PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911289

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911289

Malaysia Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

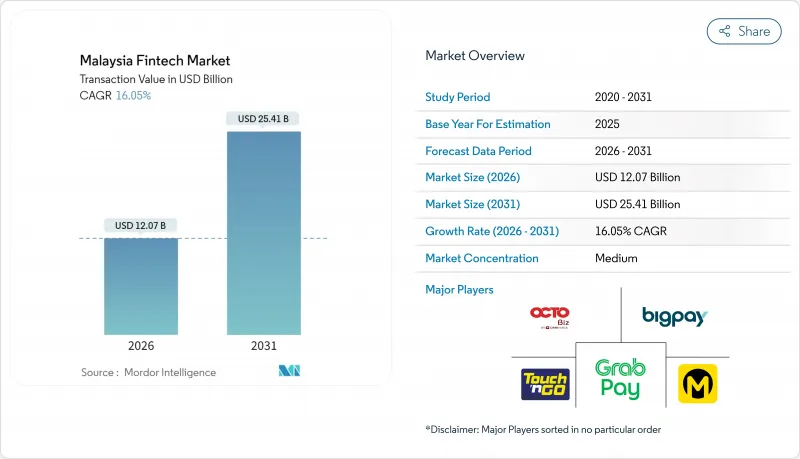

The Malaysia fintech market was valued at USD 10.40 billion in 2025 and estimated to grow from USD 12.07 billion in 2026 to reach USD 25.41 billion by 2031, at a CAGR of 16.05% during the forecast period (2026-2031).

Malaysia's role as Southeast Asia's Islamic finance hub, combined with an expanding digital-first consumer base and supportive sandbox regulations, underpins this growth. Continued licensing of digital banks, such as KAF Digital Bank and AEON Bank, has broadened service offerings while lowering acquisition costs. Cross-border QR payment links with Cambodia and Singapore elevate transaction volumes and position local providers for regional expansion. Public cloud and data-center investments across Sarawak and Penang strengthen the underlying infrastructure, enabling real-time payments and compliance analytics. As the Malaysia fintech market matures, competitive strategies increasingly revolve around super-app ecosystems, Islamic-compliant innovations, and embedded finance integrations into retail and SME workflows.

Malaysia Fintech Market Trends and Insights

High Smartphone & Internet Penetration Drives Addressable Market Expansion

Malaysia's smartphone penetration surpasses 85% and internet connectivity reaches 90% of residents, growing the digital-ready customer pool for fintech services. Touch 'n Go Digital expects its first full-year profitability in 2025 after securing USD 75 million from strategic investors, a milestone enabled by this mobile reach. E-wallet usage already touches 40%, outpacing traditional banking access. Google Pay's 2024 tie-up with ShopeePay and TNG eWallet illustrates how infrastructure maturity accelerates ecosystem partnerships that deepen wallet stickiness. Younger cohorts dominate adoption, with 90% of users aged 40 and below forming the core target for upcoming product launches.

Government MyDigital & Financial Sector Blueprint Initiatives Catalyze Ecosystem Development

The MyDigital roadmap aims for the digital economy to contribute 25.5% of GDP by end-2025, supported by MYR 163.6 billion (USD 34.36 billion) in approved digital investments in 2024, a 250% jump year-on-year. More than 3,891 Malaysia Digital-status firms now operate nationwide, buoyed by tax incentives granting 0% on IP income for a decade. The Financial Sector Blueprint's 75% cashless-transaction goal releases subsidies for payment terminals and data-protection upgrades. Regional expansion is evident as the Digital Ministry opened its northern office in Penang to funnel incentives and technical mentorship beyond Klang Valley.

Cyber-fraud Concerns Erode User Trust and Increase Compliance Costs

Rising cybersecurity threats and digital fraud incidents create significant headwinds for fintech adoption, with compliance costs increasing 25% year-on-year across the industry. Bank Negara Malaysia and Bank of Thailand signed a memorandum of understanding in April 2025 for cybersecurity and digital fraud cooperation, highlighting the cross-border nature of these threats. Malaysian banks responded by adding malware shielding to mobile applications, while BNM's National Fraud Portal launch reduced fraud tracing time by 75%, demonstrating both the severity of the problem and institutional responses. GXBank's introduction of Cyber Fraud Protect insurance products reflects how fintech companies are monetizing security concerns while addressing customer risk aversion.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Boom Amplifies Payment Volume Growth

- Favourable Sandbox & Digital Bank Licences Lower Entry Barriers

- Reliance on Incumbent Banking Rails Limits Fintech Uptime Guarantees

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital payments captured 50.72% of Malaysia fintech market share in 2025, anchored by Touch 'n Go Digital's multi-modal transport and retail integrations. Government cashless incentives and regional QR interoperability continue to widen this moat. Digital lending ranks second at 21.03%, boosted by Funding Societies' USD 27 million raise that broadened Shariah-compliant SME lines. Insurtech holds 15.05%, validated by PolicyStreet's USD 15.4 million Series B and a 5 million-strong user base.

Neobanking, though only 7.35% in 2025, is projected to grow at a 26.12% CAGR, narrowing gaps with incumbents through fee-free accounts and rapid onboarding. Digital investments stand at 5.85%, where StashAway's launch of Bitcoin and Ethereum ETFs alongside Shariah portfolios diversifies revenue. The Securities Commission's Digital Innovation Fund has co-financed 15 pilots, signalling future service-mix shifts.

The Malaysia Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending & Financing, Digital Investments, Insurtech, Neobanking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (Klang Valley, Northern Region, Southern Region, East Coast, East Malaysia). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Maybank

- CIMB

- Touch 'n Go Digital

- Boost

- BigPay

- GrabPay

- Razer Fintech

- Axiata Digital (Aspirasi)

- Funding Societies

- CapBay

- MoneyMatch

- Jirnexu (RinggitPlus)

- iMoney

- StashAway

- Wahed Invest

- Bursa Digital Exchange

- PolicyStreet

- Tune Protect

- Oyen

- Etiqa Digital

- Prudential Pulse

- GHL Systems

- MyPOSPay

- Soft Space

- FavePay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High smartphone & internet penetration

- 4.2.2 Government's MyDigital & FSB initiatives

- 4.2.3 E-commerce boom

- 4.2.4 Favourable sandbox & digital bank licences

- 4.2.5 Rising demand for Islamic fintech

- 4.2.6 ASEAN cross-border QR-code integration

- 4.3 Market Restraints

- 4.3.1 Cyber-fraud concerns

- 4.3.2 Reliance on incumbent banking rails

- 4.3.3 Shortage of deep-tech fintech talent

- 4.3.4 Regional digital tax complexity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending & Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Geography

- 5.4.1 Klang Valley

- 5.4.2 Northern Region

- 5.4.3 Southern Region

- 5.4.4 East Coast

- 5.4.5 East Malaysia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Maybank

- 6.4.2 CIMB

- 6.4.3 Touch 'n Go Digital

- 6.4.4 Boost

- 6.4.5 BigPay

- 6.4.6 GrabPay

- 6.4.7 Razer Fintech

- 6.4.8 Axiata Digital (Aspirasi)

- 6.4.9 Funding Societies

- 6.4.10 CapBay

- 6.4.11 MoneyMatch

- 6.4.12 Jirnexu (RinggitPlus)

- 6.4.13 iMoney

- 6.4.14 StashAway

- 6.4.15 Wahed Invest

- 6.4.16 Bursa Digital Exchange

- 6.4.17 PolicyStreet

- 6.4.18 Tune Protect

- 6.4.19 Oyen

- 6.4.20 Etiqa Digital

- 6.4.21 Prudential Pulse

- 6.4.22 GHL Systems

- 6.4.23 MyPOSPay

- 6.4.24 Soft Space

- 6.4.25 FavePay

7 Market Opportunities & Future Outlook

- 7.1 Embedded finance for SMEs via POS/IoT

- 7.2 Digital wealth for aging affluent segment