PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906175

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906175

Middle East And Africa Travel Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

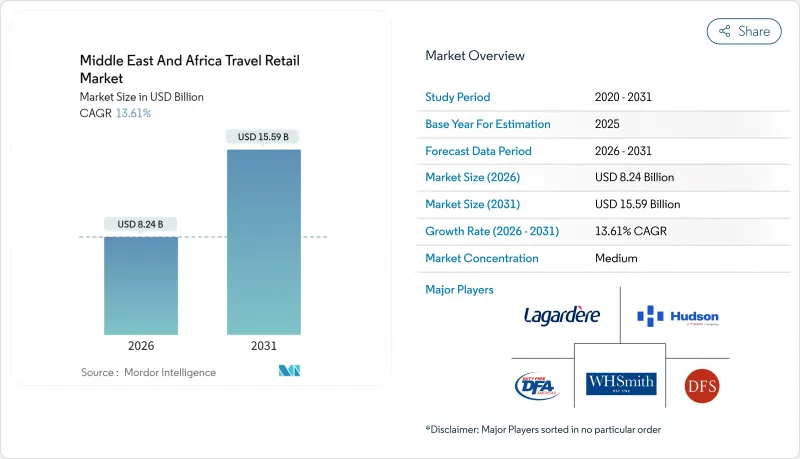

The Middle East and Africa travel retail market was valued at USD 7.25 billion in 2025 and estimated to grow from USD 8.24 billion in 2026 to reach USD 15.59 billion by 2031, at a CAGR of 13.61% during the forecast period (2026-2031).

Strong tourism-led diversification policies, airport capacity additions that exceed 120 million extra passengers every year, and rapid uptake of mobile wallets combine to underpin this momentum. Leisure travelers regain confidence, e-commerce partnerships convert that confidence into higher basket values, and duty-free price advantages continue to pull regional residents away from domestic stores. Operators also benefit from value-added tax (VAT) refunds and unified visa discussions that simplify spending decisions for international visitors. Further upside comes from AfCFTA-driven intra-African business travel and a pipeline of Red Sea cruise terminals that widen distribution touchpoints. The Middle East and Africa travel retail market therefore enjoys a unique mix of scale, policy support, and digital readiness that sustains double-digit growth even as global macro conditions fluctuate.

Middle East And Africa Travel Retail Market Trends and Insights

Rapid Airport-Capacity Expansion Across GCC Hubs

Saudi Arabia is spending USD 30 billion on King Salman International Airport to reach 120 million annual passengers by 2030, while Dubai is investing USD 34.85 billion to expand Al Maktoum International toward 260 million passengers . These flagship projects flow down to secondary airports such as Riyadh's King Khalid, which completed an upgrade that more than doubled capacity in January 2025. Every new terminal devotes roughly 15-20% of its floor area to retail, instantly enlarging the Middle East and Africa travel retail market footprint. Developers pre-install digital shelves, click-and-collect counters, and frictionless payment points, ensuring that concessionaires open with fully tech-enabled stores. Regional aviation authorities have set a combined target of 330 million passengers by 2030, translating into an enlarged, captive audience for duty-free offers. As a result, operators can negotiate longer leases that protect margins and can test new formats such as autonomous boutiques. The pipeline therefore injects predictable square footage growth that directly supports sustained revenue gains for the Middle East and Africa travel retail market.

Rising Outbound Leisure Spend by MEA Residents

Regional households resume discretionary travel quicker than many global peers because governments offer VAT refunds and unified visa talks remove friction. Disposable income stabilizes as GCC labor markets recover, pushing vacation budgets back toward pre-pandemic levels. Airlines restore routes to popular holiday spots in Europe, the Indian Ocean, and Southeast Asia, giving residents more opportunities to shop in transit and at destination airports. Digital influencers amplify brand discovery, while pre-trip duty-free reservation platforms convert browsing into higher intent purchases. Consequently, the Middle East and Africa travel retail market captures incremental wallet share whenever outbound journeys rise. Operators optimize assortments by allocating shelf space to premium beauty sets and local artisanal confectionery that resonate with gift-giving cultures. The compound effect of policy incentives, restored airline capacity, and social media marketing keeps leisure spend an important near-term catalyst for sales volume and value.

Political Instability Constrains African Market Potential

Sudan, Burkina Faso, and Central African Republic top the African instability ranking and record abrupt tourist cancellations that ripple through airline schedules and airport tenancy planning. Research shows travelers downgrade destinations perceived as unsafe, and airlines suspend routes once insurance premiums rise. Retailers then face lower traffic and higher security costs, discouraging investment in nascent airports. Although 31 nations improve stability metrics, uncertainty in 17 others injects risk premiums into lease negotiations and capital expenditure plans. Investors therefore focus on politically stable hubs such as Ghana or Rwanda, leaving some fast-growing yet volatile markets under-served. The Middle East and Africa travel retail market still expands, but the growth base narrows to geographies with reliable governance. Over time, improved peace accords and election cycles could unlock deferred projects, yet current turbulence carves 1.4 percentage points off forecast CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Tourism-Diversification Policies Drive Structural Demand

- AfCFTA Implementation Catalyzes Intra-African Business Travel

- Oil-Price Volatility Dampens GCC Consumer Spending

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fragrances and cosmetics captured 31.74% of Middle East and Africa travel retail market share in 2025, underscoring the segment's resonance with gifting culture and beauty routines among regional travelers . The category secures prime front-of-store space because beauty brands fund high-impact kiosks and travel-exclusive sets that encourage impulse buys. Operators offer instant tax refunds at checkout and deploy multichannel sampling campaigns that nudge shoppers into upsized baskets. Meanwhile, food and confectionary commands the fastest 13.63% CAGR as premium chocolates, local dates, and healthy snacks ride the wave of experiential tourism. Wine and spirits hold a loyal clientele in less restrictive destinations, yet religious sensitivities limit expansion in certain GCC terminals. Tobacco faces rising excise duties such as Kenya's increase to KES 4,100 (USD 27.88) per mille, forcing SKU rationalization but preserving cash flow from dwindling yet higher-margin volumes . Electronics, watches, and jewelry seize high-value sales because Saudi Arabia's VAT refund allows tourists to reclaim 15%, making airport prices compelling. Product diversification therefore equips retailers to hedge against regulatory shifts and seasonal demand cycles inside the Middle East and Africa travel retail market.

Travel-retail beauty brands introduce mini-formats tailored for airline liquid restrictions and develop formulations attuned to hot, dry climates, boosting conversion among Middle Eastern consumers. Confectionery suppliers bundle local flavors such as saffron and camel milk chocolate with global favorites, tapping a sense of place that souvenirs reinforce. Beverage concessionaires partner with boutique distilleries to offer travel-exclusive rums and gins, raising perceived uniqueness. Tobacco operators experiment with reduced-risk products that may comply with future regulations and attract health-conscious smokers. Electronics counters stock fast-moving accessories like noise-canceling earbuds and power banks that business travelers urgently seek. Continuous product innovation, backed by dynamic planograms and data-driven replenishment, sustains resilient category performance. Hence, a well-balanced mix keeps the Middle East and Africa travel retail market advancing even when individual product lines face cyclical headwinds.

The Middle East and Africa Travel Retail Market Report is Segmented by Product Type (Fashion and Accessories, Wine and Spirits, and Other), Distribution Channel (Airports, Cruise Liners, and Other), Traveler Demographics (Business Travelers, Leisure Travelers, and Other) and Geography (United Arab Emirates, Saudi Arabia, South Africa, Nigeria, and Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Dufry AG

- Lagardere Travel Retail

- Dubai Duty Free

- Qatar Duty Free

- The Shilla Duty Free

- Aer Rianta International

- King Power International Group

- Flemingo International

- Gebr. Heinemann SE & Co. KG

- Lotte Duty Free

- WHSmith PLC

- Saudi Arabian Airlines Duty Free

- Egyptair Duty Free Shops

- Ethiopian Airlines Skylight In-Flight Sales

- South African Airways Duty Free

- Abu Dhabi Duty Free

- Bahrain Duty Free Shop Complex

- Oman Air Duty Free

- Kenya Airports Authority (KAA) Concessions

- Heinemann Africa

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid airport capacity expansion across GCC hubs

- 4.2.2 Rising outbound leisure spend by MEA residents

- 4.2.3 Tourism-diversification policies (e.g., Saudi Vision 2030)

- 4.2.4 Pilgrimage traffic boosting secondary Saudi airports

- 4.2.5 AfCFTA-led surge in intra-African business travel

- 4.2.6 Mobile pre-order & e-wallet duty-free ecosystems

- 4.3 Market Restraints

- 4.3.1 Political instability in parts of Africa

- 4.3.2 Oil-price volatility dampening GCC spend

- 4.3.3 Tightening duty-free allowances & tobacco rules

- 4.3.4 Under-developed cruise-terminal infrastructure

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Fashion and Accessories

- 5.1.2 Wine and Spirits

- 5.1.3 Tobacco

- 5.1.4 Food and Confectionary

- 5.1.5 Fragrances and Cosmetics

- 5.1.6 Other Product Types (Stationery, Electronics, Watches, Jewelry, etc.)

- 5.2 By Distribution Channel

- 5.2.1 Airports

- 5.2.2 Cruise Liners

- 5.2.3 Railway Stations

- 5.2.4 Other Distribution Channels

- 5.3 By Traveler Demographics

- 5.3.1 Business Travelers

- 5.3.2 Leisure Travelers

- 5.3.3 Visiting Friends & Relatives (VFR)

- 5.3.4 Medical & Wellness Tourists

- 5.3.5 Student Travelers

- 5.4 By Geography

- 5.4.1 United Arab Emirates

- 5.4.2 Saudi Arabia

- 5.4.3 South Africa

- 5.4.4 Nigeria

- 5.4.5 Rest of Middle East And Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Dufry AG

- 6.4.2 Lagardere Travel Retail

- 6.4.3 Dubai Duty Free

- 6.4.4 Qatar Duty Free

- 6.4.5 The Shilla Duty Free

- 6.4.6 Aer Rianta International

- 6.4.7 King Power International Group

- 6.4.8 Flemingo International

- 6.4.9 Gebr. Heinemann SE & Co. KG

- 6.4.10 Lotte Duty Free

- 6.4.11 WHSmith PLC

- 6.4.12 Saudi Arabian Airlines Duty Free

- 6.4.13 Egyptair Duty Free Shops

- 6.4.14 Ethiopian Airlines Skylight In-Flight Sales

- 6.4.15 South African Airways Duty Free

- 6.4.16 Abu Dhabi Duty Free

- 6.4.17 Bahrain Duty Free Shop Complex

- 6.4.18 Oman Air Duty Free

- 6.4.19 Kenya Airports Authority (KAA) Concessions

- 6.4.20 Heinemann Africa

7 Market Opportunities & Future Outlook

- 7.1 Digitalised omni-channel duty-free platforms tailored to MEA travellers

- 7.2 Sustainability-driven product curation (local artisanal & eco-friendly SKUs)