PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907247

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907247

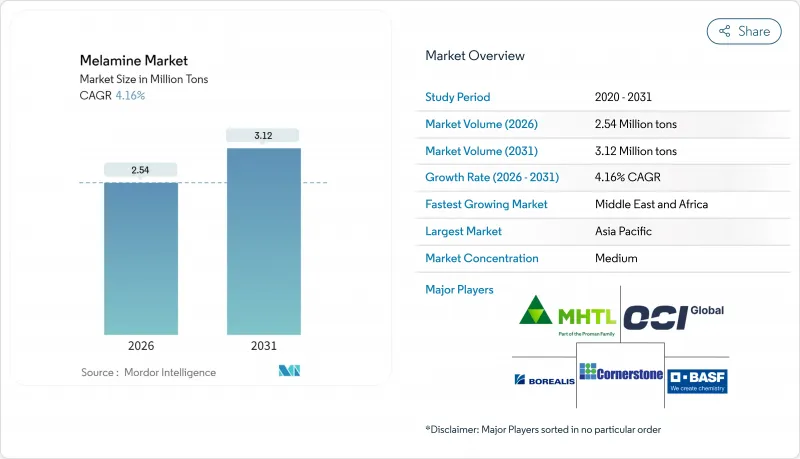

Melamine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Melamine Market size in 2026 is estimated at 2.54 million tons, growing from 2025 value of 2.44 million tons with 2031 projections showing 3.12 million tons, growing at 4.16% CAGR over 2026-2031.

Strong construction activity in the Asia-Pacific region, resilient repair-and-remodel investment in North America and Europe, and tight global supply following multiple plant curtailments continue to support price realization and reinforce expansion. Demand is further boosted by the rapid adoption of laminated flooring in emerging economies, technological advancements that enable ultra-low formaldehyde-emission resins, and the premium adoption of biomass-balanced grades in Europe. On the supply side, capacity additions in Qatar and China partially offset permanent shutdowns in Europe, yet lingering energy volatility and urea feedstock spikes keep inventory cycles short and spot prices elevated. Suppliers that combine backward urea integration with carbon-reduction road maps gain a structural cost and regulatory compliance edge, encouraging regional self-sufficiency strategies and targeted debottlenecking investments across the melamine market.

Global Melamine Market Trends and Insights

Surge in laminated flooring and furniture production in emerging economies

Urbanization and growing middle-class spending in China, India, Vietnam, and Indonesia are stimulating a boom in decorative laminates and furniture upgrades. China's 2024 national economic plan prioritizes petrochemical optimization and downstream integration, which favors local investments in melamine resin. Capacity additions ensure feedstock availability, enabling panel producers to transition from urea-formaldehyde to melamine-urea-formaldehyde systems, which offer improved moisture resistance. India's aggressive chemical build-out couples new fertilizer complexes with derivative melamine plants, shortening lead times to panel firms. Particleboard output is growing, and lesser-used species, such as alder and birch, will require higher-performance resins to meet bonding standards. Together, these factors support steady volume gains for the melamine market.

Construction recovery in United States/European Union spurring wood-adhesive demand

Housing starts stabilized in 2024 and are expected to rise modestly through 2026 in both regions, reviving consumption of oriented strand board and medium-density fiberboard, which rely on melamine-enhanced adhesives. EU builders also seek panel grades that meet upcoming REACH formaldehyde limits of 0.062 mg/m3, effective August 2026. North American producers align with EPA TSCA Title VI, driving substitution toward lower-emission melamine-urea-formaldehyde formulations. European customers are increasingly specifying biomass-balanced resins, with early adopters such as Finsa integrating OCI's bio-melamine grades, which reduce the product's carbon footprint by roughly 50% compared to conventional imports.

Stricter formaldehyde-emission regulations in EU and North America

The EU limit of 0.062 mg/m3 and aligned EPA TSCA Title VI thresholds mandate expensive certification, laboratory testing, and supply-chain documentation. Producers unable to meet the new bar risk market exclusion. While melamine-formaldehyde typically exhibits lower emissions than urea-formaldehyde, the incremental cost to prove compliance compresses margins and deters smaller converters. Sweden has taken a further step with a 0.124 mg/m3 limit, which may soon serve as a benchmark for other Nordic markets.

Other drivers and restraints analyzed in the detailed report include:

- Industrial expansion in Asia-Pacific boosting HPL and molding compounds

- Lightweight heat-resistant melamine foams for aerospace and rail acoustics

- Bio-based adhesive substitutes (soy, lignin, liquefied wood)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Melamine resins retained a 64.70% market share of melamine in 2025, serving as the backbone for decorative laminates, particleboard overlays, and high-pressure laminates. Robust flooring replacement cycles in Asia-Pacific and formaldehyde compliance pressures in Europe underpin growth for resins through 2031. In parallel, the melamine market size for foam is projected to expand at a 4.72% CAGR, albeit from a lower base, because aerospace, EV, and rail sectors prioritize ultra-light acoustic insulation. Foam manufacturers are scaling continuous blocks and bun stock production to supply large panels for interior trimming. BASF's EcoBalanced launch demonstrates how renewable electricity and biomass feedstock can deliver up to 50% lower product carbon footprint without requalification, a competitive differentiator for Original Equipment Manufacturers targeting Net Zero.

Resin formulators are focusing on ultra-low molar ratio systems to reduce formaldehyde emissions below 0.05 mg/m3, thereby protecting panel exports to the EU. Integrated producers that own urea capture and melamine reactors achieve feedstock security and leverage economies of scale to safeguard margins when urea volatility peaks. Grupa Azoty's temporary shutdown in 2024 highlights the exposure of plants that rely on merchant urea and high-cost gas inputs.

The Melamine Market Report is Segmented by Product Form (Melamine Crystals, Melamine Resins, Melamine Foam, and Others), Application (Laminates, Wood Adhesives, and More), End-User Industry (Construction and Infrastructure, Furniture and Woodworking, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific controlled 51.05% melamine market share in 2025, underpinned by China's vast resinification capacity and steady Indian demand for decorative panels. Integrated ammonia-urea-melamine complexes in Shandong and Inner Mongolia benefit from coal or low-cost gas feedstock, reinforcing regional price leadership. Japan and South Korea maintain a premium niche demand for high-purity molding compounds and acoustic foams used in the semiconductor and shipbuilding industries. Southeast Asia's fast-growing furniture exports attract incremental resin investment, boosting regional self-sufficiency despite reliance on imported melamine crystals.

North America is a significant market but remains structurally short, relying on a single domestic producer. Hurricane-related outages and maintenance downtime expose panel and flooring manufacturers to supply disruptions. Import reliance is moderated by countervailing duties placed on products from Germany, Qatar, Trinidad and Tobago, and India. Builders, meanwhile, capitalize on mellower mortgage rates and infrastructure spending to sustain panel consumption, underpinning stable resin demand.

Europe grapples with the strictest emission rules yet enjoys an early-mover advantage in biomass-balanced melamine. The Middle-East and Africa, while currently small, exhibit the highest growth rate of 4.28%, as QatarEnergy and its affiliates push melamine capacity linked to abundant, low-cost gas feedstock. New petrochemical corridors from Ras Laffan aim to serve Asian and European offtakers, yet U.S. duties constrain direct North American access. South America remains opportunistic, drawing spot cargoes from Trinidad and Tobago and Europe when arbitrage allows.

- BASF SE

- Borealis AG

- Cornerstone Chemical Company

- EuroChem Group

- Fushun Huaxing Petroleum Chemical Co., Ltd

- Grupa Azoty

- Gujarat State Fertilizers & Chemicals Ltd (GSFC)

- Henan Xinlianxin Chemicals Group Co. Ltd

- Hexion Inc.

- Methanol Holdings (Trinidad) Ltd (MHTL)

- Mitsui Chemicals Inc.

- Nissan Chemical Corporation

- OCI NV

- Prefere Resins Holding GmbH

- Qatar Melamine Company

- Sichuan Chemical Works Group Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in laminated flooring and furniture production in emerging economies

- 4.2.2 Construction recovery in United States/European union spurring wood-adhesive demand

- 4.2.3 Industrial expansion in APAC boosting HPL and molding compounds

- 4.2.4 Lightweight heat-resistant melamine foams for aero and rail acoustics

- 4.2.5 Low-carbon urea-to-melamine process innovations

- 4.3 Market Restraints

- 4.3.1 Stricter formaldehyde-emission regulations in European Union and North America

- 4.3.2 Bio-based adhesive substitutes (soy, lignin, liquefied wood)

- 4.3.3 Urea-price volatility tied to fertilizer-market disruptions

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Feedstock Analysis and Trends

- 4.8 Production Process

- 4.9 Import-Export Trends

- 4.10 Price Trends

- 4.11 Patent Analysis

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Form

- 5.1.1 Melamine Crystals

- 5.1.2 Melamine Resins (HPL, LPL, Impregnated Paper)

- 5.1.3 Melamine Foam

- 5.1.4 Others (Impregnated Decor Paper, Flame-retardant Blends)

- 5.2 By Application

- 5.2.1 Laminates

- 5.2.2 Wood Adhesives

- 5.2.3 Molding Compounds

- 5.2.4 Paints and Coatings

- 5.2.5 Flame-retardants and Textile Resins

- 5.3 By End-user Industry

- 5.3.1 Construction and Infrastructure

- 5.3.2 Furniture and Woodworking

- 5.3.3 Automotive and Transportation

- 5.3.4 Chemicals and Coatings

- 5.3.5 Appliances and Electrical

- 5.3.6 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Borealis AG

- 6.4.3 Cornerstone Chemical Company

- 6.4.4 EuroChem Group

- 6.4.5 Fushun Huaxing Petroleum Chemical Co., Ltd

- 6.4.6 Grupa Azoty

- 6.4.7 Gujarat State Fertilizers & Chemicals Ltd (GSFC)

- 6.4.8 Henan Xinlianxin Chemicals Group Co. Ltd

- 6.4.9 Hexion Inc.

- 6.4.10 Methanol Holdings (Trinidad) Ltd (MHTL)

- 6.4.11 Mitsui Chemicals Inc.

- 6.4.12 Nissan Chemical Corporation

- 6.4.13 OCI NV

- 6.4.14 Prefere Resins Holding GmbH

- 6.4.15 Qatar Melamine Company

- 6.4.16 Sichuan Chemical Works Group Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment