PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911749

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911749

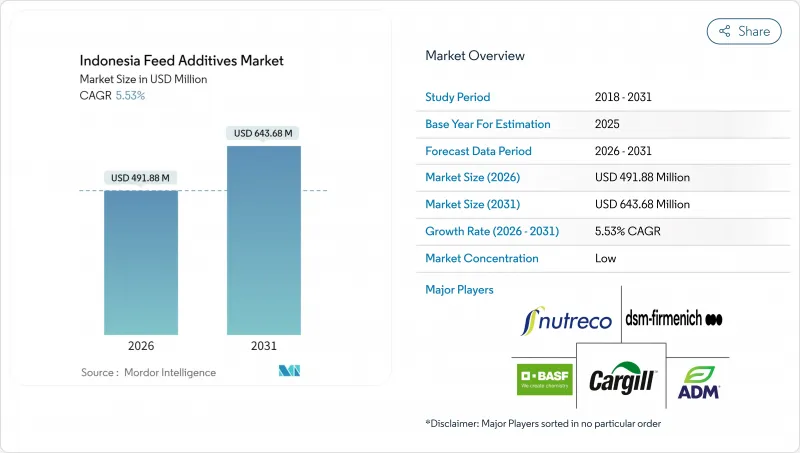

Indonesia Feed Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Indonesia feed additives market size in 2026 is estimated at USD 491.88 million, growing from 2025 value of USD 466.1 million with 2031 projections showing USD 643.68 million, growing at 5.53% CAGR over 2026-2031.

The steady rise reflects Indonesia's status as Southeast Asia's largest poultry producer, rapid urbanization, and a government-backed push for higher domestic protein intake. Consumption growth is strongest in Java and Sumatra, where industrial feed mills scale amino acid and enzyme inclusion rates to improve feed efficiency even as soybean meal prices fluctuate. A decisive regulatory shift away from antibiotic growth promoters fuels the adoption of probiotics, phytogenics, and organic acids that align with halal and export requirements. Currency volatility encourages local manufacturers to widen raw-material sourcing and hedge import costs, while blockchain-enabled traceability platforms create new competitive benchmarks. The intersection of the palm-oil and feed industries adds a unique catalyst: biodiesel mandates heighten demand for energy-density additives that capitalize on abundant palm by-products.

Indonesia Feed Additives Market Trends and Insights

Rising Domestic Poultry Protein Demand

Indonesia's Free Nutritious Meals program targets 82 million recipients and reshapes household protein preferences, lifting per-capita poultry intake to 7.46 kg in 2023, a 4.3% jump from 2022. Feed manufacturers respond by scaling amino acid inclusion rates that improve protein utilization while helping producers meet price targets for government procurement schemes. The surge also spurs enzyme adoption, enabling mills to extract more metabolizable energy from local feedstocks. Demand concentrates in Java and Sumatra, where cold-chain logistics support broader chicken distribution, prompting integrated operators to expand premix facilities and contract farming networks.

Government Ban on Antibiotic Growth Promoters Creates Alternative Opportunities

The Indonesian Food and Drug Monitoring Agency enforces strict registration requirements for antibiotic substitutes, accelerating the deployment of probiotics, prebiotics, and phytogenics. Commercial trials with indigenous lactic-acid strains demonstrate comparable growth performance to in-feed antibiotics, lowering resistance risks and meeting premium export protocols. Companies that invested early in natural solutions enjoy lower regulatory fees and faster product approvals, offering a measurable cost advantage over late adopters. The regulatory clarity supports Indonesia's positioning as a supplier to antibiotic-free poultry markets such as Japan and Singapore.

High Import Dependency for Key Raw Materials

Indonesia relies heavily on imports of synthetic amino acids, vitamins, and specialty enzymes from China, Europe, and North America. Any shipping delay or documentation discrepancy can halt production at Java-based mills. Smaller players struggle with the Ministry of Trade's import licensing procedures that now require electronic certificates of analysis for each shipment, prolonging customs clearance. Many manufacturers hold three-month safety stocks, tying up working capital and raising warehouse expenses in a market already squeezed by price-sensitive farmers.

Other drivers and restraints analyzed in the detailed report include:

- Cost-Effective Amino-Acid Supplementation to Cut Soybean Meal Usage

- Surge in Probiotic R&D From Indonesian Institutes

- Volatile Rupiah Driving Additive Input-Cost Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Amino acids held a 23.15% share of the Indonesia feed additives market size in 2025, underlining their role in protein-efficiency strategies that cut soybean meal dependence. Poultry integrators in East Java secure bulk lysine contracts from global suppliers and install on-site premix lines to reduce formulation variability. The segment also benefits from synthetic methionine inclusion in aquafeed to raise shrimp survival rates in high-density ponds.

Acidifiers are the fastest-growing category, projected at a 6.12% CAGR through 2031, mirroring the post-antibiotic pivot toward organic acids such as fumaric and lactic that inhibit pathogenic bacteria and stabilize gut pH. Probiotics and enzymes, fueled by local research and development, gain traction as mills test tropical-stable strains like BS4 that survive high humidity. Vitamins and minerals remain staples inclusions across all species, while phytogenics draw renewed attention from producers embracing natural labels to access premium export markets.

The Indonesia Feed Additives Market Report is Segmented by Additive (Acidifiers, Amino Acids, Antibiotics, Antioxidants, Binders, Enzymes, Flavors and Sweeteners, Minerals, Mycotoxin Detoxifiers, Phytogenics, Pigments, Prebiotics, and More), Animal (Aquaculture, Poultry, Ruminants, Swine, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Cargill, Incorporated.

- DSM-Firmenich

- Ajinomoto Co., Inc.

- Nutreco NV (SHV Holdings NV)

- BASF SE

- Kemin Industries, Inc.

- Evonik Industries AG

- PT Japfa Comfeed Indonesia Tbk

- PT Charoen Pokphand Indonesia Tbk

- Alltech, Inc.

- Brenntag SE

- Novus International, Inc. (Mitsui & Co., Ltd.)

- ADM

- East Hope Group

- Zinpro Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Indonesia

- 4.4 Value Chain & Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Rising domestic poultry protein demand

- 4.5.2 Government ban on antibiotic growth promoters creates alternative opportunities

- 4.5.3 Cost-effective amino-acid supplementation to cut soybean meal usage

- 4.5.4 Surge in probiotic R&D from Indonesian institutes

- 4.5.5 Palm-oil biodiesel policy tightening energy density additives need

- 4.5.6 Blockchain traceability programs for halal feed compliance

- 4.6 Market Restraints

- 4.6.1 High import dependency for key raw materials

- 4.6.2 Volatile rupiah driving additive input-cost inflation

- 4.6.3 Complex regulatory environment raises compliance costs

- 4.6.4 Infrastructure gaps in Kalimantan and Sulawesi elevate logistics costs

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Additive

- 5.1.1 Acidifiers

- 5.1.1.1 Fumaric Acid

- 5.1.1.2 Lactic Acid

- 5.1.1.3 Propionic Acid

- 5.1.1.4 Other Acidifiers

- 5.1.2 Amino Acids

- 5.1.2.1 Lysine

- 5.1.2.2 Methionine

- 5.1.2.3 Threonine

- 5.1.2.4 Tryptophan

- 5.1.2.5 Other Amino Acids

- 5.1.3 Antibiotics

- 5.1.3.1 Bacitracin

- 5.1.3.2 Penicillins

- 5.1.3.3 Tetracyclines

- 5.1.3.4 Tylosin

- 5.1.3.5 Other Antibiotics

- 5.1.4 Antioxidants

- 5.1.4.1 Butylated Hydroxyanisole (BHA)

- 5.1.4.2 Butylated Hydroxytoluene (BHT)

- 5.1.4.3 Citric Acid

- 5.1.4.4 Ethoxyquin

- 5.1.4.5 Propyl Gallate

- 5.1.4.6 Tocopherols

- 5.1.4.7 Other Antioxidants

- 5.1.5 Binders

- 5.1.5.1 Natural Binders

- 5.1.5.2 Synthetic Binders

- 5.1.6 Enzymes

- 5.1.6.1 Carbohydrases

- 5.1.6.2 Phytases

- 5.1.6.3 Other Enzymes

- 5.1.7 Flavors and Sweeteners

- 5.1.7.1 Flavors

- 5.1.7.2 Sweeteners

- 5.1.8 Minerals

- 5.1.8.1 Macrominerals

- 5.1.8.2 Microminerals

- 5.1.9 Mycotoxin Detoxifiers

- 5.1.9.1 Binders

- 5.1.9.2 Biotransformers

- 5.1.9.3 Other Mycotoxin Detoxifiers

- 5.1.10 Phytogenics

- 5.1.10.1 Essential Oil

- 5.1.10.2 Herbs and Spices

- 5.1.10.3 Other Phytogenics

- 5.1.11 Pigments

- 5.1.11.1 Carotenoids

- 5.1.11.2 Curcumin and Spirulina

- 5.1.12 Prebiotics

- 5.1.12.1 Fructo Oligosaccharides

- 5.1.12.2 Galacto Oligosaccharides

- 5.1.12.3 Inulin

- 5.1.12.4 Lactulose

- 5.1.12.5 Mannan Oligosaccharides

- 5.1.12.6 Xylo Oligosaccharides

- 5.1.12.7 Other Prebiotics

- 5.1.13 Probiotics

- 5.1.13.1 Bifidobacteria

- 5.1.13.2 Enterococcus

- 5.1.13.3 Lactobacilli

- 5.1.13.4 Pediococcus

- 5.1.13.5 Streptococcus

- 5.1.13.6 Other Probiotics

- 5.1.14 Vitamins

- 5.1.14.1 Vitamin A

- 5.1.14.2 Vitamin B

- 5.1.14.3 Vitamin C

- 5.1.14.4 Vitamin E

- 5.1.14.5 Other Vitamins

- 5.1.15 Yeast

- 5.1.15.1 Live Yeast

- 5.1.15.2 Selenium Yeast

- 5.1.15.3 Spent Yeast

- 5.1.15.4 Torula Dried Yeast

- 5.1.15.5 Whey Yeast

- 5.1.15.6 Yeast Derivatives

- 5.1.1 Acidifiers

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 Fish

- 5.2.1.2 Shrimp

- 5.2.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 Broiler

- 5.2.2.2 Layer

- 5.2.2.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 Beef Cattle

- 5.2.3.2 Dairy Cattle

- 5.2.3.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Cargill, Incorporated.

- 6.4.2 DSM-Firmenich

- 6.4.3 Ajinomoto Co., Inc.

- 6.4.4 Nutreco NV (SHV Holdings NV)

- 6.4.5 BASF SE

- 6.4.6 Kemin Industries, Inc.

- 6.4.7 Evonik Industries AG

- 6.4.8 PT Japfa Comfeed Indonesia Tbk

- 6.4.9 PT Charoen Pokphand Indonesia Tbk

- 6.4.10 Alltech, Inc.

- 6.4.11 Brenntag SE

- 6.4.12 Novus International, Inc. (Mitsui & Co., Ltd.)

- 6.4.13 ADM

- 6.4.14 East Hope Group

- 6.4.15 Zinpro Corporation

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS