PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906074

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906074

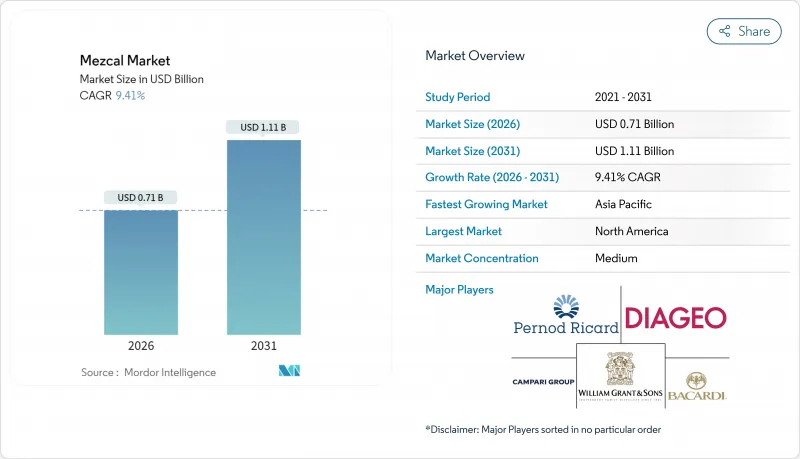

Mezcal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Mezcal market size in 2026 is estimated at USD 0.71 billion, growing from 2025 value of USD 0.65 billion with 2031 projections showing USD 1.11 billion, growing at 9.41% CAGR over 2026-2031.

As consumers increasingly gravitate towards provenance-rich beverages, multinational distillers are making strategic acquisitions, infusing fresh capital into traditional communities and underscoring a strong commercial confidence. While North America currently leads in volume, Asia Pacific's rapid double-digit growth positions it as the emerging powerhouse, marking mezcal's evolution from a regional specialty to a global luxury staple. The Consejo Regulador del Mezcal (CRM) certification not only safeguards mezcal's authenticity but also curbs swift industrial growth, bolstering its premium status. Concurrently, there's a push towards sustainable agave farming and biodiversity initiatives, aiming to stabilize raw material supplies in the face of potential constraints.

Global Mezcal Market Trends and Insights

Premiumization and artisanal appeal

As consumers increasingly prioritize quality over quantity, the mezcal category's premiumization trajectory aligns with broader trends in the spirits industry. Premium mezcal segments, expanding at an 11.64% CAGR, are significantly outpacing mass market growth. This surge is fueled by discerning consumers who seek authentic, craft-produced spirits with compelling provenance stories. Tesla's foray into the mezcal market, debuting a limited-edition bottle priced at USD 450, underscores the potential of luxury positioning to command hefty price premiums, all while upholding artisanal production methods. The allure of artisanal production isn't just a marketing ploy; it's evident in the tangible production nuances. Techniques like traditional tahona milling and wild yeast fermentation yield distinct flavor profiles, justifying the premium pricing. Further bolstering this trend, the San Francisco World Spirits Competition's 2025 nod to diverse regional expressions underscores the value of terroir-driven differentiation as a lasting competitive edge.

Innovation in ready-to-drink (RTD) mezcal cocktails

Mezcal's growth is being driven by innovations in the ready-to-drink (RTD) segment, which capitalizes on the spirit's distinctive smoky profile, setting it apart from vodka and gin alternatives. As the RTD spirits segment surges, mezcal brands find new avenues to connect with consumers, especially those who might be daunted by neat spirits, all while familiarizing them with mezcal's unique flavor. Diageo's heightened emphasis on RTDs, underscored by its investments in Crown Royal RTD and Ketel One Botanical, underscores the corporate world's acknowledgment of RTDs as pivotal for the premium spirits market. Innovations in this space aren't limited to basic cocktails; they also encompass novel cask finishes. A prime example is Ilegal's Caribbean Cask Finish Reposado, which melds rum barrel nuances with traditional mezcal aging. Such product innovations empower brands to command premium prices and broaden the contexts in which mezcal is enjoyed, moving beyond just sipping.

Limited agave supply and long cultivation cycles

Agave cultivation, with maturation periods spanning 7 to 30 years based on the species, faces inherent supply constraints that hinder the scalability of mezcal production. Overharvesting of wild agave has surged to critical levels in regions known for traditional production. This has compelled producers to increasingly depend on cultivated varieties, which often lack the nuanced complexity of their wild counterparts. Climate change further exacerbates these supply challenges in agave-growing regions, introducing water stress and temperature fluctuations that hinder plant development and sugar content. Traditional producers grapple with tough decisions: uphold the authenticity of wild agave sourcing or meet the rising demand with a consistent supply. This mismatch between cultivation cycles and market growth leads to price volatility, posing a threat to smaller producers who may not have the financial cushion to endure supply shortages.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Mexican cuisine

- Diversification of flavor profiles

- Stringent regulatory environment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Mezcal Joven captures a commanding 77.90% of the market share, underscoring a clear consumer preference for unaged expressions. These unaged variants not only highlight the pure essence of agave but also celebrate traditional production methods. The segment's widespread appeal can be attributed to its accessibility for newcomers and its lower production costs, especially when juxtaposed with aged counterparts. This makes Mezcal Joven the primary driver for the category's expansion. Yet, it's Mezcal Anejo that's witnessing the most rapid ascent, boasting a 12.62% CAGR through 2031. This surge is fueled by trends leaning towards premiumization and innovative aging techniques, helping products stand out in saturated markets. A case in point is Clase Azul's San Luis Potosi release, which underscores the power of premium positioning and artisanal packaging, allowing aged expressions to fetch retail prices as high as USD 370.

Mezcal Reposado finds its niche in the middle, striking a balance by offering a touch of aging complexity without the prolonged production times that Anejo expressions demand. Meanwhile, specialty types like Abocado and Pechuga cater to niche markets, where traditional methods yield distinct flavor profiles, justifying their premium pricing. This segmentation not only highlights mezcal's adaptability to varied consumer tastes but also its commitment to authenticity through age-old production techniques. Innovations in the aged category, such as Ilegal's Caribbean Cask Finish, further illustrate how producers can carve out a unique identity while staying true to the category's essence.

In 2025, Ancestral Mezcal, with its authentic pit-oven cooking and clay pot distillation techniques, commands a dominant 93.44% share of the mezcal market. This stronghold underscores consumers' readiness to pay a premium for artisanal products, especially those that honor age-old techniques and uplift traditional communities. Meanwhile, Artisanal Mezcal, despite its smaller slice of the market, is on an upward trajectory, boasting an impressive 11.10% CAGR. This growth is attributed to producers who, while embracing modern quality controls, remain steadfast in their traditional flavor development methods. Such segmentation in production methods not only establishes distinct value hierarchies but also empowers brands to justify their pricing based on authenticity and labor intensity.

Industrial Mezcal caters to the price-sensitive segment of the market. However, it grapples with authenticity issues, curtailing its chances for premium positioning. Regulatory bodies enforce a production method classification system, ensuring transparency and shielding traditional producers from industrial competitors misusing mezcal designations. Recent advancements, like real-time fermentation tracking systems, are revolutionizing production monitoring. These innovations empower artisanal producers to uphold quality consistency without straying from their traditional methods. By emphasizing ancestral techniques, these producers carve out sustainable competitive advantages, making it challenging for large-scale industrial players to encroach on mezcal's premium market standing.

The Mezcal Market Report is Segmented by Product Type (Mezcal Joven, Mezcal Reposado, and More), Production Method (Artisanal Mezcal, Industrial Mezcal, Ancestral Mezcal), Price Range (Mass, Premium/Luxury), Distribution Channel (On-Trade, Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

Geography Analysis

In 2025, North America commands a dominant 57.64% share of the mezcal market, underscoring its status as the leading export destination for the spirit. In 2023, the U.S. alone imported about 7 million liters out of the 7.8 million liters of mezcal exported worldwide, according to Drinks International. North America's advantages include its geographical closeness to Mexico, well-established distribution channels for premium spirits, and a discerning consumer base that values artisanal production. Yet, the region faces challenges: proposed U.S. tariffs, potentially reaching 25% on Mexican imports, threaten this growth trajectory, especially for smaller producers reliant on U.S. access. Meanwhile, Canada is emerging as a promising market, showing heightened interest in premium spirits and facing fewer regulatory hurdles than some global counterparts. While North America's mature spirits landscape offers a platform for premium branding, it simultaneously intensifies competition for both shelf space and consumer loyalty.

Asia Pacific is on track to be the fastest-growing region, boasting a projected CAGR of 12.18% through 2031. A burgeoning middle class and a growing demand for premium international spirits drive this surge. China's burgeoning cocktail scene and penchant for luxury items naturally bolster the demand for premium mezcal. Simultaneously, Australia's well-established spirits market serves as a gateway for artisanal brands. The region's growth is underscored by its increasing visibility at global spirits competitions and rising import volumes. However, challenges loom: regulatory intricacies and a cultural unfamiliarity with agave spirits can hinder market entry. Japan's refined spirits culture and its admiration for artisanal methods hint at a promising avenue for premium mezcal. Yet, breaking into this market demands hefty investments in consumer education and brand establishment, given the general lack of awareness about mezcal's production and consumption nuances among Asian consumers.

Europe, while mature, presents a fragmented landscape with diverse consumer tastes and regulatory frameworks. The continent's fondness for artisanal spirits and products with protected designations of origin bodes well for authentic mezcal. Leading the charge in consumption are Germany, the U.K., and France, all of which boast established premium spirits markets and a burgeoning cocktail culture. The successful defense of tequila's denomination rights by the Consejo Regulador del Tequila in European trademark disputes underscores the critical nature of intellectual property protection for Mexican spirits on the global stage. Meanwhile, South America, the Middle East, and Africa, though currently under-penetrated, hold promise for future growth as global spirits distribution networks broaden and consumer sophistication matures.

- Pernod Ricard SA (Del Maguey)

- Diageo PLC (Casamigos)

- William Grant & Sons Ltd (Montelobos)

- Bacardi Ltd (Ilegal & Dewar's partnership)

- Campari Group (Siete Misterios)

- E. & J. Gallo (Derrumbes)

- Beam Suntory (400 Conejos)

- Casa Cortes (Mezcal Vago)

- Casa Armando Guillermo Prieto (Mezcal Zignum)

- El Silencio Holdings Inc

- Dos Hombres LLC

- Fidencio Mezcal

- Rey Campero

- Lagrimas de Dolores

- Compania Tequilera de Arandas S.A. (400 Conejos)

- Wahaka Mezcal

- Alipus

- Del Amigo Spirits

- Madre Mezcal

- Mezcal Union

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization and artisanal appeal

- 4.2.2 Innovation in ready-to-drink (RTD) Mezcal cocktails

- 4.2.3 Influence of Mexican Cuisine

- 4.2.4 Diversification of flavor profiles

- 4.2.5 Strategic investments boosting brand awareness

- 4.2.6 Sustainability & biodiversity certification premiums (under-reported)

- 4.3 Market Restraints

- 4.3.1 Limited Agave Supply and Long Cultivation Cycles

- 4.3.2 Stringent Regulatory Environment

- 4.3.3 Prevalence of Counterfeit and Low-Quality Products

- 4.3.4 Economic and Geopolitical Uncertainties

- 4.4 Consumer Demand Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Mezcal Joven

- 5.1.2 Mezcal Reposado

- 5.1.3 Mezcal Anejo

- 5.1.4 Other Types (Abocado, Pechuga)

- 5.2 By Production Method

- 5.2.1 Artisanal Mezca

- 5.2.2 Industrial Mezcal

- 5.2.3 Ancestral Mezcal

- 5.3 By Price Range

- 5.3.1 Mass

- 5.3.2 Premium/Luxury

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Specialty/Liquor Stores

- 5.4.2.2 Others Off Trade Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Pernod Ricard SA (Del Maguey)

- 6.4.2 Diageo PLC (Casamigos)

- 6.4.3 William Grant & Sons Ltd (Montelobos)

- 6.4.4 Bacardi Ltd (Ilegal & Dewar's partnership)

- 6.4.5 Campari Group (Siete Misterios)

- 6.4.6 E. & J. Gallo (Derrumbes)

- 6.4.7 Beam Suntory (400 Conejos)

- 6.4.8 Casa Cortes (Mezcal Vago)

- 6.4.9 Casa Armando Guillermo Prieto (Mezcal Zignum)

- 6.4.10 El Silencio Holdings Inc

- 6.4.11 Dos Hombres LLC

- 6.4.12 Fidencio Mezcal

- 6.4.13 Rey Campero

- 6.4.14 Lagrimas de Dolores

- 6.4.15 Compania Tequilera de Arandas S.A. (400 Conejos)

- 6.4.16 Wahaka Mezcal

- 6.4.17 Alipus

- 6.4.18 Del Amigo Spirits

- 6.4.19 Madre Mezcal

- 6.4.20 Mezcal Union

7 MARKET OPPORTUNITIES AND FUTURE TRENDS