PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906007

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906007

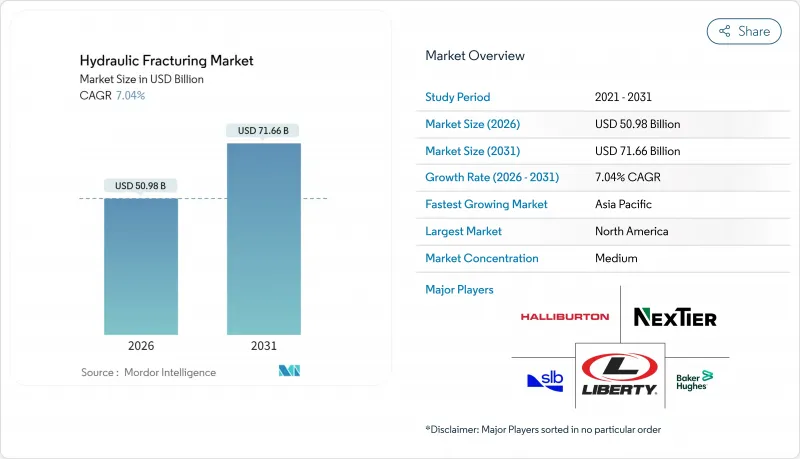

Hydraulic Fracturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Hydraulic Fracturing market is expected to grow from USD 47.63 billion in 2025 to USD 50.98 billion in 2026 and is forecast to reach USD 71.66 billion by 2031 at 7.04% CAGR over 2026-2031.

Continued electrification, real-time monitoring, and automation reduce wellsite fuel costs by up to 25% and improve stage-delivery efficiency by 17%. Mature shale plays in North America underpin current demand, while policy support in China and Argentina accelerates new activity. Consolidation among service providers concentrates technology ownership, yet moderate market concentration leaves space for regional firms with niche capabilities. Environmental regulations raise water-management costs by 15-20%, but the same rules spur investment in waterless fracturing methods that enhance permeability by several orders of magnitude.

Global Hydraulic Fracturing Market Trends and Insights

Shale Gas & Tight-Oil Development Boom

Tight-oil output in the Permian Basin is expected to reach 1 million barrels per day in 2024, underscoring the long-term demand for hydraulic fracturing market services. Argentina's Vaca Muerta formation benefits from 30-year tax stability under the RIGI regime, which lowers fiscal risk for investments above USD 200 million. China maintains direct subsidies and infrastructure funding that sustain fracturing volumes despite higher costs. Operators in premier shale plays achieve breakeven costs below USD 40 per barrel through continuous technology upgrades. These factors collectively support high utilization of fracturing fleets across multiple continents.

Rising Global Gas Demand & Fuel-Switching

The International Energy Agency expects natural-gas use to climb steadily to 2030, bolstered by coal-to-gas switching for power and industrial feedstocks.Asia-Pacific utilities are favoring gas-fired plants to meet their climate goals, which is expected to lift regional hydraulic fracturing market activity. Industrial demand for petrochemicals and fertilizers further expands unconventional gas production. Energy-security concerns following recent supply shocks prompt governments to encourage domestic gas production. Sustained demand underpins contract visibility for service companies, offsetting the periodic fluctuations in commodity prices.

Water-Use Restrictions & Environmental Opposition

Colorado now requires 80% water recycling for new completions, increasing well costs by up to 20%. The Delaware River Basin maintains a ban on fracking, and several European nations have imposed moratoria. Legal challenges prolong permitting and heighten uncertainty. Operators respond with closed-loop systems and electro-fracturing techniques that avoid freshwater consumption while boosting permeability by several magnitudes. Capital needs rise, but long-term environmental compliance improves project acceptability.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Multi-Stage Horizontal Fracturing

- Government Incentives in China & Argentina

- Commodity-Price Volatility Hurting Well Economics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Horizontal wells represented 79.85% of 2025 revenue, and their share of the hydraulic fracturing market size is projected to rise alongside an 8.16% CAGR. Multi-stage stimulation of extended laterals lifts recovery per well, keeping horizontal programs economically attractive even when commodity prices soften. Factory-style operations standardize designs and shorten cycle time, making horizontal completions the default choice in most shale plays.

Chevron's triple-frac workflow enables the completion of several wells in parallel, reducing pad days by 30%. Real-time sensing along the entire lateral tunes proppant placement, increasing ultimate recovery and lowering proppant waste. Vertical wells retain niche roles in coal-bed methane and legacy fields, but will continue losing share. The technology-intensive nature of horizontal fracturing strengthens demand for integrated digital platforms across the hydraulic fracturing industry.

Slick-water held 56.65% revenue in 2025, anchoring the hydraulic fracturing market despite competition. Its low viscosity reduces pumping horsepower and allows higher pump rates, cutting stage costs. Hybrid fluids, which combine foams or gels, are forecast to grow at a 9.02% CAGR by improving proppant transport without requiring large water volumes, a benefit particularly in arid basins.

Foam-based fluids serve water-sensitive reservoirs and comply with stricter environmental regulations. Operators experiment with energized oils and CO2-based systems to limit water consumption. Additive suppliers refine friction reducers that work at lower dosages, enhancing slick-water economics. These developments broaden fluid choices within the hydraulic fracturing industry while preserving the core position of slick-water.

The Hydraulic Fracturing Market Report is Segmented by Well Type (Horizontal and Vertical), Fluid Type (Slick-Water, Gel-Based, Foam-Based, and Hybrid/Energized), Proppant Type (Frac Sand, Resin-Coated Sand, and Ceramic Proppants), Application (Shale Gas, Tight Oil, and Coal-Bed Methane), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

North America commanded 67.60 of % hydraulic fracturing market share in 2025, supported by prolific shale resources and mature logistics. The Permian Basin leads with breakeven costs below USD 40 per barrel, while Canada's unconventional gas and oil-sands activity adds depth to service demand. Mexico's energy reforms open prospects, though near-term activity remains limited by infrastructure gaps. Widespread adoption of electric fleets and pad-level automation reinforces the region's technology leadership and cost competitiveness.

Asia-Pacific region is the fastest-growing region, with a 9.95% CAGR projected through 2031. China directs subsidies and streamlined permits toward shale gas development, sustaining hydraulic fracturing market contracts even during commodity downturns. India evaluates regulatory frameworks that could unlock sizeable basins, while Australia relies on coal-bed methane and tight-gas projects to fill export pipelines. Regional growth hinges on ongoing government support and midstream investment that lowers delivered cost to market.

Europe remains constrained by strict environmental rules, with several nations imposing moratoria. The Middle East and Africa show selective opportunities where tight-gas or shale resources align with existing production hubs. South America's outlook centers on Argentina's Vaca Muerta, now drawing increased capital under President Milei's reforms. Across all emerging regions, infrastructure development, fiscal stability, and local service capabilities will determine the pace of hydraulic fracturing market adoption.

- Halliburton Company

- Schlumberger Ltd.

- Baker Hughes Co.

- Liberty Energy Inc.

- NexTier Oilfield Solutions Inc.

- Patterson-UTI (Seventy Seven)

- Calfrac Well Services Ltd.

- FTS International Services

- Archer Ltd.

- Basic Energy Services

- RPC Inc. (Cudd Energy)

- ProPetro Holding Corp.

- BJ Energy Solutions

- Trican Well Service Ltd.

- China Oilfield Services Ltd.

- Sinopec Oilfield Service Corp.

- Weatherford International plc

- STEP Energy Services

- Superior Energy Services (Frac Tech)

- SD Energy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shale gas & tight-oil development boom

- 4.2.2 Rising global gas demand & fuel-switching

- 4.2.3 Advances in multi-stage horizontal fracturing

- 4.2.4 Government incentives in China & Argentina

- 4.2.5 Real-time fiber-optic & AI-driven frac optimization

- 4.2.6 Rapid adoption of electric frac fleets (e-Frac)

- 4.3 Market Restraints

- 4.3.1 Water-use restrictions & environmental opposition

- 4.3.2 Commodity-price volatility hurting well economics

- 4.3.3 Sand-mining bans disrupting proppant supply chain

- 4.3.4 ESG-linked capital access constraints

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Well Type

- 5.1.1 Horizontal

- 5.1.2 Vertical

- 5.2 By Fluid Type

- 5.2.1 Slick-water

- 5.2.2 Gel-based

- 5.2.3 Foam-based

- 5.2.4 Hybrid/Energized

- 5.3 By Proppant Type

- 5.3.1 Frac Sand

- 5.3.2 Resin-Coated Sand

- 5.3.3 Ceramic Proppants

- 5.4 By Application

- 5.4.1 Shale Gas

- 5.4.2 Tight Oil

- 5.4.3 Coal-Bed Methane

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 Russia

- 5.5.2.5 Norway

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 South Korea

- 5.5.3.4 ASEAN Countries

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Argentina

- 5.5.4.2 Brazil

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Halliburton Company

- 6.4.2 Schlumberger Ltd.

- 6.4.3 Baker Hughes Co.

- 6.4.4 Liberty Energy Inc.

- 6.4.5 NexTier Oilfield Solutions Inc.

- 6.4.6 Patterson-UTI (Seventy Seven)

- 6.4.7 Calfrac Well Services Ltd.

- 6.4.8 FTS International Services

- 6.4.9 Archer Ltd.

- 6.4.10 Basic Energy Services

- 6.4.11 RPC Inc. (Cudd Energy)

- 6.4.12 ProPetro Holding Corp.

- 6.4.13 BJ Energy Solutions

- 6.4.14 Trican Well Service Ltd.

- 6.4.15 China Oilfield Services Ltd.

- 6.4.16 Sinopec Oilfield Service Corp.

- 6.4.17 Weatherford International plc

- 6.4.18 STEP Energy Services

- 6.4.19 Superior Energy Services (Frac Tech)

- 6.4.20 SD Energy

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment