consumer Electronics and Appliances, ICT, Industrial and Manufacturing, Energy and Power, Aerospace and Defense, Healthcare and Equipment, Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific accounted for 51.35% of the power semiconductor market share in 2025 and sustained a 6.74% CAGR through 2031. China spearheads SiC and GaN capacity ramps, aided by state subsidies and vertically integrated supply chains. India fast-tracks an INR 7,600 crore OSAT campus targeting 15 million units per day, signaling intent to onshore assembly. Taiwan and South Korea guard leadership in advanced packaging and memory, respectively, while Japan fortifies upstream materials command.

North America benefits from USD 50 billion in CHIPS Act incentives that unlock brownfield conversions and greenfield fabs by Wolfspeed, Bosch, and overseas entrants. Automotive, defense, and data-center clusters concentrate demand, boosting local content requirements. SEMI projects regional fab-equipment outlays doubling to USD 24.7 billion by 2027, underscoring long-term scale-up .

Europe leverages its automotive and renewable energy policy alignment to catalyze SiC and GaN uptake. Germany's EUR 5 billion Dresden fab approval exemplifies public-private alignment to elevate self-sufficiency. France and Italy offer additional grant packages to preserve leading-edge module and substrate know-how. Emerging markets across the Middle East, Africa, and Latin America stay value-conscious, adopting mature silicon platforms while gradually trialing WBG for utility-scale solar and railway electrification.

- Infineon Technologies AG

- Texas Instruments Incorporated

- Qorvo Inc.

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Broadcom Inc.

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- Semikron Danfoss GmbH and Co. KG

- Wolfspeed Inc.

- ROHM Co., Ltd.

- Vishay Intertechnology Inc.

- Nexperia B.V.

- Alpha and Omega Semiconductor Ltd.

- Magnachip Semiconductor Corp.

- Microchip Technology Inc.

- Littelfuse Inc.

- Navitas Semiconductor Corp.

- Power Integrations Inc.

- Monolithic Power Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for EVs and charging infrastructure

- 4.2.2 Proliferation of 5G base-stations

- 4.2.3 Renewables-led power conversion growth

- 4.2.4 Industrial automation and motor-drive upgrades

- 4.2.5 HAPS and all-electric aircraft powertrains

- 4.2.6 Fast-charging 2-/3-wheeler EV architectures in Asia

- 4.3 Market Restraints

- 4.3.1 Silicon wafer supply tightness cycles

- 4.3.2 High cost / design complexity of WBG devices

- 4.3.3 Thermal limits in high-density EV inverters

- 4.3.4 Export controls on GaN epitaxy tools

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Discrete

- 5.1.1.1 Rectifier

- 5.1.1.2 Bipolar

- 5.1.1.3 MOSFET

- 5.1.1.4 IGBT

- 5.1.1.5 Other Discrete Components (Thyristor, HEMT, etc.)

- 5.1.2 Modules

- 5.1.2.1 Thyristor Module

- 5.1.2.2 IGBT Module

- 5.1.2.3 MOSFET Module

- 5.1.2.4 Intelligent Power Module (IPM)

- 5.1.3 Power IC

- 5.1.3.1 PMIC (Multichannel)

- 5.1.3.2 Switching Regulators (AC/DC, DC/DC, Iso/Non-iso)

- 5.1.3.3 Linear Regulators

- 5.1.3.4 Battery Management IC

- 5.1.3.5 Other Power ICs

- 5.1.1 Discrete

- 5.2 By Material

- 5.2.1 Silicon

- 5.2.2 Silicon Carbide (SiC)

- 5.2.3 Gallium Nitride (GaN)

- 5.2.4 Others

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Consumer Electronics and Appliances

- 5.3.3 ICT (IT and Telecom)

- 5.3.4 Industrial and Manufacturing

- 5.3.5 Energy and Power (Renewables, Grid)

- 5.3.6 Aerospace and Defense

- 5.3.7 Healthcare Equipment

- 5.3.8 Others (Rail, Marine)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 South Korea

- 5.4.3.4 India

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East

- 5.4.5.1 Israel

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Egypt

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Texas Instruments Incorporated

- 6.4.3 Qorvo Inc.

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 NXP Semiconductors N.V.

- 6.4.6 ON Semiconductor Corporation

- 6.4.7 Renesas Electronics Corporation

- 6.4.8 Broadcom Inc.

- 6.4.9 Toshiba Corporation

- 6.4.10 Mitsubishi Electric Corporation

- 6.4.11 Fuji Electric Co., Ltd.

- 6.4.12 Semikron Danfoss GmbH and Co. KG

- 6.4.13 Wolfspeed Inc.

- 6.4.14 ROHM Co., Ltd.

- 6.4.15 Vishay Intertechnology Inc.

- 6.4.16 Nexperia B.V.

- 6.4.17 Alpha and Omega Semiconductor Ltd.

- 6.4.18 Magnachip Semiconductor Corp.

- 6.4.19 Microchip Technology Inc.

- 6.4.20 Littelfuse Inc.

- 6.4.21 Navitas Semiconductor Corp.

- 6.4.22 Power Integrations Inc.

- 6.4.23 Monolithic Power Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment