PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906215

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906215

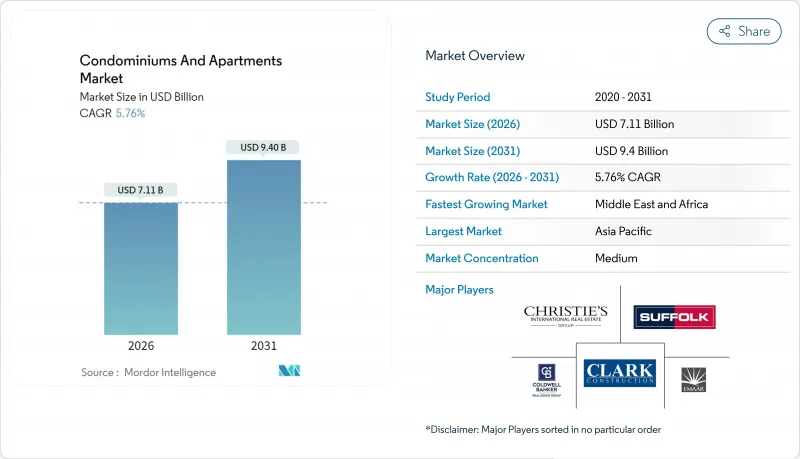

Condominiums And Apartments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Condominiums and apartments market size in 2026 is estimated at USD 7.11 billion, growing from 2025 value of USD 6.72 billion with 2031 projections showing USD 9.4 billion, growing at 5.76% CAGR over 2026-2031.

Robust urban migration, a widening middle class, and persistent housing supply gaps continue to attract institutional capital toward multifamily assets, even as financing conditions tighten in some economies. Rental-led business models are scaling fast because they offer predictable yields and inflation protection that appeal to pension funds and sovereign wealth vehicles. Government programs that underwrite affordable units and streamline project approvals further strengthen pipeline visibility, while technology-enabled design and construction methods help developers control costs and differentiate offerings through smart-home features. Together, these forces reinforce the long-term expansion path of the condominiums and apartments market.

Global Condominiums And Apartments Market Trends and Insights

Urbanization and rising demand for high-density housing in global metros

Urban populations are forecast to increase 22% between 2023 and 2035, with the sharpest growth in Southeast Asia and Africa. Crowded land markets and expensive infrastructure tilt municipal policies toward vertical construction that maximizes limited parcels. High-rise condominiums bolster transit-oriented development goals and lower per-capita emissions, aligning with sustainability mandates. Governments view the typology as essential to curb informal settlement expansion and preserve economic productivity. This structural migration tailwind underpins resilient absorption levels even during cyclical slowdowns.

Growing middle-class populations are boosting demand for mid-market condos

Rising disposable incomes across emerging economies push households into formal ownership brackets, particularly in India, where residential real estate attracted over half of private-equity inflows in 2024. Buyers prioritize mid-priced units that blend affordability with lifestyle amenities, forcing developers to recalibrate product mixes away from purely luxury inventory. In Brazil, government-backed FGTS mortgages totaled USD 1.69 billion in 2024 despite a slowdown in broader lending, underscoring sustained demand for attainable homes. Condo formats that optimize unit size while preserving community facilities capture this expanding demographic.

High land and construction costs are raising unit pricing in prime cities

Material prices climbed 4.9% in 2023 and continue to inch up because of geopolitical frictions and climate-induced supply shocks. Labor scarcity inflates wage bills since 42% of the construction workforce already serves residential builds, straining project schedules. Expensive plots in core metros compel developers to shrink unit footprints or pivot to secondary locations, sometimes jeopardizing project viability. Rising insurance premiums further squeeze margins, prompting risk-sharing models and alternative construction materials to maintain affordability. These pressures dampen near-term launches in top-tier cities.

Other drivers and restraints analyzed in the detailed report include:

- High investor interest in rental apartments as stable yield-generating assets

- Government housing programs supporting affordable and mid-income condo supply

- Regulatory restrictions and foreign ownership limits in select countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rental operations are expanding quickly, even though sales transactions held a 61.55% condominiums and apartments market share in 2025. Demand for flexible living rises as millennials postpone ownership and empty-nesters unlock home equity to downsize. The rental arm of the condominiums and apartments market benefits from professional management, integrated amenities, and predictable upkeep, elements that resonate with lifestyle-oriented tenants. Institutional investors, exemplified by Blackstone, deploy large capital pools into build-to-rent assets because stable yields align with long-duration liabilities.

Build-to-rent inventory sits near 350,000 units, and pipeline indicators remain healthy despite macro headwinds. Developers leverage bulk purchasing of materials and modular techniques to accelerate delivery. Single-family rental communities command premiums over traditional multifamily because they offer private yards and suburban settings. These features sustain higher retention rates, bolstering cash flows that feed back into further acquisitions. The trend deepens liquidity in the condominiums and apartments industry and increases the sophistication of property management standards.

The Condominiums and Apartments Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America). The Report Offers the Market Sizes and Forecasts in Value (USD Billion) for all the Above Segments.

Geography Analysis

Asia-Pacific keeps a commanding 46.20% stake in the condominiums and apartments market, underwritten by fast urbanization and a swelling middle class across China, India, and Southeast Asia. Infrastructure upgrades and favorable demographics support resilient absorption across both mid-market and premium products. India alone attracted more than 50% of global private-equity housing flows in 2024, aided by regulatory reforms that improve title clarity. Investors continue to pursue Japanese multifamily stock due to low borrowing costs and near-zero vacancy in core wards, while Australia's housing shortfall remains a structural tailwind for developers.

The Middle East and Africa register the quickest growth at 6.93% CAGR through 2031 as economic diversification programs raise residential demand. Saudi Arabia eyes USD 101.62 billion in real-estate value by 2029, supported by mega-events like FIFA 2030 and EXPO 2030. Dubai's 2024 residential prices climbed 20% and rents 19%, illustrating the magnet effect of tax advantages and global connectivity. The UAE hosts over USD 100 billion in active housing and hospitality projects. Robotics-assisted construction and AI-driven project controls are shortening build times, making the region a test bed for advanced techniques.

Europe is rebounding after monetary easing pushed average mortgage rates to 3.32% in early 2025, sparking the highest quarterly residential investment since 2022 at USD 9.79 billion. Germany expects apartment prices to rise 5-6% in 2025, helped by generous depreciation allowances for rental properties. Limited supply and tighter energy codes keep vacancy low, bolstering rent growth in gateway cities. North America shows mixed signals: buyer demand remains high, but affordability challenges and foreign-buyer curbs cap transaction velocity in some states. Nevertheless, core urban centers maintain undersupplied rental stock, anchoring occupancy rates above long-term averages.

- Christie International Real Estate

- Clark Group

- Coldwell Banker Real Estate

- Suffolk Construction

- Emaar Properties

- Lennar Corporation

- D.R. Horton

- China Vanke Co., Ltd.

- Sun Hung Kai Properties

- Lendlease Group

- Mitsui Fudosan Co., Ltd.

- DLF Ltd

- Engel & Volkers AG

- Brookfield Residential

- Greystar Real Estate Partners

- Trammell Crow Residential

- PulteGroup Inc.

- Savills PLC

- CBRE Group (Residential Dev.)

- Knight Frank LLP

- AECOM

- HOCHTIEF AG

- Bouygues Immobilier

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urbanization and rising demand for high-density housing in global metros

- 4.2.2 Growing middle-class populations boosting demand for mid-market condos

- 4.2.3 High investor interest in rental apartments as stable yield-generating assets

- 4.2.4 Government housing programs supporting affordable and mid-income condo supply

- 4.2.5 Increasing demand for smart, sustainable, and community-focused apartment projects

- 4.3 Market Restraints

- 4.3.1 High land and construction costs raising unit pricing in prime cities

- 4.3.2 Regulatory restrictions and foreign ownership limits in select countries

- 4.3.3 Economic slowdowns and mortgage rate fluctuations impacting affordabilit

- 4.4 Residential Real Estate Buying Trends - Socio-economic & Demographic Insights

- 4.5 Rental Yield Analysis

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Insights Into Affordable Housing Support Provided by Government and Public-private Partnerships

- 4.9 Insights into Existing and Upcoming Projects

- 4.10 Porter's Five Forces

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Buyers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitutes

- 4.10.5 Intensity of Competitive Rivalry

5 Condominiums and Apartments Market Size & Growth Forecasts (Value USD billion)

- 5.1 By Business Model

- 5.1.1 Sales

- 5.1.2 Rental

6 Condominiums and Apartments Market (Sales Model) Size & Growth Forecasts (Value USD billion)

- 6.1 By Price Band

- 6.1.1 Affordable

- 6.1.2 Mid-Market

- 6.1.3 Luxury

- 6.2 By Mode of Sale

- 6.2.1 Primary (New-Build)

- 6.2.2 Secondary (Existing-Home Resale)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 South America

- 6.3.2.1 Brazil

- 6.3.2.2 Rest of South America

- 6.3.3 Europe

- 6.3.3.1 United Kingdom

- 6.3.3.2 Germany

- 6.3.3.3 France

- 6.3.3.4 Italy

- 6.3.3.5 Spain

- 6.3.3.6 Rest of Europe

- 6.3.4 Middle East and Africa

- 6.3.4.1 Saudi Arabia

- 6.3.4.2 United Arab Emirates

- 6.3.4.3 Rest of Middle East and Africa

- 6.3.5 Asia-Pacific

- 6.3.5.1 China

- 6.3.5.2 India

- 6.3.5.3 Japan

- 6.3.5.4 South Korea

- 6.3.5.5 Australia

- 6.3.5.6 Indonesia

- 6.3.5.7 Rest of Asia-Pacific

- 6.3.1 North America

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 7.3.1 Christie International Real Estate

- 7.3.2 Clark Group

- 7.3.3 Coldwell Banker Real Estate

- 7.3.4 Suffolk Construction

- 7.3.5 Emaar Properties

- 7.3.6 Lennar Corporation

- 7.3.7 D.R. Horton

- 7.3.8 China Vanke Co., Ltd.

- 7.3.9 Sun Hung Kai Properties

- 7.3.10 Lendlease Group

- 7.3.11 Mitsui Fudosan Co., Ltd.

- 7.3.12 DLF Ltd

- 7.3.13 Engel & Volkers AG

- 7.3.14 Brookfield Residential

- 7.3.15 Greystar Real Estate Partners

- 7.3.16 Trammell Crow Residential

- 7.3.17 PulteGroup Inc.

- 7.3.18 Savills PLC

- 7.3.19 CBRE Group (Residential Dev.)

- 7.3.20 Knight Frank LLP

- 7.3.21 AECOM

- 7.3.22 HOCHTIEF AG

- 7.3.23 Bouygues Immobilier

8 Market Opportunities & Future Outlook