PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911744

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911744

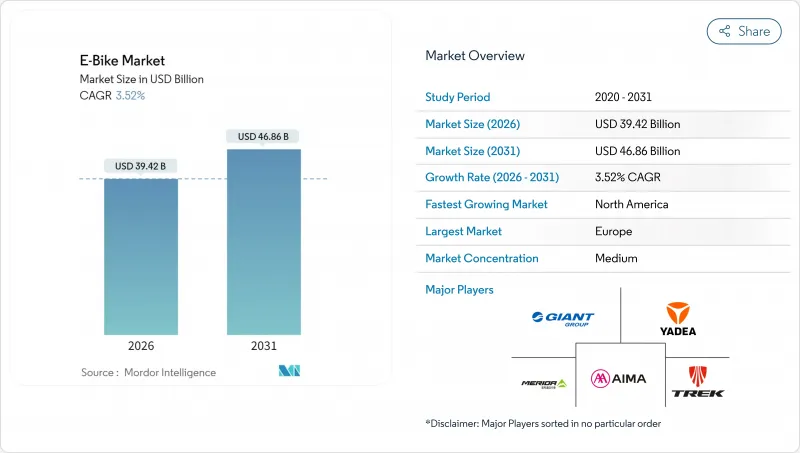

E-Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

e-bike market size in 2026 is estimated at USD 39.42 billion, growing from 2025 value of USD 38.08 billion with 2031 projections showing USD 46.86 billion, growing at 3.52% CAGR over 2026-2031.

The measured expansion reflects the transition from early adoption to mainstream use as corporate leasing schemes now give employees access to salary-sacrifice bikes. Demand is tilting toward premium models priced USD 3,500-5,999, the fastest-growing band, while targeted subsidies-France's EUR 4,000 (~USD 4,622) incentive and Poland's PLN 300 million (~USD 81 million) program-continue to widen the addressable base. Battery technology remains a cornerstone; lithium-ion captures a major share, yet sodium-ion and solid-state chemistries are lining up to ease China-centric raw-material risk.

Global E-Bike Market Trends and Insights

Urban Congestion Driving Micro-Mobility

Parking spaces in tier-1 cities cost as high as USD 30,000, making e-bikes a cost-efficient commute tool over 5-15 km trips-the distance that accounts for 40% of urban journeys. London's ULEZ expansion, plus GBP 7,000 (~USD 9,319) scrappage grants, has accelerated uptake among couriers, while companies such as Amazon and Google subsidize monthly e-bike subscriptions to ease parking stress and hit sustainability targets .

Li-ion Battery Energy-Density and Cost Declines

Lithium-ion pack prices have declined significantly since 2010, moving 100+ km range bikes under the USD 2,000 mark. Fast-charge designs now reach 80% in 30 minutes, opening doors for high-utilization commercial fleets. Sodium-ion prototypes promise similar cycle life at 30% reduced cost, while solid-state roadmaps target 2X energy density by 2028.

Battery-Fire Incidents and Stricter Safety Norms

NYC recorded 187 e-mobility fires in 2023, lifting four-year costs to USD 518.6 million. California's SB 1271 and the UL 2849 standard now require certified packs, adding USD 200-500 per unit. Manufacturers are investing in thermal management and remote diagnostics to keep pace.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives and Purchase Subsidies

- Corporate Employee E-Bike Benefit Programs

- High Upfront Cost vs. Conventional Bikes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The market size for pedal-assist models reached a commanding 78.90% share in 2025, benefiting from favorable EU regulations that classify them as bicycles. Speed-pedelec variants, offering assistance up to 45 km/h, are charting a 4.02% CAGR as commuters seek car-like travel times in dense cities.

Manufacturers are layering AI algorithms onto motor controllers to optimize output by terrain and rider habits. Shimano's forthcoming automatic-shift drivetrain illustrates how suppliers bundle smart gearboxes with high-torque motors, strengthening their appeal among urban professionals.

City/urban bikes generated 76.05% of the market share in 2025 as urban riders opted for sweat-free commuting. Trekking/mountain models, however, are advancing at 3.65% CAGR, spurred by tour operators that now default to e-assisted fleets.

Operators see expanded demographics, older cyclists and mixed-fitness groups, as key growth levers. As trail access rules evolve, the segment is poised for further penetration into national parks and resort destinations.

Lithium-ion cells controlled 98.41% of the e-bike market share in 2025, underlining cost leadership and energy density. The "Others" bucket, housing sodium-ion and early solid-state prototypes, is growing at 4.32% CAGR as brands hedge raw-material exposure.

OEMs are dual-sourcing prismatic and cylindrical formats to mitigate China-centric processing. Should sodium-ion hit expected price parity by 2027, the chemistry could siphon double-digit share from legacy packs.

The Global E-Bike Market Report is Segmented by Propulsion Type (Pedal Assisted, Speed Pedelec, and More), Application Type (Cargo/Utility, City/Urban, and More), Battery Type (Lead Acid Battery, Lithium-Ion Battery, and More), Motor Placement (Hub (Front/Rear), Mid-Drive), Drive Systems, Motor Power, Price Band, Sales Channel, End Use, and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Europe retained 54.80% of the 2025 e-bike market revenue. Germany alone has 15.7 million units in circulation and sold 2.1 million in 2024, helped by salary-sacrifice programs covering several workers . The Netherlands shows saturation traits, with e-bikes normalized across age groups, while France's EUR 4,000 (~USD 4,622) low-income grant keeps funneling new buyers. Continuous path networks and bicycle-first urban planning remain Europe's durable competitive edge.

North America, though smaller today, is the quickest-growing region at 7.19% CAGR. State rebates of up to USD 1,750 in California and New York, alongside corporate stipends, are unlocking latent demand. Canada's CAD 400 million (~USD 286 million) infrastructure rollout links e-bike lanes to charging nodes, creating end-to-end fleets for commuters and delivery riders alike.

Asia-Pacific reflects a tapestry of conditions. China supplies a major share of e-bike imports in the United States and posted notable export receipts in 2024. India crossed a significant electric two-wheeler mark in 2024, though mopeds still outweigh pedal-assist formats. Japan and South Korea cater to premium, tech-heavy niches, while Australia leans on eco-tourism routes to lift trekking sales. Localized regulation and income profiles dictate tailored channel, price, and specification strategies.

- Aima Technology Group Co., Ltd.

- Canyon Bicycles GmbH

- Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)

- Giant Manufacturing Co., Ltd.

- Jiangsu Xinri E-Vehicle Co., Ltd.

- Luyuan Electric Vehicle Co., Ltd.

- Merida Industry Co., Ltd.

- Myvelo Co., Ltd.

- Rad Power Bikes Inc.

- Riese & Muller GmbH

- Pon Holdings B.V.

- Samchuly Bicycle

- Specialized Bicycle Components, Inc.

- Dongguan Tailing Electric Vehicle Co., Ltd

- Tianjin Fuji-Ta Bicycle Co., Ltd.

- Trek Bicycle Corporation

- VanMoof BV

- Yadea Group Holdings Ltd.

- Yamaha Motor Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Key Industry Trends

- 4.1 Annual Bicycle Sales

- 4.2 Average Selling Price & Price-Band Mix

- 4.3 Cross-Border Trade in E-Bikes & Parts (Imports/Exports)

- 4.4 E-Bike Share of Total Bicycle Sales

- 4.5 Commuters with 5-15 km One-Way Trips (%)

- 4.6 Bicycle/E-Bike Rental Market Size

- 4.7 E-Bike Battery Pack Price

- 4.8 Battery Chemistry Price Comparison

- 4.9 Last-Mile (Hyper-Local) Delivery Volume

- 4.10 Protected Bicycle Lanes (km)

- 4.11 Trekking/Outdoor Activity Participation

- 4.12 E-Bike Battery Capacity (Wh)

- 4.13 Urban Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.14.1 Homologation and Certification of E-Bicycles

- 4.14.2 Export-Import and Trade Regulation

- 4.14.3 Classification, Road Access and User Rules

- 4.14.4 Battery, Charger and Charging Safety

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Urban Congestion Driving Micro-Mobility

- 5.2.2 Li-ion Battery Energy-Density and Cost Declines

- 5.2.3 Government Incentives and Purchase Subsidies

- 5.2.4 Corporate Employee E-Bike Benefit Programs

- 5.2.5 Insurance Discounts for Cargo E-Bikes

- 5.2.6 Growth of E-Bike Tourism Routes

- 5.3 Market Restraints

- 5.3.1 Battery-Fire Incidents and Stricter Safety Norms

- 5.3.2 High Upfront Cost vs. Conventional Bikes

- 5.3.3 Limited Charging Infra in Developing Regions

- 5.3.4 Critical-Mineral Supply Volatility

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Competitive Rivalry

6 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 6.1 By Propulsion Type

- 6.1.1 Pedal Assisted

- 6.1.2 Speed Pedelec

- 6.1.3 Throttle Assisted

- 6.2 By Application Type

- 6.2.1 Cargo/Utility

- 6.2.2 City/Urban

- 6.2.3 Trekking/Mountain

- 6.3 By Battery Type

- 6.3.1 Lead Acid Battery

- 6.3.2 Lithium-ion Battery

- 6.3.3 Others

- 6.4 By Motor Placement

- 6.4.1 Hub (Front/Rear)

- 6.4.2 Mid-Drive

- 6.5 By Drive Systems

- 6.5.1 Chain Drive

- 6.5.2 Belt Drive

- 6.6 By Motor Power

- 6.6.1 Below 250 W

- 6.6.2 251-350 W

- 6.6.3 351-500 W

- 6.6.4 501-600 W

- 6.6.5 Above 600 W

- 6.7 By Price Band

- 6.7.1 Up to USD 1,000

- 6.7.2 USD 1,000-1,499

- 6.7.3 USD 1,500-2,499

- 6.7.4 USD 2,500-3,499

- 6.7.5 USD 3,500-5,999

- 6.7.6 Above USD 6,000

- 6.8 By Sales Channel

- 6.8.1 Online

- 6.8.2 Offline

- 6.9 By End Use

- 6.9.1 Commercial Delivery

- 6.9.1.1 Retail and Goods Delivery

- 6.9.1.2 Food and Beverage Delivery

- 6.9.2 Service Providers

- 6.9.3 Personal and Family Use

- 6.9.4 Institutional

- 6.9.5 Others

- 6.9.1 Commercial Delivery

- 6.10 By Geography

- 6.10.1 North America

- 6.10.1.1 United States

- 6.10.1.2 Canada

- 6.10.1.3 Rest of North America

- 6.10.2 South America

- 6.10.2.1 Argentina

- 6.10.2.2 Brazil

- 6.10.2.3 Rest of South America

- 6.10.3 Europe

- 6.10.3.1 Germany

- 6.10.3.2 United Kingdom

- 6.10.3.3 France

- 6.10.3.4 Italy

- 6.10.3.5 Spain

- 6.10.3.6 Netherlands

- 6.10.3.7 Austria

- 6.10.3.8 Sweden

- 6.10.3.9 Switzerland

- 6.10.3.10 Rest of Europe

- 6.10.4 Asia-Pacific

- 6.10.4.1 China

- 6.10.4.2 India

- 6.10.4.3 Japan

- 6.10.4.4 South Korea

- 6.10.4.5 Australia

- 6.10.4.6 New Zealand

- 6.10.4.7 Rest of Asia-Pacific

- 6.10.5 Middle East and Africa

- 6.10.5.1 Saudi Arabia

- 6.10.5.2 United Arab Emirates

- 6.10.5.3 South Africa

- 6.10.5.4 Rest of the Middle East and Africa

- 6.10.1 North America

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 7.4.1 Aima Technology Group Co., Ltd.

- 7.4.2 Canyon Bicycles GmbH

- 7.4.3 Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)

- 7.4.4 Giant Manufacturing Co., Ltd.

- 7.4.5 Jiangsu Xinri E-Vehicle Co., Ltd.

- 7.4.6 Luyuan Electric Vehicle Co., Ltd.

- 7.4.7 Merida Industry Co., Ltd.

- 7.4.8 Myvelo Co., Ltd.

- 7.4.9 Rad Power Bikes Inc.

- 7.4.10 Riese & Muller GmbH

- 7.4.11 Pon Holdings B.V.

- 7.4.12 Samchuly Bicycle

- 7.4.13 Specialized Bicycle Components, Inc.

- 7.4.14 Dongguan Tailing Electric Vehicle Co., Ltd

- 7.4.15 Tianjin Fuji-Ta Bicycle Co., Ltd.

- 7.4.16 Trek Bicycle Corporation

- 7.4.17 VanMoof BV

- 7.4.18 Yadea Group Holdings Ltd.

- 7.4.19 Yamaha Motor Co., Ltd.

8 Market Opportunities & Future Outlook

9 Key Strategic Questions for E-Bikes CEOs