PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911287

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911287

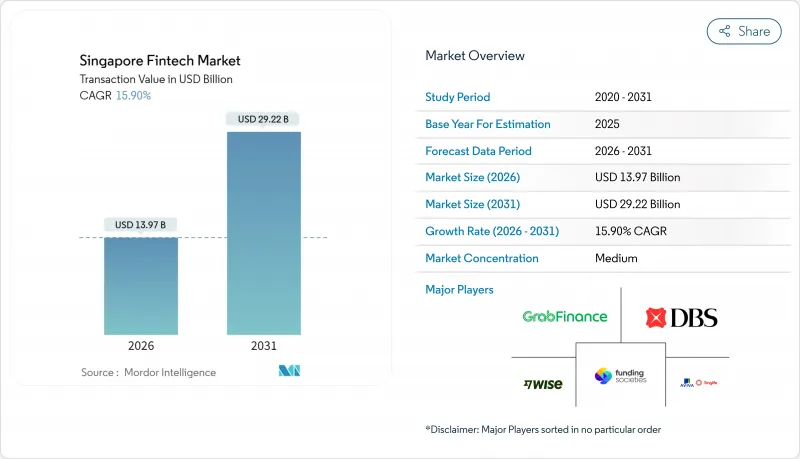

Singapore Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Singapore fintech market size in 2026 is estimated at USD 13.97 billion, growing from 2025 value of USD 12.05 billion with 2031 projections showing USD 29.22 billion, growing at 15.9% CAGR over 2026-2031.

Strong policy support, deep digital infrastructure, and sustained inflows of private capital keep the Singapore fintech market on a steep expansion path, even as competitive intensity and regulatory scrutiny increase. Market momentum reflects the Monetary Authority of Singapore's (MAS) SGD 100 million (USD 77 million) FSTI 3.0 program, which co-funds quantum-safe cybersecurity and AI-driven risk models, giving early adopters a durable technology lead. Additional uplift comes from Project Nexus-the five-country instant-payment corridor that is scheduled to go live by 2026-which will compress settlement cycles and open new revenue pools for cross-border trade service providers. The Singapore fintech market also benefits from PayNow's growing regional linkages, accelerating demand for multi-currency wallets among SMEs engaged in cross-border e-commerce. At the same time, tightened consumer-protection rules for crypto and buy-now-pay-later (BNPL) products temper near-term revenue growth, prompting business-model pivots toward embedded finance and B2B2C distribution.

Singapore Fintech Market Trends and Insights

Real-Time Payment Rails Transform Settlement Economics

Project Nexus will connect payment rails in Singapore, Malaysia, Thailand, the Philippines, and India by 2026, eliminating the need for nostro accounts and cutting settlement from T+2 to real-time . The shift frees up an estimated USD 120 billion in trapped liquidity and reduces cross-border transaction fees, generating immediate cost savings for merchants and SMEs. Early integrating fintech firms will gain share in B2B trade finance, where real-time settlement unlocks working-capital products tied to shipment milestones. PayNow's bilateral links with PromptPay and DuitNow processed more than 2.5 million transactions in 2024, demonstrating proven customer appetite for instant regional payments. As rails converge, traditional banks must overhaul legacy APIs or risk ceding high-margin corridors to nimble challengers. The new infrastructure also supports micropayments and micro-insurance, widening addressable use cases across Southeast Asia.

Quantum-Ready Innovation Funding Accelerates Competitive Differentiation

Through FSTI 3.0, MAS co-funds up to 50% of projects deploying quantum-resistant encryption and AI-powered risk analytics. The subsidy lowers capex barriers for mid-tier fintechs, enabling them to harden cybersecurity stacks ahead of regulatory mandates. Collaboration inside the Cyber and Technology Resilience Experts (CTREX) panel ensures knowledge transfer from Microsoft, Amazon, and Google Cloud, aligning domestic standards with global best practices. Early movers already test quantum-safe payment protocols that withstand Shor-algorithm attacks, positioning them for compliance once post-quantum cryptography becomes compulsory. Banks adopting quantum-secure key exchange safeguard high-value treasury flows, giving Singapore a first-mover lead in safe-harbor financial hosting. Over the long term, quantum-enhanced optimization may also streamline credit-risk modelling and portfolio rebalancing, boosting sector productivity.

Customer Acquisition Costs Strain Fintech Profitability Models

Nearly universal smartphone ownership produces a saturated addressable base, making marginal customer wins increasingly expensive. Incentive budgets for e-wallet sign-ups ballooned by 40-60% in 2024, pushing payback periods for small fintechs beyond 30 months. App fatigue further erodes return on marketing spend because consumers prefer multifunction super-apps such as Grab, which bundle ride-hailing, food delivery, and payments. The trend forces standalone providers to pivot toward embedded-finance partnerships, integrating services into merchant or platform ecosystems to share acquisition costs. B2B2C distribution also improves unit economics; SME software vendors, for example, can embed invoicing-linked credit lines, spreading marketing costs across multiple revenue streams. Elevated acquisition costs therefore act as a filtering mechanism, rewarding fintechs with strong ecosystems or differentiated IP, while pushing under-capitalized startups to consolidate or exit.

Other drivers and restraints analyzed in the detailed report include:

- Cross-Border E-Commerce Growth Drives Multi-Currency Innovation

- Digital Banking Licenses Create Niche Market Opportunities

- Regulatory Tightening Constrains High-Growth Fintech Segments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, digital payments accounted for 26.20% of the Singapore fintech market size, reflecting their central role in day-to-day commerce. The segment is on track to expand at a 16.95% CAGR through 2031, propelled by SGQR+ interoperability, merchant SoftPOS adoption, and PayNow's regional links. Card-rail bypass via account-to-account transfers reduces interchange fees, encouraging merchants to prioritize QR and instant payments. Meanwhile, alternative credit scoring in digital lending continues to unlock quick-turnaround microloans for gig workers, albeit at a slower growth than payments. Insurtech firms embed bite-sized coverage within ride-hailing and delivery apps, widening reach without requiring stand-alone policy purchases. Wealth-tech platforms such as StashAway scale on low-cost ETF portfolios, challenging private banks for mass-affluent assets. MAS's regulatory sandbox supports experiments that bundle payments, lending, and insurance, fostering holistic financial offerings. By 2030, integrated platforms are expected to direct more than 40% of domestic retail transaction value, cementing payments as the linchpin of broader fintech ecosystems.

Competition intensifies as digital-wallet providers extend credit lines and insurance add-ons, blurring traditional segment boundaries. Super-apps leverage first-party consumption data to refine underwriting, while incumbents open APIs to retain relevance within merchant checkout flows. The Singapore fintech market, therefore, continues to reward providers that control the point of sale and can layer higher-margin, add-on services onto high-frequency payment use cases. Regulatory support for tokenized deposits and network tokenization further improves security and interchange economics. As real-time rails mature, payments revenue will increasingly derive from value-added data analytics, loyalty, and payment services rather than per-transaction fees.

The Singapore Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending & Financing, Digital Investments, Insurtech, Neobanking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (Central Region, East Region, North Region, North-East Region, West Region). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Grab Financial Group

- DBS Bank

- OCBC Bank

- UOB Bank

- PayPal Singapore

- Wise

- Stripe Singapore

- Adyen Singapore

- Nium

- Thunes

- FOMO Pay

- Funding Societies

- Validus

- StashAway

- Endowus

- Singlife with Aviva

- Bolttech

- GXS Bank

- Trust Bank

- ANEXT Bank

- Revolut Singapore

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid real-time payment rail adoption (PayNow, Project Nexus)

- 4.2.2 MAS grants spurring AI & quantum-ready fintech innovation

- 4.2.3 Cross-border e-commerce fueling multi-currency wallets

- 4.2.4 Digital-only banking licences opening new niches

- 4.2.5 ESG & green-finance mandates creating new fintech revenue pools

- 4.2.6 SME credit gap boosting alternative lending platforms

- 4.3 Market Restraints

- 4.3.1 High customer-acquisition costs amid intense app competition

- 4.3.2 Tightened MAS consumer-protection rules on crypto & BNPL

- 4.3.3 Talent shortages in AI / cybersecurity raising OPEX

- 4.3.4 Interoperability & legacy core-bank integration hurdles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending & Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Geography

- 5.4.1 Central Region

- 5.4.2 East Region

- 5.4.3 North Region

- 5.4.4 North-East Region

- 5.4.5 West Region

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Grab Financial Group

- 6.4.2 DBS Bank

- 6.4.3 OCBC Bank

- 6.4.4 UOB Bank

- 6.4.5 PayPal Singapore

- 6.4.6 Wise

- 6.4.7 Stripe Singapore

- 6.4.8 Adyen Singapore

- 6.4.9 Nium

- 6.4.10 Thunes

- 6.4.11 FOMO Pay

- 6.4.12 Funding Societies

- 6.4.13 Validus

- 6.4.14 StashAway

- 6.4.15 Endowus

- 6.4.16 Singlife with Aviva

- 6.4.17 Bolttech

- 6.4.18 GXS Bank

- 6.4.19 Trust Bank

- 6.4.20 ANEXT Bank

- 6.4.21 Revolut Singapore

7 Market Opportunities & Future Outlook

- 7.1 Embedded finance in non-financial super-apps

- 7.2 Green fintech solutions for carbon-credit trading