PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906264

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906264

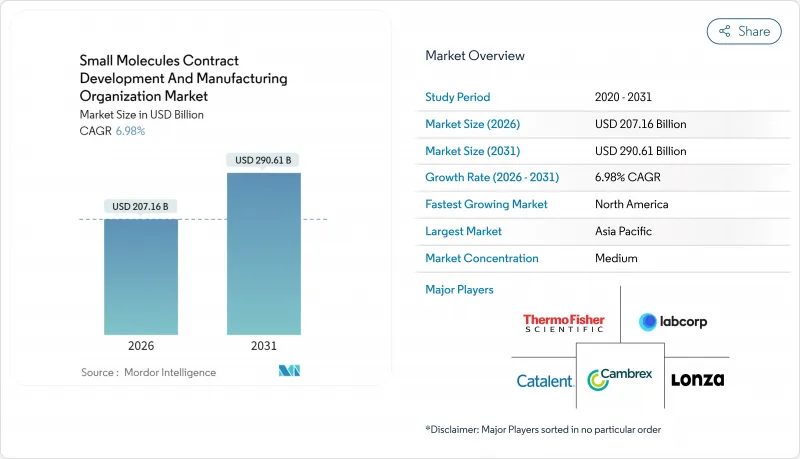

Small Molecules Contract Development And Manufacturing Organization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Small Molecules Contract Development And Manufacturing Organization market is expected to grow from USD 193.64 billion in 2025 to USD 207.16 billion in 2026 and is forecast to reach USD 290.61 billion by 2031 at 6.98% CAGR over 2026-2031.

This acceleration reflects pharmaceutical innovators' strategic pivot toward asset-light models, where outsourcing complex API synthesis and drug-product manufacturing frees capital for higher-value R&D. Continuous manufacturing, artificial-intelligence-driven process optimization, and heightened regulatory focus on supply-chain resilience amplify demand for best-in-class CDMOs. The Novo Holdings acquisition of Catalent for USD 16.5 billion in December 2024 underscores the market's status as critical infrastructure for next-generation therapeutics. Scale advantages coexist with specialization pressures: small-molecule drug-product services command more than half of current revenues, yet early-stage pipeline support and integrated CMC solutions register the fastest growth. Regionally, North America leads on revenue, whereas Asia-Pacific delivers the highest growth trajectory, supported by cost-advantaged capacity additions and government incentives that attract multinational programs.

Global Small Molecules Contract Development And Manufacturing Organization Market Trends and Insights

Rising Outsourcing of API & FDF Manufacturing by Big Pharma

Manufacturing is no longer regarded as a strategic asset inside many large pharmaceutical firms; instead, executives channel capital into discovery platforms and late-stage clinical programs. The Cambrex-Eli Lilly dedicated-capacity agreement concluded in December 2024 illustrates how Big Pharma now secures external capacity rather than erecting additional internal plants. Once transfer of know-how is complete, sponsors rarely reverse such outsourcing moves, creating a structural, rather than cyclical, pull on the small molecules contract development and manufacturing organization market. CDMOs with long regulatory track records, multiproduct containment suites, and robust quality systems capture premium pricing because sponsors prize reliability over marginal cost savings. Outsourcing momentum is reinforced by internal head-count constraints following multiple waves of pharma restructuring that depleted in-house manufacturing expertise. This sustained flow of contracts helps de-risk capital-intensive CDMO expansions and fuels consolidation, as scale becomes necessary to service pipeline breadth and global launches without supply interruptions.

Surge in Small-Molecule Oncology Approvals Post-2025

The oncology pipeline produced 91% of the FDA's 50 novel small-molecule approvals in 2024, and the momentum is expected to continue as precision-medicine research matures. High-potency APIs require stringent containment, specialized personal protective equipment, and validated cleaning protocols, capabilities that only a subset of CDMOs have mastered. Olon's EUR 25 million ultra-potent facility activated in January 2025 exemplifies the escalating infrastructure investments needed to compete in this segment. Oncology sponsors value CDMOs that integrate route scouting, high-potency API production, and late-stage drug-product formulation under one quality system, shortening tech-transfer timelines. Updated nitrosamine guidance issued in September 2024 increases analytical complexity, incentivizing innovators to partner with providers possessing in-house genotoxic-impurity expertise. This demand pattern lifts project backlogs and utilization rates, reinforcing price discipline and strengthening revenue visibility for specialized providers.

US-EU Export-Control Tightening on Dual-Use Synthesis Equipment

Amendments to the U.S. Export Administration Regulations effective December 2024 restrict shipments of automated peptide synthesizers, continuous-flow reactors, and advanced containment skids to regions flagged for potential diversion. Parallel measures under the Australia Group extend license requirements to European suppliers. APAC startups now encounter protracted lead times or outright denials when sourcing critical equipment, freezing expansion plans and lengthening validation cycles. Western CDMOs benefit in the near term because sponsors gravitate toward proven suppliers that already possess restricted assets, but domestic operators also shoulder higher capital-replacement costs due to limited vendor pools. In the small molecules contract development and manufacturing organization market, the policy shifts create geographically uneven capacity additions, ultimately pressuring global supply resilience if bottlenecks persist beyond the initial compliance horizon.

Other drivers and restraints analyzed in the detailed report include:

- Cost-Advantaged Capacity Expansions in APAC CDMO Clusters

- AI-Driven Process-Optimization Platforms Reducing CMC Timelines

- Global Shortage of Senior QC Chemists Inflating Labor Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Small-molecule drug-product services captured 52.02% of the small molecules contract development and manufacturing organization market in 2025, reflecting sponsor demand for single-source partners that manage formulation, filling, and secondary packaging under a unified quality system. The segment is forecast to post a 7.33% CAGR to 2031, outpacing API-only work as innovators increasingly bundle substance and product needs within long-term master service agreements. Oral-solid-dose projects dominate by volume thanks to patient familiarity and cost-efficient scaling, yet high-value growth resides in sterile injectables, fast-dissolving films, and abuse-deterrent tablets that require specialized equipment and containment expertise. Advanced polysorbate-free formulations for biologic-like small molecules and nanocrystal suspensions further complicate manufacturing, creating entry barriers that protect incumbents.

Demand patterns translate into capacity expansions such as the January 2025 BioCina-NovaCina merger that combines microbial expression systems with sterile fill-finish suites. Sponsors cite reduced tech-transfer risk and simplified regulatory oversight as primary reasons for awarding integrated drug-product mandates. In turn, CDMOs leverage these contracts to secure forward capacity commitments, supporting capex programs that embed new isolator technology and multiproduct lyophilization lines. The resulting ecosystem reinforces integrated providers' share of the small molecules contract development and manufacturing organization market size while encouraging API specialists to acquire downstream capabilities or risk relegation to price-centric procurement pools.

Drug-substance development and manufacturing retained 48.35% of 2025 revenues, yet drug-product formulation and manufacturing posted the fastest 7.45% growth, evidencing sponsor preference for turnkey chemistry, manufacturing, and controls solutions. Analytical and regulatory services, though smaller in revenue, deliver high margins and client lock-in, especially as global nitrosamine and elemental-impurity guidelines add complexity. EUROAPI's January 2025 collaboration with SpiroChem exemplifies the pivot toward CRO-CDMO convergence, offering route-scouting to GMP material under one contract.

Packaging and serialization, historically viewed as commoditized, now occupy strategic footing because track-and-trace mandates in the United States, European Union, and emerging markets require serialized packaging lines capable of aggregating data across multiple packaging hierarchies. CDMOs that invested early in Level-4/Level-5 IT connectivity capture incremental revenue and shield clients from DSCSA-related penalties. Over the forecast horizon, service-portfolio breadth, not isolated cost efficiency, will dictate share gains in the small molecules contract development and manufacturing organization market.

The Small Molecules Contract Development and Manufacturing Organization Market Report is Segmented by Product (Small-Molecule API, Small-Molecule Drug Product), Service Type (Drug-Substance Development & Manufacturing, and More), Stage of Development (Pre-Clinical and More ), Therapeutic Area (Cardiovascular, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 41.88% revenue in 2025 thanks to FDA familiarity, near-patient logistics, and government incentives favoring domestic production. The BIOSECURE Act debate intensifies momentum for reshoring critical-medicine manufacturing, leading to facility investments like Croda's USD 23,680-square-foot lipid site in Pennsylvania, inaugurated March 2025. Multistate incentive packages further reduce effective tax rates for capital-intensive expansions, making the region attractive despite higher labor costs.

Asia-Pacific is projected to register the highest 7.72% CAGR, anchored by cost-advantaged clusters in South Korea, India, and Singapore. Regulatory agencies such as South Korea's MFDS now offer priority-review lanes for continuous-manufacturing lines, aligning local CDMO capabilities with ICH expectations. Currency-adjusted labor-rate differentials, combined with vertically integrated chemical supply chains, enhance cost competitiveness without compromising compliance. Multinational sponsors manage perceived geopolitical risk through dual-site strategies, allocating early-phase or non-potent demand to APAC while reserving high-potency or launch-critical volumes for Western sites, balancing cost and security across their portfolios.

Europe commands a mature but innovation-focused share, buoyed by EMA harmonization, stringent environmental rules, and energy-efficiency grants that favor continuous-manufacturing retrofits. Switzerland's Dottikon ES announced CHF 700 million in small-molecule capacity additions in September 2024, reflecting regulatory stability and local talent depth. Sustainability targets embedded in the European Green Deal elevate demand for solvent-recovery systems and biomass-based feedstocks, creating new service niches for CDMOs capable of delivering low-carbon footprints alongside cGMP compliance. Collectively, geographic diversification strategies pursued by sponsors fuel a resilient, multidirectional growth path for the small molecules contract development and manufacturing organization market.

- Lonza Group

- Catalent

- Thermo Fisher Scientific (Patheon)

- WuXi App Tec

- Cambrex

- Siegfried Holding

- Recipharm

- Samsung Biologics (Chemical Division)

- PCI Pharma Services

- Jubilant Pharmova (Jubilant Pharma)

- Olon S.p.A

- CordenPharma

- Piramal Group

- Sterling Pharma Solutions

- Almac Group

- PharmaZell - Novasep

- Asymchem

- Curia Global

- Sai Life Sciences

- Eurofins CDMO

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising outsourcing of API & FDF manufacturing by Big Pharma

- 4.2.2 Surge in small-molecule oncology approvals post-2025

- 4.2.3 Cost-advantaged capacity expansions in APAC CDMO clusters

- 4.2.4 AI-driven process-optimization platforms reducing CMC timelines

- 4.2.5 HPAPI demand for targeted therapeutics (under-supplied sub-scale)

- 4.3 Market Restraints

- 4.3.1 US-EU export-control tightening on dual-use synthesis equipment

- 4.3.2 Global shortage of senior QC chemists inflating labour costs

- 4.3.3 Rising ESG-linked financing premiums for solvent-intensive CDMOs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Small-Molecule API

- 5.1.2 Small-Molecule Drug Product

- 5.1.2.1 Oral Solid Dose

- 5.1.2.2 Semi-Solid Dose

- 5.1.2.3 Liquid Dose

- 5.1.2.4 Others

- 5.2 By Service Type

- 5.2.1 Drug-Substance (API) Development & Manufacturing

- 5.2.2 Drug-Product Formulation & Manufacturing

- 5.2.3 Analytical & Regulatory Services

- 5.2.4 Packaging & Serialization

- 5.3 By Stage of Development

- 5.3.1 Pre-clinical

- 5.3.2 Clinical

- 5.3.2.1 Phase I

- 5.3.2.2 Phase II

- 5.3.2.3 Phase III

- 5.3.2.4 Phase IV

- 5.3.3 Commercial

- 5.3.4 Oncology

- 5.4 By Therapeutic Area

- 5.4.1 Cardiovascular

- 5.4.2 Infectious Diseases

- 5.4.3 Neurology

- 5.4.4 Respiratory Disorders

- 5.4.5 Metabolic & Endocrine

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Lonza Group

- 6.3.2 Catalent Inc.

- 6.3.3 Thermo Fisher Scientific (Patheon)

- 6.3.4 WuXi AppTec

- 6.3.5 Cambrex Corporation

- 6.3.6 Siegfried Holding

- 6.3.7 Recipharm AB

- 6.3.8 Samsung Biologics (Chemical Division)

- 6.3.9 PCI Pharma Services

- 6.3.10 Jubilant Pharmova (Jubilant Pharma)

- 6.3.11 Olon S.p.A

- 6.3.12 CordenPharma

- 6.3.13 Piramal Pharma Solutions

- 6.3.14 Sterling Pharma Solutions

- 6.3.15 Almac Group

- 6.3.16 PharmaZell - Novasep

- 6.3.17 Asymchem

- 6.3.18 Curia Global

- 6.3.19 Sai Life Sciences

- 6.3.20 Eurofins CDMO

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment