PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910687

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910687

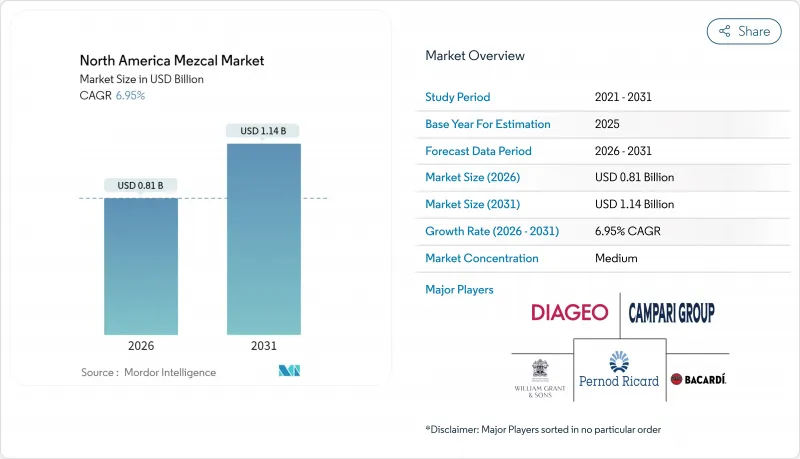

North America Mezcal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

North America mezcal market size in 2026 is estimated at USD 0.81 billion, growing from 2025 value of USD 0.76 billion with 2031 projections showing USD 1.14 billion, growing at 6.95% CAGR over 2026-2031.

The market expansion is primarily driven by the increasing consumer inclination toward authentic, premium, and artisanal alcoholic beverages that deliver distinctive flavor characteristics and cultural heritage. The implementation of traditional production methodologies and expanding international market presence have enhanced mezcal's acceptance among diverse consumer segments. North America maintains market dominance, attributed to substantial consumer interest in craft spirits and premium offerings. The proliferation of cocktail culture, expansion of distribution infrastructure through retail and e-commerce platforms, and strategic marketing initiatives are facilitating broader market penetration. The industry's commitment to sustainable agave cultivation practices and biodiversity conservation resonates with environmentally conscious consumers, while experiential tourism centered around mezcal production strengthens consumer engagement and brand allegiance.

North America Mezcal Market Trends and Insights

Growing Consumer Preference for Premium and Artisanal Spirits

The North American mezcal market expansion is primarily attributed to heightened consumer demand for premium and artisanal spirits. The demographic composition, predominantly millennials and Gen Z consumers, demonstrates a marked preference for products characterized by superior quality, authenticity, and established heritage, leading to a significant shift from mass-produced alternatives toward small-batch and sustainable spirits. Mezcal's market differentiation stems from its specialized production methodology, regional diversity, and traditional manufacturing processes, distinguishing it from other agave-based spirits. Manufacturing entities have responded to this market evolution by implementing region-specific product development, limited-edition offerings, and environmentally sustainable production protocols, while maintaining supply chain transparency. This market transformation is evidenced by the strategic distribution agreement established in June 2023 between Beam Suntory and Mezcal Amaras, a premium manufacturer specializing in handcrafted mezcal production across the Oaxaca, Guerrero, and Durango regions.

Rising Popularity of Craft Cocktail Culture and Mixology

The proliferation of craft cocktail culture and mixology is significantly influencing the expansion of the North American mezcal market through its impact on consumer preferences and consumption patterns. The spirit has established a prominent position in bars, restaurants, and residential settings, primarily attributed to its distinctive smoky characteristics, pronounced agave profile, and versatility in cocktail applications. The incorporation of mezcal in both traditional and contemporary cocktail preparations, including Mezcal Margaritas, Palomas, and Negronis, has contributed to its broader market acceptance. The increasing demand for craft cocktails corresponds to consumer preferences for authentic products and experiential consumption, which directly aligns with mezcal's traditional production methodology and cultural heritage. Statistical evidence from Statistics Canada indicates that in 2023, more than 77% of adults in Canadian provinces engaged in alcoholic beverage consumption within the previous 12 months, demonstrating a substantial consumer foundation for premium spirit categories such as mezcal .

Regulatory and Certification Complexity

The North American mezcal market experiences significant growth limitations attributed to stringent regulatory frameworks and certification protocols, predominantly affecting small-scale and traditional Mexican producers. The Consejo Regulador del Mezcal (CRM) administers the certification procedures, ensuring adherence to product authenticity standards and Denomination of Origin requirements. The certification protocol encompasses substantial financial obligations and administrative procedures, presenting considerable impediments for small-scale and family-operated distilleries utilizing traditional production methodologies. Numerous small-scale producers elect to abstain from certification processes due to operational and financial constraints, subsequently restricting their market accessibility, particularly in international markets where certification is mandatory. Moreover, regulatory ambiguities and legal contestations have resulted in procedural delays and operational disruptions within the certification framework, further impacting industry operations.

Other drivers and restraints analyzed in the detailed report include:

- Sustainable, biodiverse agave-farming narratives

- Mezcal Tourism and Experiential Discovery Fueling Demand

- High Production Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mezcal Joven maintains a 45.12% market share in 2025 in North America. The product's distinctive pure agave flavor profile attracts consumers seeking traditional mezcal experiences. This market segment demonstrates significant appeal among millennial consumers and individuals who prioritize traditional production methodologies and Mexican cultural heritage. The product's versatility in both direct consumption and mixology applications has enhanced its market presence across hospitality establishments. For instance, in February 2024, Clase Azul introduced their Mezcal San Luis Potosi, an ultra-premium Mezcal Joven expression, representing the eighth installment in their icons portfolio.

Mezcal Reposado demonstrates a projected compound annual growth rate (CAGR) of 8.86% through 2031, attributed to increasing consumer demand for refined mezcal products. The segment occupies a strategic position between unaged Mezcal Joven and extended-aged variants through its controlled barrel aging process. This production methodology enhances product complexity and palatability, attracting both established mezcal consumers and market entrants. The segment's growth corresponds with the broader premiumization trend in alcoholic beverages, where consumer preferences increasingly emphasize product quality and manufacturing expertise.

Traditional production methods remain central to mezcal's market positioning, with artisanal mezcal holding 68.06% market share in 2025. This dominance stems from consumers' appreciation for the craftsmanship, authenticity, and cultural heritage in artisanal mezcal production. Artisanal mezcal production involves traditional techniques such as roasting agave in earthen pits, fermenting in wood or stone containers, and distilling in small copper or clay stills. These methods create complex flavor profiles that reflect regional characteristics, attracting premium spirit consumers seeking authentic experiences. The smaller-scale operations of artisanal mezcal producers provide exclusivity and direct connection with consumers, meeting the growing demand for products with transparent origins and production methods.

Ancestral mezcal is expected to grow at a CAGR of 8.32% through 2031 in the North American mezcal market, driven by consumers seeking traditional mezcal experiences. This category encompasses mezcal produced using traditional methods, roasting agave in underground pits, fermenting in clay pots or wooden vats with wild yeast, and distilling in clay or copper stills heated by wood fires. The limited production and artisanal nature of ancestral mezcal appeal to consumers who prioritize heritage, craftsmanship, and sustainability. These production methods preserve the natural characteristics specific to each region, while small-scale production reinforces its position as a premium spirit.

The North America Mezcal Market Report is Segmented by Product Type (Mezcal Joven, Mezcal Reposado, and More), Production Method (Artisanal Mezcal, Industrial Mezcal, and Ancestral Mezcal), Price Range (Mass, and Premium/Luxury), Distribution Channel (On-Trade, and Off-Trade), and Geography (United States, Canada, Mexico, and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Pernod Ricard SA

- Diageo PLC

- William Grant & Sons Ltd

- Casa Lumbre Group

- Bacardi Limited (Ilegal Mezcal)

- Davide Campari-Milano N.V.

- El Silencio Holdings Inc.

- Lagrimas de Dolores

- Mezcal Vago

- Wahaka Mezcal

- Real Minero

- Catapulta LP (Mezcales de Leyenda)

- Dos Hombres

- Maguey Spirits Co. (Bozal Mezcal)

- Mezcal Los Siete Misterios

- 400 Conejos

- Mezcal Amar's

- Sombra Mezcal

- La Luna Mezcal

- Derrumbes Mezcal

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing consumer preference for premium and artisanal spirits

- 4.2.2 Rising popularity of craft cocktail culture and mixology

- 4.2.3 Sustainable, biodiverse agave-farming narratives

- 4.2.4 Mezcal tourism and experiential discovery fueling demand

- 4.2.5 Unique flavor profile and cultural heritage

- 4.2.6 Increased exports and international demand

- 4.3 Market Restraints

- 4.3.1 Regulatory and certification complexity

- 4.3.2 High production costs

- 4.3.3 Fluctuating raw material prices

- 4.3.4 Intense market competition

- 4.4 Consumer Demand Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Mezcal Joven

- 5.1.2 Mezcal Reposado

- 5.1.3 Mezcal Anejo

- 5.1.4 Other Types

- 5.2 By Production Methdod

- 5.2.1 Artisanal Mezcal

- 5.2.2 Industrial Mezcal

- 5.2.3 Ancestral Mezcal

- 5.3 By Price Range

- 5.3.1 Mass

- 5.3.2 Premium/Luxury

- 5.4 By Distribution Channel

- 5.4.1 On-trade

- 5.4.2 Off-trade

- 5.4.2.1 Specialty/Liquor Stores

- 5.4.2.2 Others Off Trade Channels

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Pernod Ricard SA

- 6.4.2 Diageo PLC

- 6.4.3 William Grant & Sons Ltd

- 6.4.4 Casa Lumbre Group

- 6.4.5 Bacardi Limited (Ilegal Mezcal)

- 6.4.6 Davide Campari-Milano N.V.

- 6.4.7 El Silencio Holdings Inc.

- 6.4.8 Lagrimas de Dolores

- 6.4.9 Mezcal Vago

- 6.4.10 Wahaka Mezcal

- 6.4.11 Real Minero

- 6.4.12 Catapulta LP (Mezcales de Leyenda)

- 6.4.13 Dos Hombres

- 6.4.14 Maguey Spirits Co. (Bozal Mezcal)

- 6.4.15 Mezcal Los Siete Misterios

- 6.4.16 400 Conejos

- 6.4.17 Mezcal Amar's

- 6.4.18 Sombra Mezcal

- 6.4.19 La Luna Mezcal

- 6.4.20 Derrumbes Mezcal

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK