PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906260

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906260

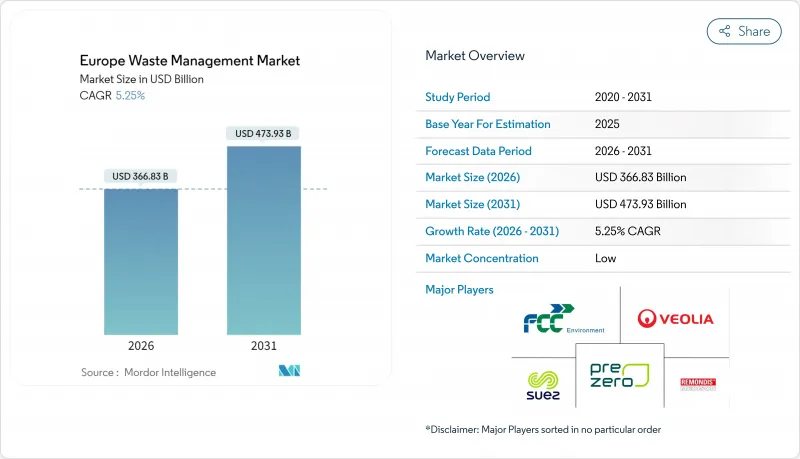

Europe Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

European Waste Management Market size in 2026 is estimated at USD 366.83 billion, growing from 2025 value of USD 348.54 billion with 2031 projections showing USD 473.93 billion, growing at 5.25% CAGR over 2026-2031.

This solid growth path underscores how the European waste management market is benefiting from strict landfill-reduction mandates, fast-rising investment in waste-to-energy (WtE) assets, and an unmistakable shift toward circular economy principles. Regulatory pressure, most notably the European Union's requirement to cap municipal landfilling at 10% by 2035, is accelerating capital inflows into recycling, chemical recovery, and AI-enabled collection systems, while creating a step-change in demand for advanced treatment technologies. Germany remains the anchor market, leveraging mature Extended Producer Responsibility (EPR) systems and robust WtE networks, yet Spain is now the headline growth story as large-scale chemical recycling plants and smart-bin pilots unlock new capacity. Across the value chain, leading operators are acquiring complementary assets to build fully integrated service offerings, and data-centric start-ups are monetizing analytics that cut truck mileage, carbon emissions, and operating costs.

Europe Waste Management Market Trends and Insights

EU Landfill-to-10% Mandate Drives Infrastructure Transformation

The 10% cap on landfilling is rewriting municipal budgets and planning calendars across the European waste management market. Germany already operates near-zero landfill levels, yet Spain and Italy are quickly adding WtE lines and high-throughput MRFs to stay on track for 2035 compliance. Penalties for non-compliance, coupled with restricted EU funding, are pushing even slower adopters to redirect residual waste toward energy recovery or advanced recycling. Operators such as SUEZ have responded with district-heating WtE projects that convert waste into 360 GWh of heat annually for Toulouse, demonstrating how compliance can unlock new utility revenue. As the lowest-cost disposal option disappears, every stakeholder now optimizes around higher-value treatment pathways that strengthen the circular economy.

E-commerce Packaging Waste Surge Creates Specialized Processing Demand

A spike in online shopping yields complex, multi-layer packages that frustrate conventional recycling. New UK rules starting March 2025 obligate firms to separate food waste and dry recyclables, forcing reverse-logistics partnerships and dedicated processing lines. Chemical recycling plants, such as LyondellBasell's USD 44 million Wesseling unit, target composite films that traditional systems reject. Operators who master this niche command premium gate fees, giving the European waste management market fresh revenue streams.

Waste-to-Energy Infrastructure Faces Capital and Social Acceptance Barriers

Typical WtE units cost USD 220-440 million, and permitting can stretch seven years, exposing sponsors to policy shifts and rising interest rates. Community push-back, especially in densely populated corridors, slows approvals despite proven emission controls. Activist pressure for "zero-incineration" policies has forced developers to invest in real-time emissions dashboards and carbon-capture add-ons, elevating project economics and capping capacity additions.

Other drivers and restraints analyzed in the detailed report include:

- Extended Producer Responsibility Scaling Accelerates Packaging Circularity

- AI and IoT Smart-Bin Deployments Optimize Collection Efficiency

- Plastic Recycling Capacity Stagnation Limits Circular Economy Progress

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential sources held a commanding 55.02% share of the European waste management market in 2025, underscoring how predictable household generation patterns underpin collection routes, fee structures, and municipal budgets. Smart-bin rollouts in Berlin and Copenhagen are optimizing collection frequency and cutting truck miles, keeping cost escalation in check. Although households remain the volume anchor, commercial sources are emerging as the primary growth lever with a forecast 7.18% CAGR through 2031. The surge is rooted in e-commerce packaging and the mushrooming of flexible workspaces that generate light but bulky streams requiring specialized baling and reverse logistics.

Commercial waste expansion injects new materials corrugated board, multi-layer films, and discarded IT equipment, into the European waste management market, demanding tailored segregation and advanced treatment. Logistics hubs near Madrid and Milan are piloting robotics that pre-sort cardboard and plastic, while office towers in Paris are embedding fill-level sensors to trigger just-in-time pickups. Industrial waste remains a steady contributor, yet its growth is tempered by process efficiency gains and near-sourcing, whereas healthcare waste scales in line with aging populations, supporting niche operators in thermal disinfection and autoclave services.

The European Waste Management Market Report is Segmented by Source (Residential, Commercial, Industrial, and More), by Service Type (Collection, Transportation, Sorting & Segregation, and More), by Waste Type (Municipal Solid, Industrial Hazardous, E-Waste, Plastic, and More), and by Geography (UK, Germany, France, Italy, Spain, BENELUX, NORDICS, and the Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Veolia

- Suez

- Remondis

- FCC Environment

- PreZero

- Urbaser

- Renewi

- Biffa PLC

- Viridor

- ALBA Group

- Stena Recycling

- Cleanaway Germany

- AVR

- IAG-Ihlenberger

- Covanta Europe

- DS Smith Recycling

- Macquarie Asset Management

- Augean

- Energy Capital Partners

- Paprec Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU landfill-to-10 % mandate (2035)

- 4.2.2 Extended Producer Responsibility (EPR) scaling across EU-27

- 4.2.3 Surge in AI/IoT smart-bin deployments

- 4.2.4 Rapid growth of e-commerce packaging waste

- 4.2.5 Chemical-recycling projects closing non-recyclable gap

- 4.2.6 Cement co-processing demand for Refuse-Derived Fuel (RDF)

- 4.3 Market Restraints

- 4.3.1 WtE incinerator CAPEX & social-license hurdles

- 4.3.2 Stagnation in plastic-recycling capacities

- 4.3.3 Talent shortage for AI-driven waste operations

- 4.3.4 Municipal "zero-incineration" activism curbing WtE pipelines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Values, In USD Billion)

- 5.1 By Source

- 5.1.1 Residential

- 5.1.2 Commercial (retail, office, etc.)

- 5.1.3 Industrial

- 5.1.4 Medical (Health and Pharmaceutical)

- 5.1.5 Construction & Demolition

- 5.1.6 Others (institutional, agricultural, etc)

- 5.2 By Service Type

- 5.2.1 Collection, Transportation, Sorting & Segregation

- 5.2.2 Disposal / Treatment

- 5.2.2.1 Landfill

- 5.2.2.2 Recycling & Resource Recovery

- 5.2.2.3 Incineration & Waste-to-Energy

- 5.2.2.4 Others (Chemical Treatment, Composting, etc.)

- 5.2.3 Others (Consulting, Audit & Training, etc.)

- 5.3 By Waste Type

- 5.3.1 Municipal Solid Waste

- 5.3.2 Industrial Hazardous Waste

- 5.3.3 E-waste

- 5.3.4 Plastic Waste

- 5.3.5 Biomedical Waste

- 5.3.6 Construction & Demolition Waste

- 5.3.7 Agricultural Waste

- 5.3.8 Other Specialized Waste (radio active, etc)

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Veolia

- 6.4.2 Suez

- 6.4.3 Remondis

- 6.4.4 FCC Environment

- 6.4.5 PreZero

- 6.4.6 Urbaser

- 6.4.7 Renewi

- 6.4.8 Biffa PLC

- 6.4.9 Viridor

- 6.4.10 ALBA Group

- 6.4.11 Stena Recycling

- 6.4.12 Cleanaway Germany

- 6.4.13 AVR

- 6.4.14 IAG-Ihlenberger

- 6.4.15 Covanta Europe

- 6.4.16 DS Smith Recycling

- 6.4.17 Macquarie Asset Management

- 6.4.18 Augean

- 6.4.19 Energy Capital Partners

- 6.4.20 Paprec Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment