PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911265

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911265

Europe Prefabricated Housing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

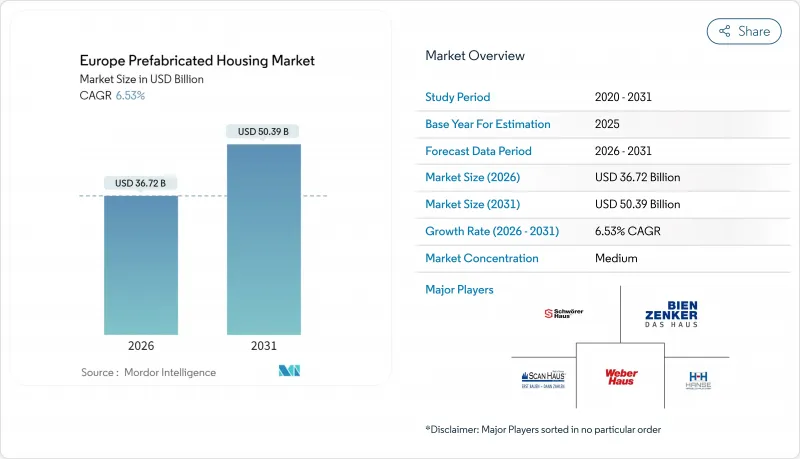

The Europe prefabricated housing market was valued at USD 34.47 billion in 2025 and estimated to grow from USD 36.72 billion in 2026 to reach USD 50.39 billion by 2031, at a CAGR of 6.53% during the forecast period (2026-2031).

This trajectory underscores the segment's transition from a niche construction method to a mainstream residential solution across the continent. Mounting zero-emission mandates, persistent housing shortages, and rapid advances in off-site manufacturing are converging to accelerate adoption. Energy-performance regulation now rewards factory-built envelopes that embed renewable systems, while robotics and BIM-enabled production slash build times by up to 50% and project costs by 20%.

As investors direct record sums into sustainable real-estate funds, the Europe prefabricated housing market is poised to capture a larger share of new-build activity, particularly in countries that link green-finance incentives to carbon-negative materials such as timber. Competitive intensity is rising as incumbents integrate vertically from design to installation and as technology start-ups introduce automated micro-factories that de-risk labor shortages.

Europe Prefabricated Housing Market Trends and Insights

EU Renovation Wave & EPBD Mandates Fuel Energy-Efficient Prefab Retrofits

Revisions to the Energy Performance of Buildings Directive require Member States to retrofit the lowest-performing 16% of non-residential stock by 2030 and to achieve zero on-site emissions in all new buildings that year. Governments are therefore promoting standardized, factory-produced wall, roof and facade modules that deliver predictable thermal performance and minimal waste. Germany's implementation blueprint emphasizes off-site assembly as a pathway to halve construction time lines and demonstrate verifiable carbon savings under ISO 14001 management systems. Green-mortgage programs further amplify demand, trimming interest margins for households that opt for certified prefab envelopes, while public bodies accelerate school and hospital retrofits through serial contracting frameworks.

2 Million-Unit Affordable-Housing Gap Drives Serial-Construction Tenders

Eurostat estimates reveal a continent-wide deficit of roughly 2 million affordable dwellings, prompting authorities to bundle procurement lots that specify repeatable volumetric or panelized designs. Berlin's Gewobag utility recently executed a 1,500-unit social-housing order in under 18 months at a unit cost 50% below average inner-city delivery, thanks to modular tender rules. The United Kingdom's Pan-London Accommodation Collaborative Enterprise deployed a GBP 75 million framework for relocatable homes, demonstrating political commitment to precision manufacturing that meets both social and energy targets. As serial contracting migrates eastward, suppliers that standardize building systems for cross-border codes are best positioned to scale.

Double-Digit Input-Cost Inflation Erodes Prefab Price Advantage

The EU construction-cost index reached 117.00 points in December 2024, reflecting a 27.5% year-on-year rise in cement prices and a 42% jump in structural steel. Prefabrication, once 15% cheaper than in-situ methods, now risks parity for cost-sensitive projects, especially in affordable housing. Timber supply is tightening as sustainable-forestry quotas cap hardwood harvests, inflating saw-log prices and shrinking margins for module producers. Firms locked into fixed-price public contracts face pronounced margin pressure and must increasingly hedge raw-material exposure through forward purchasing agreements.

Other drivers and restraints analyzed in the detailed report include:

- Factory Automation & Robotics Offset Skilled-Labor Shortages

- Green-Finance Taxonomies Lower Mortgage Rates for Timber Modules

- Fragmented National Building Codes & Warranty Rules Delay Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Timber captured 53.62% of Europe prefabricated housing market share in 2025, owing to carbon-sequestration benefits that align with Taxonomy-linked financing. The segment is projected to clock a 7.05% CAGR through 2031, outpacing steel and concrete. Sweden has introduced building-code amendments that prioritize mass-timber structures in public projects, accelerating demand for cross-laminated components. Hybrid wood-steel frames developed by KLEUSBERG extend timber's application to mid-rise urban infill while preserving structural rigidity. Concrete remains essential for podiums and foundations, but its share is progressively eroded by printed masonry alternatives that cut embodied carbon by integrating recycled aggregates.

Second-tier materials, including glass and advanced composites, fulfill performance niches such as high-spec facade systems with integrated photovoltaic cells. Steel maintains relevance in volumetric pods requiring long spans, yet higher import prices are pushing suppliers to adopt lighter-gauge alloys and modular connection details that reduce tonnage. EU circular-economy policies favor materials with established recycling loops, a criterion that benefits aluminum curtain-wall systems now entering prefabrication supply chains.

The European Prefabricated Housing Market Report is Segmented by Material Type (Concrete, Glass, Metal, and More), Housing Type (Single-Family, Multi-Family), Product Type (Modular Homes, Panelized and Componentized Systems, Manufactured Homes, and Others), and by Country (Germany, UK, France, Spain, Italy, Netherlands, Sweden, Denmark, Norway, and the Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SchworerHaus

- Hanse Haus GmbH

- WeberHaus GmbH & Co.

- Bien-Zenker GmbH

- DFH Haus Holding AG (Massa / Allkauf)

- ScanHaus Marlow GmbH

- Goldbeck GmbH (Modular Housing)

- HUF Haus GmbH

- Danwood S.A.

- Kampa GmbH

- FingerHaus GmbH

- Baufritz GmbH & Co.

- Luxhaus GmbH

- Kleusberg GmbH

- Redbloc Elemente GmbH

- Laing O'Rourke (Explore Modular EU)

- Skanska AB (BoKlok Europe)

- Bouygues Construction (Housing Europe)

- Eiffage Construction Europe

- Lindbacks Bygg

- Clayton Homes

- Skyline Champion Corp.

- Cavco Industries Inc.

- Sekisui House Ltd (European arm)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU's Renovation Wave and EPBD Mandates Energize the Push for Energy-Efficient Prefab Retrofits.

- 4.2.2 A 2 Million-Unit Shortfall in Affordable Housing Fuels a Surge in Serial-Construction Tenders.

- 4.2.3 Factory Automation and Robotics Bridge the Gap Left by Skilled-Labor Shortages.

- 4.2.4 Green-Finance Taxonomies Pave the Way for Reduced Mortgage Rates on Timber Modules.

- 4.2.5 NATO and Civil-Protection Contracts Accelerate the Demand for Rapid-Deploy Volumetric Units.

- 4.2.6 BIM-integrated 3-D printing shortens foundation lead-times by 25 %

- 4.3 Market Restraints

- 4.3.1 Double-digit input-cost inflation erodes prefab price advantage

- 4.3.2 Fragmented national building codes & warranty rules delay approvals

- 4.3.3 Road-escort & width limits raise logistics cost for oversized modules

- 4.3.4 "Catalogue-house" stigma depresses demand in dense urban cores

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Brief on Different Structures Used in Prefabricated Housing

- 4.9 Cost Structure Analysis of Prefabricated Housing

5 Market Size & Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Concrete

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Timber

- 5.1.5 Other Materials

- 5.2 By Housing Type

- 5.2.1 Single-Family

- 5.2.2 Multi-Family

- 5.3 By Product Type

- 5.3.1 Modular Homes

- 5.3.2 Panelized & Componentized Systems

- 5.3.3 Manufactured Homes

- 5.3.4 Other Prefab Types

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 Netherlands

- 5.4.7 Sweden

- 5.4.8 Denmark

- 5.4.9 Norway

- 5.4.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 SchworerHaus

- 6.4.2 Hanse Haus GmbH

- 6.4.3 WeberHaus GmbH & Co.

- 6.4.4 Bien-Zenker GmbH

- 6.4.5 DFH Haus Holding AG (Massa / Allkauf)

- 6.4.6 ScanHaus Marlow GmbH

- 6.4.7 Goldbeck GmbH (Modular Housing)

- 6.4.8 HUF Haus GmbH

- 6.4.9 Danwood S.A.

- 6.4.10 Kampa GmbH

- 6.4.11 FingerHaus GmbH

- 6.4.12 Baufritz GmbH & Co.

- 6.4.13 Luxhaus GmbH

- 6.4.14 Kleusberg GmbH

- 6.4.15 Redbloc Elemente GmbH

- 6.4.16 Laing O'Rourke (Explore Modular EU)

- 6.4.17 Skanska AB (BoKlok Europe)

- 6.4.18 Bouygues Construction (Housing Europe)

- 6.4.19 Eiffage Construction Europe

- 6.4.20 Lindbacks Bygg

- 6.4.21 Clayton Homes

- 6.4.22 Skyline Champion Corp.

- 6.4.23 Cavco Industries Inc.

- 6.4.24 Sekisui House Ltd (European arm)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment