PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906112

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906112

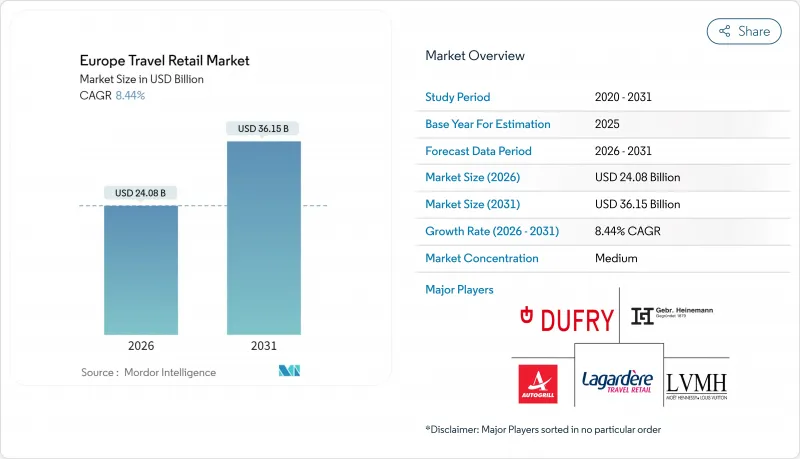

Europe Travel Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe travel retail market was valued at USD 22.21 billion in 2025 and estimated to grow from USD 24.08 billion in 2026 to reach USD 36.15 billion by 2031, at a CAGR of 8.44% during the forecast period (2026-2031).

Passenger traffic recovery, the return of long-haul visitors, and rising disposable incomes underpin this expansion. Premium brands, data-driven merchandising, and experiential store formats keep dwell times high and baskets larger, while younger leisure travelers and affluent tourists sustain luxury sales. Airports retain the largest revenue share, ferries and cruise lines post the sharpest growth, and the shift toward omnichannel retail improves conversion rates. Operators that align with sustainability goals and local authenticity secure prime concessions and passenger loyalty, positioning the Europe travel retail market for sustained, broad-based gains.

Europe Travel Retail Market Trends and Insights

Growing International Tourism

Around 3 billion nights spent in European accommodations in 2024 lifted duty-free footfall and average spend, especially in Spain, Italy, France, and Germany, which together captured 61.6% of tourism nights. Younger visitors from India and Southeast Asia displayed higher demand for premium goods, boosting luxury conversion. This tourism surge coincides with the recovery of Chinese outbound travel, which historically represented the highest per-capita spending segment in European travel retail. The sustained growth trajectory suggests that tourism-dependent travel retail segments will continue outperforming domestic-focused retail channels through 2030.

Rising Air Passenger Traffic

European airports processed 10.7 million flights in 2024, 96% of pre-crisis levels, while low-cost carriers edged to a 34% share, bringing new budget-conscious but digitally engaged shoppers. Lower jet-fuel costs enhanced airline profitability, lengthening dwell times as carriers invested in customer experience, which benefits airside retailers. Intra-European traffic increased by 4%, with Southern Europe driving significant growth through tourism, suggesting that leisure-focused travel retail strategies will outperform business travel-dependent approaches in the near term.

Macro-economic and Geopolitical Volatility Impacting Travel

Freight contractions and shifting route networks exposed demand gaps, especially near conflict zones, trimming discretionary spend at border shops. Currency swings squeezed operator margins, and higher energy bills raised concession costs, tempering the near-term trajectory of the Europe travel retail market. Energy costs and inflation pressures force airports to increase concession fees, which travel retail operators must absorb or pass through to consumers, potentially dampening discretionary spending. The structural shift toward domestic and regional travel, while supporting overall passenger numbers, typically generates lower per-capita retail spending compared to long-haul international travelers who historically drove premium purchases.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Airports and Travel Hubs

- Premium and Luxury Brand Availability

- Growing Competition from E-commerce and Domestic Retail

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fragrances and cosmetics retained a 37.88% share of the Europe travel retail market in 2025 to universal appeal, gifting suitability, and high margins. The segment leverages impulse tendencies and efficient supply chains to protect volume, yet its growth tempers as affluent tourists pivot toward durable keepsakes. Jewellery and watches are forecast to grow at 12.45% CAGR, outpacing all categories and enlarging their contribution to the Europe travel retail market size between 2026-2031. The segment's resilience rests on brand storytelling, perceived investment value, and demand from Asian visitors. Wine and spirits maintain relevance with Scotch and cognac mainstays, while agave spirits pull younger drinkers. Fashion and accessories secure cross-sell opportunities tied to airport exclusives. Electronics struggles with price parity outside duty-free, whereas food and confectionery thrive on local provenance. Tobacco declines under regulatory and social pressures, and sustainable travel essentials attract eco-minded flyers.

The Europe Travel Retail Market is Segmented by Retail Activity Type (Fragrances and Cosmetics, Fashion and Accessories, Jewellery and Watches, and More), by Distribution Channel (Airport, Airline, Ferries and Cruise Lines, Land-Border Shops, Downtown Duty-Free), by Country (United Kingdom, Germany, France, Andmore). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Dufry AG

- Lagardere Travel Retail

- Gebr. Heinemann SE & Co. KG

- Autogrill S.p.A. / World Duty Free

- LVMH (Moet Hennessy Louis Vuitton)

- WH Smith PLC

- Aena Duty Free

- Flemingo International

- Baltona SA

- Daa Plc (ARI)

- TRE

- Aer Rianta International

- SSP Group plc

- Hudson Group

- Areas SAU

- Valiram Group

- Nuance Group

- DFS Group

- RegStaer Group

- JR Duty Free*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing International Tourism

- 4.2.2 Rising Air Passenger Traffic

- 4.2.3 Expansion of Airports and Travel Hubs

- 4.2.4 Premium and Luxury Brand Availability

- 4.2.5 Regulatory Framework and Duty-Free Policies

- 4.2.6 Shift in Consumer Preferences Toward Gifting and Experiences

- 4.3 Market Restraints

- 4.3.1 Macro-economic and Geopolitical Volatility Impacting Travel

- 4.3.2 Stringent Regulations and Customs Policies

- 4.3.3 High Operational Costs in Airport Retail Spaces

- 4.3.4 Growing Competition from E-commerce and Domestic Retail

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Trends in Passenger Traffic by Channel

5 Market Size and Growth Forecasts (Value, 2020-2030)

- 5.1 By Retail Activity Type

- 5.1.1 Fragrances and Cosmetics

- 5.1.2 Fashion and Accessories

- 5.1.3 Jewellery and Watches

- 5.1.4 Wine and Spirits

- 5.1.5 Food and Confectionery

- 5.1.6 Tobacco

- 5.1.7 Electronics and Gadgets

- 5.1.8 Travel Essentials and Gifts

- 5.2 By Distribution Channel

- 5.2.1 Airports

- 5.2.2 Airlines (In-flight)

- 5.2.3 Ferries and Cruise Lines

- 5.2.4 Railway Stations

- 5.2.5 Land-Border Shops

- 5.2.6 Downtown Duty-Free

- 5.3 By Country

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.3.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Dufry AG

- 6.4.2 Lagardere Travel Retail

- 6.4.3 Gebr. Heinemann SE & Co. KG

- 6.4.4 Autogrill S.p.A. / World Duty Free

- 6.4.5 LVMH (Moet Hennessy Louis Vuitton)

- 6.4.6 WH Smith PLC

- 6.4.7 Aena Duty Free

- 6.4.8 Flemingo International

- 6.4.9 Baltona SA

- 6.4.10 Daa Plc (ARI)

- 6.4.11 TRE

- 6.4.12 Aer Rianta International

- 6.4.13 SSP Group plc

- 6.4.14 Hudson Group

- 6.4.15 Areas SAU

- 6.4.16 Valiram Group

- 6.4.17 Nuance Group

- 6.4.18 DFS Group

- 6.4.19 RegStaer Group

- 6.4.20 JR Duty Free*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment