PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911430

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911430

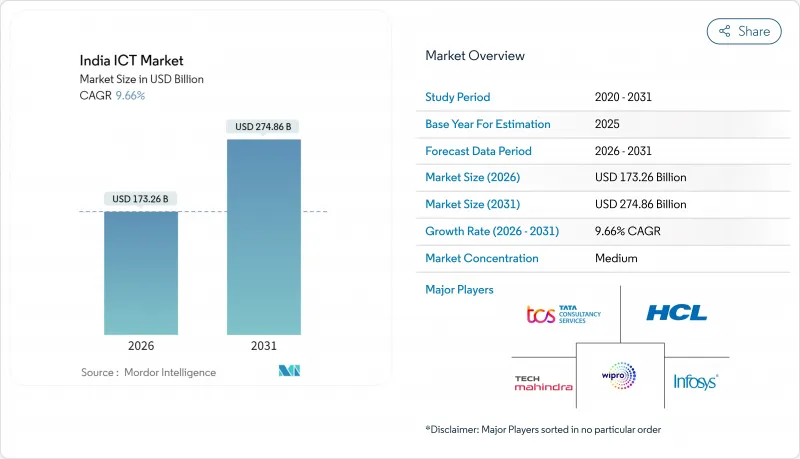

India ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India ICT market size in 2026 is estimated at USD 173.26 billion, growing from 2025 value of USD 158 billion with 2031 projections showing USD 274.86 billion, growing at 9.66% CAGR over 2026-2031.

The growth trajectory reflects how the India ICT market benefits from government digitization programs, record enterprise cloud migrations, and fast-rising consumer connectivity. Large hyperscaler projects, a flourishing startup ecosystem, and production-linked incentives continue to shift technology investments from cost optimization to strategic differentiation. Telecom operators are expanding 5G networks into Tier-2 cities, while enterprises channel budgets toward cloud-native architectures, artificial intelligence, and cybersecurity. Talent shortages and rural last-mile fiber gaps temper the otherwise buoyant outlook, but ongoing skilling initiatives and BharatNet roll-outs offer medium-term relief

India ICT Market Trends and Insights

Government Digital India and PLI Incentives Boosting Enterprise Tech Spend

The Production Linked Incentive scheme has attracted INR 1.46 lakh crore investments and generated INR 12.50 lakh crore production value, transforming electronics manufacturing capacity from INR 2.4 lakh crore in 2014 to INR 9.8 lakh crore in 2024. The IndiaAI mission allocates USD 1.25 billion to compute, innovation, and startup funding, laying a sovereign AI foundation. Eighty-two percent of CXOs plan digital budgets to rise by more than 5% during 2025, responding to compliance obligations and competitive needs. National Informatics Centre expansion to 1,000 MW IT load and 100 PB storage signals a long-term public infrastructure commitment that cascades into private technology demand. These interventions reinforce the India ICT market by ensuring robust local supply chains, stimulating enterprise modernization, and anchoring hyperscaler data-center projects.

Accelerated Cloud Adoption After COVID-19

Sixty-seven percent of Indian organizations are migrating workloads to cloud platforms, making hybrid the dominant deployment choice. Public-cloud revenue is forecast to reach USD 24.2 billion by 2028, growing at a 23.8% CAGR. Hyperscaler commitments totaling USD 21.7 billion from Microsoft, Amazon, and Google secure localized infrastructure that answers data sovereignty norms and performance targets. Enterprise AI spending is expanding at 2.2X the pace of general digital outlays, tethered to cloud platforms that deliver scalable compute and ready-made ML services. Cloud-native architectures speed product cycles and slash operational bottlenecks, reinforcing the competitive edge of early movers within the India ICT market.

Skill-Gap and High Attrition in Cutting-Edge Domains

Roughly 300,000 technology vacancies remain open, as AI, cloud-architecture, and cybersecurity demands outrun talent supply. Attrition in niche skills exceeds sector norms as specialists pursue global opportunities or startups, diluting institutional knowledge. Rising wage offers inflate project costs and squeeze margins across service providers in the India ICT market. Domain expertise shortages, such as healthcare informatics and industrial IoT, magnify the constraint because universities struggle to adapt curricula in real-time. Unless reskilling programs scale rapidly, delivery timelines and innovation velocity risk deceleration.

Other drivers and restraints analyzed in the detailed report include:

- MSME Digital-Commerce Boom

- Exploding Mobile-Data Consumption and Affordable 4G/5G Tariffs

- Fragmented Last-Mile Fiber in Rural Belts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Telecommunication Services captured 36.50% India ICT market share in 2025, underpinned by vast 4G and 5G roll-outs and a consistent spectrum policy. Hardware demand rises in sync with PLI incentives that localize device and component manufacturing, reducing reliance on imports and strengthening supply resilience. Software adoption, especially AI-enabled platforms, records double-digit growth as enterprises embed analytics in workflows. IT Services continues the pivot from staff-augmentation to consulting-led, outcome-based engagements, safeguarding margins. Cloud Services, while smaller, shows the steepest climb at a 15.71% CAGR, reflecting data-center buildouts and enterprise shift to OPEX models.

Momentum in Cloud Services translates into a growing slice of the India ICT market size for infrastructure-as-a-service, platform-as-a-service, and software-as-a-service lines. Telecom firms pursue edge-cloud offerings to leverage tower real estate, and hardware vendors push AI-optimized chips to domestic OEMs. Software suppliers align with hyperscalers to offer vertical solutions infused with generative AI, creating cross-selling synergies. Overall, competition intensifies as cloud-native entrants nibble at legacy managed-service accounts.

The India ICT Market Report is Segmented by Type (Hardware, Software, IT Services, Telecommunication Services), Enterprise Size (Large Enterprises, Smes), Industry Vertical (BFSI, Government and Public Administration, Retail, E-Commerce and Logistics, Manufacturing and Industry 4. 0, Healthcare and Life Sciences, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tata Consultancy Services Ltd

- HCL Technologies Ltd

- Infosys Ltd

- Tech Mahindra Ltd

- Wipro Ltd

- Bharti Airtel Ltd

- Reliance Jio Infocomm Ltd

- Vodafone Idea Ltd

- IBM India Pvt Ltd

- Accenture Solutions Pvt Ltd

- Capgemini Technology Services India Ltd

- Mphasis Ltd

- Mindtree Ltd

- Larsen & Toubro Infotech Ltd

- Oracle India Pvt Ltd

- Cisco Systems India Pvt Ltd

- Amazon Internet Services Pvt Ltd (AWS India)

- Google Cloud India Pvt Ltd

- Microsoft Corporation India Pvt Ltd

- Dell Technologies India

- Hewlett Packard Enterprise India

- Atria Convergence Technologies Ltd

- Bharat Sanchar Nigam Ltd

- Sify Technologies Ltd

- Allied Digital Services Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding mobile-data consumption and affordable 4G/5G tariffs

- 4.2.2 Government "Digital India" and PLI incentives boosting enterprise tech spend

- 4.2.3 Accelerated cloud adoption after COVID-19

- 4.2.4 MSME digital-commerce boom

- 4.2.5 Growing hyperscaler colocation in Tier-2 cities (under-the-radar)

- 4.2.6 Climate-tech demand for green data-centres (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Skill-gap and high attrition in cutting-edge domains

- 4.3.2 Fragmented last-mile fibre in rural belts

- 4.3.3 Supply-chain dependence on imported semiconductors

- 4.3.4 Power-cost volatility hitting data-centre ROI (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.1.1 Computer Hardwar

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Business Process Services

- 5.1.3.3 Business Consulting Services

- 5.1.3.4 Cloud Services

- 5.1.4 IT Infrastructure

- 5.1.5 IT Security

- 5.1.6 Communication Services

- 5.1.1 Hardware

- 5.2 By End-user Enterprise Size

- 5.2.1 Large Enterprises

- 5.2.2 SMEs

- 5.3 By Industry Vertical

- 5.3.1 BFSI

- 5.3.2 Government and Public Administration

- 5.3.3 Retail, E-commerce and Logisitcs

- 5.3.4 Manufacturing and Industry 4.0

- 5.3.5 Halthcare and Life Sciences

- 5.3.6 Gaming and Esports

- 5.3.7 Oil and Gas (Up-, Mid-, Down-stream)

- 5.3.8 Energy and Utilities

- 5.3.9 Other Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Tata Consultancy Services Ltd

- 6.4.2 HCL Technologies Ltd

- 6.4.3 Infosys Ltd

- 6.4.4 Tech Mahindra Ltd

- 6.4.5 Wipro Ltd

- 6.4.6 Bharti Airtel Ltd

- 6.4.7 Reliance Jio Infocomm Ltd

- 6.4.8 Vodafone Idea Ltd

- 6.4.9 IBM India Pvt Ltd

- 6.4.10 Accenture Solutions Pvt Ltd

- 6.4.11 Capgemini Technology Services India Ltd

- 6.4.12 Mphasis Ltd

- 6.4.13 Mindtree Ltd

- 6.4.14 Larsen & Toubro Infotech Ltd

- 6.4.15 Oracle India Pvt Ltd

- 6.4.16 Cisco Systems India Pvt Ltd

- 6.4.17 Amazon Internet Services Pvt Ltd (AWS India)

- 6.4.18 Google Cloud India Pvt Ltd

- 6.4.19 Microsoft Corporation India Pvt Ltd

- 6.4.20 Dell Technologies India

- 6.4.21 Hewlett Packard Enterprise India

- 6.4.22 Atria Convergence Technologies Ltd

- 6.4.23 Bharat Sanchar Nigam Ltd

- 6.4.24 Sify Technologies Ltd

- 6.4.25 Allied Digital Services Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-Need Assessment