PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906916

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906916

Japan Cosmetic Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

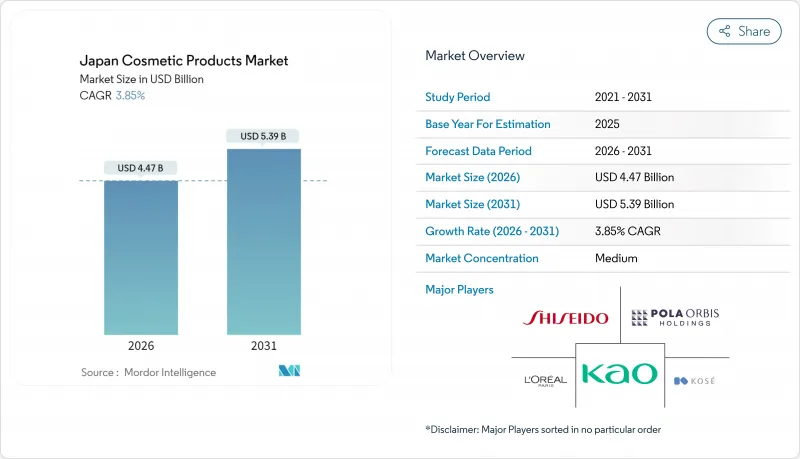

The Japanese cosmetic products market size in 2026 is estimated at USD 4.47 billion, growing from 2025 value of USD 4.30 billion with 2031 projections showing USD 5.39 billion, growing at 3.85% CAGR over 2026-2031.

In the Japanese cosmetic products market, a subtle headline expansion hints at a shift towards quasi-drug, efficacy-driven formulations. This shift, coupled with a trend of trading up to premium products and the use of sustainable biotech actives, is redefining the competitive landscape. Functional medicated cosmetics now make up about 40% of domestic shipments. Premium lines are outpacing their mass-market counterparts, buoyed by a 3% nominal wage increase and strong household purchasing power. E-commerce is booming, with Shiseido aiming to triple its online presence and Cosme boasting 16.6 million monthly users. This surge is expanding digital platforms for both established brands and emerging indie players. Meanwhile, Korean imports, which represent 39.3% of lip-product inflows, are influencing preferences in color cosmetics. This trend highlights how global retail dynamics are reshaping brand hierarchies in Japan's cosmetic market.

Japan Cosmetic Products Market Trends and Insights

Aging population drives anti-aging and dermo cosmetics

Japan's aging population plays a significant role in driving this trend, as the World Bank reported in 2024 that 30% of the country's population is aged 65 or older. As a result, there's been a noticeable shift in demand towards solutions addressing wrinkles, pigmentation, and skin elasticity. These are now being formulated as quasi-drugs, allowing them to legally assert their efficacy. Notably, these medicated variants already account for 40% of Japan's domestic cosmetic shipments. With a life expectancy of 84.9 years, product-use cycles are extended. This suggests that growth in the market is more reliant on increased per-capita spending than on volume expansion. Ingredient innovation is taking center stage, with exosomes and iPS-derived actives making waves at Cosme Tokyo 2024, highlighting the intersection of biomedical advancements and Japan's cosmetic market. While the aging population drives a surge in premium spending, formulators face a challenge: securing quasi-drug approval. This six-month review process can slow down their speed to market.

Male grooming acceptance boosts color cosmetics for men

In recent years, male grooming sales in Japan have grown significantly, showing a strong upward trend. This growth is driven by social media's increasing promotion of products like tinted moisturizers and brow definers for men, which are becoming more normalized in male grooming routines. Mandom leads the market, holding a dominant position in men's hair-styling and men's cosmetics, supported by its extensive product portfolio and strong brand recognition. Meanwhile, Shiseido's men's line has seen a remarkable surge in sales during the current fiscal year, reflecting the growing acceptance of male-specific cosmetic products. Thanks to the absence of gender-specific hurdles in MHLW regulations, brands are efficiently repurposing existing quasi-drug dossiers for male SKUs, significantly shortening development cycles and reducing time-to-market. Yet, penetration of male cosmetics lags behind their female counterparts, indicating untapped potential and a substantial growth opportunity in Japan's cosmetic products market as consumer preferences continue to evolve.

Shrinking working-age population limits volume growth

In 2023, Japan's working-age population (ages 15-64) made up 59.5% of the total demographic, but projections indicate a drop to 51.4% by 2050, according to the Statistics Bureau of Japan. This shift, highlighted by the Statistics Bureau of Japan, is largely due to the exit of the baby-boom cohort from the labor force, resulting in millions fewer in absolute numbers. The United Nations has also chimed in, predicting a 14% contraction in Japan's population from 2024 to 2054. This demographic shift is set to shrink the core consumer base for daily-use cosmetics. While spending per capita on premium and anti-aging products might see an uptick, the overall volume sales are grappling with structural challenges. The Bank of Japan, observing the trends in 2023-2024, pointed out a dip in cosmetics production within the chemicals sector, linking it to a lackluster domestic demand. In response, companies are pivoting towards high-margin, low-volume SKUs and are broadening their export horizons, targeting Southeast Asia and China, where the working-age demographic is more robust. However, this demographic crunch isn't just affecting sales; it's also tightening the labor supply in retail and manufacturing sectors, leading to increased wage costs and slimmer operating margins.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization underpinned by high disposable income

- Clean-label dermatological actives from biotech fermentation

- Stringent functional-claim approval delays time-to-market

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, facial makeup dominated Japan's cosmetic products market, seizing a 41.78% share. This leadership stems from the rising allure of base products, promising flawless and poreless finishes. Highlighting a trend towards functional infusion, Shiseido unveiled its Foundation Serum in May 2024, merging skincare benefits with cosmetic coverage. The increasing consumer preference for multi-functional products that combine beauty and skincare benefits has significantly contributed to the growth of this segment. Meanwhile, eye makeup is adopting "skinification," integrating peptides and hyaluronic acid for enhanced skin health. This approach aligns with the broader consumer demand for products that not only enhance appearance but also provide long-term skin benefits. In response to dermatitis concerns, nail products are shifting towards safer formulations, reflecting a growing emphasis on product safety and consumer well-being.

On the other hand, the lip sub-segment is emerging as the fastest-growing category in color cosmetics, boasting a projected CAGR of 4.31% through 2031. This surge is driven by a preference for glossy "mucosal" lip aesthetics and the competitive pricing of Korean brands, which resonate with younger consumers. The affordability and trend-driven appeal of these products have made them particularly popular among Gen Z and millennial demographics. Even in the face of economic challenges, this robust demand underscores a desire for affordable self-expression, cementing the lip segment's status as a pivotal growth area in Japan's color cosmetics landscape. The segment's growth also highlights the importance of innovation and accessibility in capturing consumer interest in a competitive market.

In 2025, conventional cosmetic products commanded a dominant 73.58% value share of Japan's cosmetic market, thanks to their affordability and extended shelf life. This segment is primarily driven by skin-care and hair-care formulations leveraging biotech "nature-identical" actives for enhanced stability and scalability, which allow manufacturers to meet consumer demands for effective and reliable products. As of March 31, 2023, the Japan Cosmetic Industry Association (JCIA) reported 4,243 marketing license holders and 4,222 manufacturing license holders in the cosmetics industry, showcasing a strong infrastructure for product development and supply.While ISO 16128 provides a voluntary framework for organic claims, the absence of mandatory certification heightens the risk of greenwashing. This lack of regulation has led to growing consumer skepticism, prompting many to favor brands with transparent supply chains and verified sustainability practices.

Yet, the organic and natural segment is on a steady rise, boasting a CAGR of 4.12%, largely driven by eco-conscious millennials and Gen Z. This growth in Japan's organic and natural cosmetics market underscores a burgeoning demand for sustainable and health-oriented beauty products. Social media platforms have amplified awareness of eco-friendly lifestyles, influencing purchasing decisions and encouraging consumers to seek products aligned with their values. Within this niche, natural and organic skin-care not only dominates but is also set for significant growth, as consumers increasingly prioritize clean ingredients and environmentally responsible production methods. Even as the organic segment flourishes, conventional products anchor the market, leveraging their cost-effectiveness and longevity to maintain a central role in Japan's cosmetic scene.

The Japan Cosmetic Products Market Report is Segmented by Type (Facial Make-Up, Eye Make-Up, Lip and Nail Make-Up), Nature (Conventional, Organic/Natural), Category (Mass, Premium, Other), and Distribution Channel (Supermarkets/Hypermarkets, Health and Beauty Stores, Online Retail, Other). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Shiseido Co Ltd

- Kao Corporation

- Kose Corporation

- Pola Orbis Holdings Inc

- Unilever PLC

- Procter & Gamble Co

- LOreal SA

- Lion Corporation

- Mandom Corporation

- Rohto Pharmaceutical Co Ltd

- Fancl Corporation

- DHC Corporation

- Noevir Holdings Co Ltd

- Isehan Co Ltd

- Albion Co Ltd

- Kanebo Cosmetics Inc

- Shiro Co Ltd

- ACRO Inc (THREE)

- Soft99 Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Age-ing population drives anti-age and dermocosmetics

- 4.2.2 Male-grooming acceptance boosts colour-cosmetics for men

- 4.2.3 Premiumisation underpinned by high disposable income

- 4.2.4 Clean-label dermatological actives from biotech fermentation

- 4.2.5 Solid/water-free formats gain traction for sustainability

- 4.2.6 Cross-border e-commerce inflow of niche foreign brands

- 4.3 Market Restraints

- 4.3.1 Shrinking working-age population limits volume growth

- 4.3.2 Stringent functional-claim approval delays time-to-market

- 4.3.3 Consumer allergy concerns raise preservative scrutiny

- 4.3.4 Highly saturated retail shelf space restricts new listings

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Facial Make-up Products

- 5.1.2 Eye Make-up Products

- 5.1.3 Lip and Nail Make-up Products

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic/Natural

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.3.3 Other

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Health and Beauty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Shiseido Co Ltd

- 6.4.2 Kao Corporation

- 6.4.3 Kose Corporation

- 6.4.4 Pola Orbis Holdings Inc

- 6.4.5 Unilever PLC

- 6.4.6 Procter & Gamble Co

- 6.4.7 LOreal SA

- 6.4.8 Lion Corporation

- 6.4.9 Mandom Corporation

- 6.4.10 Rohto Pharmaceutical Co Ltd

- 6.4.11 Fancl Corporation

- 6.4.12 DHC Corporation

- 6.4.13 Noevir Holdings Co Ltd

- 6.4.14 Isehan Co Ltd

- 6.4.15 Albion Co Ltd

- 6.4.16 Kanebo Cosmetics Inc

- 6.4.17 Shiro Co Ltd

- 6.4.18 ACRO Inc (THREE)

- 6.4.19 Soft99 Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK