PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910827

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910827

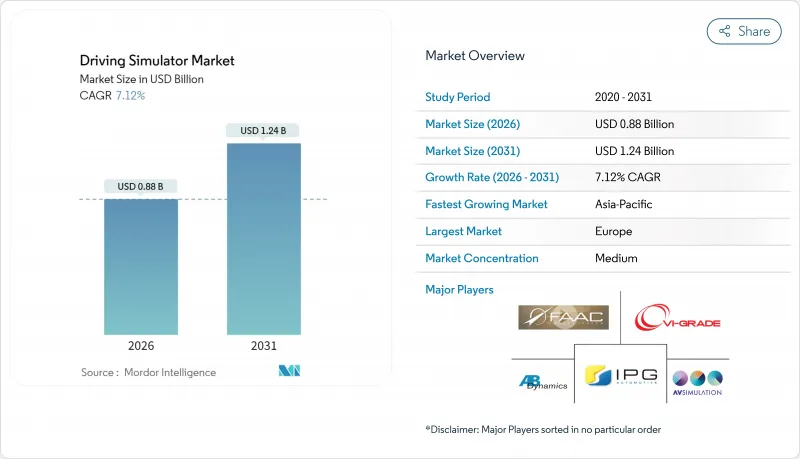

Driving Simulator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Driving Simulator Market was valued at USD 0.82 billion in 2025 and estimated to grow from USD 0.88 billion in 2026 to reach USD 1.24 billion by 2031, at a CAGR of 7.12% during the forecast period (2026-2031).

This steady rise stems from regulatory pressure for safer driver certification, the need to cut prototype testing costs, and the alignment of autonomous-vehicle roadmaps with virtual validation mandates. Commercial fleets turn to advanced simulators to shorten recruitment cycles, while carmakers channel research budgets toward software-in-the-loop test beds that complement physical tracks. Subscription-based, cloud-hosted platforms broaden access in cost-sensitive regions and nurture new user segments. Europe keeps its lead on account of a mature automotive ecosystem, but Asia-Pacific contributes the largest incremental revenue as China and India expand logistics networks. Competitive advantage now flows to providers that fuse digital-twin maps, over-the-air software verification, and hardware-agnostic motion cueing, although high capital outlays, motion-sickness risks, and rising cyber-security alerts hold back smaller adopters.

Global Driving Simulator Market Trends and Insights

ADAS/AV Validation Needs Surge

Tougher homologation rules now insist on billions of virtual test miles before autonomous functions reach public roads. Euro NCAP and NHTSA protocols released in 2024 pair track runs with simulation, turning high-fidelity rigs into compliance gates. The IEEE forecasts over a billion dollar autonomous-driving simulation niche by 2030, underscoring how carmakers rely on digital twins to probe edge cases unreachable on open roads. Platforms integrating real-world sensor logs with scalable scenario engines let engineers shorten iteration loops and trim prototype fleets. As software updates move over the air, virtual regression testing becomes mandatory, anchoring steady demand for the driving simulator market. Vendors that wrap scenario libraries, physics engines, and data-fusion interfaces into one stack now win more RFQs from tier-1 suppliers.

E-Commerce Boom Raising Truck-Driver Training Demand

Online retail pushes parcel volumes upward, straining freight capacity. Carriers such as UPS and Fremont Contract Carriers equip classrooms with motion-based simulators and report accident reductions alongside faster rookie onboarding. The Nebraska Trucking Association's mobile units bring training to remote colleges, easing the rural talent gap. Repeatable hazard scenarios help fleets meet insurance audits and qualify recruits within weeks, boosting uptake. This commercial pull offsets slower growth in consumer driver-ed programs and keeps the driving simulator market momentum above one-tenth in the short term.

High Capex Of Full-Motion Systems

Eight-axis motion bases, panoramic domes, and purpose-built halls push acquisition costs beyond the reach of many vocational centers. Europe's Stuttgart Driving Simulator illustrates the real-estate and maintenance footprint such rigs require. Financing hurdles prolong payback periods, especially where tuition fees are regulated. Emerging-market buyers often defer purchases or settle for static cockpits, tempering volume growth for premium hardware in the driving simulator market.

Other drivers and restraints analyzed in the detailed report include:

- Road-Safety Regulations & Driver-Licensing Reforms

- Digital-Twin Integration For OTA Software Regression

- Motion-Sickness & Fidelity Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger-car simulators still dominate with 59.88% of the driving simulator market share in 2025, serving both novice driver education and OEM R&D, but growth moderates as consumer licensing boards limit simulator substitution. The divergence in uptake illustrates how logistics digitization reshapes simulator demand patterns. Commercial vehicles accounted for a smaller revenue base in 2025, yet their 7.14% CAGR makes them the primary engine of future expansion for the driving simulator market. Fleet managers deploy simulators to cut per-driver training costs, keep rigs on the road, and satisfy stricter hours-of-service audits. Telematics integration further links in-cab behavior with classroom refreshers.

The commercial-vehicle push stimulates peripheral services scenario library customization for hazmat routes, multi-language UI overlays, and remote instructor stations. Vendors leveraging modular cockpits and cloud rendering penetrate small and mid-sized transport operators previously priced out. Meanwhile, passenger-car programs focus on human-machine interface testing for next-gen infotainment, a niche that commands higher margins but fewer seats. Suppliers that craft dual-purpose architectures, swappable dashboards, and adaptable software stacks retain cross-segment flexibility in the driving simulator market.

Training held 50.72% of the driving simulator market size in 2025 due to entrenched driver-ed curricula and corporate compliance needs. Yet the 7.21% CAGR logged by testing and research signals a structural pivot. Automakers wanting to shorten release cycles channel budgets toward software-dominated validation, where virtual miles are cheaper than track miles. Growth also comes from regulatory labs conducting crash-avoidance verification under controlled, repeatable conditions.

Training demand remains resilient, particularly in regions where road congestion and fuel prices make real-world lessons inefficient. Virtual-reality headsets and adaptive AI tutors personalize modules, boosting learner retention. Still, budget-sensitive schools adopt a wait-and-see stance on replacing entire fleets of conventional cars. Providers hedge by offering mixed-use licenses that toggle between test automation scripts and classroom content, increasing seat utilization and diversifying revenue in the driving simulator market.

The Driving Simulator Market Report is Segmented by Vehicle Type (Passenger Car and Commercial Vehicle), Application (Training and Testing & Research), Simulator Type (Compact Simulator and More), End-User (Driving Schools & Training Centers and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East & Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe preserved a 36.22% share of the driving simulator market in 2025 on the strength of its dense testing circuits, harmonized safety rules, and R&D tax incentives. Carmakers in Germany, France, and Sweden run integrated simulation pipelines that feed regulatory dossiers, ensuring a steady hardware refresh cycle. National transport ministries pilot simulator-based licensing updates, keeping public procurement programs alive even as private budgets fluctuate.

Asia-Pacific, advancing at a 7.17% CAGR, adds the most new seats. China funnels smart-city budgets into autonomous shuttle pilots, while India scales truck-driver academies to plug chronic labor gaps. Cloud-rendered solutions bypass infrastructure bottlenecks, letting institutes deploy laptop-controlled cockpits in temporary classrooms. Japan's well-established automotive sector focuses on scenario libraries that represent complex urban intersections, reinforcing upstream software demand in the driving simulator market.

North America benefits from structured federal guidelines covering commercial-driver qualifications and an early culture of simulator adoption in aviation and defense. Large freight haulers invest in networked fleets of rigs across regional hubs, leveraging centralized content pushes. Latin America and the Middle East remain smaller consumers, yet oil-and-gas convoy operators in the Gulf show rising interest, signaling wider geographic penetration ahead.

- AB Dynamics plc

- VI-grade GmbH

- IPG Automotive GmbH

- Ansible Motion Ltd

- Cruden BV

- AutoSim AS

- AVSimulation

- Virage Simulation Inc.

- Tecknotrove Simulator Systems Pvt Ltd

- XPI Simulation

- FAAC Incorporated

- Moog Inc.

- Mechanical Simulation Corp.

- CAE Inc.

- Thales Group

- Bosch Rexroth AG

- Dassault Systemes SE

- Applied Intuition Inc.

- Exail Technologies SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 ADAS/AV Validation Needs Surge

- 4.2.2 E-Commerce Boom Raising Truck-Driver Training Demand

- 4.2.3 Road-Safety Regulations & Driver-Licensing Reforms

- 4.2.4 Cloud "Simulator-As-A-Service" Lowering Capex

- 4.2.5 Insurance-Linked Premium Discounts For Simulator-Certified Fleets

- 4.2.6 Digital-Twin Integration For OTA Software Regression

- 4.3 Market Restraints

- 4.3.1 High Capex Of Full-Motion Systems

- 4.3.2 Motion-Sickness & Fidelity Limitations

- 4.3.3 Shortage Of Scenario-Content Developers

- 4.3.4 Cyber-Security Risk In Networked Simulators

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Application

- 5.2.1 Training

- 5.2.2 Testing & Research

- 5.3 By Simulator Type

- 5.3.1 Compact Simulator

- 5.3.2 Full-Scale Simulator

- 5.3.3 Advanced Simulator

- 5.4 By End-User

- 5.4.1 Driving Schools & Training Centers

- 5.4.2 Automotive OEMs

- 5.4.3 Fleet Operators & Logistics

- 5.4.4 Academic & Research Institutions

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 AB Dynamics plc

- 6.4.2 VI-grade GmbH

- 6.4.3 IPG Automotive GmbH

- 6.4.4 Ansible Motion Ltd

- 6.4.5 Cruden BV

- 6.4.6 AutoSim AS

- 6.4.7 AVSimulation

- 6.4.8 Virage Simulation Inc.

- 6.4.9 Tecknotrove Simulator Systems Pvt Ltd

- 6.4.10 XPI Simulation

- 6.4.11 FAAC Incorporated

- 6.4.12 Moog Inc.

- 6.4.13 Mechanical Simulation Corp.

- 6.4.14 CAE Inc.

- 6.4.15 Thales Group

- 6.4.16 Bosch Rexroth AG

- 6.4.17 Dassault Systemes SE

- 6.4.18 Applied Intuition Inc.

- 6.4.19 Exail Technologies SA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment