PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910946

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910946

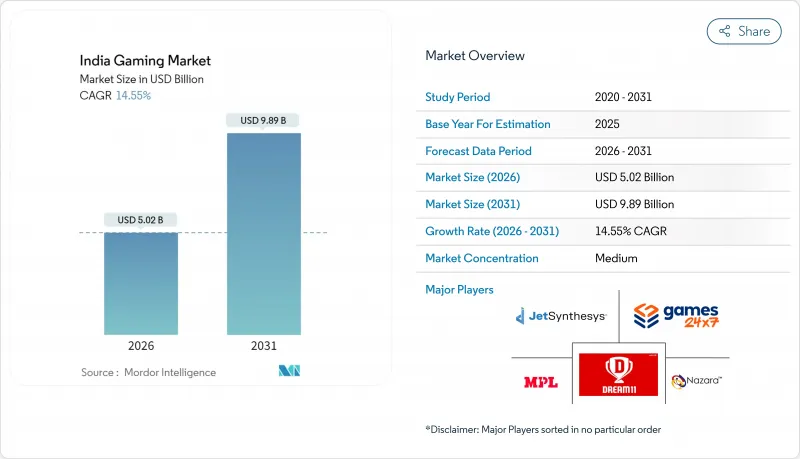

India Gaming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India Gaming Market was valued at USD 4.38 billion in 2025 and estimated to grow from USD 5.02 billion in 2026 to reach USD 9.89 billion by 2031, at a CAGR of 14.55% during the forecast period (2026-2031).

Underscoring vigorous momentum within the country's digital entertainment ecosystem. Demand stems from low-cost smartphones, expanding 5G coverage, and frictionless UPI micro-payments that together convert casual users into paying players. Monthly mobile data use of 32 GB per smartphone supports graphics-rich titles, while cloud delivery shortens hardware cycles and lowers entry barriers for first-time gamers. Growing vernacular content, supportive government initiatives, and corporate esports leagues further reinforce engagement and revenue depth. Competitive dynamics sharpen as operators absorb 28% GST on real-money gaming and higher compliance costs, pushing consolidation among scale-seeking studios.

India Gaming Market Trends and Insights

Booming smartphone shipments catalyze mobile-first gaming ecosystem

More than 1 billion smartphone users are expected by 2026, and handset prices below USD 100 place capable devices within reach of first-time gamers. Data plans near INR 200 each month remove download friction, prompting 8.45 billion mobile game installs in 2024 alone. Two-thirds of players now reside in tier-2 and tier-3 cities, confirming penetration well beyond metro audiences. Publishers exploit these dynamics by tailoring file sizes below 200 MB and integrating UPI Lite for one-tap payments, which lifts first-purchase conversion rates by double-digit percentages in the India gaming market.

5G infrastructure unlocks cloud gaming potential

India's 5G subscriptions rose to 270 million in 2024 and are on course for 980 million by 2030, cutting average latency below 20 milliseconds. Reliance Jio's Blacknut rollout offers 50+ premium titles without console ownership, proving a viable subscription path for mid-core and AAA content. Real-time esports streams now sustain 1080p resolution at 60 fps on budget phones, narrowing the performance gap with PC rooms. Analysts forecast that India could become the world's largest cloud-streamed arena by 2033 as fiber backhaul and edge data centers proliferate.

Patchwork regulations create fragmentation

Different states apply divergent rules, from Tamil Nadu's midnight gaming curfew to Maharashtra's proposed blanket ban on select online titles. Operators must geo-fence, implement Aadhaar verification, and adapt payout logic per jurisdiction, raising fixed compliance costs. The Supreme Court's pending verdict on betting apps injects additional policy risk that deters venture funding and pushes smaller studios toward mergers.

Other drivers and restraints analyzed in the detailed report include:

- Vernacular content revolution drives cultural renaissance

- Government digital infrastructure initiatives accelerate adoption

- Rising compliance costs pressure profitability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mobile captured 55.12% India gaming market share in 2025 and remains the primary on-ramp for new users due to Android handsets under USD 150 and low data tariffs. Annual downloads crossed 8.45 billion in 2024, and the segment's revenue growth continues at double digits as 5G coverage widens. Entry-level devices now ship with 6 GB RAM, enabling mid-core play without thermal throttling. India's gaming market size for cloud/streaming is projected to surge at a 16.05% CAGR after Jio offered all-you-can-play libraries that negate hardware spending. Console and PC niches grow more modestly yet drive esports infrastructure demand and AAA content localization.

Cloud services boost publisher lifetime value by extending catalog reach to users with older phones that only need a 15 Mbps link, trimming churn relative to download-only titles. Console hardware scarcity eased after parallel imports of Nintendo Switch crossed 500,000 units. PlayStation retains leadership through regional promotions linking cricket stars and first-party exclusives. PC rigs remain favored for development and professional esports scrims, supported by cafe chains upgrading to RTX-class GPUs.

In-app purchases accounted for 40.45% of the India gaming market size in 2025 as UPI micro-payments reduced checkout abandonment. High-engagement genres deploy season passes, limited-time skins, and gacha mechanics that elevate ARPDAU. However, subscription passes post a 15.55% CAGR, bundling 50-plus premium cloud titles for a flat monthly fee that smooths revenue volatility.

Publishers report churn falling under 4% within six months of subscription enrollment. Advertising-supported formats continue but face CPM pressure amid privacy shifts, while premium pay-to-download remains niche due to price sensitivity. GST on deposits compressed margins for real-money operators, with Nazara's RMG revenue halving year on year.

The India Gaming Market Report is Segmented by Platform (Mobile, Console, PC, and Cloud/Streaming), Revenue Model (In-App Purchase, Advertising-Supported, Subscription Pass, and Premium/Pay-to-Download), Genre (Casual and Hyper-Casual, Action/Adventure, Battle-Royale and FPS, Sports and Racing, and More), Gamer Demographics (Age Group and Gender), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nazara Technologies Ltd.

- Dream Sports (Dream11 Gaming Pvt Ltd.)

- Games24x7 Pvt Ltd.

- MPL Gaming Pvt Ltd.

- JetSynthesys Pvt Ltd.

- Moonfrog Labs Pvt Ltd.

- Octro Inc

- Paytm First Games (One97 Comm.)

- WinZO Games Pvt Ltd.

- SuperGaming Pvt Ltd.

- Krafton India (PUBG Corp.)

- Garena Intl. - India Ops

- Ubisoft Entertainment SA

- Electronic Arts Games (India)

- Sony Interactive Entertainment

- Microsoft Xbox India

- Nintendo India

- Zynga Games Network India Pvt Ltd.

- Rolocule Games Pvt Ltd.

- nCORE Games Pvt Ltd.

- Reliance Games - Zapak Mobile

- Green Gold Animation Pvt Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming smartphone shipments and low-cost data plans

- 4.2.2 Roll-out of 5G enabling low-latency cloud gaming

- 4.2.3 Surge in vernacular content and locally themed titles

- 4.2.4 Government's ONDC and Digital India initiatives

- 4.2.5 Growth of UPI-based micro-transactions

- 4.2.6 Corporate e-sports leagues driving engagement

- 4.3 Market Restraints

- 4.3.1 Patchwork state-level real-money gaming bans

- 4.3.2 Rising cyber-fraud and AML compliance cost

- 4.3.3 Talent crunch in AAA game development

- 4.3.4 Stricter age-rating and loot-box regulations ahead

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Gaming Base Indicator Analysis

- 4.9.1 Internet Penetration - Current and Forecast

- 4.9.2 Smartphone Penetration - 2019-2030

- 4.9.3 PC Hardware Install Base

- 4.9.4 Console Unit Sales and Revenue

- 4.9.5 Mobile Gamer Demographics

- 4.9.6 Indian vs International Publishers Split

- 4.9.7 Top 10 Games and Publishers

- 4.9.8 Global vs India Market Bench-marking

- 4.9.9 Map of State-wise Real-Money Game Bans

- 4.10 5G Outlook in India

- 4.10.1 Key Enablers and Opportunities

- 4.10.2 Stakeholder Investments

- 4.10.3 5G Spectrum Auction Insights

- 4.10.4 Timeline of Commercial Roll-out

- 4.10.5 Global Cues on 5G Impact on Gaming

- 4.11 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Platform

- 5.1.1 Mobile

- 5.1.1.1 Android

- 5.1.1.2 iOS

- 5.1.2 Console

- 5.1.2.1 Hand-held

- 5.1.2.2 Home Console

- 5.1.3 PC

- 5.1.4 Cloud/Streaming

- 5.1.1 Mobile

- 5.2 By Revenue Model

- 5.2.1 In-App Purchase (IAP)

- 5.2.2 Advertising-supported

- 5.2.3 Subscription Pass

- 5.2.4 Premium/Pay-to-Download

- 5.3 By Genre

- 5.3.1 Casual and Hyper-casual

- 5.3.2 Action/Adventure

- 5.3.3 Battle-Royale and FPS

- 5.3.4 Sports and Racing

- 5.3.5 Real-Money Gaming (RMG)

- 5.3.6 Strategy and Card

- 5.4 By Gamer Demographics

- 5.4.1 Age Group

- 5.4.1.1 <=14 years

- 5.4.1.2 15-24 years

- 5.4.1.3 25-34 years

- 5.4.1.4 >=35 years

- 5.4.2 Gender

- 5.4.2.1 Male

- 5.4.2.2 Female

- 5.4.1 Age Group

- 5.5 By Region

- 5.5.1 North India

- 5.5.2 South India

- 5.5.3 West India

- 5.5.4 East and North-East India

- 5.5.5 Central India

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nazara Technologies Ltd.

- 6.4.2 Dream Sports (Dream11 Gaming Pvt Ltd.)

- 6.4.3 Games24x7 Pvt Ltd.

- 6.4.4 MPL Gaming Pvt Ltd.

- 6.4.5 JetSynthesys Pvt Ltd.

- 6.4.6 Moonfrog Labs Pvt Ltd.

- 6.4.7 Octro Inc

- 6.4.8 Paytm First Games (One97 Comm.)

- 6.4.9 WinZO Games Pvt Ltd.

- 6.4.10 SuperGaming Pvt Ltd.

- 6.4.11 Krafton India (PUBG Corp.)

- 6.4.12 Garena Intl. - India Ops

- 6.4.13 Ubisoft Entertainment SA

- 6.4.14 Electronic Arts Games (India)

- 6.4.15 Sony Interactive Entertainment

- 6.4.16 Microsoft Xbox India

- 6.4.17 Nintendo India

- 6.4.18 Zynga Games Network India Pvt Ltd.

- 6.4.19 Rolocule Games Pvt Ltd.

- 6.4.20 nCORE Games Pvt Ltd.

- 6.4.21 Reliance Games - Zapak Mobile

- 6.4.22 Green Gold Animation Pvt Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment