PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911803

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911803

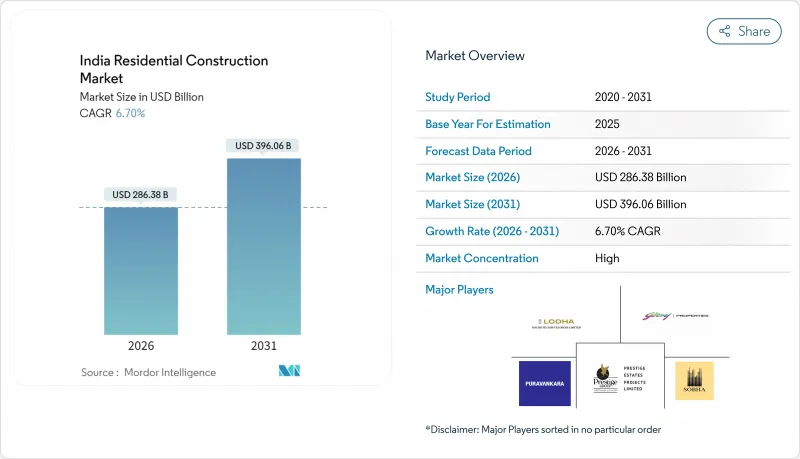

India Residential Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India Residential Construction Market size in 2026 is estimated at USD 286.38 billion, growing from 2025 value of USD 268.40 billion with 2031 projections showing USD 396.06 billion, growing at 6.7% CAGR over 2026-2031.

Rising urban migration, an enlarged public-sector housing budget, and steady private capital continue to underpin growth despite material cost volatility. Demand moves beyond tier-I centres as tier-II and tier-III cities gain infrastructure, while hybrid-work models steer buyers toward larger homes with integrated workspaces. Digital mortgage platforms compress loan approval times, improving affordability, and NRI inflows keep luxury launches resilient even during macro-uncertainty. Developers respond with smart-enabled amenities and greater use of modular building systems to counter skilled-labour shortages and shorten site schedules.

India Residential Construction Market Trends and Insights

Government affordable-housing thrust accelerates tier-city development

Central allocations of INR 78,126 crore (USD 9.41 billion) for PMAY in FY 2025-26 mark a 64% rise over the prior year and expand the target to 3 crore homes. Concurrently, the INR 15,000 crore (USD 1.81 billion) SWAMIH Fund 2 focuses on 1 lakh delayed units, freeing developer cash flows and encouraging site restarts. GST remains at 1% for units below INR 45 lakh (USD 0.05 million), protecting affordability as steel and cement prices fluctuate. Several states cut stamp duty for female buyers, with Maharashtra and Karnataka at the forefront, nudging first-time purchasers. Digital registration planned under the Registration Bill 2025 reduces approval cycles and bolsters working-capital efficiency for mid-sized builders.

Tier-II/III urbanisation drives construction beyond metro saturation

Housing demand pivots toward cost-competitive cities where land and labour run 30-40% below tier-I norms, helped by the Smart Cities Mission and PM Gati Shakti road-rail expansions. The INR 80 trillion National Infrastructure Pipeline amplifies expressway and metro connectivity, opening new suburban nodes. Corporate relocations to Pune, Ahmedabad, and Coimbatore sustain mid-income launches priced at INR 15,000-25,000 per square foot (USD 180 - 300 per square), far under Mumbai averages. Industrial corridors along Delhi-Mumbai and Chennai-Bengaluru add job hubs, while shorter permitting queues in these cities allow quicker project starts than in saturation-hit metros.

Material price volatility pressures project economics

Domestic steel tracked energy swings with 15-20% price shifts in 2024, while cement climbed 8-12% due to freight and fuel escalations. Developers insert cost-escalation clauses yet still face near-term cash gaps when spikes outpace billing cycles. Fly-ash concrete and recycled steel gain share, and forward contracts become vital for volume buyers. Regional price gaps of 20-25% push some builders toward East-based manufacturing clusters to curb freight loads.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid-work models reshape space requirements and location preferences

- NRI and HNI capital influx elevates luxury segment dynamics

- Skilled-labour shortages intensify as infrastructure boom competes for workforce

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Apartments & condominiums held 69.30% of the India residential construction market share in 2025, reflecting density regulations and entry-level affordability. Rising land costs in metro cores keep vertical living economical, and mixed-use towers around transit nodes boost developer margins through retail add-ons. High-rise projects increasingly reserve podium floors for community amenities that raise absorption rates among mid-income buyers. The segment also benefits from digital sales tools that shorten booking cycles and reduce marketing overhead.

Villas and landed houses, though smaller in count, deliver the fastest 7.07% CAGR as wealthier households pursue privacy and outdoor space. Peri-urban pockets in NCR, Pune, and Bengaluru see villa premiums of 20-30% over equivalent apartment carpet area. Gated layouts bundle clubhouses, sports courts, and landscaped gardens to replicate resort living on city edges. Smart-home wiring and solar roofs come standard, supporting higher ticket sizes and keeping churn low.

New construction accounted for 82.40% of the India residential construction market size with the highest project pipeline in FY 2025. Housing-shortage mitigation, greenfield townships, and corridor-linked suburbs fuel this stream. RERA compliance, environmental safeguards, and pre-approved design typologies speed up clearances for greenfield sites compared with brownfield conversions.

Urban renovation, advancing at 7.00% CAGR, benefits from the INR 1 lakh crore Urban Challenge Fund, which encourages society redevelopment and slum rehabilitation. Aging stock in Mumbai and Delhi undergoes reconstruction to unlock higher floor-space indices, while individual unit upgrades push the home-interior market toward premium fixtures. Modular kitchens, bathroom refits, and home-automation retrofits lift spend per unit and catalyse ancillary trades such as MEP specialists.

India Residential Construction Market Report is Segmented by Type (Apartment & Condominiums, Villas and Landed Houses), Construction Type (New Construction, Renovation), Construction Method (Conventional On-Site, Modern Methods of Construction), Investment Source (Public, Private), and Geography (North India, South India, West India, East & North-East India, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DLF Ltd.

- Macrotech Developers (Lodha)

- Godrej Properties

- Prestige Estates Projects

- Sobha Ltd.

- Puravankara Ltd.

- Oberoi Realty

- Brigade Enterprises

- Tata Housing / Tata Realty

- Mahindra Lifespace Developers

- Signature Global

- Shriram Properties

- ATS Infrastructure

- Hiranandani Group

- Kolte-Patil Developers

- Sunteck Realty

- Casagrand Builders

- Aparna Constructions

- TVS Emerald

- Bhartiya City Developers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Govt affordable-housing thrust (PMAY, tax breaks)

- 4.2.2 Tier-II/III urbanisation & income growth

- 4.2.3 Low mortgage rates & digital loan access

- 4.2.4 Hybrid-work demand for larger homes

- 4.2.5 NRI/HNI capital shift into luxury housing

- 4.2.6 PropTech-enabled fractional/BTR models

- 4.3 Market Restraints

- 4.3.1 Volatile steel-cement prices

- 4.3.2 Skilled-labour shortages

- 4.3.3 Stricter 2025 environmental clearances

- 4.3.4 Rising climate-risk insurance premiums

- 4.4 Government Initiatives & Vision

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.9 Comparison of Key Industry Metrics of India with Other Countries

- 4.10 Key Upcoming/Ongoing Projects (with a focus on Mega Residential Projects)

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Apartment & Condominiums

- 5.1.2 Villas and Landed Houses

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Construction Method

- 5.3.1 Conventional On-Site

- 5.3.2 Modern Methods of Construction (Prefabricated, Modular, etc)

- 5.4 By Investment Source

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Region

- 5.5.1 North India

- 5.5.2 South India

- 5.5.3 West India

- 5.5.4 East & North-East India

- 5.5.5 Central India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 DLF Ltd.

- 6.4.2 Macrotech Developers (Lodha)

- 6.4.3 Godrej Properties

- 6.4.4 Prestige Estates Projects

- 6.4.5 Sobha Ltd.

- 6.4.6 Puravankara Ltd.

- 6.4.7 Oberoi Realty

- 6.4.8 Brigade Enterprises

- 6.4.9 Tata Housing / Tata Realty

- 6.4.10 Mahindra Lifespace Developers

- 6.4.11 Signature Global

- 6.4.12 Shriram Properties

- 6.4.13 ATS Infrastructure

- 6.4.14 Hiranandani Group

- 6.4.15 Kolte-Patil Developers

- 6.4.16 Sunteck Realty

- 6.4.17 Casagrand Builders

- 6.4.18 Aparna Constructions

- 6.4.19 TVS Emerald

- 6.4.20 Bhartiya City Developers

7 Market Opportunities & Future Outlook