PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906971

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906971

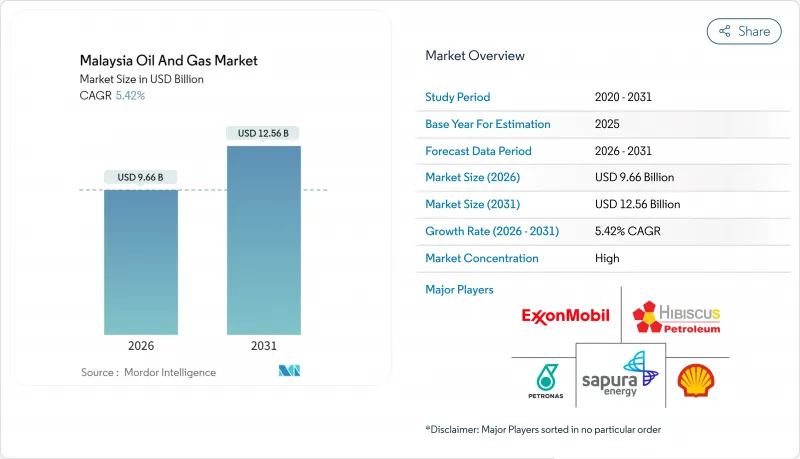

Malaysia Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Malaysia Oil And Gas Market size in 2026 is estimated at USD 9.66 billion, growing from 2025 value of USD 9.16 billion with 2031 projections showing USD 12.56 billion, growing at 5.42% CAGR over 2026-2031.

The strong growth outlook for the Malaysia oil and gas market stems from sizable investments in deep-water exploration, downstream petrochemical integration, and an expanding carbon management pipeline. Petronas' integrated value-chain footprint secures feedstock reliability, while Production Sharing Contract (PSC) revisions continue to attract international partners. Offshore basins in Sarawak and Sabah are set to deliver incremental volumes, and new LNG supply deals preserve Malaysia's role as a regional gas hub. Meanwhile, constructive fiscal terms and project-ready infrastructure in Peninsular Malaysia accelerate petrochemical capacity additions and reinforce the Malaysia oil and gas market as a Southeast Asian energy pivot.

Malaysia Oil And Gas Market Trends and Insights

Surging Demand for Refined Petroleum Products

Regional fuel consumption recovery and new mobility trends stimulate refinery utilization rates across Southeast Asia. The Pengerang Integrated Complex entered commercial service in November 2024 with 300,000 barrels-per-day capacity, underpinning Peninsular Malaysia's aspiration to supply deficit markets in Indonesia, Vietnam, and the Philippines. Petronas Chemicals is constructing a 33,000-tonnes-per-annum chemical recycling plant due in 2026, embedding circular-economy practices into the downstream landscape. These projects lock in crude intake for upstream producers and frame Malaysia as a processing hub rather than a pure exporter of crude.

Untapped Deep-Water Reserves in Sarawak & Sabah

Frontier acreage in the Langkasuka and Layang-Layang clusters offers sizable gas and condensate potential that requires high-spec rigs, subsea tie-backs, and floating LNG solutions. The Malaysia Bid Round 2025 listed five exploration blocks and three Development and Risk-sharing Option clusters to catalyze investment. ConocoPhillips and Shell have shifted portfolio capital toward gas-weighted developments to maximize LNG feedstock security. The stable PSC framework and Petronas' role as resource custodian shorten lead times from discovery to first gas, enhancing the long-term competitiveness of the Malaysia oil and gas market.

High Crude-Price Volatility

Brent fluctuations between USD 70-90 per barrel in 2024-2025 disrupted cash-flow planning, deferred some final investment decisions, and raised borrowing costs. Marginal field economics remain sensitive to price dips, particularly where enhanced recovery requires costly gas lift or chemical injection. The Malaysian Oil, Gas and Energy Services Council's appeal for fiscal relief underscores exposure to market swings. While hedging and cost optimization help, sustained volatility may temper the pace of deep-water and decommissioning commitments.

Other drivers and restraints analyzed in the detailed report include:

- Rising Asian LNG Demand Lifting Malaysian Exports

- Downstream Petrochemical Integration Momentum

- Global Energy-Transition Investment Shift

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The upstream segment captured 74.85% of the Malaysia oil and gas market size in 2025, buoyed by robust PSC activity and Petronas' project pipeline. Jerun, Kasawari, and Gumusut-Kakap Redevelopment sustain plateau output while offsetting natural decline rates. The Malaysian oil and gas market share leadership in upstream activities reflects a geology rich in gas-condensate plays and a supportive fiscal regime that accelerates field monetization.

Upstream investment momentum will likely continue through 2031 as international operators secure acreage in deep-water wells and marginal redevelopments. Concurrently, midstream operators face rerouting challenges once the Sabah-Sarawak Gas Pipeline retires in 2027, requiring alternative evacuation for East Malaysian gas. Downstream players benefit from new feedstock when upstream debottlenecking releases incremental condensate volumes that feed into Pengerang's reformers.

The Malaysia Oil and Gas Market Report is Segmented by Sector (Upstream, Midstream, and Downstream), Location (Onshore and Offshore), and Service (Construction, Maintenance and Turn-Around, and Decommissioning). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Petroliam Nasional Berhad (Petronas)

- Shell plc

- Exxon Mobil Corp.

- Chevron Corp.

- BP plc

- Hibiscus Petroleum Bhd

- Sapura Energy Bhd

- Dialog Group Bhd

- MISC Berhad

- Yinson Holdings Bhd

- PTTEP (Malaysia assets)

- Repsol Exploration (Malaysia) S.A.

- Lundin Energy Malaysia

- Murphy Oil Corporation (Malaysia)

- Serba Dinamik Holdings

- Velesto Energy Bhd

- Malaysia Marine & Heavy Engineering

- Altus Oil & Gas Malaysia Sdn Bhd

- Petro-Excel Sdn Bhd

- Petro Teguh (M) Sdn Bhd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for refined petroleum products

- 4.2.2 Untapped deep-water reserves (Sarawak & Sabah)

- 4.2.3 Incentive-driven PSC revisions & fiscal terms

- 4.2.4 Rising Asian LNG demand lifting Malaysian exports

- 4.2.5 CCUS & blue-hydrogen project pipeline

- 4.2.6 Downstream petrochemical integration momentum

- 4.3 Market Restraints

- 4.3.1 High crude-price volatility

- 4.3.2 Global energy-transition investment shift

- 4.3.3 ESG-driven capital access constraints

- 4.3.4 Aging offshore infrastructure & OPEX escalation

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Crude-Oil Production & Consumption Outlook

- 4.8 Natural-Gas Production & Consumption Outlook

- 4.9 Installed Pipeline Capacity Analysis

- 4.10 Unconventional Resources CAPEX Outlook (tight oil, oil sands, deep-water)

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power - Suppliers

- 4.11.2 Bargaining Power - Buyers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Competitive Rivalry

- 4.12 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 By Location

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 By Service

- 5.3.1 Construction

- 5.3.2 Maintenance and Turn-around

- 5.3.3 Decommissioning

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Petroliam Nasional Berhad (Petronas)

- 6.4.2 Shell plc

- 6.4.3 Exxon Mobil Corp.

- 6.4.4 Chevron Corp.

- 6.4.5 BP plc

- 6.4.6 Hibiscus Petroleum Bhd

- 6.4.7 Sapura Energy Bhd

- 6.4.8 Dialog Group Bhd

- 6.4.9 MISC Berhad

- 6.4.10 Yinson Holdings Bhd

- 6.4.11 PTTEP (Malaysia assets)

- 6.4.12 Repsol Exploration (Malaysia) S.A.

- 6.4.13 Lundin Energy Malaysia

- 6.4.14 Murphy Oil Corporation (Malaysia)

- 6.4.15 Serba Dinamik Holdings

- 6.4.16 Velesto Energy Bhd

- 6.4.17 Malaysia Marine & Heavy Engineering

- 6.4.18 Altus Oil & Gas Malaysia Sdn Bhd

- 6.4.19 Petro-Excel Sdn Bhd

- 6.4.20 Petro Teguh (M) Sdn Bhd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment