PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906160

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906160

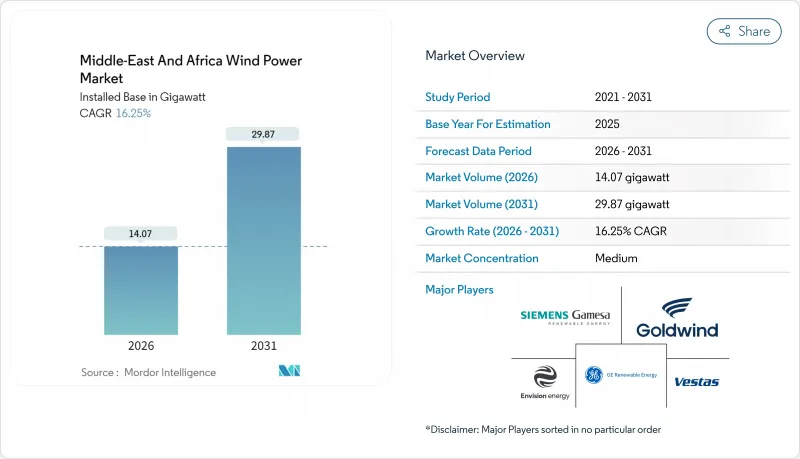

Middle-East And Africa Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle-East And Africa Wind Power Market is expected to grow from 12.10 gigawatt in 2025 to 14.07 gigawatt in 2026 and is forecast to reach 29.87 gigawatt by 2031 at 16.25% CAGR over 2026-2031.

Robust sovereign wealth-fund investments, especially the Saudi Public Investment Fund's USD 50 billion renewable allocation, anchor this momentum. Intensifying policy targets, declining onshore levelized costs, and expanding corporate power purchase agreements (PPAs) form the core growth architecture. International turbine makers strengthen local footprints while Chinese entrants win cost-sensitive bids. Developers hedge grid risks through storage pilots and hybrid designs that smooth output variability. Supply-chain congestion at regional ports and early-stage offshore permitting remain operational friction points, yet the depth of national targets secures multi-year project visibility.

Middle-East And Africa Wind Power Market Trends and Insights

Government Renewable-Energy Targets & Auctions

National auction programs underpin project pipelines. Saudi Arabia targets 50% clean electricity by 2030 with 16 GW of wind capacity, achieving a record USD 0.0199 per kWh tariff at Dumat Al Jandal in 2024. Egypt aims to achieve 7.2 GW of wind energy by 2035, backed by USD 3.2 billion in multilateral financing. Morocco's 10 GW target for 2030 exploits Atlantic resources, while the UAE channels 12% of its 2050 generation mix toward wind. These synchronized mandates reduce demand risk, attract tier-one financiers, and encourage supply-chain localization.

Falling On-Shore LCOE Below Regional Fossil Benchmarks

Wind costs have dropped below USD 0.03 per kWh in Morocco, Egypt, and Saudi Arabia, which is lower than natural-gas tariffs of USD 0.035-0.045 per kWh. Dumat Al Jandal's 2024 tariff came in 40% under fossil alternatives. Morocco's Tarfaya complex sells at USD 0.025 per kWh, making cross-border exports commercially viable. Gulf of Suez projects operate at capacity factors above 40%, reinforcing the economic argument for wind investment.

Policy Uncertainty in Several Sub-Saharan Markets

Nigeria's shifting feed-in tariffs and multi-layer permitting elevate financing spreads by 150-200 basis points. Kenya's new grid codes create transition delays, Ghana faces currency fluctuations that inflate capacity payments, and Ethiopia's regional conflicts hinder wind corridor development. These issues stretch development timelines by up to 18 months and temper near-term capacity additions outside stable auction jurisdictions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Corporate PPAs from Data-Center & Mining Sectors

- Grid-Expansion Investments Across GCC & East Africa

- Grid Stability & Curtailment Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Onshore projects are expected to control the entire Middle East and Africa wind power market in 2025 and sustain a 16.25% CAGR to 2031, driven by mature supply chains and low capital costs. South Africa's Eastern Cape farms and Saudi Arabia's Dumat Al Jandal demonstrate performance with capacity factors of nearly 40%. Morocco's Atlantic villas exceed 45% factors thanks to consistent trade winds.

Offshore potential is substantial. The Red Sea coasts offer water depths of 20-50 m with wind speeds of 9 m/s. NEOM's 4 GW plan aims to anchor the first projects by 2028. Egypt is lining up 10 GW of offshore prospects and is negotiating concessional European financing. As pilot arrays prove bankable, the Middle East and Africa wind power market may diversify rapidly toward offshore capacity after 2027.

The Middle East and Africa Wind Power Market Report is Segmented by Location (Onshore and Offshore), Turbine Capacity (Up To 3 MW, 3 To 6 MW, and Above 6 MW), Application (Utility-Scale, Commercial and Industrial, and Community Projects), and Geography (Saudi Arabia, UAE, Jordan, Iran, South Africa, Egypt, Morocco, and Rest of Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- GE Renewable Energy

- Xinjiang Goldwind Science & Technology

- Envision Energy

- Acciona Energia

- Mainstream Renewable Power

- EDF Renouvelables

- Enel Green Power

- ENGIE

- ACWA Power

- Masdar Clean Energy

- Lekela Power

- Orascom Construction

- Nordex SE

- Enercon GmbH

- Ming Yang Smart Energy

- Siemens Energy

- Doosan Enerbility

- Suzlon Energy Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government renewable-energy targets & auctions

- 4.2.2 Falling on-shore LCOE below regional fossil benchmarks

- 4.2.3 Expansion of corporate PPAs from data-centre & mining sectors

- 4.2.4 Grid-expansion investments across GCC & East Africa

- 4.2.5 Offshore wind-to-hydrogen pilots along the Red Sea

- 4.2.6 Saudi localisation incentives for turbine manufacturing

- 4.3 Market Restraints

- 4.3.1 Policy uncertainty in several Sub-Saharan markets

- 4.3.2 Grid stability & curtailment risk

- 4.3.3 High upfront CAPEX for offshore projects

- 4.3.4 Supply-chain congestion at MEA ports

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 By Turbine Capacity

- 5.2.1 Up to 3 MW

- 5.2.2 3 to 6 MW

- 5.2.3 Above 6 MW

- 5.3 By Application

- 5.3.1 Utility-scale

- 5.3.2 Commercial and Industrial

- 5.3.3 Community Projects

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Nacelle/Turbine

- 5.4.2 Blade

- 5.4.3 Tower

- 5.4.4 Generator and Gearbox

- 5.4.5 Balance-of-System

- 5.5 By Geography

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Jordan

- 5.5.4 Iran

- 5.5.5 South Africa

- 5.5.6 Egypt

- 5.5.7 Morocco

- 5.5.8 Rest of Middle East & Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Siemens Gamesa Renewable Energy

- 6.4.2 Vestas Wind Systems A/S

- 6.4.3 GE Renewable Energy

- 6.4.4 Xinjiang Goldwind Science & Technology

- 6.4.5 Envision Energy

- 6.4.6 Acciona Energia

- 6.4.7 Mainstream Renewable Power

- 6.4.8 EDF Renouvelables

- 6.4.9 Enel Green Power

- 6.4.10 ENGIE

- 6.4.11 ACWA Power

- 6.4.12 Masdar Clean Energy

- 6.4.13 Lekela Power

- 6.4.14 Orascom Construction

- 6.4.15 Nordex SE

- 6.4.16 Enercon GmbH

- 6.4.17 Ming Yang Smart Energy

- 6.4.18 Siemens Energy

- 6.4.19 Doosan Enerbility

- 6.4.20 Suzlon Energy Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment