PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907229

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907229

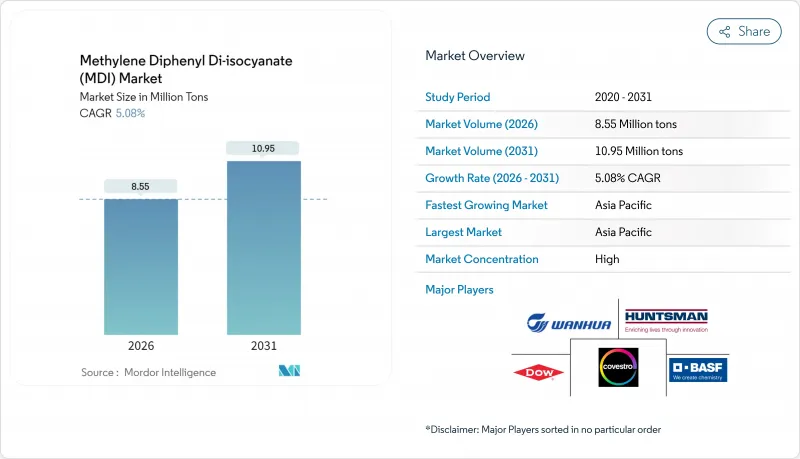

Methylene Diphenyl Di-isocyanate (MDI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Methylene Diphenyl Di-isocyanate market is expected to grow from 8.14 Million tons in 2025 to 8.55 Million tons in 2026 and is forecast to reach 10.95 Million tons by 2031 at 5.08% CAGR over 2026-2031.

Cost-competitive supply expansions in Asia-Pacific, paired with net-zero building mandates and appliance efficiency standards across North America and Europe, underpin this growth trajectory. Industry leaders are scaling bio-circular and mass-balanced grades to retain customer loyalty, while phosgene-free pilot lines point to longer-term process disruption. Feedstock price swings-aniline fell 36.81% year-on-year in 2025-add margin volatility, yet integrated producers remain better cushioned. Intensifying worker-exposure regulations and the capital intensity of new plants keep the competitive moat high and accelerate consolidation around technology-rich incumbents.

Global Methylene Diphenyl Di-isocyanate (MDI) Market Trends and Insights

Surge in PU-Insulation Demand from Net-Zero Buildings

The Energy Performance of Buildings Directive obliges EU member states to invest EUR 3.5 trillion (USD 3.8 trillion) in energy upgrades by 2030. New builds must meet near-zero energy targets, while older stock faces mandatory deep retrofits that favor rigid polyurethane panels with thermal conductivity down to 0.022 W/m*K. Comparable rules in California's 2025 codes replicate this pull in North America. Building automation specifications further boost MDI consumption because advanced controls demand tighter thermal envelopes. The synergy between regulation and performance cements rigid foams as the highest-growth slice of the MDI market.

Cold-Chain Capacity Build-Out for Food and Pharma

Post-pandemic vaccine logistics illustrated the cost of temperature excursions, pivoting pharma supply chains toward ultralow-temperature storage. India's subsidized cold-chain programs add greenfield warehouses that rely on polyurethane systems capable of -80 °C thermal integrity. Parallel food cold-chains, driven by urban lifestyle changes, upscale refrigerated transport and retail cases across ASEAN and Latin America. Higher performance specs elevate margin profiles for premium MDI grades, strengthening volume resilience even amid raw-material inflation.

Stricter Worker-Exposure Limits for Diisocyanates

The EU capped workplace exposure at 6 µg NCO/m3 and mandated certified training for all handlers. OSHA is following suit. Compliance forces investments in ventilation, monitoring and medical surveillance, raising fixed costs for spray-foam contractors and small appliance lines. The burden accelerates market consolidation toward capital-rich processors and biases demand toward low-monomer or prepolymer solutions that command price premiums but require formulation know-how.

Other drivers and restraints analyzed in the detailed report include:

- HVAC Efficiency Regulations Boosting Appliance Foams

- Rise of Battery-Thermal-Management Foams in EV Packs

- High Capital Intensity of Phosgenation Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid foams contributed 36.78% of the MDI market size in 2025 and are expected to climb at a 5.63% CAGR to 2031. The category benefits from polyisocyanurate panels delivering best-in-class 0.022 W/m*K thermal conductivity, enabling compliance with net-zero standards in residential and commercial construction. Flexible foams maintain relevance in bedding and automotive seats, though maturity limits upside. Coatings and elastomers secure recurring demand from industrial maintenance and materials-handling applications, reinforcing baseline volumes. Emerging uses include EV battery encapsulants that need dimensional stability under thermal cycling, highlighting the versatility of MDI chemistry. Rigid foams' rising uptake in re-roofing and curtain-wall systems all but assures their continued dominance within the MDI market.

With building codes tightening globally, insurers and financiers are prescribing minimum R-values that only rigid polyurethane or PIR products can feasibly meet at slim wall sections. Recticel's Eurowall Impact board, featuring 25% bio-circular content, cut embodied CO2 by 43% without compromising thermal performance. Adhesives and sealants form a niche yet profitable sub-segment in automotive and infrastructure repair, where MDI imparts fast cure and structural bonding. Specialty elastomers carry weight in mining screens and industrial wheels, generating steady aftermarket revenue. Collectively, these sub-segments make rigid foams the linchpin of long-term growth for the MDI market.

The Methylene Diphenyl Di-Isocyanate (MDI) Market Report is Segmented by Application (Rigid Foams, Flexible Foams, Coatings, Elastomers, Adhesives and Sealants, and Others), End-User Industry (Construction, Furniture and Interiors, Electronics and Appliances, Automotive, Footwear, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 46.35% of the MDI market in 2025 and is projected to expand at a region-leading 5.90% CAGR to 2031. China's green-building codes and infrastructure boom absorb vast rigid-foam volumes, while India's vaccine logistics push inflate cold-storage capacity. Expansion projects, such as Kumho Mitsui's 200 kt debottlenecking that lifted its Yeosu complex to 610 kt, underpin local supply.

North America remains significant through retrofit incentives and the Section 45L tax credit that rewards high-performance residential buildings. Notably, Covestro supplies bio-circular MDI to Carlisle Construction Materials, cutting upstream carbon 99% relative to fossil-based grades. Local appliance makers also specify higher-density foams to satisfy 2025 energy rules, anchoring stable base demand.

Europe's policy leadership creates a synthetic pull exceeding organic growth. The EPBD's EUR 3.5 trillion retrofit agenda accelerates rigid-foam adoption, while the 6 µg exposure cap motivates formulators to shift toward low-monomer variants. Producer focus aligns with circularity: BASF separated its Shanghai joint venture to optimize its 1.9 million-ton global MDI grid, freeing assets for mass-balanced production. Meanwhile, Middle East and Africa register catch-up growth driven by logistics parks and climate-controlled agriculture, though most product still ships in from Europe and Asia.

- BASF

- Covestro AG

- Dow

- Hexion Inc.

- Huntsman International LLC

- Karoon Petrochemical Company

- Kumho Mitsui Chemicals Inc

- KURMY CORPORATIONS

- Sadara

- Shanghai Lianheng Isocyanate Co. Ltd

- Sumitomo Chemical Co. Ltd

- Tosoh Corporation

- Vardhman Chemicals

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in PU-insulation demand from net-zero buildings

- 4.2.2 Cold-chain capacity build-out for food and pharma

- 4.2.3 HVAC efficiency regulations boosting appliance foams

- 4.2.4 Rise of battery-thermal-management foams in EV packs

- 4.2.5 Circular-economy push for mass-balanced/ISCC-Plus MDI

- 4.3 Market Restraints

- 4.3.1 Stricter worker-exposure limits for diisocyanates

- 4.3.2 Crude-oil price volatility hitting aniline feedstock

- 4.3.3 High capital intensity of phosgenation plants

- 4.4 Value Chain Analysis

- 4.5 Regulatory Policy Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Degree of Competition

- 4.7 Production Process Analysis

- 4.8 Technology Licensing and Patent Analysis

- 4.9 Price Trend Scenario

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Rigid Foams

- 5.1.2 Flexible Foams

- 5.1.3 Coatings

- 5.1.4 Elastomers

- 5.1.5 Adhesives and Sealants

- 5.1.6 Others

- 5.2 By End-user Industry

- 5.2.1 Construction

- 5.2.2 Furniture and Interiors

- 5.2.3 Electronics and Appliances

- 5.2.4 Automotive

- 5.2.5 Footwear

- 5.2.6 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 Hexion Inc.

- 6.4.5 Huntsman International LLC

- 6.4.6 Karoon Petrochemical Company

- 6.4.7 Kumho Mitsui Chemicals Inc

- 6.4.8 KURMY CORPORATIONS

- 6.4.9 Sadara

- 6.4.10 Shanghai Lianheng Isocyanate Co. Ltd

- 6.4.11 Sumitomo Chemical Co. Ltd

- 6.4.12 Tosoh Corporation

- 6.4.13 Vardhman Chemicals

- 6.4.14 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Phosgene-free MDI Production Process