PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906979

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906979

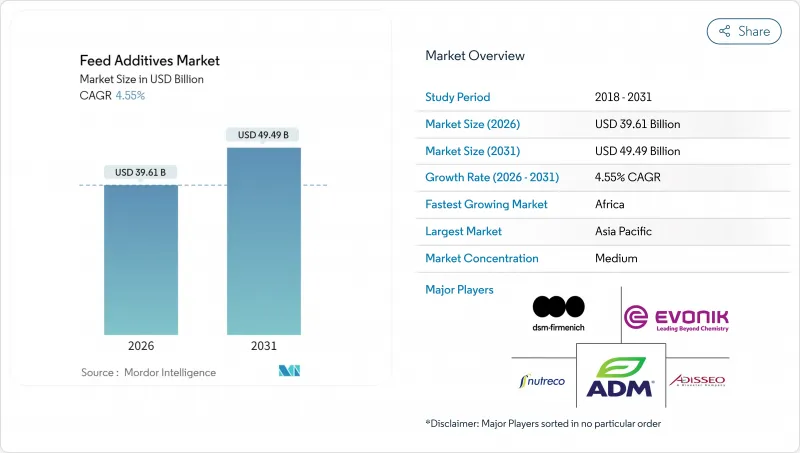

Feed Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Feed additives market size in 2026 is estimated at USD 39.61 billion, growing from 2025 value of USD 37.88 billion with 2031 projections showing USD 49.49 billion, growing at 4.55% CAGR over 2026-2031.

Demand pivots around functional alternatives as universal antibiotic-growth-promoter bans take hold, while precision-fermentation streams transform waste proteins into peptide-rich inputs that lower formulation costs and appeal to clean-label buyers. Companies that align with evolving approval frameworks in China, the European Union, and the United States expand faster, as harmonized dossiers shorten time to market and widen geographic reach. Strategic partnerships between ingredient specialists and integrated meat producers accelerate data-driven product development, tightening the link between in-barn performance metrics and additive choice. Environmental declarations now influence purchasing decisions, pushing methane-reducing and low-phosphorus solutions into mainstream rations and reinforcing a premium pricing tier across all regions.

Global Feed Additives Market Trends and Insights

Ban on Antibiotic Growth Promoters

Regulatory restrictions on antibiotic growth promoters have accelerated beyond traditional markets, with China implementing comprehensive bans in 2024 that mirror European Union standards established under Regulation (EU) 2019/6. The Food and Drug Administration's (FDA's) termination of its Memorandum of Understanding with the Association of American Feed Control Officials (AAFCO) in October 2024 signals a shift toward more stringent oversight, launching the Animal Food Ingredient Consultation process to expedite approval of novel alternatives . This regulatory evolution creates immediate demand for functional replacements, particularly organic acids, essential oils, and probiotic blends that can maintain growth performance without antimicrobial resistance concerns. The transition has proven most challenging in swine production, where producers report a 5-8% feed conversion ratio deterioration during the initial adaptation period, driving premium pricing for proven alternatives.

Rising Meat Consumption Per Capita

Global per capita meat consumption continues its upward trajectory, reaching 43.2 kg annually in 2024, with developing economies driving the most significant increases. India's meat consumption has grown 12% year-over-year, while African markets show even more dramatic shifts as urbanization accelerates dietary transitions. This consumption growth translates directly into feed additive demand, as producers seek efficiency-enhancing solutions to meet protein requirements cost-effectively. The trend particularly benefits amino acid and enzyme segments, where optimization can improve feed conversion ratios by 8-12%, crucial for maintaining profitability amid rising grain costs that have increased 15% globally since early 2024 .

Stringent Approval Regulations

Regulatory approval timelines for novel feed additives have extended significantly, with the European Food Safety Authority requiring an average of 36 months for a comprehensive dossier review, compared to 24 months in 2019. The Food and Drug Administration's (FDA's) new Animal Food Ingredient Consultation process, while streamlining some procedures, has introduced additional data requirements for safety assessment that can add 6-12 months to approval timelines. These delays particularly impact innovative products like precision fermentation derivatives and novel enzyme formulations, where regulatory precedents remain limited. Companies report spending USD 2-5 million on regulatory compliance for each new additive, with no guarantee of approval, creating barriers for smaller innovators and slowing market dynamism.

Other drivers and restraints analyzed in the detailed report include:

- Industrialization of Livestock Production

- Increasing Focus on Gut Health and Feed Efficiency

- Volatile Raw-Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The precision nutrition revolution has elevated amino acids to their dominant 21.85% market share in 2025, as producers optimize protein utilization to combat feed cost inflation that has increased ingredient expenses by 18% year-over-year. Methionine and lysine command premium pricing due to supply concentration, with only three global suppliers controlling 70% of methionine production capacity. Regulatory frameworks under the Association of American Feed Control Officials (AAFCO) and the European Food Safety Authority (EFSA) guidelines increasingly favor products with demonstrated mode-of-action data, creating competitive advantages for science-backed formulations over traditional empirical approaches.

Antioxidants emerge as the fastest-growing segment with a 4.25% CAGR through 2031. The market is witnessing a notable shift towards natural and clean-label antioxidants, reflecting broader consumer preferences for natural ingredients throughout the food chain. Enzymes maintain steady growth through phytase innovations that unlock phosphorus from plant-based feeds, while vitamins face margin pressure from Chinese supply disruptions that have created 45% price volatility in key compounds like vitamin E and biotin.

The Feed Additives Market Report is Segmented by Additive (Acidifiers, Amino Acids, and More), by Animal (Aquaculture, Poultry, and More), and by Geography (Africa, Asia-Pacific, Europe, Middle East, North America, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific's 31.05% market share in 2025 reflects the region's industrial-scale livestock operations and sophisticated regulatory frameworks that increasingly mirror European Union standards for additive approval and usage. China's implementation of new feed additive registration requirements has created market consolidation opportunities, as smaller suppliers lack resources for the comprehensive dossier preparation required under the updated regulatory framework.

Africa demonstrates the highest growth potential with 3.05% CAGR through 2031, supported by urbanization trends that are shifting protein consumption patterns and government initiatives to modernize livestock production systems across Kenya, Nigeria, and Egypt. The continent's growth trajectory reflects infrastructure development that enables cold chain distribution of premium feed additives, previously limited by logistics constraints. Egypt's new DSM-Firmenich premix facility, with 10,000 metric tons annual capacity, demonstrates multinational confidence in regional market potential and provides local production capabilities that reduce import dependency.

North American producers benefit from streamlined regulatory processes under the Food and Drug Administration's (FDA's) new Animal Food Ingredient Consultation framework, which has reduced approval timelines for novel additives by 15-20% compared to previous procedures. South American markets, led by Brazil and Argentina, capitalize on export-oriented production systems that demand consistent quality standards, creating opportunities for premium additive solutions that ensure product traceability and compliance with international food safety requirements.

- DSM-Firmenich AG

- Evonik Industries AG

- SHV (Nutreco NV)

- Archer Daniel Midland Co.

- Adisseo

- BASF SE

- Elanco Animal Health Inc.

- Solvay S.A.

- IFF(Danisco Animal Nutrition)

- Novus International, Inc.

- Kemin Industries, Inc.

- Alltech, Inc.

- Phibro Animal Health Corporation

- Zoetis Inc.

- Archer Daniel Midland Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 EXECUTIVE SUMMARY & KEY FINDINGS

3 REPORT OFFERS

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount Analysis

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production Analysis

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 Chile

- 4.3.6 China

- 4.3.7 Egypt

- 4.3.8 France

- 4.3.9 Germany

- 4.3.10 India

- 4.3.11 Indonesia

- 4.3.12 Iran

- 4.3.13 Italy

- 4.3.14 Japan

- 4.3.15 Kenya

- 4.3.16 Mexico

- 4.3.17 Netherlands

- 4.3.18 Philippines

- 4.3.19 Russia

- 4.3.20 Saudi Arabia

- 4.3.21 South Africa

- 4.3.22 South Korea

- 4.3.23 Spain

- 4.3.24 Thailand

- 4.3.25 Turkey

- 4.3.26 United Kingdom

- 4.3.27 United States

- 4.3.28 Vietnam

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Ban on Antibiotic Growth Promoters

- 4.5.2 Rising Meat Consumption Per Capita

- 4.5.3 Industrialization of Livestock Production

- 4.5.4 Increasing Focus on Gut Health and Feed Efficiency

- 4.5.5 Precision-Fermentation By-Products as Functional Additives

- 4.5.6 Carbon-Footprint Labeling Spurring Methane-Reducing Additives

- 4.6 Market Restraints

- 4.6.1 Stringent Approval Regulations

- 4.6.2 Volatile Raw-Material Prices

- 4.6.3 Consumer Skepticism Toward Synthetic Additives

- 4.6.4 Biotech-Enzyme Capacity Bottlenecks

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Additive

- 5.1.1 Acidifiers

- 5.1.1.1 By Sub Additive

- 5.1.1.1.1 Fumaric Acid

- 5.1.1.1.2 Lactic Acid

- 5.1.1.1.3 Propionic Acid

- 5.1.1.1.4 Other Acidifiers

- 5.1.1.1 By Sub Additive

- 5.1.2 Amino Acids

- 5.1.2.1 By Sub Additive

- 5.1.2.1.1 Lysine

- 5.1.2.1.2 Methionine

- 5.1.2.1.3 Threonine

- 5.1.2.1.4 Tryptophan

- 5.1.2.1.5 Other Amino Acids

- 5.1.2.1 By Sub Additive

- 5.1.3 Antibiotics

- 5.1.3.1 By Sub Additive

- 5.1.3.1.1 Bacitracin

- 5.1.3.1.2 Penicillins

- 5.1.3.1.3 Tetracyclines

- 5.1.3.1.4 Tylosin

- 5.1.3.1.5 Other Antibiotics

- 5.1.3.1 By Sub Additive

- 5.1.4 Antioxidants

- 5.1.4.1 By Sub Additive

- 5.1.4.1.1 Butylated Hydroxyanisole (BHA)

- 5.1.4.1.2 Butylated Hydroxytoluene (BHT)

- 5.1.4.1.3 Citric Acid

- 5.1.4.1.4 Ethoxyquin

- 5.1.4.1.5 Propyl Gallate

- 5.1.4.1.6 Tocopherols

- 5.1.4.1.7 Other Antioxidants

- 5.1.4.1 By Sub Additive

- 5.1.5 Binders

- 5.1.5.1 By Sub Additive

- 5.1.5.1.1 Natural Binders

- 5.1.5.1.2 Synthetic Binders

- 5.1.5.1 By Sub Additive

- 5.1.6 Enzymes

- 5.1.6.1 By Sub Additive

- 5.1.6.1.1 Carbohydrases

- 5.1.6.1.2 Phytases

- 5.1.6.1.3 Other Enzymes

- 5.1.6.1 By Sub Additive

- 5.1.7 Flavors & Sweeteners

- 5.1.7.1 By Sub Additive

- 5.1.7.1.1 Flavors

- 5.1.7.1.2 Sweeteners

- 5.1.7.1 By Sub Additive

- 5.1.8 Minerals

- 5.1.8.1 By Sub Additive

- 5.1.8.1.1 Macrominerals

- 5.1.8.1.2 Microminerals

- 5.1.8.1 By Sub Additive

- 5.1.9 Mycotoxin Detoxifiers

- 5.1.9.1 By Sub Additive

- 5.1.9.1.1 Binders

- 5.1.9.1.2 Biotransformers

- 5.1.9.1 By Sub Additive

- 5.1.10 Phytogenics

- 5.1.10.1 By Sub Additive

- 5.1.10.1.1 Essential Oil

- 5.1.10.1.2 Herbs & Spices

- 5.1.10.1.3 Other Phytogenics

- 5.1.10.1 By Sub Additive

- 5.1.11 Pigments

- 5.1.11.1 By Sub Additive

- 5.1.11.1.1 Carotenoids

- 5.1.11.1.2 Curcumin & Spirulina

- 5.1.11.1 By Sub Additive

- 5.1.12 Prebiotics

- 5.1.12.1 By Sub Additive

- 5.1.12.1.1 Fructo Oligosaccharides

- 5.1.12.1.2 Galacto Oligosaccharides

- 5.1.12.1.3 Inulin

- 5.1.12.1.4 Lactulose

- 5.1.12.1.5 Mannan Oligosaccharides

- 5.1.12.1.6 Xylo Oligosaccharides

- 5.1.12.1.7 Other Prebiotics

- 5.1.12.1 By Sub Additive

- 5.1.13 Probiotics

- 5.1.13.1 By Sub Additive

- 5.1.13.1.1 Bifidobacteria

- 5.1.13.1.2 Enterococcus

- 5.1.13.1.3 Lactobacilli

- 5.1.13.1.4 Pediococcus

- 5.1.13.1.5 Streptococcus

- 5.1.13.1.6 Other Probiotics

- 5.1.13.1 By Sub Additive

- 5.1.14 Vitamins

- 5.1.14.1 By Sub Additive

- 5.1.14.1.1 Vitamin A

- 5.1.14.1.2 Vitamin B

- 5.1.14.1.3 Vitamin C

- 5.1.14.1.4 Vitamin E

- 5.1.14.1.5 Other Vitamins

- 5.1.14.1 By Sub Additive

- 5.1.15 Yeast

- 5.1.15.1 By Sub Additive

- 5.1.15.1.1 Live Yeast

- 5.1.15.1.2 Selenium Yeast

- 5.1.15.1.3 Spent Yeast

- 5.1.15.1.4 Torula Dried Yeast

- 5.1.15.1.5 Whey Yeast

- 5.1.15.1.6 Yeast Derivatives

- 5.1.15.1 By Sub Additive

- 5.1.1 Acidifiers

- 5.2 By Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.1.1 By Sub Animal

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.2.1 By Sub Animal

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 By Geography

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 Egypt

- 5.3.1.1.2 Kenya

- 5.3.1.1.3 South Africa

- 5.3.1.1.4 Rest of Africa

- 5.3.1.1 By Country

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Philippines

- 5.3.2.1.7 South Korea

- 5.3.2.1.8 Thailand

- 5.3.2.1.9 Vietnam

- 5.3.2.1.10 Rest of Asia-Pacific

- 5.3.2.1 By Country

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Turkey

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.3.1 By Country

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Iran

- 5.3.4.1.2 Saudi Arabia

- 5.3.4.1.3 Rest of Middle East

- 5.3.4.1 By Country

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 United States

- 5.3.5.1.4 Rest of North America

- 5.3.5.1 By Country

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Chile

- 5.3.6.1.4 Rest of South America

- 5.3.6.1 By Country

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 6.4.1 DSM-Firmenich AG

- 6.4.2 Evonik Industries AG

- 6.4.3 SHV (Nutreco NV)

- 6.4.4 Archer Daniel Midland Co.

- 6.4.5 Adisseo

- 6.4.6 BASF SE

- 6.4.7 Elanco Animal Health Inc.

- 6.4.8 Solvay S.A.

- 6.4.9 IFF(Danisco Animal Nutrition)

- 6.4.10 Novus International, Inc.

- 6.4.11 Kemin Industries, Inc.

- 6.4.12 Alltech, Inc.

- 6.4.13 Phibro Animal Health Corporation

- 6.4.14 Zoetis Inc.

- 6.4.15 Archer Daniel Midland Co.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS