PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906038

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906038

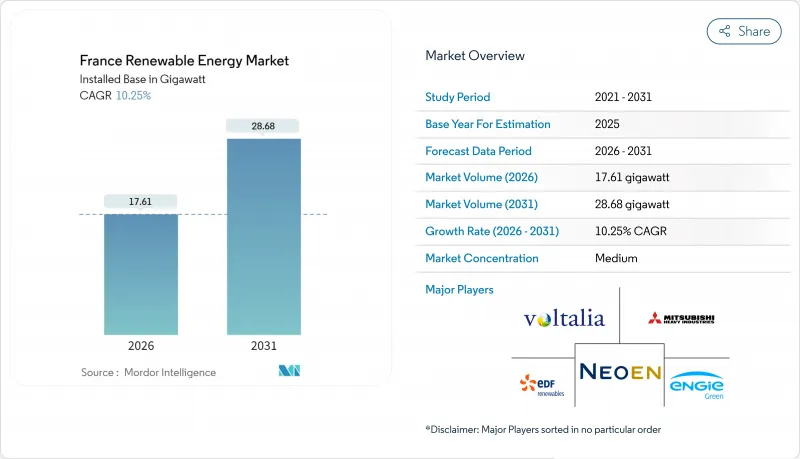

France Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The France Renewable Energy Market is expected to grow from 15.97 gigawatt in 2025 to 17.61 gigawatt in 2026 and is forecast to reach 28.68 gigawatt by 2031 at 10.25% CAGR over 2026-2031.

Steady momentum reflects binding REPowerEU mandates, a 20% fall in solar-PV installed costs reported by IRENA in 2024, and a corporate PPA pipeline that surpassed 1,842 GWh during 2024. Falling levelized costs have lifted project returns above the 8% hurdle preferred by French pension funds, helping utilities and independent power producers accelerate the conversion of their pipelines. Offshore wind auctions under the revised Multi-year Energy Programme (PPE2) are broadening the diversity of technology and crowding in long-term project finance from domestic banks. At the same time, agrivoltaics legislation enacted in 2024 is unlocking dual land use across 500,000 hectares of viticulture and cereal zones, laying the groundwork for the next growth leg of commercial-scale solar. Competitive intensity is rising as integrated utilities, such as EDF Renewables, TotalEnergies, and Engie Green, vie with Neoen, Voltalia, and Akuo Energy for feed-in tariff contracts and corporate off-take agreements. Meanwhile, grid bottlenecks in Brittany and Provence-Alpes-Cote d'Azur are expected to require EUR 100 billion of transmission upgrades through 2040.

France Renewable Energy Market Trends and Insights

EU Fit-for-55 And REPowerEU Targets Accelerate French RES Uptake

Brussels requires France to lift the renewable share of final energy consumption to 42.5% by 2030, up from 20.7% in 2024. Recovery and Resilience Facility grants of EUR 5.4 billion support grid reinforcement, permitting digitalization, and storage pilots that ease integration. France's updated National Energy and Climate Plan commits to 54-60 GW of solar and 33-35 GW of onshore wind by 2030, requiring a threefold increase in annual installation rates. Allowance prices above EUR 80 per ton under the EU ETS shift marginal economics decisively in favor of wind and solar, while renewable heat and transport mandates accelerate the injection of biomethane. Compliance checkpoints every two years create a hard back-stop that keeps policy pressure high and maintains investor confidence in the France renewable energy market.

Multi-year Energy Programme (PPE2) Raises Offshore Wind Auction Pipeline

The revised PPE2 schedules 17.2 GW of offshore wind capacity across four auction rounds, with strike prices in the 2024 AO7 round clearing at EUR 69 /MWh, 30% below earlier ceilings. Atlantic fixed-bottom projects boast capacity factors exceeding 50%, while Mediterranean floating auctions are driving the development of local manufacturing hubs in Saint-Nazaire and Cherbourg. Local-content rules that require 40% nacelle value and 60% foundation fabrication within the EU are fostering supply-chain localization and job creation. Capital intensity of EUR 3 million per MW concentrates financing in syndicates led by BNP Paribas and Societe Generale; however, the low merchant exposure after COD makes the assets attractive to pension funds seeking duration.

Lengthy Permitting & Court Appeals Delay Grid-Connected RES

Onshore wind projects average 7-9 years from feasibility to COD, with administrative steps consuming four years and court appeals adding up to three more. Setback distances of 500 m from residences curtail 60% of otherwise viable parcels, while radar rules near military airbases eliminate an additional 10%. Appeals overturned 15% of prefectural approvals in 2024, forcing developers to restart studies and eroding net present value. The burden falls hardest on small developers lacking in-house legal teams, tilting market power toward large utilities.

Other drivers and restraints analyzed in the detailed report include:

- Falling LCOE of Solar-PV & Onshore Wind Improves Project IRR

- Corporate PPAs Surge As CAC-40 Firms Decarbonize Scopes 1-2

- Grid Congestion In Brittany & PACA Limits Additional Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar added 2.8 GW in 2024 and is forecast to expand at a 18.55% CAGR through 2031, the strongest uplift in the France renewable energy market. Two drivers dominate: agrivoltaics, which open up dual land use on 500,000 hectares, and rooftop mandates on new commercial buildings exceeding 1,000 m2. Hydropower retained 33.12% of installed capacity in 2025, providing indispensable pumped-storage flexibility even as environmental constraints cap greenfield development. Wind energy follows, buoyed by 3 GW of repowering and 17.2 GW of offshore auctions, while bioenergy pursues France's 44 TWh biomethane target for 2030. Ocean and geothermal energy remain at the demonstration stage, adding, accounting for less than 1% combined capacity.

Solar's momentum accelerates the France renewable energy market as bifacial modules reach 22% efficiency and tracker penetration deepens across Occitanie and Nouvelle-Aquitaine. Offshore wind contributes scale and diversity, with fixed-bottom Atlantic projects and floating Mediterranean farms capturing deep-water potential. Hydropower's aging fleet receives targeted upgrades that add 2 GW of pumped storage by 2030 to integrate solar oversupply. Bioenergy growth hinges on digestate disposal regulations, and geothermal pilots in Alsace aim to achieve cost breakthroughs before scaling up.

The France Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- EDF Renewables

- TotalEnergies Renewables

- Engie Green

- Neoen SA

- Voltalia SA

- Akuo Energy

- Albioma SA

- Boralex Inc

- WPD Offshore France

- RWE Renewables France

- Iberdrola (?Ailes Marines)

- Enel Green Power France

- Orsted France

- Vestas France

- Siemens Gamesa RE France

- GE Vernova France

- Nordex France

- BayWa r.e. France

- Envision France

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Fit-for-55 & REPowerEU targets accelerate French RES uptake

- 4.2.2 Multi-year Energy Programme (PPE2) raises offshore wind auction pipeline

- 4.2.3 Falling LCOE of solar-PV & onshore wind improves project IRR

- 4.2.4 Corporate PPAs surge as CAC-40 firms decarbonise scopes 1-2

- 4.2.5 Repowering ageing wind farms doubles yield without extra land

- 4.2.6 Agrivoltaics law unlocks dual-land use in agri-regions

- 4.3 Market Restraints

- 4.3.1 Lengthy permitting & court appeals delay grid-connected RES

- 4.3.2 Grid congestion in Brittany & PACA limits additional capacity

- 4.3.3 Nuclear life-extension works squeeze skilled labour pool

- 4.3.4 Li-ion cell shortages constrain co-located storage roll-outs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTEL Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 EDF Renewables

- 6.4.2 TotalEnergies Renewables

- 6.4.3 Engie Green

- 6.4.4 Neoen SA

- 6.4.5 Voltalia SA

- 6.4.6 Akuo Energy

- 6.4.7 Albioma SA

- 6.4.8 Boralex Inc

- 6.4.9 WPD Offshore France

- 6.4.10 RWE Renewables France

- 6.4.11 Iberdrola (?Ailes Marines)

- 6.4.12 Enel Green Power France

- 6.4.13 Orsted France

- 6.4.14 Vestas France

- 6.4.15 Siemens Gamesa RE France

- 6.4.16 GE Vernova France

- 6.4.17 Nordex France

- 6.4.18 BayWa r.e. France

- 6.4.19 Envision France

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment