PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906231

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906231

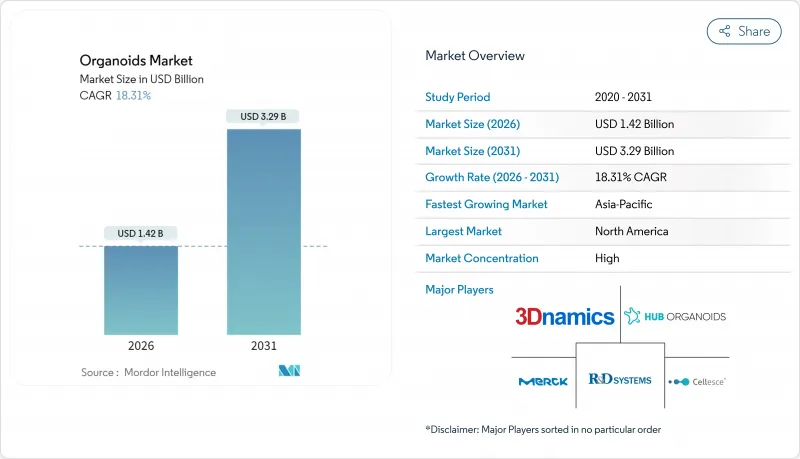

Organoids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The organoids market is expected to grow from USD 1.20 billion in 2025 to USD 1.42 billion in 2026 and is forecast to reach USD 3.29 billion by 2031 at 18.31% CAGR over 2026-2031.

The strong upside rests on three converging forces: regulatory mandates that phase out animal testing, fast-maturing 3-D bioprinting, and the pharmaceutical shift to human-relevant disease models. Vascularized heart and liver organoids created at Stanford remove the size barriers that once limited downstream manufacturing, while matrix-free protocols are easing the long-standing cost burden of extracellular hydrogels. Commercial demand is reinforced by oncology programs that now rely on patient-derived tumor organoids to trim high attrition rates, and by the broader decline in animal-testing approvals that accelerates 3-D human model uptake. Contract research organizations (CROs) are scaling turnkey organoid services, putting additional momentum behind the organoids market as smaller biotechs outsource complex culture workflows.

Global Organoids Market Trends and Insights

Rapid Adoption in Oncology Drug-Discovery Pipelines

Pharmaceutical teams are embedding patient-derived tumor organoids into early discovery to curb the historical 90% failure rate of oncology assets. Organoids conserve tumor heterogeneity, enabling multiple drug combinations to be screened against authentic patient biology before costly clinical trials. The approach supplies real-time insight into resistance mechanisms and informs adaptive dosing strategies. Cincinnati Children's multi-zonal liver organoids, which improved rodent survival, illustrate how organoid complexity now extends beyond static disease modeling toward functional tissue replacement. Competitive urgency among big pharma is reflected in dedicated organoid units, IP filings, and venture funding channelled to 3-D tumor platforms.

Rising Precision-Medicine Trials Using Patient-Derived Organoids

Organoid-guided trials are shifting care from population averages to truly individualized regimens. A pancreatic cancer study achieved 83.3% sensitivity and 92.9% specificity in predicting responses, underscoring clinical relevance. Trials focused on rare diseases leverage organoids to overcome recruitment hurdles, modeling pathologies in vitro with only limited patient samples. iScience reported the first human inflammatory bowel disease transplant trial, marking clinical entry for regenerative organoid therapy (01343-9). Regulators are drafting guidance for organoid-based companion diagnostics, clearing a path for future products that link predictive assays with targeted therapeutics.

High Consumable Costs & Specialized ECM Hydrogels

Animal-derived matrices such as Matrigel cost USD 200-500 per mL and account for up to 60% of culture spend, discouraging widespread adoption outside well-funded labs. Batch variability triggers expensive validation cycles that further inflate budgets. Synthetic or engineered hydrogels now entering the market promise price stability and better lot-to-lot consistency. Parallel research on matrix-free protocols-leveraging low-adhesion plastics and controlled agitation-could eliminate ECM inputs altogether, but these strategies require fresh standard-operating procedures and extensive cell-line requalification.

Other drivers and restraints analyzed in the detailed report include:

- Decline in Animal-Testing Approvals Spurring 3-D Human Models

- CRISPR-Edited "Next-Gen" Organoids Creating IP Race

- Lack of Assay-to-Assay Reproducibility Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Stem-cell-derived systems captured 62.94% of organoids market share in 2025, underscoring their suitability for standardized screening requirements. The segment benefits from well-characterized induced pluripotent stem cells that differentiate reliably across production runs, reducing batch variance and easing regulatory audits. The stem-cell-driven organoids market contributes the largest slice of current revenue owing to predictable expansion rates and clear intellectual-property paths. Tumor-derived organoids, while holding a smaller base, are rising at a 19.18% CAGR as oncology centers demand patient-specific avatars for treatment stratification.

The technological intersection of iPSC reprogramming, microfluidic perfusion, and multi-cell co-culture is expanding the physiological depth of both stems and tumor systems. Data sharing consortia have started to archive genomic and pharmacological fingerprints linked to each line, enabling meta-analysis across institutions. Nevertheless, tumor-derived models must still overcome heterogeneity in take rates and culture lifespans before matching stem-cell reliability.

Drug discovery and screening amassed 41.42% of the 2025 organoids market size, reflecting big pharma's urgent need to lower attrition and spot toxic liabilities earlier. Integration of high-content screening with miniaturized multi-well bioreactors now yields tens of thousands of organoids per experiment, approaching compound-library scale. Precision and personalized medicine, however, exhibits the highest trajectory with a 19.84% CAGR. Regulatory recognition of organoid-guided therapy decisions, especially in colorectal and pancreatic cancers, positions this use-case for fast-track reimbursement pathways.

Artificial-intelligence pipelines that parse organoid imaging and single-cell transcriptomics accelerate hit identification, reduce human error, and uncover non-intuitive biomarkers. Toxicology and disease-modeling applications follow closely, especially where organoids replicate organ-specific metabolism absent in rodent studies. Regenerative medicine remains an emerging frontier, yet the successful liver and thyroid preclinical implants underscore its transformative potential.

The Organoids Market Report is Segmented by Type (Stem-Cell-Derived Organoids, Tumor-Derived Organoids), Application (Drug Discovery & Screening, Disease & Toxicology Modelling, and More), End User (Pharmaceutical & Biotech Companies, Academic & Research Institutes, and More), Technology (Scaffold-Based 3-D Culture, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America opened 2025 with 43.88% revenue, buoyed by the FDA roadmap that accelerates non-animal models and by generous National Institutes of Health funding for CuSTOM, Stanford, and other hubs. U.S. conglomerates such as Thermo Fisher Scientific reinforced the ecosystem by allocating USD 4.1 billion to acquire high-purity filtration assets that dovetail with organoid workflows. Academic breakthroughs-from multi-zonal liver to vascularized cardiac tissue-feed directly into commercial pipelines through technology-transfer offices.

Europe sits on a solid academic backbone with clusters in the Netherlands, Germany, and the United Kingdom. Merck KGaA's purchase of HUB Organoids exemplifies strategic consolidation aimed at expanding advanced-biology portfolios. Policymakers align with public sentiment against animal use, driving grant schemes that prioritize 3-D human models. Economic diversity across member states causes uneven adoption rates, but pan-EU initiatives-such as the Innovative Medicines Initiative-help harmonize standards and funding streams.

Asia-Pacific is the fastest-growing territory at 21.38% CAGR to 2031. China's Five-Year Plan prioritizes regenerative medicine, funneling grants to universities and startups that co-develop with Western pharma through joint ventures and IP-sharing arrangements. Japan offers a mature regulatory path for cell-based therapies, enabling earlier human trials. South Korea, Australia, and India are scaling contract manufacturing resources, making the region an attractive site for cost-effective pilot production. While currency fluctuations and training gaps pose risks, government incentives and rising clinical-trial volume underpin long-term expansion.

- Thermo Fisher Scientific

- Merck

- Corning

- Stem Cell Technologies

- Lonza Group

- Greiner Bio One International

- Cellesce

- Hubrecht Organoid Technology

- Emulate

- CN Bio Innovations Ltd

- Mimetas

- InSphero

- ATCC

- Sartorius

- Eppendorf

- Miltenyi Biotec B.V. & Co. KG

- BICO Group AB

- Hubrecht Organoid Biobank (Hub)

- QGel SA

- Advanced BioMatrix Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption in oncology drug-discovery pipelines

- 4.2.2 Rising precision-medicine trials using patient-derived organoids

- 4.2.3 Decline in animal-testing approvals spurring 3-D human models

- 4.2.4 Government grants for stem-cell & 3-D culture infrastructure

- 4.2.5 Organoid biobank monetisation models emerging

- 4.2.6 CRISPR-edited "next-gen" organoids creating IP race

- 4.3 Market Restraints

- 4.3.1 High consumable costs & specialised ECM hydrogels

- 4.3.2 Lack of assay-to-assay reproducibility standards

- 4.3.3 Ethical scrutiny over embryo-like gastruloid work

- 4.3.4 Limited cold-chain logistics for live organoid shipping

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Organoid Biobank Landscape

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Stem-cell-derived Organoids

- 5.1.2 Tumor-derived Organoids

- 5.2 By Application

- 5.2.1 Drug Discovery & Screening

- 5.2.2 Disease & Toxicology Modelling

- 5.2.3 Precision & Personalised Medicine

- 5.2.4 Regenerative Medicine

- 5.2.5 Others (e.g., Gene-editing validation)

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotech Companies

- 5.3.2 Academic & Research Institutes

- 5.3.3 CROs & CDMOs

- 5.3.4 Hospitals & Diagnostics Labs

- 5.4 By Technology

- 5.4.1 Scaffold-based 3-D Culture

- 5.4.2 Scaffold-free / Suspension Culture

- 5.4.3 Micro-fluidic / Organ-on-chip-integrated

- 5.4.4 3-D Bioprinting-assisted Organoids

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Merck KGaA

- 6.3.3 Corning Inc.

- 6.3.4 STEMCELL Technologies Inc.

- 6.3.5 Lonza Group AG

- 6.3.6 Greiner Bio-One International GmbH

- 6.3.7 Cellesce Ltd

- 6.3.8 Hubrecht Organoid Technology

- 6.3.9 Emulate Inc.

- 6.3.10 CN Bio Innovations Ltd

- 6.3.11 MIMETAS BV

- 6.3.12 InSphero AG

- 6.3.13 ATCC

- 6.3.14 Sartorius AG

- 6.3.15 Eppendorf SE

- 6.3.16 Miltenyi Biotec B.V. & Co. KG

- 6.3.17 BICO Group AB

- 6.3.18 Hubrecht Organoid Biobank (Hub)

- 6.3.19 QGel SA

- 6.3.20 Advanced BioMatrix Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment