PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911285

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911285

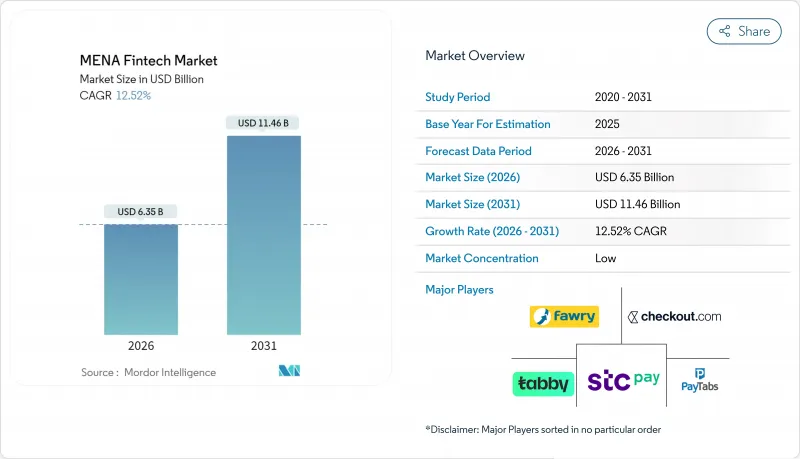

MENA Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

MENA fintech market size in 2026 is estimated at USD 6.35 billion, growing from 2025 value of USD 5.65 billion with 2031 projections showing USD 11.46 billion, growing at 12.52% CAGR over 2026-2031.

A surge in cash-lite policy mandates, broad smartphone availability, and growing venture-capital inflows are expanding the addressable base for digital financial services. Central-bank digital-currency (CBDC) pilots in the GCC and Egypt are modernizing payment rails, while regulatory sandboxes in Saudi Arabia, the UAE, and Jordan shorten product launch cycles. At the same time, e-commerce, gig-economy, and remittance corridors are fuelling embedded-finance use cases. Industry participants respond through platform diversification and cross-border partnerships that create new revenue streams and consolidate fragmented positions.

MENA Fintech Market Trends and Insights

Government Cash-Lite & Financial-Inclusion Mandates Accelerate Fintech Demand

Saudi Arabia targets 70% cashless transactions by 2030, Egypt aims to bank 50% of adults by 2025, and the UAE streamlined licensing in 2024. These targets provide clear metrics for adoption and reduce go-to-market friction for private players. Sandboxes in Jordan further cut regulatory risk, helping startups scale without prohibitive compliance spend. As governments digitize payroll and welfare transfers, consumer familiarity with e-wallets rises, lowering acquisition costs. The policy push also incentivizes retailers to deploy contactless acceptance, enlarging acceptance networks. Collectively, mandates create a virtuous circle that widens the MENA fintech market.

Mobile & Internet Penetration Surge Enables Mobile-First Financial Access

Smartphone penetration tops 80% in GCC states, turning mobiles into the default banking channel. The UAE already sees digital wallets covering 18% of POS spend, on track for 33% by 2027. Egypt and Morocco extend reach through telco-based agent models, bypassing branch infrastructure and shrinking operating costs. Gen Z users account for 23% of regional e-commerce spend via digital wallets, establishing lasting payment habits. Growing 4G/5G coverage in rural North Africa enables remote KYC onboarding, unlocking new customer pools. The mobile-first model thus propels rapid share gains across consumer cohorts.

Regulatory Fragmentation Across Jurisdictions Increases Compliance Burden

Nineteen different licensing regimes require fintechs to form market-specific entities, adding 15-25% to overheads versus unified frameworks. Disparate capital and data-localization rules hinder passporting and delay regional scaling. Larger incumbents absorb the cost but startups face resource strain, limiting innovation diversity. Lack of mutual recognition also hampers cross-border open-API linkage, creating integration dead-zones. Investors price the risk into valuations, nudging consolidation as a workaround for multi-country reach.

Other drivers and restraints analyzed in the detailed report include:

- VC Funding & Sandbox Momentum Fuel Startup Formation

- CBDC Pilots Enabling Cross-Border Rails Create Common API Infrastructure

- Cash-Centric Habits Inflate Customer-Acquisition Costs in North Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital payments controlled 54.12% of MENA fintech market share in 2025, underpinned by near-ubiquitous smartphone wallets and aggressive merchant-acquiring incentives. The sub-segment added new rails such as QR and tokenized wallet checkout, further cementing stickiness. Digital lending, though smaller, is growing at an 17.74% CAGR on the strength of real-time alternative-data scoring. Fawry's EGP 1 billion disbursement surge in 2025 illustrates payments-to-credit adjacency.

Robo-advisory and insurtech expand via API-first distribution, while neobanks like STC Bank convert wallet bases into full-service accounts. Regulatory sandboxes allow parametric and usage-based policies, fostering experimentation. Cross-sell synergies emerge as payments brands add credit, investment, and insurance tabs within the same app, stretching user lifetime value. The diversification push points to escalating platform convergence across the MENA fintech market.

The MENA Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending & Financing, Digital Investments, Insurtech, Neobanking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (GCC, North Africa, Levant). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Fawry

- PayTabs

- Checkout.com

- Tabby

- Tamara

- STC Pay

- Paymob

- MNT-Halan

- Geidea

- Network International

- BenefitPay

- Careem Pay

- Lean Technologies

- HyperPay

- YAP

- Telda

- NymCard

- Sarwa

- OPay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Govt cash-lite and financial-inclusion mandates

- 4.2.2 Mobile & internet penetration surge

- 4.2.3 VC funding & sandbox momentum

- 4.2.4 CBDC pilots enabling cross-border rails

- 4.2.5 Embedded-finance demand from e-commerce and gig platforms

- 4.2.6 Instant-payment rails unlocking alternative lending data

- 4.3 Market Restraints

- 4.3.1 Regulatory fragmentation across jurisdictions

- 4.3.2 Cash-centric habits inflating CAC in North Africa

- 4.3.3 Scarcity of Arabic AI/ML risk-scoring datasets

- 4.3.4 Legacy core-bank IT bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending & Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Geography

- 5.4.1 GCC

- 5.4.1.1 Saudi Arabia

- 5.4.1.2 United Arab Emirates

- 5.4.1.3 Qatar

- 5.4.1.4 Bahrain

- 5.4.1.5 Kuwait

- 5.4.1.6 Oman

- 5.4.2 North Africa

- 5.4.2.1 Egypt

- 5.4.2.2 Morocco

- 5.4.2.3 Algeria

- 5.4.2.4 Tunisia

- 5.4.3 Levant

- 5.4.3.1 Jordan

- 5.4.3.2 Lebanon

- 5.4.1 GCC

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Fawry

- 6.4.2 PayTabs

- 6.4.3 Checkout.com

- 6.4.4 Tabby

- 6.4.5 Tamara

- 6.4.6 STC Pay

- 6.4.7 Paymob

- 6.4.8 MNT-Halan

- 6.4.9 Geidea

- 6.4.10 Network International

- 6.4.11 BenefitPay

- 6.4.12 Careem Pay

- 6.4.13 Lean Technologies

- 6.4.14 HyperPay

- 6.4.15 YAP

- 6.4.16 Telda

- 6.4.17 NymCard

- 6.4.18 Sarwa

- 6.4.19 OPay

7 Market Opportunities & Future Outlook

- 7.1 Cross-border GCC-North Africa remittance corridors via tokenized wallets

- 7.2 Green Islamic fintech products aligned with ESG & Sharia mandates