PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910708

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910708

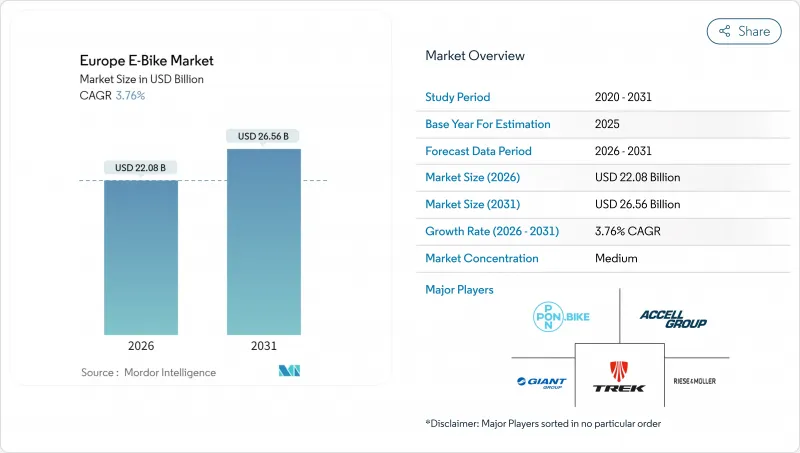

Europe E-Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European e-bike market is expected to grow from USD 21.28 billion in 2025 to USD 22.08 billion in 2026 and is forecast to reach USD 26.56 billion by 2031 at 3.76% CAGR over 2026-2031.

Healthy underlying demand from corporate fleets, last-mile logistics, and commuter substitution offsets the post-pandemic inventory correction. Expansion of protected cycle networks, the five-year extension of anti-dumping duties on Chinese e-bikes, and battery technology upgrades collectively sustain pricing power and shield margins. Leasing models that convert large one-time purchases into predictable operating expenses accelerate penetration among employers, while localized EU manufacturing mitigates tariff risk and shortens lead times. Gradual regulatory alignment on speed-pedelecs, combined with solid-state micro-battery breakthroughs, is expected to widen the total addressable base for higher-performance models.

Europe E-Bike Market Trends and Insights

Corporate Bike-Leasing Boom

Tax-advantaged leasing turns e-bikes into employee benefits rather than discretionary buys. Payroll deductions cut effective outlay by 30-50% and open premium tiers without sticker shock. Fleets give OEMs volume visibility, enabling just-in-time production and lower inventory risk. Platforms like NAVIT unify cross-border HR rules, accelerating rollouts in France and the Netherlands under tight labor markets.

Purchase Subsidies and Tax Incentives

Generous national and municipal incentives compress effective prices and pull demand forward. France still grants up to EUR 4,000 (~USD 4,646) per unit, the Netherlands lets employers depreciate e-bike costs, and Belgium couples payroll credits with leases, slicing significant savings from sticker prices. Because renewals follow predictable cycles, manufacturers time production runs to subsidy windows, smoothing inventories and protecting mid-range volume tiers. These measures sustain growth.

High Upfront Cost vs Acoustic Bikes

Average prices are significantly higher, commanding a substantial premium over conventional bicycles. Even after a German price retreat, entry models rarely dip, while high battery replacements add lifetime expense. Eastern European households, with lower median wages, feel the gap most, slowing mainstream adoption despite better infrastructure. Financing helps, yet cultural resistance to consumer credit leaves many buyers waiting for price cuts or income growth.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Last-Mile E-Cargo Fleets

- Protected Bicycle-Lane Expansion

- Dealer Inventory Write-Downs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The European e-bike market size for pedal-assist propulsion accounted for 77.35% share in 2025. Pedal-assist thrives on regulatory simplicity and a familiar ride feel, anchoring commuter and leisure volumes. Speed-pedelecs outpaced all categories at 3.88% CAGR, leveraging commuter appetite for 45 km/h capability and fleet demand for quicker deliveries.

Regulatory convergence remains the swing factor: draft EU proposals aiming to synchronize helmet and path-access rules could unlock scale manufacturing and lower unit costs. Riese & Muller's forthcoming Pinion-equipped models reflect OEM bets on premium speed-pedelec expansion . As insurance products mature and infrastructure adapts, the propulsion mix is likely to tilt gradually toward higher-power classes.

City/urban commuting generated 73.62% of the European e-bike market share in 2025, because e-bikes excel on sub-10 km trips where parking scarcity and congestion charges penalize cars. Cargo/utility formats, purpose-built with long racks or boxes, expand at a 3.84% CAGR as retailers, couriers, and young families replace second cars. Family cargo variants with dual-child seating broaden the appeal beyond couriers, substituting short car trips and capturing sustainability-minded parents. OEMs redesign frames for 200 kg payloads without exceeding 250 W legal limits, further blurring lines between personal and commercial use.

Trekking and mountain bikes command premium ASPs through rugged frames, dual batteries, and high-torque motors, but remain limited by discretionary budgets and seasonal weather. Municipal climate plans and last-mile contracts tilt R&D toward payload optimization, regenerative braking, and modular accessories that transform bikes from leisure gear into professional equipment.

Lithium-ion holds 99.86% of the European e-bike market share in 2025, anchoring market size through cost erosion and energy-density gains. Continuous chemistry tweaks, shift toward nickel-manganese-cobalt blends or LFP for cost stability, drive incremental 3.76% CAGR, mirroring total market.

Lead-acid survives only in replacement sales and ultra-budget imports. Pilot fleets with lithium-carbon or semi-solid packs promise 15-20% faster charging and better low-temperature resilience. Until solid-state gigafactories scale, incremental gains in housing design, BMS algorithms, and recycled-content cathodes will lengthen warranties and lift resale values, keeping lithium-ion unchallenged during the forecast window.

The Europe E-Bike Market Report is Segmented by Propulsion Type (Pedal Assisted, Speed Pedelec, and More), Application Type (Cargo/Utility, City/Urban, and More), Battery Type (Lead-Acid Battery, Lithium-Ion Battery, and More), Motor Placement (Hub (Front/Rear), Mid-Drive), Drive Systems, Motor Power, Price Band, Sales Channel, End Use, and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Accell Group

- Pon Holdings B.V.

- Giant Manufacturing Co. Ltd.

- Trek Bicycle Corporation

- Riese & Muller GmbH

- Brompton Bicycle Limited

- CUBE Bikes

- Yamaha Motor Co., Ltd.

- Merida Industry Co. Ltd.

- VanMoof BV

- Volt Electric Bikes

- Pedego Electric Bikes

- KTM Fahrrad GmbH

- Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Report Offers

3 Introduction

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 Key Industry Trends

- 4.1 Annual Bicycle Sales

- 4.2 Average Selling Price & Price-Band Mix

- 4.3 Cross-Border Trade in E-Bikes & Parts

- 4.4 E-Bike Share of Total Bicycle Sales

- 4.5 5-15 km Commuter Share

- 4.6 Bicycle/E-Bike Rental Market Size

- 4.7 E-Bike Battery Pack Price

- 4.8 Battery Chemistry Price Comparison

- 4.9 Last-Mile Delivery Volume

- 4.10 Protected Bicycle Lanes (km)

- 4.11 Trekking/Outdoor Activity Participation

- 4.12 E-Bike Battery Capacity (Wh)

- 4.13 Urban Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.14.1 Homologation & Certification

- 4.14.2 Export-Import & Trade Rules

- 4.14.3 Classification & Road-Access Rules

- 4.14.4 Battery & Charger Safety

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Corporate Bike-Leasing Boom

- 5.2.2 Purchase Subsidies and Tax Incentives

- 5.2.3 Growth of Last-Mile E-Cargo Fleets

- 5.2.4 Protected Bicycle-Lane Expansion

- 5.2.5 Regionalized EU Manufacturing Shift

- 5.2.6 Solid-State Micro-Battery Advances

- 5.3 Market Restraints

- 5.3.1 High Upfront Cost vs Acoustic Bikes

- 5.3.2 Dealer Inventory Write-Downs

- 5.3.3 Speed-Pedelec Regulatory Grey-Zones

- 5.3.4 Tariff Volatility on Chinese Inputs

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Industry Rivalry

- 5.8 Pricing Analysis

6 Market Segmentation Analysis (Market Size & Growth Forecasts -Value (USD) and Volume (Units))

- 6.1 By Propulsion Type

- 6.1.1 Pedal Assisted

- 6.1.2 Speed Pedelec

- 6.1.3 Throttle Assisted

- 6.2 By Application Type

- 6.2.1 Cargo / Utility

- 6.2.2 City / Urban

- 6.2.3 Trekking / Mountain

- 6.3 By Battery Type

- 6.3.1 Lead-Acid Battery

- 6.3.2 Lithium-ion Battery

- 6.3.3 Others

- 6.4 By Motor Placement

- 6.4.1 Hub (Front / Rear)

- 6.4.2 Mid-Drive

- 6.5 By Drive Systems

- 6.5.1 Chain Drive

- 6.5.2 Belt Drive

- 6.6 By Motor Power

- 6.6.1 Below 250 W

- 6.6.2 251-350 W

- 6.6.3 351-500 W

- 6.6.4 501-600 W

- 6.6.5 Above 600 W

- 6.7 By Price Band

- 6.7.1 Less than/Equals USD 1,000

- 6.7.2 USD 1,000-1,499

- 6.7.3 USD 1,500-2,499

- 6.7.4 USD 2,500-3,499

- 6.7.5 USD 3,500-5,999

- 6.7.6 Greater than/Equals USD 6,000

- 6.8 By Sales Channel

- 6.8.1 Online

- 6.8.2 Offline

- 6.9 By End Use

- 6.9.1 Commercial Delivery

- 6.9.1.1 Retail and Goods Delivery

- 6.9.1.2 Food and Beverage Delivery

- 6.9.2 Service Providers

- 6.9.3 Personal and Family Use

- 6.9.4 Institutional

- 6.9.5 Others

- 6.9.1 Commercial Delivery

- 6.10 By Country

- 6.10.1 Germany

- 6.10.2 Netherlands

- 6.10.3 France

- 6.10.4 Italy

- 6.10.5 Spain

- 6.10.6 United Kingdom

- 6.10.7 Switzerland

- 6.10.8 Austria

- 6.10.9 Belgium

- 6.10.10 Denmark

- 6.10.11 Sweden

- 6.10.12 Norway

- 6.10.13 Poland

- 6.10.14 Czech Republic

- 6.10.15 Portugal

- 6.10.16 Rest of Europe

7 Competitive Landscape

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 7.3.1 Accell Group

- 7.3.2 Pon Holdings B.V.

- 7.3.3 Giant Manufacturing Co. Ltd.

- 7.3.4 Trek Bicycle Corporation

- 7.3.5 Riese & Muller GmbH

- 7.3.6 Brompton Bicycle Limited

- 7.3.7 CUBE Bikes

- 7.3.8 Yamaha Motor Co., Ltd.

- 7.3.9 Merida Industry Co. Ltd.

- 7.3.10 VanMoof BV

- 7.3.11 Volt Electric Bikes

- 7.3.12 Pedego Electric Bikes

- 7.3.13 KTM Fahrrad GmbH

- 7.3.14 Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)

8 Key Strategic Questions for E-Bikes CEOs