PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910570

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910570

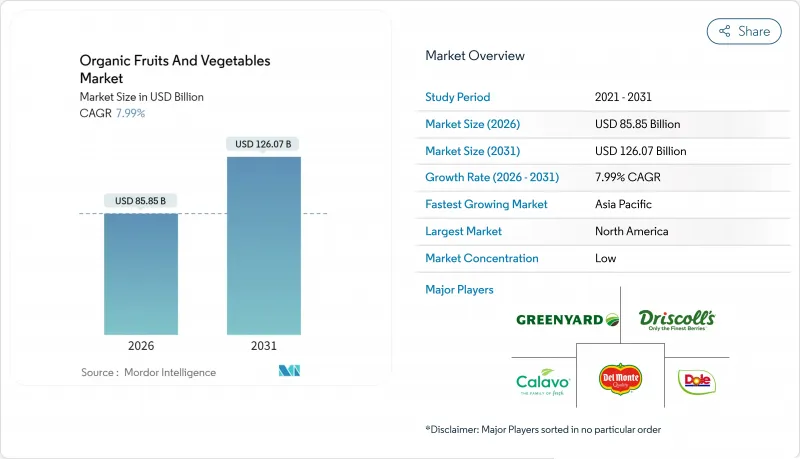

Organic Fruits And Vegetables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The organic fruits and vegetables market is expected to grow from USD 79.5 billion in 2025 to USD 85.85 billion in 2026 and is forecast to reach USD 126.07 billion by 2031 at 7.99% CAGR over 2026-2031.

The robust expansion of the organic fruits and vegetables market rests on a confluence of Environmental, Social, and Governance capital flows, rising regenerative farming adoption, and retailer-driven supply-chain integration. Institutional investors view soil carbon sequestration as a measurable climate outcome, channeling long-dated funds into certified organic acreage that once relied mainly on consumer demand alone. Retailers are cementing exclusive grower contracts that guarantee volume, shorten lead times, and sustain premium pricing that offsets higher production costs. Controlled-environment farming technologies reduce water use by up to 95% and cut harvest cycles to as few as 15 days, reinforcing the competitiveness of the organic fruits and vegetables market in urban centers. Price gaps between organic and conventional produce narrowed from 71% in 2021 to 61% in 2024, which improves consumer access even as producers pivot toward differentiation through regenerative practices and transparent audit trails.

Global Organic Fruits And Vegetables Market Trends and Insights

Health-driven consumer demand surge

Millennial and Generation Z shoppers purchased 36% more organic goods than older cohorts and fueled record certified sales of USD 69.7 billion in 2023, showing resilience even as average prices declined. Volume sales of organic produce climbed 7.2% against a 1.9% price dip, indicating that shoppers prioritize health benefits over cost savings. Fast-casual restaurants and university dining programs now feature certified menus, embedding organic preferences in daily consumption. Post-pandemic attitudes transformed organic labels from discretionary upgrades to perceived safeguards against contamination. Over half of surveyed consumers research the environmental impact of their food choices, illustrating how health considerations have broadened into sustainability awareness.

Government conversion subsidies and incentives

The United States Department of Agriculture (USDA) allocated USD 300 million in 2022 to its Organic Transition Initiative, reversing an 11% drop in certified acreage and stabilizing domestic supplies. In 2024, the European Union's Common Agricultural Policy Eco-Schemes pay producers to convert and maintain certified land as part of the European Green Deal target of 25% organic farmland by 2030, disbursing EUR 612 million (USD 673 million) annually in direct support. India's Paramparagat Krishi Vikas Yojana offers grants that aim to lift organic exports to INR 20,000 crore (USD 2.4 billion) within three years starting from 2025. Comparative studies reveal that integrated contract farming outperforms single-farmer grants in sustaining long-term compliance.

Higher unit production cost and yield gaps

Organic operations reach only 85% of conventional yields and bear 15-20% higher variable costs. U.S. organic corn prices slid 14% in 2024 while production expenses rose 20%, squeezing margins until some growers exited. Smallholders lacking economies of scale face the greatest risk, driving consolidation toward larger holdings that can amortize compliance and technology investments. The disparity widens in pest-heavy environments where biological controls remain less efficient than synthetic alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Price premium boosting farm profitability

- Retail-led contract farming for organic supply security

- Certification complexity and audit fatigue for smallholders

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bananas accounted for 25.62% of the organic fruits and vegetables market share in 2025, underscoring their dominance in overall fruit revenue. This leadership reflects mature certification pathways in tropical regions and habitual consumer demand for staple produce. Supply continuity keeps banana pricing stable, reinforcing their role as the volume anchor within the organic fruits and vegetables market. Apples follow as a large sub-segment that leverages controlled-atmosphere storage to reduce shrink and extend sales windows. Consolidation among growers streamlines export logistics while maintaining certification integrity that appeals to premium retailers.

Organic berries, while smaller in absolute terms, register an 10.56% CAGR through 2031, the fastest among fruit categories. Year-round supply chains created through cross-hemisphere plantings and recent mergers such as Gem-Pack Berries and Red Blossom Berries sustain a steady shelf presence and justify premium positioning. Grapes illustrate how regenerative practices can double farm-gate prices by linking soil health metrics to brand storytelling. Kiwi, passion fruit, and dragon fruit remain niche but benefit from superfood marketing that attracts health-focused shoppers and lifts the organic fruits and vegetables market size in specialty outlets.

The Organic Fruits and Vegetables Market Report is Segmented by Fruits (Banana, Apple, Berries, and More), Vegetables (Tomato, Potato, and More), and Geography (North America, South America, Europe, Asia-Pacific, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 34.20% of the organic fruits and vegetables market revenue in 2025, underpinned by the USDA Organic Transition Initiative and the Organic Certification Cost Share Program, which reimburses 75% of audit expenses up to USD 750 per category. Amazon's elevation of Whole Foods leadership to spearhead its grocery portfolio signals long-term strategic alignment around certified produce. The Strengthening Organic Enforcement rule, effective March 2024, mandates importer certification that curbs fraud and implicitly favors domestic output. Growth pockets cluster in the Southern states where mild winters trim energy costs and diversified cropping systems permit multi-season harvests.

Europe pursues aggressive organic expansion through the EU Green Deal's target of 25% organic farmland by 2030, supported by Common Agricultural Policy eco-schemes that provide direct financial incentives for organic conversion and maintenance. Tightened EU organic regulations, effective 2025, create compliance challenges for third-country imports, potentially reducing supply diversity while protecting domestic organic producers from lower-cost competition. Germany, France, and Italy lead European consumption through established organic retail channels and consumer acceptance of premium pricing. The region's regulatory framework influences global organic standards through trade agreements that require equivalent certification systems for market access.

Asia-Pacific records the fastest growth at a 10.05% CAGR. In 2025, China ranks third globally with an organic retail market of EUR 12.4 billion (USD 13.6 billion) as domestic dairies and beverage leaders champion organic sourcing. India aims for Rs 20,000 crore (USD 2.4 billion) in exports within three years starting from 2025 through schemes that provide training and certification financing. Australia controls 53.02 million hectares of certified organic land, leveraging extensive rangelands for grass-fed livestock and broad-acre grains. Japan's Japanese Organic and Natural Foods Association (JONA) certification commands premiums in retail channels, supporting the modernization of local supply chains.

- Dole plc

- Fresh Del Monte Produce Inc.

- Driscoll's Inc

- Greenyard

- Healthy Buddha

- Calavo Growers Inc.

- Westfalia Fruit International (Hans Merensky Holdings)

- Mission Produce Inc.

- Melinda

- Zespri International (Grower-Owned Co-operative)

- Naturipe Farms LLC (MBG Marketing & Hortifrut SA)

- Cal-Organic Farms(Grimmway Enterprises)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Health-driven consumer demand surge

- 4.2.2 Government conversion subsidies and incentives

- 4.2.3 Price premium boosting farm profitability

- 4.2.4 Retail-led contract farming for organic supply security

- 4.2.5 Adoption of regenerative practices improving organic yields

- 4.2.6 ESG-focused capital favoring climate-resilient organic systems

- 4.3 Market Restraints

- 4.3.1 Higher unit production cost and yield gaps

- 4.3.2 Scarcity of organic-compliant pest-control inputs

- 4.3.3 Certification complexity and audit fatigue for smallholders

- 4.3.4 Export-route carbon-footprint limits on perishables

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Value /Supply Chain Analysis

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Fruits

- 5.1.1 Banana

- 5.1.2 Apple

- 5.1.3 Berries

- 5.1.4 Grapes

- 5.1.5 Kiwi

- 5.1.6 Other Fruits(Passion Fruit, Dragon Fruit, etc.)

- 5.2 By Vegetables

- 5.2.1 Leafy Vegetables

- 5.2.2 Tomato

- 5.2.3 Potato

- 5.2.4 Other Vegetables (Asparagus, Sweet Corn, etc.)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Austria

- 5.3.3.6 Spain

- 5.3.3.7 Belgium

- 5.3.3.8 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 India

- 5.3.4.2 China

- 5.3.4.3 Japan

- 5.3.4.4 Australia

- 5.3.4.5 Rest of Asia-pacific

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Egypt

- 5.3.6.3 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Dole plc

- 6.4.2 Fresh Del Monte Produce Inc.

- 6.4.3 Driscoll's Inc

- 6.4.4 Greenyard

- 6.4.5 Healthy Buddha

- 6.4.6 Calavo Growers Inc.

- 6.4.7 Westfalia Fruit International (Hans Merensky Holdings)

- 6.4.8 Mission Produce Inc.

- 6.4.9 Melinda

- 6.4.10 Zespri International (Grower-Owned Co-operative)

- 6.4.11 Naturipe Farms LLC (MBG Marketing & Hortifrut SA)

- 6.4.12 Cal-Organic Farms(Grimmway Enterprises)

7 Market Opportunities and Future Outlook