PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906868

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906868

Philippines Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

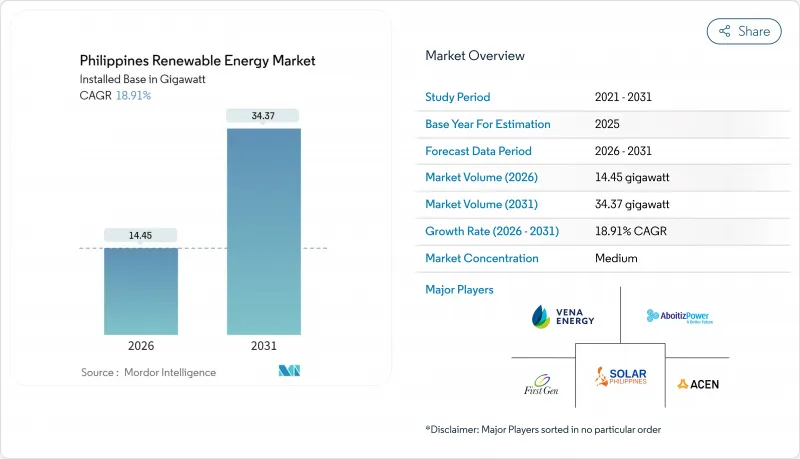

The Philippines Renewable Energy Market was valued at 12.15 gigawatt in 2025 and estimated to grow from 14.45 gigawatt in 2026 to reach 34.37 gigawatt by 2031, at a CAGR of 18.91% during the forecast period (2026-2031).

Policy-mandated portfolio standards, falling solar and wind equipment costs, rising retail tariffs, and a moratorium on new coal plants are collectively accelerating the shift away from thermal generation. Coal still supplied 60% of electricity in 2022; yet, imminent retirements backed by USD 500 million of concessional capital from the Climate Investment Funds will displace 900 MW of aging capacity, creating headroom for new green projects. Grid-ready assets, notably ACEN's 600 MW Bataan solar farm and Solar Philippines' 3.5 GW Terra Solar complex, are capturing first-mover scale advantages and attracting institutional capital. At the same time, the corporate power-purchase market is booming as data centers and 24/7 business-process outsourcing campuses sign long-term offtake contracts to hedge against the country's region-leading retail tariffs.

Philippines Renewable Energy Market Trends and Insights

Renewable Portfolio Standards & Feed-in Tariffs

The Renewable Portfolio Standard was reset to 11% in 2024 and is expected to increase to 35% by 2030, forcing distribution utilities to contract a third of their supply from clean generators. Feed-in tariffs helped seed initial projects; however, the latest Green Energy Auction Program rounds are now the principal procurement channel, with 3.4 GW awarded in 2024, and storage-linked bids are scheduled for 2025. The Energy Regulatory Commission's June 2024 circular removed most foreign-ownership caps, simplifying partnership structures. Seven-year income-tax holidays followed by a 10% rate under the CREATE Act sharpen fiscal competitiveness, placing the Philippines among Southeast Asia's most favorable jurisdictions for greenfield renewables.

Declining Solar-PV & Wind Turbine Capex

Global module prices have fallen by 89% since 2010, pushing utility-scale solar levelized costs below PHP 2.50/kWh in Ilocos Norte and Pangasinan. ACEN's Bataan plant commissioned in 4Q 2024 at under USD 0.60 per watt, 25% under the prior domestic benchmark, while NREL projects offshore-wind costs sliding to USD 34 /MWh by 2050 as floating-platform learning curves mature. Manufacturers Trina Solar and Vestas are integrating bifacial modules and turbines exceeding 5 MW into the Philippine supply chain, accelerating efficiency gains.

Grid congestion & limited transmission capacity

Only 75 of 258 planned transmission projects were completed by 2024, leaving 58 schemes delayed up to nine years. TransCo estimates that congestion adds PHP 0.80/kWh to end-user bills, nullifying much of the cost advantage of renewables. ERC's deferral of Group 3 capex frozen interconnection for 2 GW of solar and wind contracts, and curtailment in the Ilocos Norte corridor reached 12% during off-peak hours in 2024.

Other drivers and restraints analyzed in the detailed report include:

- Rising Electricity Demand & High Retail Tariffs

- Corporate PPAs from BPO/IT Hubs

- Regulatory Uncertainty around CREZ Auctions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydropower accounted for 41.20% of the installed capacity in 2025 and remains the cornerstone of electricity generation in mountainous regions. The Philippines' renewable energy market size for hydropower is expected to expand as retrofits upgrade existing dams, although growth is moderate compared to solar and wind additions. Ocean energy, while starting from a negligible baseline, is projected to compound at a rate of 114.2% per year through 2031, thanks to tidal and wave pilot plants in San Bernardino and Eastern Visayas. This niche could transform coastal supply if floating platforms prove commercially viable. The National Renewable Energy Laboratory maps 42.86 GW of offshore wind technical potential, 93% of which is suited for floating turbines, indicating long-term marine dominance once costs converge with onshore benchmarks.

The expansion of solar energy in the Philippines is relentless; ACEN's Solar Philippines' Terra Solar projects alone will surpass 4 GW when Luzon's power grid is reinforced, thereby solidifying Luzon's dominance. Wind farms cluster along the Ilocos and Panay corridors where monsoon speeds average 7.5 m/s. Geothermal output remains steady at about 1.5 GW, with binary-cycle upgrades at Bacman leveraging existing wells. Bioenergy plays a modest role, and pumped storage, exemplified by the 360 MW Kalayaan plant, supplies vital balancing; however, no new schemes have reached financial close since 2010. Overall, diversified additions underpin the new renewable industry's resilience against fluctuations in energy supply and fluctuations in fuel prices.

The Philippines Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Aboitiz Power Corporation

- ACEN Corporation

- Solar Philippines Power Project Holdings Inc.

- Vena Energy

- First Gen Corporation

- Energy Development Corporation (EDC)

- SN Aboitiz Power Group

- Alternergy Holdings Corp.

- Trina Solar Co. Ltd.

- Vestas Wind Systems A/S

- Solenergy Systems Inc.

- Solaric Corp.

- National Power Corporation (NPC-PSALM)

- Philippine Geothermal Production Company Inc.

- Meralco PowerGen Corp.

- Siemens Gamesa Renewable Energy

- Nexif Energy

- Kepco Philippines Holdings

- Enfinity Global Inc.

- Sharp Energy Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Renewable Portfolio Standards & Feed-in Tariffs

- 4.2.2 Declining Solar-PV & Wind Turbine Capex

- 4.2.3 Rising Electricity Demand & High Retail Tariffs

- 4.2.4 Corporate PPAs from BPO/IT Hubs

- 4.2.5 Grid Upgrades via JICA-funded Projects

- 4.2.6 Disaster-resilient Island & Micro-grid Programs

- 4.3 Market Restraints

- 4.3.1 Grid Congestion & Limited Transmission Capacity

- 4.3.2 Regulatory Uncertainty around CREZ Auctions

- 4.3.3 Typhoon-driven Insurance Cost Escalation

- 4.3.4 Land-use Conflicts with Agrarian Reform Lands

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Hybrid, Floating, Storage)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Aboitiz Power Corporation

- 6.4.2 ACEN Corporation

- 6.4.3 Solar Philippines Power Project Holdings Inc.

- 6.4.4 Vena Energy

- 6.4.5 First Gen Corporation

- 6.4.6 Energy Development Corporation (EDC)

- 6.4.7 SN Aboitiz Power Group

- 6.4.8 Alternergy Holdings Corp.

- 6.4.9 Trina Solar Co. Ltd.

- 6.4.10 Vestas Wind Systems A/S

- 6.4.11 Solenergy Systems Inc.

- 6.4.12 Solaric Corp.

- 6.4.13 National Power Corporation (NPC-PSALM)

- 6.4.14 Philippine Geothermal Production Company Inc.

- 6.4.15 Meralco PowerGen Corp.

- 6.4.16 Siemens Gamesa Renewable Energy

- 6.4.17 Nexif Energy

- 6.4.18 Kepco Philippines Holdings

- 6.4.19 Enfinity Global Inc.

- 6.4.20 Sharp Energy Solutions

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Developing Floating PV Parks in Calm Backwaters