PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907339

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907339

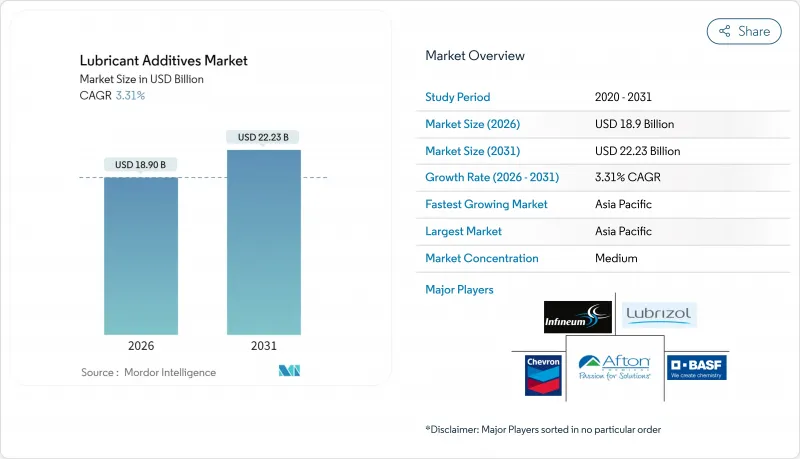

Lubricant Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Lubricant Additives Market size in 2026 is estimated at USD 18.9 billion, growing from 2025 value of USD 18.29 billion with 2031 projections showing USD 22.23 billion, growing at 3.31% CAGR over 2026-2031.

This measured expansion reflects the industry's shift from volume-driven growth toward value-focused innovation, where premium additive chemistries offset moderating lubricant demand. Rising regulatory stringency, led by the March 2025 introduction of ILSAC GF-7, has accelerated the uptake of sophisticated multi-functional packages that support tighter emission limits and lower viscosities. Asia-Pacific commands both the largest regional presence and the highest growth momentum because manufacturing expansion in China and India underpins robust automotive and industrial lubricant consumption. Competitive dynamics emphasize technology differentiation rather than price, exemplified by Lubrizol's launch of Solsperse W60 Hyperdispersant in February 2025, a product positioned for next-generation low-SAPs engine oils. Extended drain intervals and electrification temper absolute additive volumes, yet nano-scale innovations and stricter emission standards sustain demand for high-value solutions.

Global Lubricant Additives Market Trends and Insights

Stringent Environmental Regulations on Emissions

ILSAC GF-7 took effect in March 2025 and compels additive suppliers to mitigate low-speed pre-ignition while safeguarding timing chains under tighter phosphorus and sulfur caps. New ACEA 2023 C7 categories in Europe target SAE 0W-16 oils, spurring demand for friction modifiers and viscosity index improvers that deliver at least 0.3% fuel-economy gains versus reference oils. As OEMs push toward 0W-8 grades, additive formulations must reconcile fuel efficiency with wear protection and oxidative stability. This balancing act elevates the value of high-purity detergent chemistries and advanced antiwear boosters. Regulatory convergence across regions accelerates global harmonization of performance standards, incentivizing multinational suppliers to invest in versatile additive platforms rather than region-specific blends. Suppliers that demonstrate rapid certification capabilities secure stronger bargaining power with both blenders and OEMs.

Industrial Capacity Build-up in MEA

Downstream diversification programs under Saudi Arabia's Vision 2030 have triggered joint ventures that localize additive production close to abundant feedstocks. Projects such as the prospective Aramco-Castrol facility and Richful Group's partnership with Farabi Petrochemicals illustrate regional momentum toward self-reliance. Integrated complexes lower logistics costs for import-dependent African manufacturers and shorten lead times for customers across the Red Sea corridor. Over the long term, these investments create an export platform serving Asia-Pacific demand spikes while insulating local blenders from global freight volatility. Regional governments also incentivize specialty chemical clusters through tax holidays and preferential land leases, amplifying the financial viability of greenfield facilities. As installed capacity rises, additive suppliers can tailor formulations to climatic extremes and fuel qualities characteristic of MEA markets.

Extended Drain Intervals in Vehicles and Machinery

Passenger-car oil-change intervals in the United States have doubled from 5,000 miles to 10,000 miles, while wind-turbine gearboxes now target 36-month lubricant life cycles. Condition-monitoring sensors embedded in filters enable data-driven maintenance that defers service until oil oxidation or particle levels trigger alarms. Although each oil fill contains a higher additive loading, the aggregate annual additive volume contracts. Blenders therefore shift marketing toward premium long-life brands, squeezing suppliers focused on commodity chemistries. Independent workshops lose service revenue, reinforcing consumer adoption of extended intervals. To compensate, additive manufacturers promote supplemental products such as flush fluids and filter-conditioner tablets, but uptake remains limited.

Other drivers and restraints analyzed in the detailed report include:

- Surging Automotive Lubricant Demand in Asia-Pacific

- Rising OEM Shift to High-Performance Engine Oils

- Electrification Curbing Engine-Oil Volumes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dispersants and emulsifiers accounted for 29.13% of 2025 revenues, reflecting their critical role in keeping soot and oxidation by-products suspended to prevent varnish formation. The segment is forecast to grow at a 4.32% CAGR through 2031, outpacing the lubricant additives market as OEMs migrate to gasoline direct-injection engines with elevated particulate loading. The lubricant additives market size attributed to dispersants is projected to expand steadily because regulatory caps on sulfated ash and phosphorus intensify the need for highly efficient polyisobutylene succinimide chemistries that operate at lower treat rates.

Polymeric viscosity index improvers hold the second-largest share, benefiting from the pivot toward low-viscosity grades such as 0W-8 that require robust film strength at high operating temperatures. Detergents and corrosion inhibitors enjoy stable demand as extended drain intervals magnify the importance of base-number retention. Friction modifiers gain relevance in passenger-car and heavy-duty oils targeting a 1% fuel-economy improvement, while extreme-pressure additives remain core to industrial gear oils and metalworking fluids. Suppliers consolidate these chemistries into multi-functional packages to optimize treat levels within stringent ash budgets, a trend that enables formulators to meet global engine-test matrices with fewer SKUs.

The Lubricant Additives Report is Segmented by Function Type (Dispersants and Emulsifiers, Viscosity Index Improvers, Detergents, Corrosion Inhibitors, and More), Lubricant Type (Engine Oil, Transmission and Hydraulic Fluid, Metalworking Fluid, and More), End-User Industry (Automotive and Other Transportation, Power Generation, Heavy Equipment, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific dominated the global landscape with 45.05% share in 2025 and is anticipated to register a 3.98% CAGR through 2031. China's vertically integrated petrochemical complexes generate competitively priced Group II and Group III base oils that feed additive blend plants, supporting local and export demand. India leverages production-linked incentives to attract investment in specialty chemicals, transforming the country into a sourcing hub for ASEAN assemblers. Japan and South Korea contribute proprietary polymer modifiers and high-purity dispersants, while Thailand and Vietnam offer cost-efficient blending services for regional OEM service-fill programs.

North America retains significant influence through its role in setting global performance specifications. API and ILSAC committees headquartered in the United States drive new category introductions, compelling worldwide adoption of accompanying additive test protocols. While vehicle electrification and extended drain intervals temper volume growth, fleet owners in the region demand superior oxidative stability and fuel-efficiency credentials, sustaining high per-unit additive value. Mexico's expanding automotive assembly capacity further underpins regional demand as OEMs localize supply chains to meet trade-agreement content rules.

Europe combines a mature car parc with some of the world's strictest environmental regulations. ACEA 2023 standards and Euro VII proposals mandate particulate filter compatibility and ultra-low-viscosity grades, forcing formulators to balance ash limits against turbocharger cleanliness. German chemical majors supply advanced antioxidants and friction modifiers, while the United Kingdom maintains notable additive research and development hubs. Russia's geopolitical situation restricts technology transfer, yet domestic blenders continue to consume traditional additive packages for industrial oils.

South America experiences moderate expansion led by Brazil, where agricultural mechanization boosts heavy-duty diesel lubricant consumption. Energy reforms in Argentina encourage shale development, translating into gear-oil and hydraulic-fluid demand for drilling equipment. Saudi Arabia's Vision 2030 downstream projects and United Arab Emirates' push to become a regional maritime services center stimulate demand for marine and industrial lubricants.

- AFTON CHEMICAL

- BASF

- BRB International BV

- Chevron Corporation

- D.O.G Deutsche Oelfabrik

- Dorf Ketal Chemicals

- Dover Chemical Corporation

- Evonik Industries AG

- GANESH BENZOPLAST LIMITED.

- INFINEUM INTERNATIONAL LIMITED

- ITALMATCH CHEMICALS SPA

- Kangtai Lubricant Additives Co., Ltd.

- King Industries, Inc.

- Lanxess

- MULTISOL LIMITED

- Nouryon

- RT Vanderbilt Holding Company, Inc.

- Shepherd Chemical

- The Lubrizol Corporation

- Wuxi South Petroleum Additives Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent environmental regulations on emissions

- 4.2.2 Industrial capacity build-up in MEA

- 4.2.3 Surging automotive lubricant demand in Asia-Pacific

- 4.2.4 Rising OEM shift to high-performance engine oils

- 4.2.5 Emergence of nano-additive packages

- 4.3 Market Restraints

- 4.3.1 Extended drain intervals in vehicles and machinery

- 4.3.2 Electrification curbing engine-oil volumes

- 4.3.3 Volatile supply of PIB and other key chemistries

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Function Type

- 5.1.1 Dispersants and Emulsifiers

- 5.1.2 Viscosity Index Improvers

- 5.1.3 Detergents

- 5.1.4 Corrosion Inhibitors

- 5.1.5 Oxidation Inhibitors

- 5.1.6 Extreme-pressure Additives

- 5.1.7 Friction Modifiers (FM)

- 5.1.8 Other Function Types

- 5.2 By Lubricant Type

- 5.2.1 Engine Oil

- 5.2.2 Transmission and Hydraulic Fluid

- 5.2.3 Metalworking Fluid

- 5.2.4 General Industrial Oil

- 5.2.5 Gear Oil

- 5.2.6 Grease

- 5.2.7 Process Oil

- 5.2.8 Other Lubricant Types

- 5.3 By End-user Industry

- 5.3.1 Automotive and Other Transportation

- 5.3.2 Power Generation

- 5.3.3 Heavy Equipment

- 5.3.4 Metallurgy and Metal Working

- 5.3.5 Food and Beverage

- 5.3.6 Other End-Users Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Mexico

- 5.4.2.3 Canada

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Russia

- 5.4.3.4 Italy

- 5.4.3.5 France

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments}

- 6.4.1 AFTON CHEMICAL

- 6.4.2 BASF

- 6.4.3 BRB International BV

- 6.4.4 Chevron Corporation

- 6.4.5 D.O.G Deutsche Oelfabrik

- 6.4.6 Dorf Ketal Chemicals

- 6.4.7 Dover Chemical Corporation

- 6.4.8 Evonik Industries AG

- 6.4.9 GANESH BENZOPLAST LIMITED.

- 6.4.10 INFINEUM INTERNATIONAL LIMITED

- 6.4.11 ITALMATCH CHEMICALS SPA

- 6.4.12 Kangtai Lubricant Additives Co., Ltd.

- 6.4.13 King Industries, Inc.

- 6.4.14 Lanxess

- 6.4.15 MULTISOL LIMITED

- 6.4.16 Nouryon

- 6.4.17 RT Vanderbilt Holding Company, Inc.

- 6.4.18 Shepherd Chemical

- 6.4.19 The Lubrizol Corporation

- 6.4.20 Wuxi South Petroleum Additives Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment