PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906140

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906140

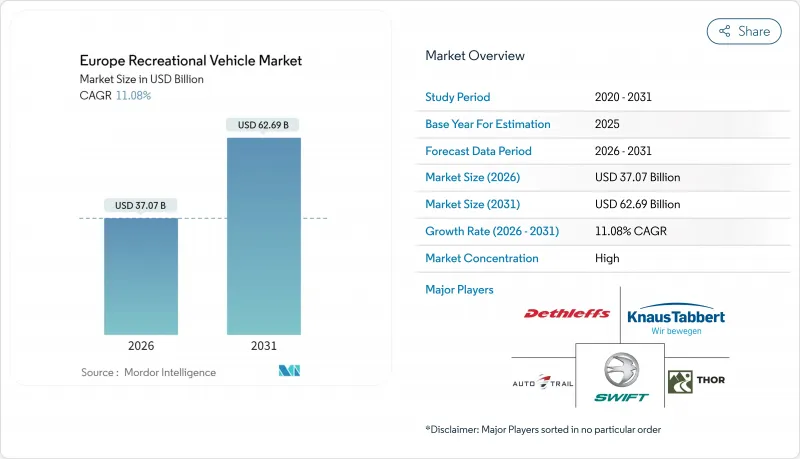

Europe Recreational Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Recreational Vehicle market is expected to grow from USD 33.38 billion in 2025 to USD 37.07 billion in 2026 and is forecast to reach USD 62.69 billion by 2031 at 11.08% CAGR over 2026-2031.

This robust growth trajectory reflects the sector's resilience following post-pandemic recovery and structural shifts in European leisure patterns. The market's expansion is underpinned by regulatory tailwinds, particularly the EU Parliament's approval of extending B-license eligibility to 4.25-tonne motorhomes by 2028, which will unlock access for millions of additional drivers.

Europe Recreational Vehicle Market Trends and Insights

Post-pandemic Surge in Domestic and Intra-Europe Tourism

European camping activity has reached unprecedented levels, with Germany recording 42.9 million camping overnight stays in 2024, representing a 19.9% increase compared to 2019 pre-pandemic levels. This sustained elevation in domestic tourism reflects a fundamental shift in European leisure preferences, where proximity-based travel has evolved from pandemic necessity to preferred lifestyle choice. The trend extends beyond Germany, with Norway's camping sites witnessing a rise in guest nights, marking significant year-over-year growth. The persistence of elevated camping activity well into 2025 suggests this represents structural demand rather than temporary pandemic-driven behavior, particularly as camping accounts for most German guest overnight stays compared to historical levels. This tourism reorientation creates sustained tailwinds for RV demand across vehicle segments, from compact campervans enabling urban-adjacent exploration to larger motorhomes supporting extended domestic touring.

Rapid Expansion of RV-sharing and Rental Platforms

The European RV-sharing ecosystem has matured rapidly. The sector's growth acceleration is evidenced by Roadsurfer securing EUR 30 million from Avellinia Capital in April 2025, specifically for fleet expansion from 8,500 to 10,000 vehicles. This capital deployment reflects institutional recognition that peer-to-peer RV platforms have overcome initial trust barriers and achieved operational scale. Notably, platforms are expanding eastward, with Ruuts targeting Eastern European markets through API integrations, providing access to major European RVs, and addressing previously underserved regions. The sharing economy's penetration into RV ownership patterns creates dual market effects: democratizing access for first-time users while generating utilization-based revenue streams for private owners, effectively expanding the addressable market beyond traditional ownership models.

High Upfront Purchase and Insurance Costs

European RV prices have surged, straining affordability across market segments. This increase stems from supply chain disruptions, chassis shortages, and manufacturers leveraging pandemic-driven demand. Rising insurance premiums, driven by higher replacement values and specialized repair needs, add to the financial burden. Middle-market buyers increasingly opt for used vehicles or rentals, while younger and first-time buyers face barriers, limiting market growth despite strong demand. Even with inventory corrections, persistent high prices highlight structural cost inflation, necessitating income growth or alternative ownership models to sustain accessibility.

Other drivers and restraints analyzed in the detailed report include:

- Ageing but Affluent 55 to 75 Cohort Boosting Premium Demand

- EU B-license Weight Limit Rising to 4.25 t Enabling Larger Floorplans

- Volatile Interest-rate-driven Financing Squeeze

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Motorhomes maintained their dominant position with a 53.72% share of the Europe recreational vehicle market in 2025, reflecting European consumers' preference for self-contained mobile living solutions that provide comprehensive amenities without external dependencies. The segment's leadership stems from its appeal to the affluent 55-75 demographic, prioritizing comfort and convenience over mobility constraints. However, campervans are experiencing the fastest growth at 11.62% CAGR through 2031, driven by younger demographics embracing van life culture and urban professionals seeking flexible work-travel solutions. Travel and fifth-wheel trailers occupy smaller but stable niches, appealing to consumers who prefer to maintain separate towing vehicles for daily use. Pop-up and folding campers represent the entry-level segment, attracting price-sensitive buyers and seasonal users.

The regulatory environment supports this segmentation evolution, with EU type-approval frameworks under Regulation 2018/858 providing clear pathways for multi-stage vehicle approvals that facilitate campervan conversions while maintaining safety standards. Class A motorhomes command premium pricing but face headwinds from urban low-emission zone restrictions, while Class B campervans benefit from improved urban accessibility and parking flexibility.

Diesel ICE powertrains command 91.10% share of the Europe recreational vehicle market in 2025, reflecting the segment's traditional reliance on diesel's superior torque characteristics and fuel efficiency for heavy vehicle applications. Petrol ICE variants maintain a smaller presence, primarily in lighter campervan applications where weight considerations favor gasoline engines. However, battery-electric variants are surging at a 36.91% CAGR through 2031, driven by tightening EU emission regulations and expanding charging infrastructure. Hybrid-electric solutions occupy a transitional position, offering compromise solutions for range-anxious consumers while providing emission benefits for urban access.

Norway leads electric adoption with 96% BEV share in passenger cars, creating spillover effects into commercial and recreational vehicle segments. Manufacturers are investing heavily in electric solutions, with Truma appointing Dr. Joachim Weckwerth from Bosch's Electric Solutions division to lead product development, signaling a strategic commitment to electrification.

The Europe Recreational Vehicle Market Report is Segmented by Type (Towable RVs, Motorhomes), Propulsion and Fuel (Diesel ICE, Petrol ICE, Hybrid-Electric, Battery-Electric), Ownership Model (Private Owners, Rental and Sharing Fleets), Sales Channel (OEM-Franchised Dealers, and More), and Country (Germany, United Kingdom, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Erwin Hymer Group (Thor Industries)

- Trigano SA

- Auto Trail VR LTD

- Knaus Tabbert AG

- Hobby-Fendt Caravan GmbH

- Swift Group Ltd.

- Rapido Group

- Adria Mobil d.o.o.

- Dethleffs GmbH & Co. KG

- Rimor Motorhomes

- Eura Mobil GmbH

- Burstner GmbH

- Laika Caravans S.p.A.

- Westfalia Mobil GmbH

- Globe-Traveller RV Sp. z O.o.

- Malibu GmbH & Co. KG

- Benimar SL

- Challenger (Trigano)

- Possl Group

- Pilote Groupe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Pandemic Surge In Domestic And Intra-Europe Tourism

- 4.2.2 Rapid Expansion Of RV-Sharing And Rental Platforms

- 4.2.3 Ageing But Affluent 55 to 75 Cohort Boosting Premium Demand

- 4.2.4 Upgrade Of More Than 3,000 EU Campsites To "Connected-Stay" Standards

- 4.2.5 EU B-License Weight Limit Rising To 4.25 t Enabling Larger Floorplans

- 4.2.6 Emergence Of "Work-From-Anywhere" Digital-Nomad Van Conversions

- 4.3 Market Restraints

- 4.3.1 High Upfront Purchase And Insurance Costs

- 4.3.2 Volatile Interest-Rate-Driven Financing Squeeze

- 4.3.3 Oversupply-Led Price Depreciation Of 2021-22 Inventory

- 4.3.4 Urban Low-Emission Zones Curbing Diesel RV Access

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecast (Value (USD) and Volume (Units))

- 5.1 By Type

- 5.1.1 Towable RVs

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth-Wheel Trailers

- 5.1.1.3 Pop-up/Folding Campers

- 5.1.2 Motorhomes

- 5.1.2.1 Class A

- 5.1.2.2 Class B (Campervans)

- 5.1.2.3 Class C

- 5.1.1 Towable RVs

- 5.2 By Propulsion and Fuel

- 5.2.1 Diesel Internal Combustion Engine

- 5.2.2 Petrol Internal Combustion Engine

- 5.2.3 Hybrid-Electric

- 5.2.4 Battery-Electric

- 5.3 By Ownership Model

- 5.3.1 Private Owners

- 5.3.2 Rental and Sharing Fleets

- 5.4 By Sales Channel

- 5.4.1 OEM-Franchised Dealers

- 5.4.2 Direct-to-Consumer Online

- 5.4.3 Rental Agency Networks

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Norway

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Erwin Hymer Group (Thor Industries)

- 6.4.2 Trigano SA

- 6.4.3 Auto Trail VR LTD

- 6.4.4 Knaus Tabbert AG

- 6.4.5 Hobby-Fendt Caravan GmbH

- 6.4.6 Swift Group Ltd.

- 6.4.7 Rapido Group

- 6.4.8 Adria Mobil d.o.o.

- 6.4.9 Dethleffs GmbH & Co. KG

- 6.4.10 Rimor Motorhomes

- 6.4.11 Eura Mobil GmbH

- 6.4.12 Burstner GmbH

- 6.4.13 Laika Caravans S.p.A.

- 6.4.14 Westfalia Mobil GmbH

- 6.4.15 Globe-Traveller RV Sp. z O.o.

- 6.4.16 Malibu GmbH & Co. KG

- 6.4.17 Benimar SL

- 6.4.18 Challenger (Trigano)

- 6.4.19 Possl Group

- 6.4.20 Pilote Groupe