PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910896

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910896

Latin America Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

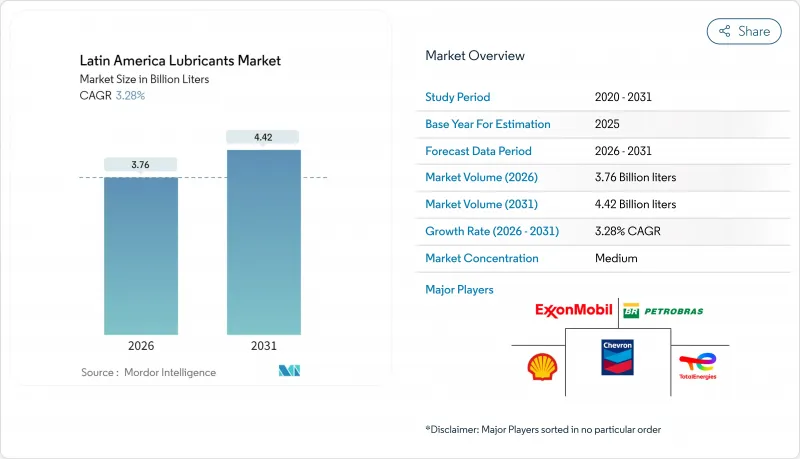

The Latin America Lubricants Market is expected to grow from 3.64 Billion liters in 2025 to 3.76 Billion liters in 2026 and is forecast to reach 4.42 Billion liters by 2031 at 3.28% CAGR over 2026-2031.

Expansion is anchored in industrial recovery, a rising vehicle parc, and renewed capital spending across mining, power, and nearshoring-led manufacturing. Petrobras' USD 111 billion investment plan, which includes a Group II base-oil unit, secures regional feedstock and lowers import reliance. Mexico's nearshoring wave, expected to draw USD 46 billion through 2029, accelerates lubricant demand in fast-growing manufacturing clusters. Meanwhile, the continent's emergence as a key offshore drilling arena, with 10 of 36 global high-impact wells slated for 2024, stimulates specialized drilling-fluid use. Lastly, a dual energy matrix, where fossil fuels supply two-thirds of total energy yet renewables deliver 60% of electricity, creates overlapping needs for both conventional and advanced synthetic lubricants.

Latin America Lubricants Market Trends and Insights

Vehicle-parc Expansion and Ageing Fleet

Brazilian auto production grew 9.7% in 2024, returning to pre-pandemic output and signaling robust lubricant pull-through as older vehicles require shorter drain intervals and consume 15-20% more engine oil. Mexico's export-led manufacturing base has added commercial trucks that heighten demand for hydraulic fluids and gear oils. Across the continent, vehicles older than 10 years already represent over half of the total fleet, locking in a steady service-fill requirement. The Latin America lubricants market therefore enjoys durable demand even as electrification gains momentum because turnover cycles span 15-20 years. Blenders increasingly formulate mid-tier synthetics aimed at aging engines in cost-sensitive segments, preserving volume while upselling performance.

Manufacturing and Industrial Capex Rebound

A nearshoring-fueled revival in Mexican industrial output is pushing vacancy rates to historic lows and inflating demand for metalworking fluids in newly commissioned plants. Brazil's 1.4% liquid-fuel demand upturn in 2025 confirms a broader industrial rebound that requires hydraulic oils for process equipment. The Latin America lubricants market benefits from project pipelines in petrochemicals, cement, and steel, each seeking productivity gains through high-viscosity-index base stocks. Local blending incentives in Brazil and Mexico further stimulate domestic additive consumption, shortening lead times and buffering global supply shocks. Industrial users, in turn, embrace condition-monitoring programs that raise the share of synthetics in total lubricant spend.

EV Penetration Curbing Engine-oil Demand

Twenty-seven Latin American nations have enshrined transport electrification targets under the Paris Agreement, triggering city-bus fleet conversions in Bogota and Mexico City. Electric drivetrains do not use crankcase oils, shaving volume off urban service bays. Yet the new battery-coolant and reduction-gear fluid niches partly compensate by introducing synthetic esters that must dissipate heat while conducting minimal electricity. Uptake outside large cities remains slow due to limited charging infrastructure, keeping internal-combustion engines dominant through most of this decade. Consequently, the Latin America lubricants market expects a gradual, not abrupt, transition toward EV-ready fluids.

Other drivers and restraints analyzed in the detailed report include:

- High-performance Synthetics for Mining and Energy

- Local Blending-plant Incentives

- Longer Drain-intervals for Premium Lubricants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine oils accounted for 57.05% of the Latin America lubricants market share in 2025, propelled by sustained ICE dominance and a fleet whose average age tops 12 years. Volumes correlate closely with Brazil's production uptick and Mexico's trucking expansion, while multigrade formulations capture share from monogrades due to improved cold-start protection. Transmission and gear oils piggyback on commercial-vehicle proliferation, whereas hydraulic fluids supply a mining sector operating across harsh altitudes in Chile and Peru. Metalworking fluids enjoy a tailwind from nearshoring investments that double Mexican industrial space compared with 2019 levels.

Other Product Types represent the fastest-growing category, clocking a 3.74% CAGR to 2031 as renewable-energy projects and precision manufacturing seek niche formulations. Wind-turbine gearboxes rely on PAO-ester blends offering more than 10,000-hour service life, while solar-tracker actuators need low-temperature greases. Lithium-free polyurea and calcium-sulfonate complex greases gain traction on cost and performance grounds. Electric-vehicle coolant growth, though nascent, seeds future demand for high-dielectric fluids. The Latin America lubricants market size for specialty grades, therefore, advances faster than overall consumption as equipment complexity rises.

The Latin America Lubricants Report is Segmented by Product Type (Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, and More), End-User Industry (Automotive, Power Generation, Heavy Equipment, Metallurgy and Metalworking, and Other End-User Industries), and Geography (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Rest of Latin America). The Market Forecasts are Provided in Terms of Volume (Liters).

List of Companies Covered in this Report:

- BP p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

- GULF OIL INTERNATIONAL LIMITED

- Motul

- Petrobras

- Repsol

- Roshfrans

- Shell plc

- TotalEnergies

- Valvoline Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Vehicle-Parc Expansion and Ageing Fleet

- 4.2.2 Manufacturing and Industrial Capex Rebound

- 4.2.3 High-Performance Synthetics for Mining and Energy

- 4.2.4 E-Commerce Last-Mile Fleet Boom

- 4.2.5 Local Blending-Plant Incentives

- 4.3 Market Restraints

- 4.3.1 EV Penetration Curbing Engine-Oil Demand

- 4.3.2 Longer Drain-Intervals for Premium Lubes

- 4.3.3 Additive-Package Supply Bottlenecks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oils

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Metalworking Fluids

- 5.1.5 Greases

- 5.1.6 Other Product Types

- 5.2 By End-User Industry

- 5.2.1 Automotive

- 5.2.2 Power Generation

- 5.2.3 Heavy Equipment

- 5.2.4 Metallurgy and Metalworking

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Mexico

- 5.3.3 Argentina

- 5.3.4 Colombia

- 5.3.5 Chile

- 5.3.6 Peru

- 5.3.7 Rest of Latin America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BP p.l.c.

- 6.4.2 Chevron Corporation

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 GULF OIL INTERNATIONAL LIMITED

- 6.4.5 Motul

- 6.4.6 Petrobras

- 6.4.7 Repsol

- 6.4.8 Roshfrans

- 6.4.9 Shell plc

- 6.4.10 TotalEnergies

- 6.4.11 Valvoline Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment