PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906228

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906228

Italy ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

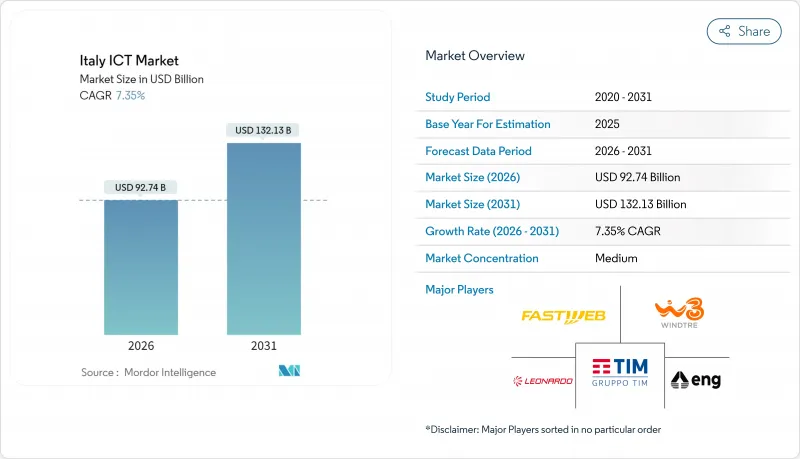

The Italy ICT market was valued at USD 86.39 billion in 2025 and estimated to grow from USD 92.74 billion in 2026 to reach USD 132.13 billion by 2031, at a CAGR of 7.35% during the forecast period (2026-2031).

Current momentum stems from the government's National Recovery and Resilience Plan, private-sector capital inflows, and rapid migration toward sovereign cloud architectures that reduce legacy system dependence. Edge computing pilots in Northern manufacturing hubs, nationwide 5G densification, and fast-growing cybersecurity spend reinforce the shift toward data-centric services. At the same time, heightened investment from hyperscalers and domestic operators positions the Italy ICT market as a core part of Europe's digital value chain. Competitive intensity has risen following the Fastweb + Vodafone integration, which introduced a second full-service network alongside incumbent TIM's infrastructure, enabling broader connectivity options and nudging prices lower.

Italy ICT Market Trends and Insights

NRRP-funded Digital Investment Surge

The Piano Transizione 5.0 channelled USD 13.8 billion into enterprise digitalisation and energy efficiency, triggering record purchase orders for cloud, cybersecurity, and data integration tools . Allocation rules that earmark at least 20% of EU Recovery funds for digital objectives further extend the spending runway. Vendors that establish local delivery facilities in Mezzogiorno benefit from a USD 327 million Southern Italy budget line, which addresses regional gaps while lifting demand in traditionally underserved provinces. The funding cycle supports the Italy ICT market through 2029, creating a predictable pipeline for system integrators and telecom carriers.

Rapid Enterprise Cloud Migration

TIM recorded 19% cloud revenue growth in 2024, while its cybersecurity unit doubled sales, proving the link between cloud adoption and stronger security demand . Microsoft pledged USD 4.7 billion for new Italian data-center regions and AI labs, and AWS added USD 1.3 billion for edge zones that will inject USD 958 million into GDP over five years. These moves lower latency, address data-sovereignty rules, and draw application developers into local ecosystems, fuelling the Italy ICT market. Hybrid architectures that combine local availability zones with on-premise edge servers are now standard for large manufacturers and banks, accelerating workload migration through 2027.

Digital-Skills Deficit

Only 45% of Italians hold basic digital capabilities, below the EU's 80% target for 2030. Unfilled cybersecurity roles already exceed 10,000, and a 175,000-person ICT shortage is possible by 2027, squeezing wages and elongating project cycles. Universities produce 44,000 ICT graduates per year against 88,000 needed, prompting firms to import talent or outsource specialised tasks. Upskilling programmes in the PNRR and private academies help, yet structural relief will not arrive before 2028, capping the growth pace of the Italy ICT market.

Other drivers and restraints analyzed in the detailed report include:

- Nationwide 5G and FTTH Roll-out

- Sovereign-Cloud and GAIA-X Compliance Push

- Macroeconomic and Energy-Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Communication Services contributed a 34.12% share to the Italy ICT market in 2025, reflecting sizeable 5G and fiber backhaul capex. IT Security/Cybersecurity is expanding at an 12.4% CAGR as banks, utilities, and public agencies harden critical workloads under the National Cybersecurity Strategy. The Italy ICT market size for security reached USD 2.47 billion in 2025 and is projected to grow alongside USD 2.4 billion earmarked for threat-defence projects.

Edge-enabled data-center builds worth USD 10.9 billion for 2025-2026 elevate hardware sales, while software demand is fuelled by cloud-native development and low-code adoption in retail and logistics. IT Services vendors benefit from SMEs that outsource transformation tasks, and cloud units record double-digit gains as hyperscalers localise capacity. Together these shifts indicate the Italy ICT market will carry momentum beyond traditional telecom revenue streams.

Large Enterprises captured 59.15% of the Italy ICT market in 2025 thanks to multi-year digital agendas and in-house IT teams. They now prioritise AI-enhanced analytics, sovereign data fabrics, and zero-trust architectures. Conversely, SMEs are expected to expand spending at 7.95% CAGR, narrowing the digital divide and broadening addressable demand. Voucher schemes worth USD 327 million in Southern Italy, plus subsidised broadband tariffs, lower entry barriers.

SME procurement, however, remains fragmented, prompting operators to bundle connectivity, cloud, and security into fixed-price packages. Fastweb + Vodafone's Enterprise Business Unit posted 2.7% revenue growth in Q1 2025 on these converged offers. Vendors that combine user-friendly portals, bilingual support, and pay-as-you-grow terms are positioned to capture incremental Italy ICT market opportunities.

Italy ICT Market Report is Segmented by Type (IT Hardware [Computer Hardware, and More], IT Software, IT Services [Managed Service, and More], IT Infrastructure, and More), End-User Enterprise Size (Small and Medium Enterprise, Large Enterprises), End-User Industry (BFSI, IT and Telecom, and More), and Deployment Mode (On-Premise, Cloud). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Telecom Italia S.p.A. (TIM)

- Fastweb S.p.A.

- Vodafone Italia S.p.A.

- Wind Tre S.p.A.

- Leonardo S.p.A.

- IBM Italia S.p.A.

- Accenture S.p.A.

- Capgemini Italia S.p.A.

- Oracle Italia S.r.l.

- Microsoft Italia S.r.l.

- Google Cloud Italy S.r.l.

- Amazon Web Services Italy S.r.l.

- Engineering Ingegneria Informatica S.p.A.

- Reply S.p.A.

- AlmavivA S.p.A.

- SIA S.p.A. (Nexi Group)

- Dedagroup S.p.A.

- Aruba S.p.A.

- Dell Technologies Italy S.r.l.

- Hewlett Packard Enterprise Italia S.r.l.

- SAP Italia S.p.A.

- Cisco Systems Italy S.r.l.

- Italtel S.p.A.

- InfoCert S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 NRRP-funded digital investment surge

- 4.2.2 Rapid enterprise cloud migration

- 4.2.3 Nationwide 5G and FTTH roll-out

- 4.2.4 Sovereign-cloud and GAIA-X compliance push

- 4.2.5 Edge computing in manufacturing clusters

- 4.2.6 Public-sector hybrid cloud (PSN) transition

- 4.3 Market Restraints

- 4.3.1 Digital-skills deficit

- 4.3.2 Macroeconomic and energy-price volatility

- 4.3.3 Fragmented SME ICT procurement

- 4.3.4 Regulatory delay for 6G spectrum

- 4.4 Value / Supply-Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 IT Hardware

- 5.1.1.1 Computer Hardware

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Business Process Services

- 5.1.3.3 Business Consulting Services

- 5.1.3.4 Cloud Services

- 5.1.4 IT Infrastructure / Data Centers

- 5.1.5 IT Security / Cybersecurity

- 5.1.5.1 Solutions

- 5.1.5.1.1 Application Security

- 5.1.5.1.2 Cloud Security

- 5.1.5.1.3 Data Security

- 5.1.5.1.4 Identity and Access Management

- 5.1.5.1.5 Infrastructure Protection

- 5.1.5.1.6 Integrated Risk Management

- 5.1.5.1.7 Network Security Equipment

- 5.1.5.1.8 Other Solutions

- 5.1.5.2 Services

- 5.1.5.2.1 Professional Services

- 5.1.5.2.2 Managed Services

- 5.1.5.1 Solutions

- 5.1.6 Communication Services

- 5.1.1 IT Hardware

- 5.2 By End-user Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Government

- 5.3.4 Retail and E-commerce

- 5.3.5 Manufacturing

- 5.3.6 Healthcare

- 5.3.7 Energy and Utilities

- 5.3.8 Others

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Telecom Italia S.p.A. (TIM)

- 6.4.2 Fastweb S.p.A.

- 6.4.3 Vodafone Italia S.p.A.

- 6.4.4 Wind Tre S.p.A.

- 6.4.5 Leonardo S.p.A.

- 6.4.6 IBM Italia S.p.A.

- 6.4.7 Accenture S.p.A.

- 6.4.8 Capgemini Italia S.p.A.

- 6.4.9 Oracle Italia S.r.l.

- 6.4.10 Microsoft Italia S.r.l.

- 6.4.11 Google Cloud Italy S.r.l.

- 6.4.12 Amazon Web Services Italy S.r.l.

- 6.4.13 Engineering Ingegneria Informatica S.p.A.

- 6.4.14 Reply S.p.A.

- 6.4.15 AlmavivA S.p.A.

- 6.4.16 SIA S.p.A. (Nexi Group)

- 6.4.17 Dedagroup S.p.A.

- 6.4.18 Aruba S.p.A.

- 6.4.19 Dell Technologies Italy S.r.l.

- 6.4.20 Hewlett Packard Enterprise Italia S.r.l.

- 6.4.21 SAP Italia S.p.A.

- 6.4.22 Cisco Systems Italy S.r.l.

- 6.4.23 Italtel S.p.A.

- 6.4.24 InfoCert S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment