PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907273

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907273

North America Feed Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

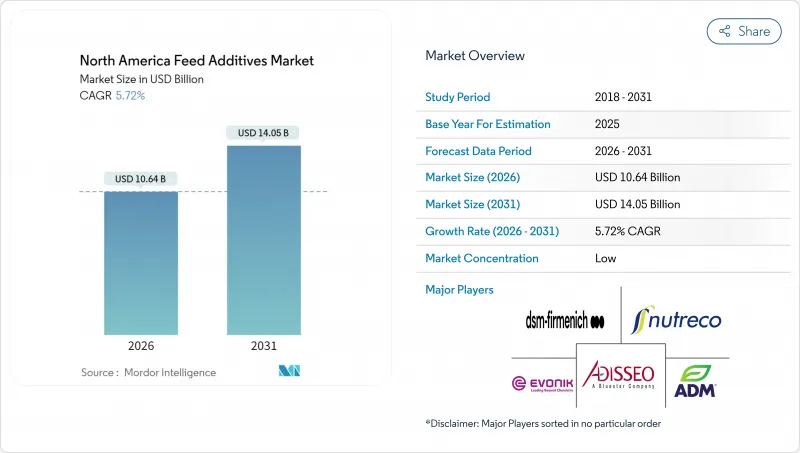

The North America feed additives market is expected to grow from USD 10.06 billion in 2025 to USD 10.64 billion in 2026 and is forecast to reach USD 14.05 billion by 2031 at 5.72% CAGR over 2026-2031.

Robust demand for precision livestock nutrition, regulatory limits on antibiotic growth promoters, and rising sustainability mandates underpin the steady expansion of the North America feed additives market. Industrial livestock consolidation spurs larger farms to adopt tailored additive packages that improve feed conversion ratios and animal performance. Concurrently, digital formulation platforms that leverage real-time data analytics strengthen supplier differentiation, while supply-chain vulnerabilities in amino acid sourcing continue to influence price dynamics. Heightened merger and acquisition activity signals a maturing competitive arena as leading firms re-focus on core competencies through strategic divestitures and portfolio realignments.

North America Feed Additives Market Trends and Insights

Rising Demand for High-Protein Meat and Dairy

Consumer dietary patterns increasingly favor protein-rich foods, driving livestock producers to maximize feed conversion efficiency through targeted additive supplementation. North American per-capita meat consumption remains among the world's highest, with poultry consumption alone reaching 50.8 kg annually, necessitating optimized amino acid profiles to support rapid muscle development and egg production. Dairy operations particularly benefit from precision mineral supplementation and rumen-protected amino acids that enhance milk protein content while reducing nitrogen excretion. This trend accelerates the adoption of specialized additives, including organic trace minerals, bypass proteins, and metabolizable energy enhancers that directly correlate with protein output metrics. The economic multiplier effect becomes evident as feed costs represent 60-70% of total livestock production expenses, making additive-driven efficiency gains critical for maintaining profit margins amid volatile commodity prices.

Expansion of Industrial Livestock and Poultry Production

Consolidation toward larger-scale operations fundamentally alters additive demand patterns as mega-farms implement sophisticated nutrition management systems requiring consistent, scientifically validated feed formulations. Operations exceeding 10,000 head capacity increasingly dominate North American livestock production, with these facilities generating economies of scale that justify investment in premium additive packages and precision feeding technologies. The vertical integration trend sees major protein companies acquiring feed mills and additive suppliers to control quality and costs throughout the production chain. Geographic concentration in regions with favorable climate, water access, and transportation infrastructure drives localized additive demand spikes, particularly in the US Corn Belt and Canadian Prairie provinces. This industrialization process accelerates the adoption of automation-compatible additive forms, including liquid supplements, microencapsulated products, and precision-dosing systems that integrate with existing feed manufacturing equipment.

Volatile Raw-Material Prices for Key Additives

Amino acid price volatility directly impacts feed additive market dynamics as methionine and lysine costs fluctuate 20-40% annually based on energy prices, raw material availability, and production capacity utilization in Asia-Pacific manufacturing hubs. The concentration of global amino acid production in China creates supply chain vulnerabilities that translate into unpredictable cost structures for North American feed manufacturers and livestock producers. The economic impact cascades through the value chain as livestock producers adjust additive inclusion rates based on cost-benefit calculations, potentially compromising animal performance during periods of extreme price volatility. Forward contracting and price hedging mechanisms provide limited protection due to the specialized nature of many additive ingredients and limited supplier alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push to Reduce Antibiotic Growth Promoters

- Functional Feed Aimed at Lowering Livestock Methane Emissions

- Lengthy FDA and CFIA Approval Timelines for New Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Amino acids retained the largest slice of the North America feed additives market at 20.18% in 2025, sustained by relentless methionine and lysine demand from high-density poultry and swine units. The North America feed additives market size for amino acids is predicted to expand steadily as capacity expansions by Evonik and strategic repositioning by DSM-Firmenich bolster regional supplies. Acidifiers register the highest growth momentum at a 6.58% CAGR through 2031, propelled by regulatory curbs on antibiotic growth promoters that spotlight organic acid efficacy in gut-health management.

Beyond these headline categories, probiotics, enzymes, and organic minerals collectively build share on the back of enhanced bioavailability and environmental stewardship narratives. Competitive intensity increases as niche innovators exploit unmet needs in heat-stable enzymes and micro-encapsulation, yet supply-chain concentration keeps raw-material volatility a persistent concern.

The North America Feed Additives Market Report is Segmented by Additive (Acidifiers, Amino Acids, Antibiotics, and More), Animal (Aquaculture, Poultry, Ruminants, and More), and Geography (Canada, Mexico, United States, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Archer Daniels Midland Co.

- DSM-Firmenich AG

- Evonik Industries AG

- Adisseo

- Nutreco NV (SHV Holdings N.V.)

- Alltech, Inc.

- BASF SE

- Cargill Inc.

- IFF Danisco Animal Nutrition (International Flavors and Fragrances Inc.)

- Land O Lakes Inc.

- Novus International

- Kemin Industries

- Phibro Animal Health Corporation

- Zoetis Inc.

- Elanco Animal Health Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY & KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Rising demand for high-protein meat and dairy

- 4.5.2 Expansion of industrial livestock and poultry production

- 4.5.3 Regulatory push to reduce antibiotic growth promoters

- 4.5.4 Functional feed aimed at lowering livestock methane emissions

- 4.5.5 Growth of insect-based protein meal requiring tailored premixes

- 4.5.6 Digital twin modeling accelerating customized additive adoption

- 4.6 Market Restraints

- 4.6.1 Volatile raw-material prices for key additives

- 4.6.2 Lengthy FDA and CFIA approval timelines for new additives

- 4.6.3 Retail pressure driven by consumer skepticism toward synthetics

- 4.6.4 Supply-chain risk from geographic concentration of amino-acid production

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Additive

- 5.1.1 Acidifiers

- 5.1.1.1 By Sub Additive

- 5.1.1.1.1 Fumaric Acid

- 5.1.1.1.2 Lactic Acid

- 5.1.1.1.3 Propionic Acid

- 5.1.1.1.4 Other Acidifiers

- 5.1.1.1 By Sub Additive

- 5.1.2 Amino Acids

- 5.1.2.1 By Sub Additive

- 5.1.2.1.1 Lysine

- 5.1.2.1.2 Methionine

- 5.1.2.1.3 Threonine

- 5.1.2.1.4 Tryptophan

- 5.1.2.1.5 Other Amino Acids

- 5.1.2.1 By Sub Additive

- 5.1.3 Antibiotics

- 5.1.3.1 By Sub Additive

- 5.1.3.1.1 Bacitracin

- 5.1.3.1.2 Penicillins

- 5.1.3.1.3 Tetracyclines

- 5.1.3.1.4 Tylosin

- 5.1.3.1.5 Other Antibiotics

- 5.1.3.1 By Sub Additive

- 5.1.4 Antioxidants

- 5.1.4.1 By Sub Additive

- 5.1.4.1.1 Butylated Hydroxyanisole (BHA)

- 5.1.4.1.2 Butylated Hydroxytoluene (BHT)

- 5.1.4.1.3 Citric Acid

- 5.1.4.1.4 Ethoxyquin

- 5.1.4.1.5 Propyl Gallate

- 5.1.4.1.6 Tocopherols

- 5.1.4.1.7 Other Antioxidants

- 5.1.4.1 By Sub Additive

- 5.1.5 Binders

- 5.1.5.1 By Sub Additive

- 5.1.5.1.1 Natural Binders

- 5.1.5.1.2 Synthetic Binders

- 5.1.5.1 By Sub Additive

- 5.1.6 Enzymes

- 5.1.6.1 By Sub Additive

- 5.1.6.1.1 Carbohydrases

- 5.1.6.1.2 Phytases

- 5.1.6.1.3 Other Enzymes

- 5.1.6.1 By Sub Additive

- 5.1.7 Flavors & Sweeteners

- 5.1.7.1 By Sub Additive

- 5.1.7.1.1 Flavors

- 5.1.7.1.2 Sweeteners

- 5.1.7.1 By Sub Additive

- 5.1.8 Minerals

- 5.1.8.1 By Sub Additive

- 5.1.8.1.1 Macrominerals

- 5.1.8.1.2 Microminerals

- 5.1.8.1 By Sub Additive

- 5.1.9 Mycotoxin Detoxifiers

- 5.1.9.1 By Sub Additive

- 5.1.9.1.1 Binders

- 5.1.9.1.2 Biotransformers

- 5.1.9.1 By Sub Additive

- 5.1.10 Phytogenics

- 5.1.10.1 By Sub Additive

- 5.1.10.1.1 Essential Oil

- 5.1.10.1.2 Herbs & Spices

- 5.1.10.1.3 Other Phytogenics

- 5.1.10.1 By Sub Additive

- 5.1.11 Pigments

- 5.1.11.1 By Sub Additive

- 5.1.11.1.1 Carotenoids

- 5.1.11.1.2 Curcumin & Spirulina

- 5.1.11.1 By Sub Additive

- 5.1.12 Prebiotics

- 5.1.12.1 By Sub Additive

- 5.1.12.1.1 Fructo Oligosaccharides

- 5.1.12.1.2 Galacto Oligosaccharides

- 5.1.12.1.3 Inulin

- 5.1.12.1.4 Lactulose

- 5.1.12.1.5 Mannan Oligosaccharides

- 5.1.12.1.6 Xylo Oligosaccharides

- 5.1.12.1.7 Other Prebiotics

- 5.1.12.1 By Sub Additive

- 5.1.13 Probiotics

- 5.1.13.1 By Sub Additive

- 5.1.13.1.1 Bifidobacteria

- 5.1.13.1.2 Enterococcus

- 5.1.13.1.3 Lactobacilli

- 5.1.13.1.4 Pediococcus

- 5.1.13.1.5 Streptococcus

- 5.1.13.1.6 Other Probiotics

- 5.1.13.1 By Sub Additive

- 5.1.14 Vitamins

- 5.1.14.1 By Sub Additive

- 5.1.14.1.1 Vitamin A

- 5.1.14.1.2 Vitamin B

- 5.1.14.1.3 Vitamin C

- 5.1.14.1.4 Vitamin E

- 5.1.14.1.5 Other Vitamins

- 5.1.14.1 By Sub Additive

- 5.1.15 Yeast

- 5.1.15.1 By Sub Additive

- 5.1.15.1.1 Live Yeast

- 5.1.15.1.2 Selenium Yeast

- 5.1.15.1.3 Spent Yeast

- 5.1.15.1.4 Torula Dried Yeast

- 5.1.15.1.5 Whey Yeast

- 5.1.15.1.6 Yeast Derivatives

- 5.1.15.1 By Sub Additive

- 5.1.1 Acidifiers

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.4 Other Aquaculture Species

- 5.2.1.1 By Sub Animal

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.2.1 By Sub Animal

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Geography

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 6.4.1 Archer Daniels Midland Co.

- 6.4.2 DSM-Firmenich AG

- 6.4.3 Evonik Industries AG

- 6.4.4 Adisseo

- 6.4.5 Nutreco NV (SHV Holdings N.V.)

- 6.4.6 Alltech, Inc.

- 6.4.7 BASF SE

- 6.4.8 Cargill Inc.

- 6.4.9 IFF Danisco Animal Nutrition (International Flavors and Fragrances Inc.)

- 6.4.10 Land O Lakes Inc.

- 6.4.11 Novus International

- 6.4.12 Kemin Industries

- 6.4.13 Phibro Animal Health Corporation

- 6.4.14 Zoetis Inc.

- 6.4.15 Elanco Animal Health Inc.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS