PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911808

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911808

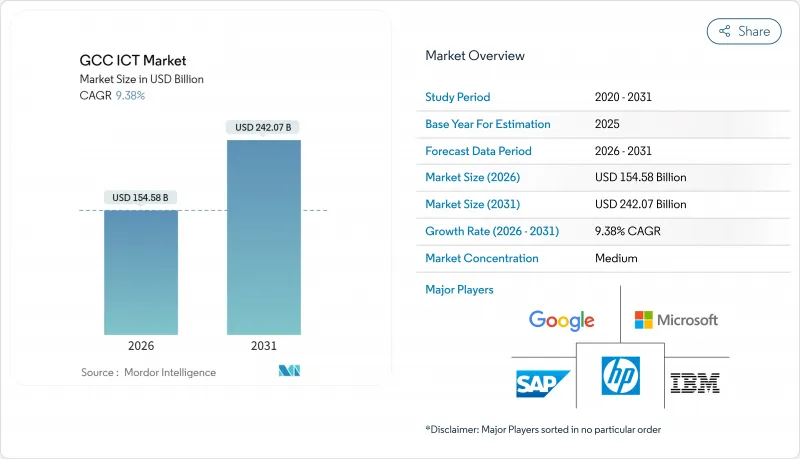

GCC ICT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC ICT market was valued at USD 141.32 billion in 2025 and estimated to grow from USD 154.58 billion in 2026 to reach USD 242.07 billion by 2031, at a CAGR of 9.38% during the forecast period (2026-2031).

This momentum reflects vision-led digital-economy budgets, hyperscale cloud region build-outs, and near-universal 5G deployment targets that together anchor demand for advanced connectivity, cloud, and AI services. Sovereign wealth funds are financing indigenous technology capacity, while mandatory digitization of public services creates structural demand that cushions the GCC ICT market from cyclicality. Gaming, esports, and edge computing solutions are emerging as outsized growth pockets, supported by youth demographics and smart-city mega-projects. At the same time, the region's chronic cyber-skills gap and water-scarcity pressures on hyperscale cooling infrastructure temper the otherwise robust outlook.

GCC ICT Market Trends and Insights

Vision-led Digital-Economy Budgets Drive Unprecedented ICT Investments

National transformation programs are anchoring long-term demand as governments allocate ring-fenced budgets for cloud, AI, and cybersecurity. Saudi Arabia earmarked USD 40 billion for AI and launched a USD 1 billion accelerator that mandates on-shore operations for foreign firms, thereby stimulating local capacity building. The UAE's We the UAE 2031 targets 11 million daily digital interactions, compelling agencies to modernize core systems. Qatar, Kuwait, and Oman are adopting scaled variants, which together create predictable multiyear project pipelines across the GCC ICT market.

5G/FTTx Infrastructure Rollouts Accelerate Digital Service Adoption

Telecom operators are racing toward >= 95% urban 5G and fiber coverage, enabling low-latency use cases that spur incremental spending on edge computing and IoT. Saudi Telecom Company deployed Nokia's AI-driven MantaRay SON to optimize 5G performance during peak events. The UAE's e& became the first regional operator to integrate Ciena's WaveLogic 6 Extreme optics, raising backbone capacity to 1.6 Tbit/s. Such rollouts position the GCC ICT market for rapid uptake of cloud gaming, autonomous mobility, and remote surgery services.

Chronic Cyber-Skills Gap Constrains Implementation Capabilities

With only 35% of required specialists available locally, organizations must import expertise, inflating project costs and delaying go-lives. Saudi and UAE initiatives aim to train 20,000 AI professionals, yet near-term shortages persist. Smaller economies experience deeper deficits, complicating cybersecurity posture across the GCC ICT market.

Other drivers and restraints analyzed in the detailed report include:

- Hyperscale Cloud Region Build-outs Transform Service Delivery Models

- Smart-City Mega-Projects Create Technology Integration Opportunities

- Oil-Price Cyclicality Impacts Enterprise Technology Spending

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT Services contributed 45.35% of 2025 revenue, underscoring the preference for end-to-end project delivery partners in the GCC ICT market. Hyperscale data-center build-outs and 5G rollouts are propelling IT Infrastructure to a 14.55% CAGR, signaling a pivot toward hardware refreshes and edge nodes that underpin AI workloads. Zain KSA's cloud-based BSS/OSS migration cut product launch times by 50%, illustrating infrastructure modernizations that drive incremental service revenues . The interplay between new hardware demand and managed services implies robust multi-year growth trajectories.

At the same time, GCC governments favor framework agreements that bundle consulting, integration, and support into multiyear contracts, sustaining IT Services dominance. However, hardware suppliers are capturing share in high-density servers, liquid cooling, and photonics interconnects as AI training clusters proliferate. This balanced expansion anchors long-term opportunities for vendors across the GCC ICT market.

Large Enterprises accounted for 61.25% of expenditure in 2025, reflecting resource advantages in adopting multi-cloud and zero-trust architectures. Yet SMEs are registering an 11.2% CAGR to 2031 as SaaS subscription models democratize advanced capabilities. Ooredoo's Kloudville marketplace brings AI, cybersecurity, and ERP tools to more than 400,000 regional SMEs via pay-as-you-grow plans. This model reduces capital barriers and narrows the digital divide within the GCC ICT market.

Government grants and incubation zones in Dubai Silicon Oasis and Bahrain's FinTech Bay further accelerate SME digitalization. As localized AI copilots and no-code platforms mature, SMEs are expected to account for progressively larger slices of the GCC ICT market size across support, commerce, and creative sectors.

The GCC ICT Market Report is Segmented by Component (IT Hardware, IT Software, and More), Enterprise Size (Small and Medium Enterprises, Large Enterprises), Industry Vertical (Government and Public Administration, and More), Deployment Model (On-Premises, and More, Technology Stack (Cloud Computing, and More)), and Geography (Saudi Arabia, United Arab Emirates, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amazon Web Services Inc.

- Accenture plc

- Alphabet Inc. (Google LLC)

- Cisco Systems Inc.

- Dell Technologies Inc.

- Emirates Telecommunication Group Company PJSC (e&)

- Equinix Inc.

- Hewlett Packard Enterprise Co.

- HP Inc.

- Huawei Investment & Holding Co. Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- Oracle Corp.

- Ooredoo Q.P.S.C.

- Palo Alto Networks Inc.

- Salesforce Inc.

- Saudi Telecom Company (stc)

- Tata Consultancy Services Ltd.

- Wipro Ltd.

- Zain Kuwait Telecommunication Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Vision-led digital-economy budgets (Vision 2030, We the UAE 2031)

- 4.2.2 5G/FTTx build-outs reaching over 95% urban coverage by 2027

- 4.2.3 Hyper-scale cloud region build-outs (AWS Jeddah, Azure Abu Dhabi, etc.)

- 4.2.4 Smart-city mega-projects (NEOM, Masdar, Silicon Oasis)

- 4.2.5 Sovereign-AI capital pools targeting Arab-language LLM stacks

- 4.2.6 GCC-wide green-hydrogen MoUs lowering data-center energy OPEX

- 4.3 Market Restraints

- 4.3.1 Chronic cyber-skills gap-import-dependency greater than 65%

- 4.3.2 Oil-price cyclicality throttling public-cloud adoption outside KSA/UAE

- 4.3.3 Water-scarcity constraints on new hyperscale DC cooling loops

- 4.3.4 Divergent national data-residency mandates raising compliance cost

- 4.4 Value and Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI-everywhere, Quantum-ready cryptography)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Post-Pandemic Demand Re-Calibration

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 IT Hardware

- 5.1.1.1 Computer Hardware

- 5.1.1.2 Networking Equipment

- 5.1.1.3 Peripherals

- 5.1.2 IT Software

- 5.1.3 IT Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Business Process Services

- 5.1.3.3 Business Consulting Services

- 5.1.3.4 Cloud Services

- 5.1.4 IT Infrastructure

- 5.1.5 IT Security

- 5.1.6 Communication Services

- 5.1.1 IT Hardware

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By Industry Vertical

- 5.3.1 Government and Public Administration

- 5.3.2 Banking, Financial Services and Insurance

- 5.3.3 Energy and Utilities

- 5.3.4 Retail, E-commerce and Logistics

- 5.3.5 Manufacturing and Industry 4.0

- 5.3.6 Healthcare and Life Sciences

- 5.3.7 Oil and Gas (Up-/Mid-/Down-stream)

- 5.3.8 Gaming and Esports

- 5.3.9 Other Verticals

- 5.4 By Deployment Model

- 5.4.1 On-premises

- 5.4.2 Cloud-only

- 5.4.3 Hybrid

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Oman

- 5.5.5 Kuwait

- 5.5.6 Bahrain

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Amazon Web Services Inc.

- 6.4.2 Accenture plc

- 6.4.3 Alphabet Inc. (Google LLC)

- 6.4.4 Cisco Systems Inc.

- 6.4.5 Dell Technologies Inc.

- 6.4.6 Emirates Telecommunication Group Company PJSC (e&)

- 6.4.7 Equinix Inc.

- 6.4.8 Hewlett Packard Enterprise Co.

- 6.4.9 HP Inc.

- 6.4.10 Huawei Investment & Holding Co. Ltd.

- 6.4.11 International Business Machines Corp.

- 6.4.12 Microsoft Corp.

- 6.4.13 Oracle Corp.

- 6.4.14 Ooredoo Q.P.S.C.

- 6.4.15 Palo Alto Networks Inc.

- 6.4.16 Salesforce Inc.

- 6.4.17 Saudi Telecom Company (stc)

- 6.4.18 Tata Consultancy Services Ltd.

- 6.4.19 Wipro Ltd.

- 6.4.20 Zain Kuwait Telecommunication Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment