PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852179

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852179

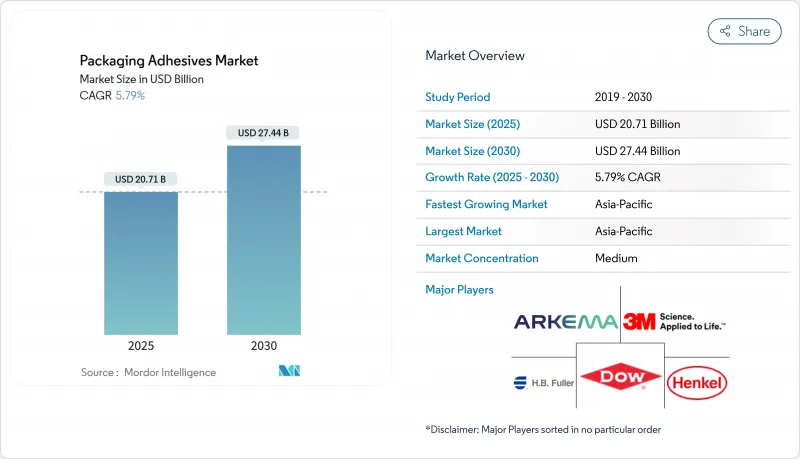

Packaging Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Packaging Adhesives Market size is estimated at USD 20.71 billion in 2025, and is expected to reach USD 27.44 billion by 2030, at a CAGR of 5.79% during the forecast period (2025-2030).

Growth rests on four pillars: rising volumes of ready-to-eat food, an e-commerce boom that prioritizes tamper-evident sealing, regulatory pressure on volatile organic compound (VOC) emissions, and rapid uptake of bio-based chemistries. Water-based formulations command more than half of all revenue because they meet tightening air-quality rules without compromising bond strength, while hot-melt lines keep gaining share in automated fulfillment centers that demand quicker line speeds. Regionally, Asia-Pacific benefits from manufacturing scale and public-sector investment in recycling infrastructure, North America monetizes process innovation, and Europe enforces circular-economy rules that lift demand for repulpable or compostable grades. Competitive intensity stays moderate as large chemical producers use acquisitions, joint R&D, and scope-3 carbon targets to differentiate in an otherwise price-sensitive landscape.

Global Packaging Adhesives Market Trends and Insights

Growing Demand from the Food & Beverage Sector

Demand for barrier integrity and extended shelf life keeps the packaging adhesives market aligned with new product launches in beverages, dairy, and ready meals. Producers now specify migration-tested grades that pass multi-regional rules while running at lower line temperatures to save energy. Henkel's bio-based Technomelt Supra 079 Eco Cool, commercialized in 2024, contains 49% renewable content and cuts operating heat by 40 °C, which translates to 32% lower CO2 emissions and seamless recyclability with paper fibers. Similar energy-saving profiles help large bottlers achieve public climate milestones.

Increasing Awareness of Food Safety

Global regulators are closing loopholes in indirect-food-contact approvals. China's GB 4806.15-2024 introduces positive lists for 392 adhesive substances, mandatory labeling, and migration limits that apply on 8 February 2025. In parallel, the U.S. Food & Drug Administration phased out PFAS grease-proofing chemistries in early 2024, compelling converters to qualify non-fluorinated alternatives. The resulting compliance burden spurs multi-regional adhesive formulations that simplify documentation across export markets.

Stringent Government Regulations

VOC caps continue to tighten. New Jersey's 2024 draft lowers allowable VOCs in consumer adhesives to 7%, while California's rulebook bans 47 toxic air contaminants outright. European Union Regulation 2024/3190 removes Bisphenol A from food packaging, driving formulators to water-based or UV-cured alternatives. Compliance costs rise, yet early adopters gain pricing power through certified low-emission labels.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Adhesive Chemistry

- E-Commerce Packaging Requirements

- Fluctuating Raw Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Water-based systems held a 57.19% share of the packaging adhesives market in 2024 on revenue terms, reflecting converters' need to meet zero-solvent production targets. This dominance will expand at a 6.04% CAGR, far ahead of solvent-borne analogues. Fast-drying acrylic dispersions now bond multilayer films at room temperature, lowering oven dwell times. In parallel, upgraded rheology modifiers preserve bead shape on high-speed slot coaters, elevating throughput without adding stabilizers. Hot-melt chemistries rank a close second because warehouse automation favors instant set-up; innovations such as renewable-sourced polyolefin backbones shrink the carbon gap with water-based peers.

Stringent rules across Europe and North America guarantee demand longevity. As upcoming OECD guidelines quantify life-cycle emissions, brand owners lock in suppliers that disclose plant-level emissions data. Consequently, water-based lines are positioned to supply both mass-market corrugate and premium flexible laminates, reinforcing the packaging adhesives market size advantage of technology leaders through 2030. Solvent-based players will still serve niche high-temperature applications but face gradual erosion unless they reformulate toward ultra-low VOC blends.

EVA accounted for 30.51% of the packaging adhesives market size in 2024, underpinned by favorable cost-to-performance ratios and compatibility with diverse substrates. Its role in carton sealing, magazine spine gluing, and tamper-evident labeling sustains high volumes. To counter thermal sensitivity drawbacks, suppliers now blend metallocene polyethylene segments for stronger hot-tack, safeguarding margins as resin prices swing. Bio-based grades, although smaller in volume, are on track for a 6.71% CAGR as sugar-cane-derived monomers scale. Bostik's 60% bio-content cyanoacrylate line brings instant adhesion to high-value packages while cutting greenhouse-gas footprints, a template other majors aim to replicate.

Investor scrutiny of scope-3 disclosures speeds the transition. Multinationals with science-based targets screen vendors for on-site renewable energy and mass-balance certification, reallocating volume toward bio-based innovators. In parallel, acrylics and polyurethanes remain indispensable where chemical resistance or flexibility is vital, maintaining mid-single-digit growth. Collectively, this chemistry mix ensures the packaging adhesives market remains both competitive and innovation-rich.

The Packaging Adhesives Market Report Segments the Industry by Technology (Water-Based, Solvent-Based, and Hot-Melt), Resin Chemistry (Acrylics, Polyurethanes, and More), Application (Flexible Packaging, Folding Cartons and Boxes, and More), End-Use Industry (Food and Beverage, Pharmaceuticals and Healthcare, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific dominated 2024 revenue with a 40.19% stake in the packaging adhesives market and is set to advance at the highest 6.51% CAGR. Chinese converters invest in high-speed lamination to keep pace with single-serve beverage launches, while Indian corrugators add water-based coating lines to tap regional fulfilment hubs. Japan's brand owners innovate barrier films for ready-to-eat bento boxes, creating demand for low-migration polyurethane dispersions that cure at room temperature. National packaging waste rules-such as China's 2023 mandate capping excessive wrap layers-force adhesive suppliers to engineer bonds that survive thinner substrates without delamination. Growing adoption of e-commerce across ASEAN economies adds further upside for hot-melt sticks and reinforced gummed tapes.

North America remains a trendsetter in technology adoption. The Environmental Protection Agency's purchasing framework references over 40 private ecolabels, steering federal agencies toward low-VOC and recycled-content packs. This shifts demand toward water-based and bio-based grades across envelope closures and military meal kits. Large-scale carton makers in the United States now trial mass-balance EVA derived from tall-oil feedstocks, aiming to show measurable carbon reductions in customer scorecards. Canada's 2021-2028 VOC reduction agenda targets industrial adhesives next, pushing local formulators to accelerate solvent replacement.

Europe remains the regulatory bellwether, with the ban on Bisphenol A in food contact materials under Regulation 2024/3190 setting a new baseline for indirect-food-contact adhesives. Germany's DIN CERTCO certifies compostable laminates, while France's AGEC law drives mono-material flexible packs that still require ultra-thin tie layers. Eastern European plants leverage this shift to compete for contract manufacturing as Western brands rationalize capacity. South America, led by Brazil, exhibits solid mid-single-digit growth because grocery chains extend private-label snack lines that use sachets sealed with hot-melt EVA blends. Although smaller, the Middle East and Africa witness rising demand in Saudi Arabia's dairy sector and South Africa's fruit export operations, opening space for moisture-cure polyurethane hot melts that handle cold-chain logistics.

Collectively, geographic diversification cushions the packaging adhesives market from localized downturns. Suppliers blending global regulatory intelligence with localized technical service capture outsized value by formulating halal-compliant raw materials for Gulf markets or tuning tackifiers for sub-equatorial humidity levels.

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- Dow

- Dymax

- Franklin International

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jowat SE

- Paramelt

- Sonoco Products Company

- Synthomer plc

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from the Food and Beverage Industry

- 4.2.2 Increasing Awareness for Food Safety

- 4.2.3 Technological Advancements in Adhesive Formulations

- 4.2.4 Growing Demand form the E-commerce industry

- 4.2.5 Expansion of Retail and Consumer Good Sector

- 4.3 Market Restraints

- 4.3.1 Stringent Government Regulations

- 4.3.2 Fluctiations in Raw Material Prices

- 4.3.3 Concerns of VOC Emissions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Hot-Melt

- 5.2 By Resin Chemistry

- 5.2.1 Acrylics

- 5.2.2 Polyurethanes

- 5.2.3 Ethylene-Vinyl Acetate (EVA)

- 5.2.4 Styrenic Block Copolymers

- 5.2.5 Natural/Bio-based

- 5.3 By Application

- 5.3.1 Flexible Packaging

- 5.3.2 Folding Cartons and Boxes

- 5.3.3 Labels and Tapes

- 5.3.4 Sealing

- 5.3.5 Other Applications (Tissue and Towel Over-wrap, Graphics and Specialty)

- 5.4 By End-Use Industry

- 5.4.1 Food and Beverage

- 5.4.2 Pharmaceuticals and Healthcare

- 5.4.3 Personal Care and Cosmetics

- 5.4.4 Industrial and Consumer Goods

- 5.4.5 E-Commerce Retail Fulfilment

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Dow

- 6.4.6 Dymax

- 6.4.7 Franklin International

- 6.4.8 H.B. Fuller Company

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 Jowat SE

- 6.4.11 Paramelt

- 6.4.12 Sonoco Products Company

- 6.4.13 Synthomer plc

- 6.4.14 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment