PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910600

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910600

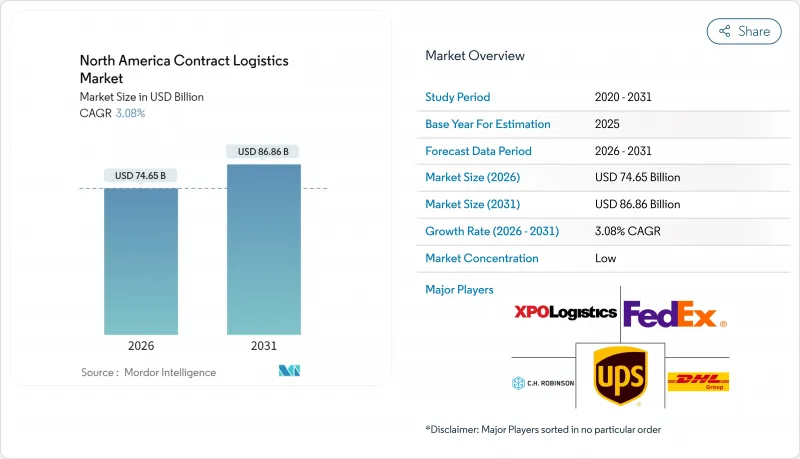

North America Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America Contract Logistics Market was valued at USD 72.42 billion in 2025 and estimated to grow from USD 74.65 billion in 2026 to reach USD 86.86 billion by 2031, at a CAGR of 3.08% during the forecast period (2026-2031).

Growing outsourcing of non-core logistics functions, persistent e-commerce volume spikes, and cross-border integration enabled by the USMCA continue to anchor expansion. Transportation services still dominate spend, but value-added activities-ranging from assembly to labeling-record the briskest growth as shippers search for cost-effective customization near end markets. Stable long-term contracts underpin investment in automation and cold-chain infrastructure, while near-shoring to Mexico drives a fresh wave of distribution-center construction. Competitive intensity is heightening as global integrators consolidate scale and regional specialists carve out technology-rich niches.

North America Contract Logistics Market Trends and Insights

Surging E-commerce Fulfillment Volumes

Retailers now demand robotics-equipped warehouses, real-time visibility, and omnichannel orchestration. FedEx has deployed autonomous mobile robots and high-speed sorters to cope with package complexity, cutting cycle times and lifting throughput. Logistics providers use AI for demand forecasting and inventory positioning, improving last-mile accuracy for direct-to-consumer and B2B flows. Mid-tier 3PLs increasingly win contracts by offering distributed node networks that slash shipping zones. SME shippers, once priced out of complex solutions, plug into cloud-based 3PL portals that bundle WMS, TMS, and rate shopping features at subscription pricing. These shifts direct more revenue toward outsourced partners and reinforce the importance of value-added services within the North America contract logistics market.

Outsourcing Push for Cost-Efficient Asset-Light Models

Shippers restructure balance sheets by monetizing captive logistics assets while 3PLs pick up warehouses, fleets, and talent. The 2024 State of Logistics report noted a robust uptick in contract logistics revenues, eclipsing traditional trucking segments as volatility made guaranteed capacity critical. Longer contracts enable providers to amortize automation investments and devote dedicated labor, producing higher service KPIs for shippers while stabilizing provider cash flows. The trend harmonizes with the North America contract logistics market's steady shift toward hybrid models that blend dedicated assets with brokerage flexibility.

Warehouse Labor Scarcity & Wage Inflation

Providers reported double-digit pay increases for pickers and forklift drivers in 2024 as unemployment dipped and e-commerce labor demand soared. Robotics deployments rose 23%, partially offsetting shortages while raising capex needs. Recruitment incentives, including USD 2,500 signing bonuses, inflate operating costs, but failing to staff facilities risks service penalties. Shippers lacking scale turn to the North America contract logistics market to secure reliable staffing indirectly.

Other drivers and restraints analyzed in the detailed report include:

- USMCA-Led Cross-Border Flow Growth

- Near-Shoring to Mexico Spurring New DC Builds

- Rising Cyber-Insurance Premiums for 3PLs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation contributed 64.35% of 2025 revenue, illustrating freight's irreplaceable role in the North America contract logistics market. Trucking remains the backbone, carrying 72.2% of U.S.-Mexico and 60.1% of U.S.-Canada flows. Rail supports bulk freight and long-haul consumer goods; air caters to high-value SKUs; ocean feeds coastal DCs. The segment's scale endures, yet its growth pace remains modest compared with ancillary offerings.

The value-added cluster-assembly, kitting, labeling-posts a 3.53% CAGR through 2031, outpacing every other category. Manufacturers delegate late-stage customization to 3PLs to shrink finished-goods inventory and sharpen market responsiveness. Ryder's heat-shrinking and blister-sealing lines illustrate how integrated services deepen customer stickiness. Buske Logistics' kitting programs reclaim plant floor space and elevate throughput. As these solutions mature, providers bundle them with conventional warehousing to lift contractual share of wallet, raising the strategic value of the North America contract logistics market size for shippers looking to rationalize vendor rosters.

The North America Contract Logistics Market Report is Segmented by Service Type (Transportation, Warehousing & Distribution, and Value-Added Services), Contract Duration (1-3 Years and Above 3 Years), End-User Industry (Manufacturing & Automotive, Food & Beverage, Retail & E-Commerce, Healthcare & Pharmaceuticals, and More), Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deutsche Post DHL Group

- United Parcel Service Inc.

- FedEx Corp.

- C.H. Robinson Worldwide

- XPO Logistics Inc.

- Kuehne + Nagel International AG

- Ryder System Inc.

- J.B. Hunt Transport Services Inc.

- DSV

- CEVA Logistics

- Geodis

- Penske Logistics Inc.

- Hellmann Worldwide Logistics

- GXO Logistics

- NFI Industries

- Neovia Logistics Services LLC

- Yusen Logistics

- Werner Enterprises

- PiVAL International

- Metro Supply Chain

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging e-commerce fulfilment volumes

- 4.2.2 Outsourcing push for cost & asset-light models

- 4.2.3 USMCA-led cross-border flow growth

- 4.2.4 Near-shoring to Mexico spurring new DC builds

- 4.2.5 SME adoption of AI-enabled 3PL platforms

- 4.2.6 ESG-linked logistics contracts gaining traction

- 4.3 Market Restraints

- 4.3.1 Warehouse labour scarcity & wage inflation

- 4.3.2 Patchy state-level trucking regulations

- 4.3.3 Rising cyber-insurance premiums for 3PLs

- 4.3.4 EV-truck charging gaps limiting green fleets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape (incl. USMCA impact)

- 4.6 Technological Outlook (automation, AI, IoT)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Insights on E-commerce (domestic & cross-border)

- 4.9 Insights on Reverse Logistics

- 4.10 Impact of COVID-19 and Geo-Political Events

5 Market Size & Growth Forecasts

- 5.1 By Service Type

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Warehousing & Distribution

- 5.1.3 Value-added Services (Assembly, Labelling, Kitting)

- 5.1.1 Transportation

- 5.2 By Contract Duration

- 5.2.1 1 - 3 Years

- 5.2.2 Above 3 years

- 5.3 By End-user Industry

- 5.3.1 Manufacturing & Automotive

- 5.3.2 Food & Beverage

- 5.3.3 Retail & E-commerce

- 5.3.4 Healthcare & Pharmaceuticals

- 5.3.5 Chemicals

- 5.3.6 Other Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Deutsche Post DHL Group

- 6.4.2 United Parcel Service Inc.

- 6.4.3 FedEx Corp.

- 6.4.4 C.H. Robinson Worldwide

- 6.4.5 XPO Logistics Inc.

- 6.4.6 Kuehne + Nagel International AG

- 6.4.7 Ryder System Inc.

- 6.4.8 J.B. Hunt Transport Services Inc.

- 6.4.9 DSV

- 6.4.10 CEVA Logistics

- 6.4.11 Geodis

- 6.4.12 Penske Logistics Inc.

- 6.4.13 Hellmann Worldwide Logistics

- 6.4.14 GXO Logistics

- 6.4.15 NFI Industries

- 6.4.16 Neovia Logistics Services LLC

- 6.4.17 Yusen Logistics

- 6.4.18 Werner Enterprises

- 6.4.19 PiVAL International

- 6.4.20 Metro Supply Chain

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

8 Appendix

- 8.1 GDP Distribution by Activity

- 8.2 Capital Flows Insights

- 8.3 External Trade Statistics