PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910930

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910930

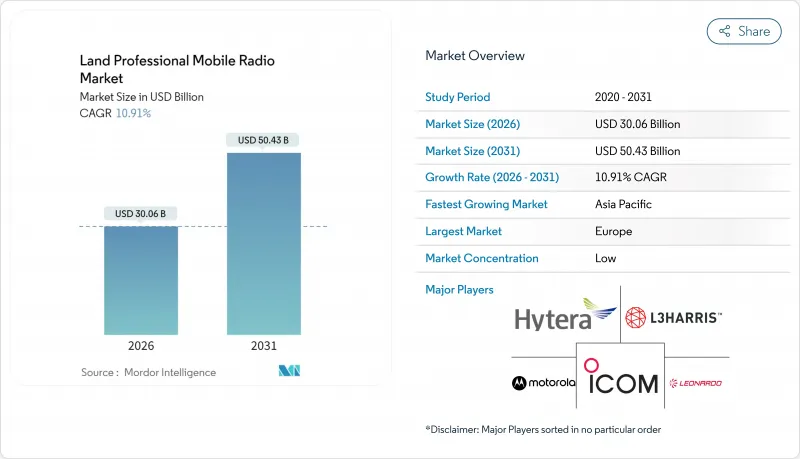

Land Professional Mobile Radio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Land Professional Mobile Radio Market was valued at USD 27.10 billion in 2025 and estimated to grow from USD 30.06 billion in 2026 to reach USD 50.43 billion by 2031, at a CAGR of 10.91% during the forecast period (2026-2031).

Continued analog-to-digital migration, higher spectrum efficiencies, and 5G-enabled backhaul integration are accelerating system replacements across public safety, transport, utilities, and industrial users. Adoption momentum is reinforced by national interoperability mandates, rising climate-driven disaster response requirements, and the growing need for secure voice and data in field operations. Vendors differentiate through software-defined architectures, AI-assisted features, and multi-band capabilities that future-proof investments while easing integration with private LTE and MC-X platforms. Heightened cyber-risk awareness further pushes agencies toward encrypted digital protocols that meet evolving compliance standards.

Global Land Professional Mobile Radio Market Trends and Insights

5G-enabled PMR backhaul demand surge

Cellular operators and radio vendors now pair 5G backhaul with narrowband PMR links to extend coverage and offload peak traffic without jeopardizing mission-critical uptime. Early deployments such as the Los Angeles Regional Interoperable Communications System show how 5G pipes enable high-bandwidth applications-live video, mapping, and biometric data-while voice and signaling remain on licensed PMR channels. Broader adoption is encouraged by falling small-cell costs, shared infrastructure models, and continuing public funding for critical communications. The hybrid design keeps spectrum use efficient, ensures prioritization, and delays costly wholesale equipment swaps, positioning the Land Professional Mobile Radio market for sustained expansion.

Transition from analog to digital protocols

Retirement of legacy analog systems accelerates as agencies confront security gaps, limited channel capacity, and poor audio quality. Digital standards such as TETRA, P25, and DMR deliver encryption, better spectrum usage, and backward compatibility modes that smooth changeovers. Contracts like BK Technologies' USD 9.1 million CAL FIRE order demonstrate how public-safety buyers emphasize future-proofing when procuring new fleets. Developing economies often bypass analog altogether, stepping directly into digital platforms and thus compounding global unit growth. Because radios, repeaters, and dispatch consoles are refreshed concurrently, the replacement cycle fuels both hardware and software revenue streams within the Land Professional Mobile Radio market.

Spectrum scarcity in sub-1 GHz bands

Low-band frequencies prized for wide-area coverage face re-farm pressure from commercial broadband and IoT services. The U.S. Federal Communications Commission review of 900 MHz allocations illustrates policymaker balancing acts that inject planning risk for PMR license holders. When incumbents must migrate or accept tighter channelization, deployment timelines lengthen and radio re-tuning costs rise. Agencies increasingly hedge by adopting dual-mode radios capable of roaming onto cellular networks, adding expense and complexity to procurement decisions in the Land Professional Mobile Radio market.

Other drivers and restraints analyzed in the detailed report include:

- Public-safety network modernisation mandates

- AI-driven dispatch and predictive maintenance

- Capital-intensive multi-technology overhaul cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital platforms held 60.85% share of the Land Professional Mobile Radio market in 2025 and are set to grow at a 13.05% CAGR through 2031. This dominance is anchored in encryption, data capability, and spectral efficiency that align with stricter public-safety standards. P25 leads North America, TETRA underpins many European and Asian emergency networks, while cost-oriented DMR gains ground among commercial fleets. Convergence pressures hasten multi-standard terminals, allowing agencies to phase migration without losing backward compatibility. Analog's footprint will shrink, yet it persists in cost-sensitive and rural uses where simplicity outweighs advanced features. The Land Professional Mobile Radio market size tied to technology upgrades remains a core revenue engine, with software licenses and over-the-air encryption keys adding recurring value.

From 2025 onward, suppliers emphasize software-defined radios that load protocol stacks on demand, lowering SKUs and warehouse costs. JVCKENWOOD's NEXEDGE line exemplifies hybrid units capable of analog and digital modes, smoothing user transitions. Ecosystem openness also helps integrators plug radios into GIS, incident command, and asset-tracking suites. This interoperability heightens switching elasticity, prompting established players to nurture developer programs and API toolkits to safeguard share amid rising digital multi-vendor environments in the broader Land Professional Mobile Radio market.

Handheld and portable units accounted for 58.10% share in 2025, given their frontline utility across sectors. Yet repeaters and gateways will post a 13.95% CAGR as agencies densify coverage and link disparate voice groups over IP backbones through 2031. Urban tunnels, high-rise complexes, and remote energy sites require additional nodes to guarantee signal saturation, pushing infrastructure spending faster than subscriber additions. Vendors bundle cloud-based management portals that monitor gateway health and automate firmware patching, trimming field service costs.

Mobile vehicular sets retain relevance where extended range and higher power are needed, especially in transport and utility truck fleets. Fixed base stations anchor dispatch centers, integrating CAD databases and AI-powered incident analytics. As organizations pursue one-platform strategies, hardware built on common chipsets and modular RF front-ends streamlines logistics, benefiting every form factor. The Land Professional Mobile Radio market share expansion for gateway makers will hinge on open-standard interfaces that bridge legacy and broadband domains without locking buyers into proprietary middleware.

The Land Professional Mobile Radio Market Report is Segmented by Technology (Analog, Digital Including TETRA, and More), Form Factor (Handheld/Portable, Mobile Vehicular, and More), Frequency Band (VHF 30-300 MHz, UHF 300-1000 MHz, and More), End-User Sector (Public Safety and Security, Transportation and Logistics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 35.90% of global spend in 2025, buoyed by structured federal grant programs, large statewide P25 systems, and military modernization programs such as the U.S. Army's HMS radio procurements.The mature channel landscape encourages multi-year service contracts, software upgrades, and cybersecurity audits that deliver predictable annuity revenue for incumbent vendors. Rapid wildfire and hurricane response needs further validate continuous investment in interoperable voice networks.

Asia-Pacific posts the most rapid 13.55% CAGR to 2031 as China and India funnel infrastructure budgets into smart cities, high-speed rail, and industrial digitization. Domestic champions leverage cost advantages to penetrate African and Latin American exports, widening their addressable base. Southeast Asian nations, rebuilding disaster-resilient networks, adopt dual-mode radios compatible with both TETRA and LTE, reinforcing volume growth. Japan and South Korea lead feature innovation, experimenting with AI-enabled command centers tied to robots and drones.

Europe maintains steady expansion through harmonized spectrum policies and cross-border emergency cooperation initiatives. The United Kingdom's Emergency Services Network, now extended to 2032, underscores the region's pivot toward broadband-integrated PMR rather than simple like-for-like replacements. Nordic nations pilot 5G slicing for mission-critical push-to-talk, setting frameworks other EU states may replicate. Meanwhile, Eastern European members invest EU recovery funds into upgrading analog municipal networks, preserving long-term order visibility across the Land Professional Mobile Radio market.

- Motorola Solutions

- Hytera Communications

- JVCKenwood Corporation

- Airbus Defence and Space

- Tait Communications

- L3Harris Technologies

- BK Technologies

- Sepura PLC

- Thales Group

- Icom Incorporated

- Codan Communications

- Simoco Wireless Solutions

- DAMM Cellular Systems

- Rohill Engineering

- Kirisun Communications

- TISR (Leonardo)

- Omnitronics

- Syndico Distribution

- Siyata Mobile

- Pyramid Communications

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G-enabled PMR backhaul demand surge

- 4.2.2 Transition from analog to digital protocols

- 4.2.3 Public-safety network modernisation mandates

- 4.2.4 AI-driven dispatch and predictive maintenance

- 4.2.5 Integration with private LTE and MC-X platforms

- 4.2.6 Inter-agency interoperability needs amid climate-driven disasters

- 4.3 Market Restraints

- 4.3.1 Spectrum scarcity in sub-1 GHz bands

- 4.3.2 Capital-intensive multi-technology overhaul cycles

- 4.3.3 Rising cyber-security compliance costs

- 4.3.4 Regulatory uncertainty over PMR-LTE spectrum sharing

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Analysis of Key Economic Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Analog

- 5.1.2 Digital

- 5.1.2.1 TETRA

- 5.1.2.2 P25

- 5.1.2.3 DMR

- 5.1.2.4 NXDN / dPMR

- 5.2 By Form Factor

- 5.2.1 Handheld / Portable

- 5.2.2 Mobile (Vehicular)

- 5.2.3 Fixed / Base-Station

- 5.2.4 Repeaters and Gateways

- 5.3 By Frequency Band

- 5.3.1 VHF (30-300 MHz)

- 5.3.2 UHF (300-1000 MHz)

- 5.3.3 700/800 MHz

- 5.3.4 900 MHz +

- 5.4 By End-user Sector

- 5.4.1 Public Safety and Security

- 5.4.2 Transportation and Logistics

- 5.4.3 Utilities and Energy

- 5.4.4 Manufacturing and Industrial

- 5.4.5 Construction and Mining

- 5.4.6 Hospitality and Retail

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Motorola Solutions

- 6.4.2 Hytera Communications

- 6.4.3 JVCKenwood Corporation

- 6.4.4 Airbus Defence and Space

- 6.4.5 Tait Communications

- 6.4.6 L3Harris Technologies

- 6.4.7 BK Technologies

- 6.4.8 Sepura PLC

- 6.4.9 Thales Group

- 6.4.10 Icom Incorporated

- 6.4.11 Codan Communications

- 6.4.12 Simoco Wireless Solutions

- 6.4.13 DAMM Cellular Systems

- 6.4.14 Rohill Engineering

- 6.4.15 Kirisun Communications

- 6.4.16 TISR (Leonardo)

- 6.4.17 Omnitronics

- 6.4.18 Syndico Distribution

- 6.4.19 Siyata Mobile

- 6.4.20 Pyramid Communications

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment